Nevada Sole Proprietor Coverage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

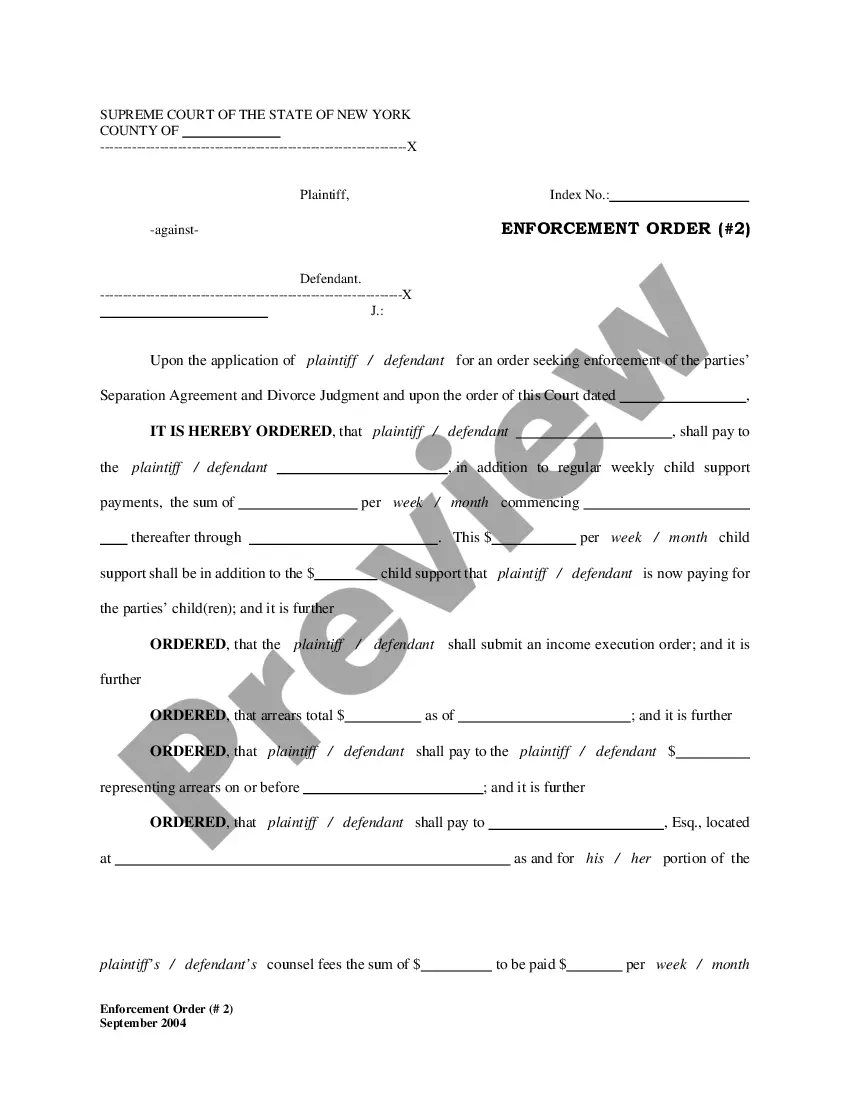

How to fill out Nevada Sole Proprietor Coverage?

US Legal Forms is actually a unique system to find any legal or tax form for completing, such as Nevada Sole Proprietor Coverage. If you’re tired of wasting time looking for suitable samples and spending money on papers preparation/lawyer fees, then US Legal Forms is precisely what you’re seeking.

To enjoy all the service’s advantages, you don't need to install any application but just choose a subscription plan and sign up an account. If you already have one, just log in and look for the right sample, save it, and fill it out. Saved files are all stored in the My Forms folder.

If you don't have a subscription but need to have Nevada Sole Proprietor Coverage, check out the recommendations below:

- Double-check that the form you’re looking at applies in the state you want it in.

- Preview the sample its description.

- Click Buy Now to reach the register page.

- Select a pricing plan and keep on signing up by providing some information.

- Select a payment method to finish the sign up.

- Download the file by selecting the preferred file format (.docx or .pdf)

Now, submit the document online or print out it. If you feel unsure concerning your Nevada Sole Proprietor Coverage template, contact a attorney to examine it before you send or file it. Begin without hassles!

Form popularity

FAQ

Sole proprietors file need to file two forms to pay federal income tax for the year. Firstly, there's Form 1040, which is the individual tax return. Secondly, there's Schedule C, which reports business profit and loss. Form 1040 reports your personal income, while Schedule C is where you'll record business income.

State law requires that every person or entity doing business in the state of Nevada obtain a business license annually. A business that meets the criteria shall not do business in the state of Nevada without the State Business License. Certain businesses may be exempt from the State Business License requirement.

Since the sole proprietorship and its owner are considered identical, a sole proprietor can generally be defined as a small business when it comes to qualifying for a small business health insurance plan; however, if you have no employees but yourself, then your sole proprietorship will likely not qualify you for a

How Can I Protect Myself? The only way to get complete liability protection for your business is to form an LLC, a corporation, or another formal business entity. Thankfully, you can start out as a sole proprietorship and convert into one of these entities if you determine that you need your personal assets protected.

You can obtain the form from the county clerk's office. The filing fee is around $20 but may vary depending on the county. Your business must obtain a Nevada State Business Licenses or meet an exemption from these requirements depending on its business activities.

SOLE PROPRIETORSHIPSole Proprietorships are not required to file formation documents with the Secretary of State's office. However, a Nevada State Business License or Notice of Exemption is required before conducting business in the state of Nevada.

Income Taxes for Sole ProprietorshipIRS Form 1040 is the form used by individuals and, thus, by unincorporated sole proprietorships since they file under the same forms as their owners. IRS Schedule C is the profit and loss statement for the business.

Do I need a business license? Yes, if you are not paid as an employee, you are considered independent or self-employed and are required to obtain a business license.

Sole proprietors need to file Form 941, Employer's Quarterly Federal Tax Return (or Form 944, Employer's Annual Federal Tax Return), for the calendar quarter in which they make final wage payments.