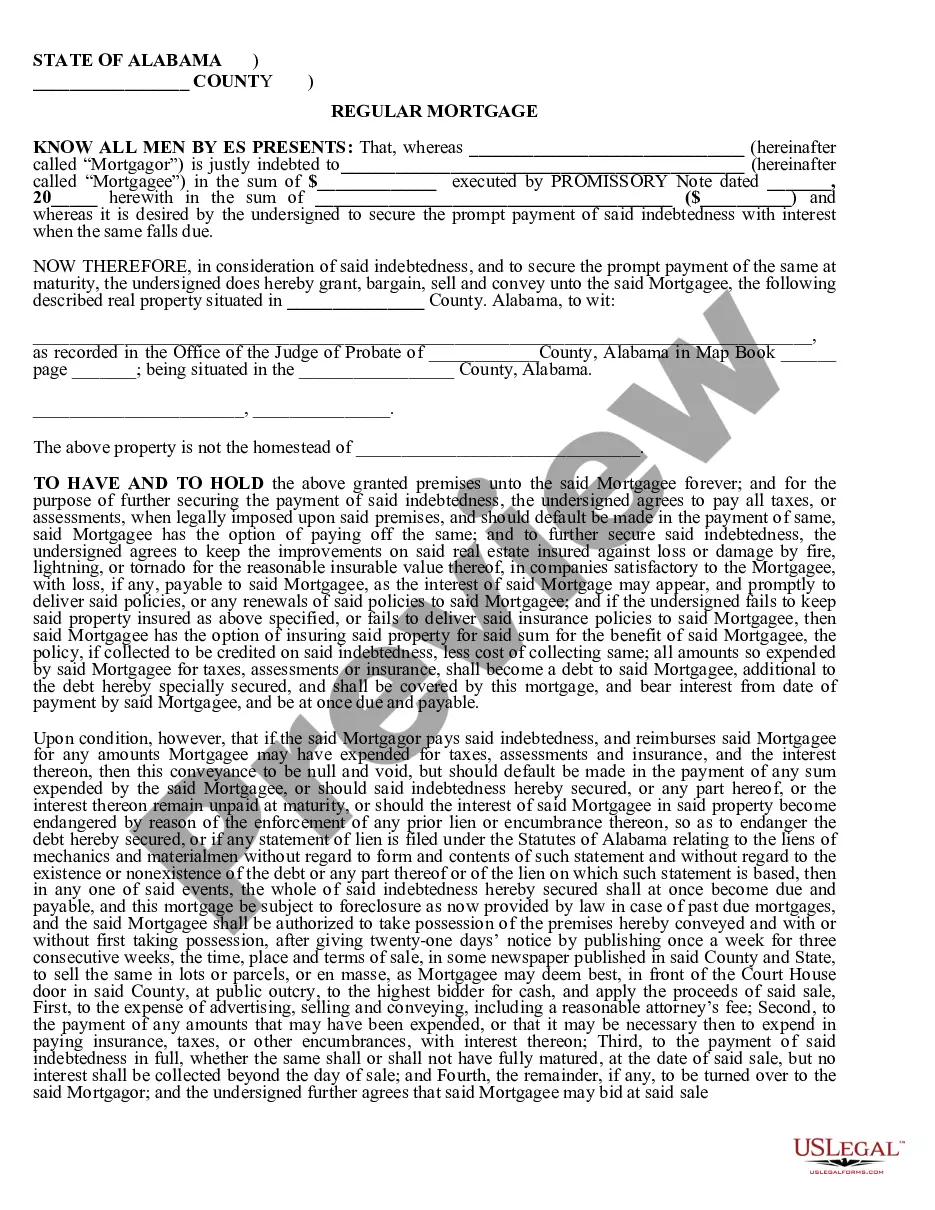

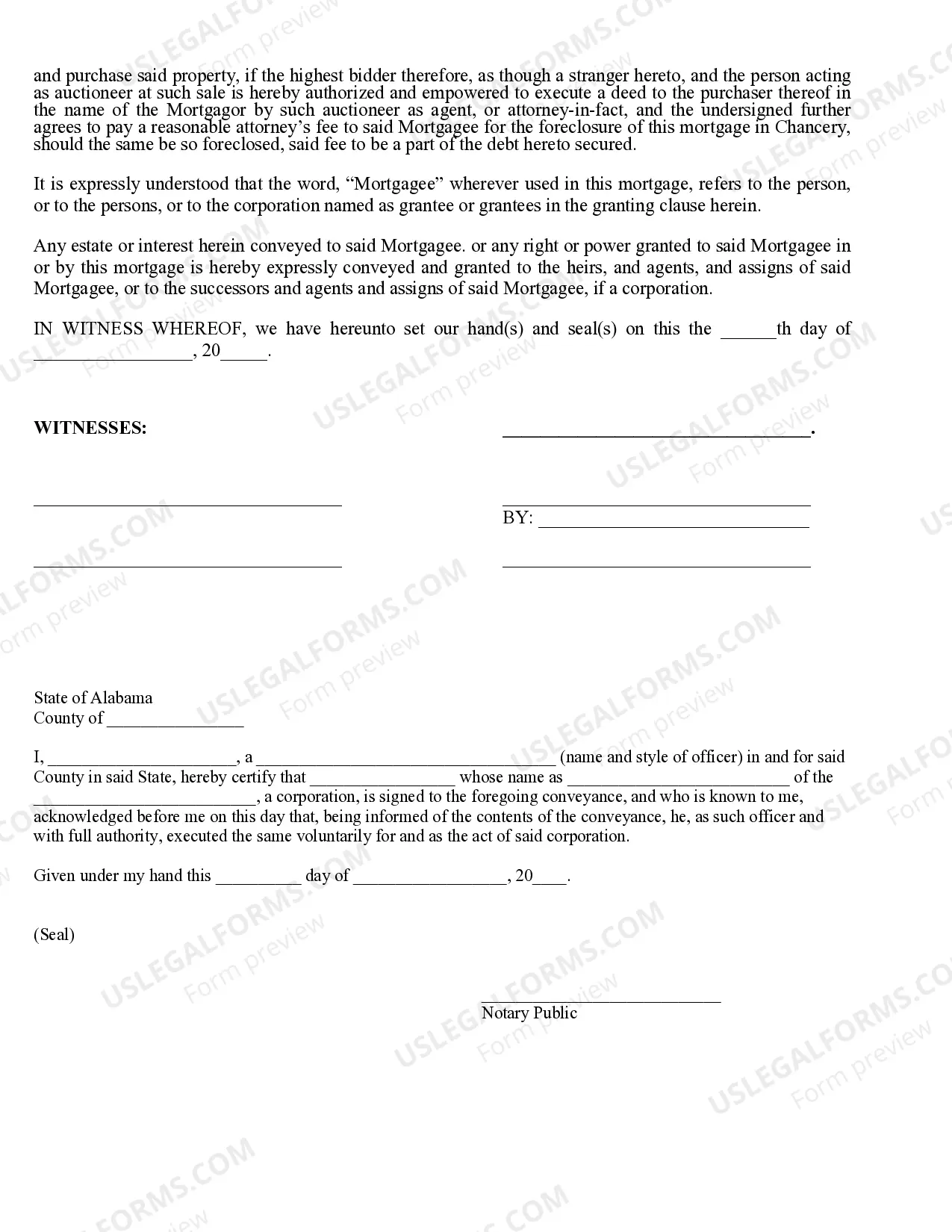

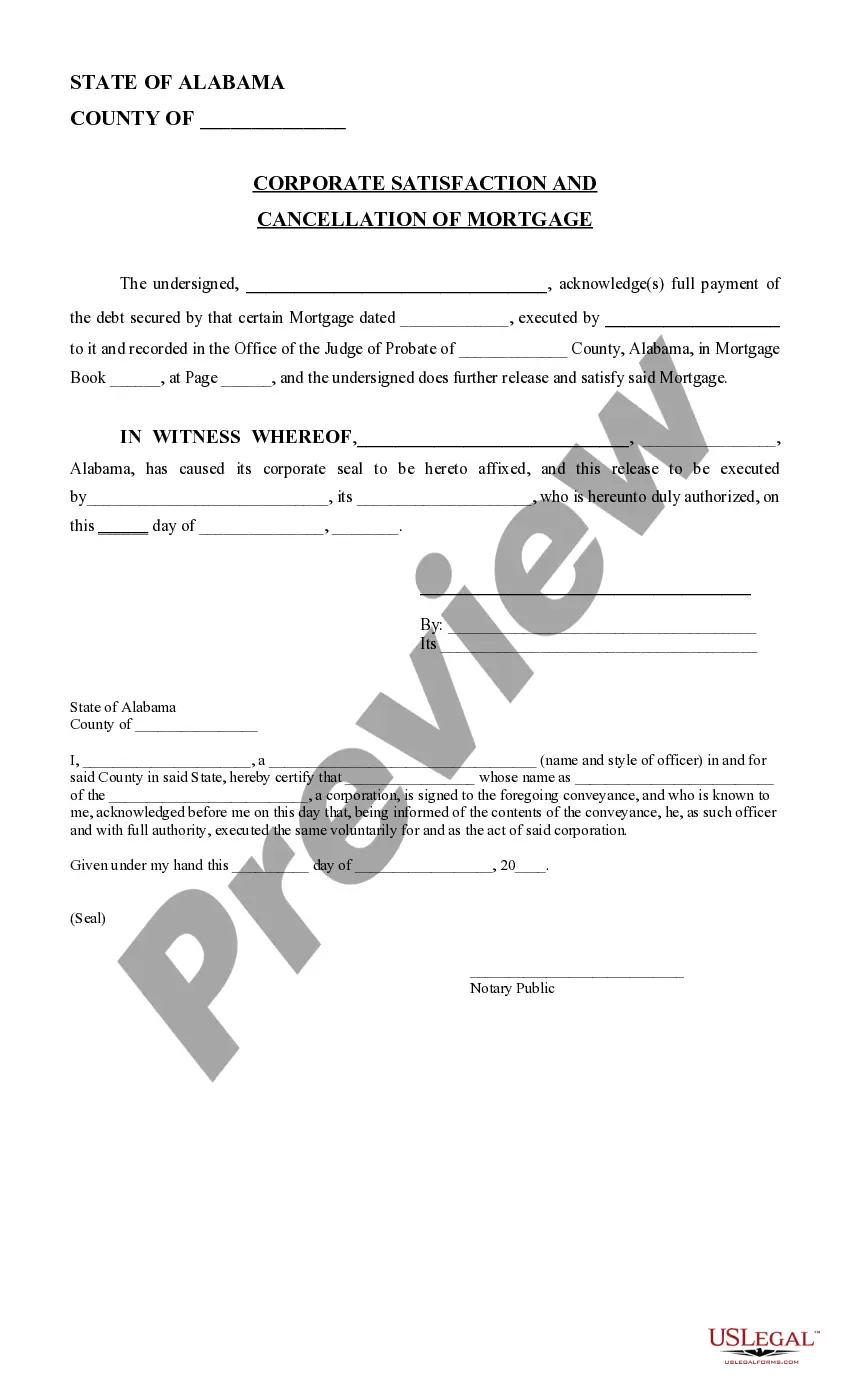

This is a Regular Mortgage by Corporation where the mortgagor is not claiming the secured real property as a homestead.

Alabama Regular Mortgage by Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Regular Mortgage By Corporation?

Utilizing Alabama Standard Mortgage by Corporation instances generated by experienced lawyers allows you to evade hassles during document submission.

Simply obtain the form from our website, complete it, and ask an attorney to verify it.

This approach can assist you in conserving considerably more time and energy than having a lawyer create a document from scratch for you.

Remember to review all provided information for accuracy before submitting or mailing it out. Reduce the time you spend on filling out documents with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In to your account and navigate back to the form section.

- Locate the Download button next to the template you are reviewing.

- After downloading a file, you can find all of your saved documents in the My documents tab.

- If you lack a subscription, that's not an issue.

- Simply adhere to the instructions below to register for an account online, obtain, and complete your Alabama Standard Mortgage by Corporation template.

- Verify that you are downloading the correct state-specific form.

Form popularity

FAQ

Yes, Alabama requires Limited Liability Companies (LLCs) to file an annual report. This report contains essential information about the LLC’s business activities and ensures that the entity remains in good standing with the state. For LLCs engaged in the Alabama Regular Mortgage by Corporation, completing this annual report correctly is vital for compliance and continued business operations.

Alabama form 65 is the state income tax return specifically for partnerships. Partnerships, including those that may be involved in the Alabama Regular Mortgage by Corporation, must file this form to report their income. Proper completion of form 65 ensures that all partners meet their tax obligations while benefiting from the available deductions and credits.

Yes, Alabama imposes a state corporate income tax on corporations operating within its borders. This tax is assessed based on the corporation’s net income and is reported using the Alabama Corporate Income Tax Form. If your business involves Alabama Regular Mortgage by Corporation, it is essential to understand the tax implications to effectively manage your financial operations.

The primary corporate tax form for Alabama is the Alabama Corporate Income Tax Form, typically form 20C. This form enables corporations to report their taxable income and calculate their state tax liability. If your corporation is engaged in activities related to Alabama Regular Mortgage by Corporation, filing this form accurately will help streamline your tax process and ensure adherence to state regulations.

The Alabama PPT, or Property Tax, must be filed by individuals and corporations that own tangible personal property in the state. This includes entities involved in the Alabama Regular Mortgage by Corporation, as they may have property subject to taxation. Understanding these requirements is crucial for maintaining compliance and avoiding penalties.

Even if your business has no income, you may still need to file Form 1120 with the IRS. It is important to file this form to maintain good standing, especially if your corporation operates with an Alabama Regular Mortgage by Corporation. Filing ensures that you indicate your corporation’s activity status to the IRS and comply with legal requirements.

The primary corporate tax return form for Alabama is the Form 20C. This form allows corporations to report their income and deductions to the state, ensuring compliance with Alabama tax laws. By using Alabama Regular Mortgage by Corporation, your understanding of this form can greatly enhance your company's financial strategy.

C corporations in Alabama are subject to a corporate income tax based on their net income from operations. This tax rate is typically established by state law, and corporations must file their taxes annually. If your corporation has an Alabama Regular Mortgage by Corporation, understanding the C Corp tax helps you plan for financial obligations effectively.

Alabama form 20C serves as the corporate income tax return for C corporations. This form captures the corporation's financial activities throughout the tax year. For businesses engaged in Alabama Regular Mortgage by Corporation, filing this form is vital for accurate tax reporting and compliance with state regulations.

Any corporation that conducts business in Alabama is required to file for the business privilege tax. This tax applies regardless of whether the business is based in Alabama or operates from another state. If you are dealing with an Alabama Regular Mortgage by Corporation, you should be mindful of these requirements to avoid penalties.