Kansas law provides a form with which a subcontractor may claim a lien for labor and/or materials provided to new residential property. This Notice of Intent to Provide is filed in the office of the clerk of the district court of the county where the property is located. After the lien claimant is paid in full, the lien claimant is required to also file a form releasing the previous Notice and waiving any lien.

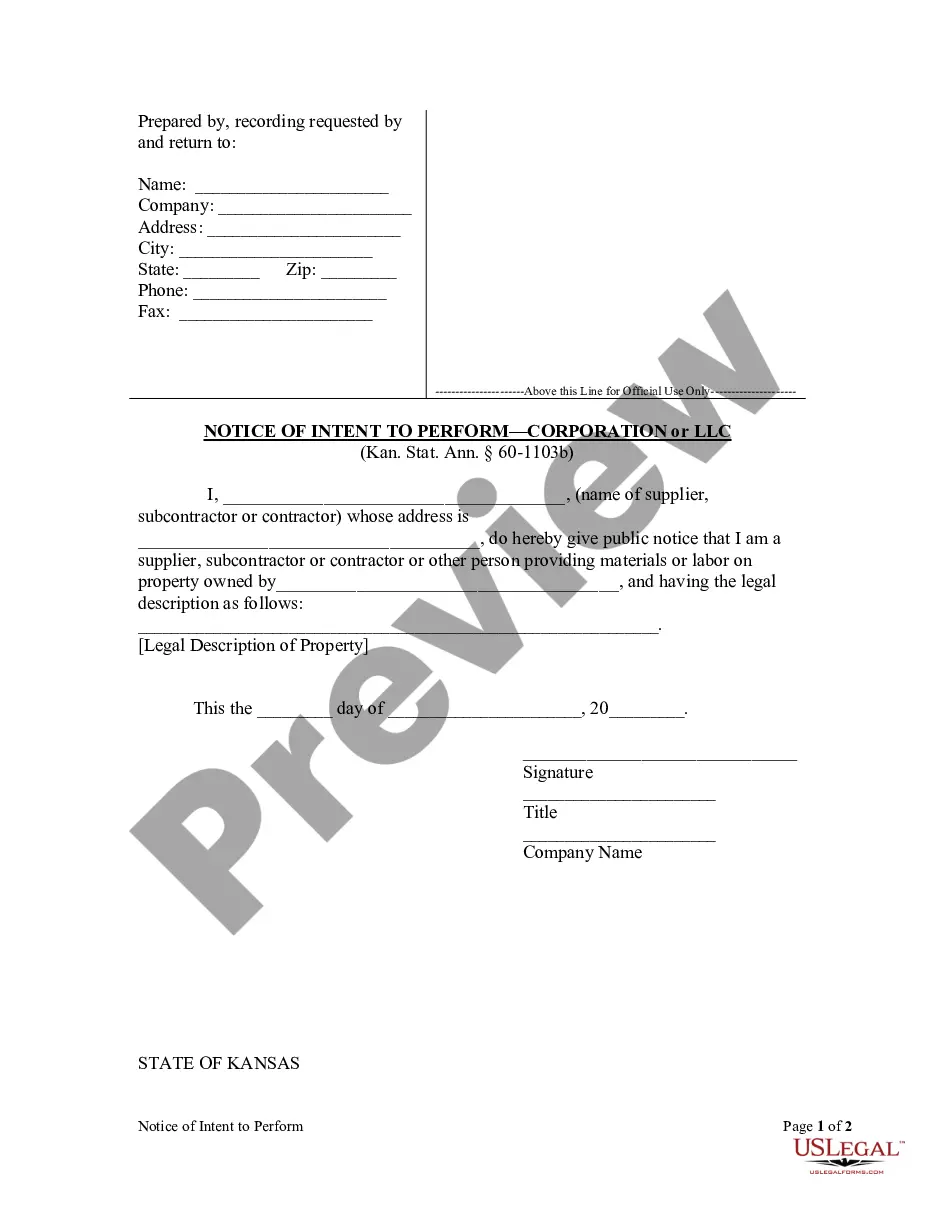

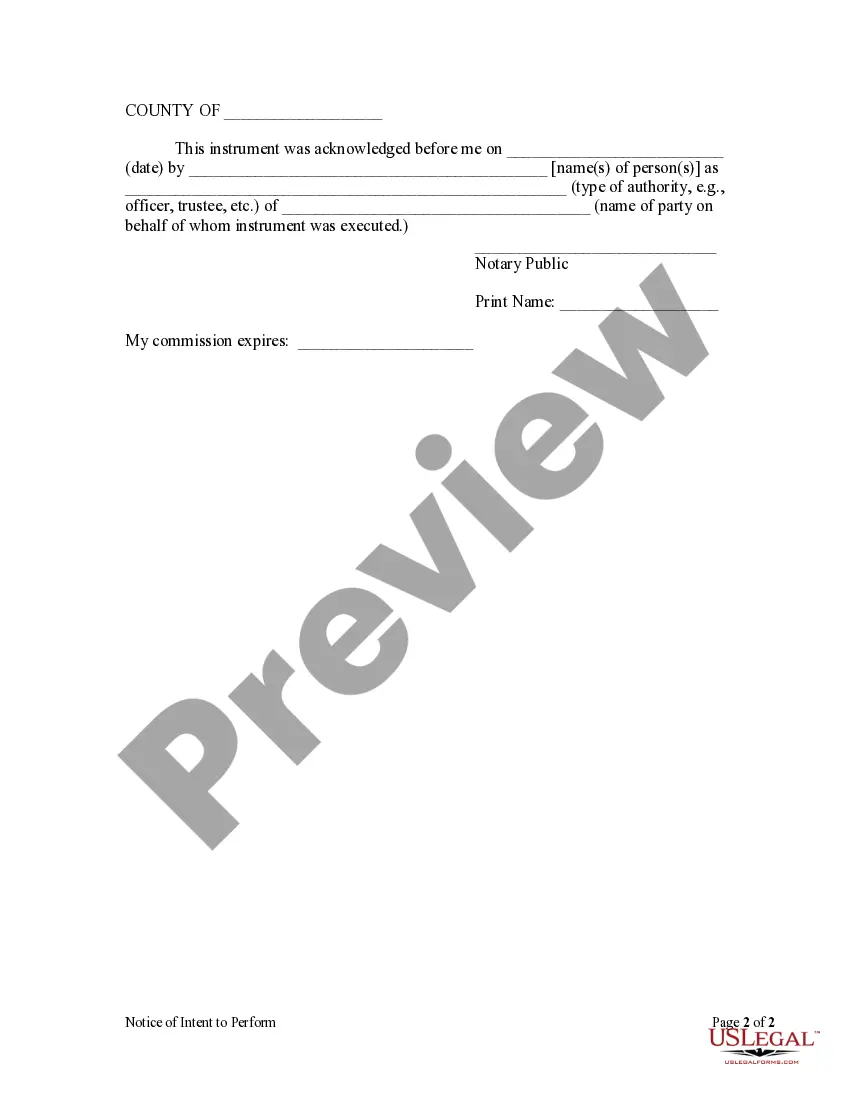

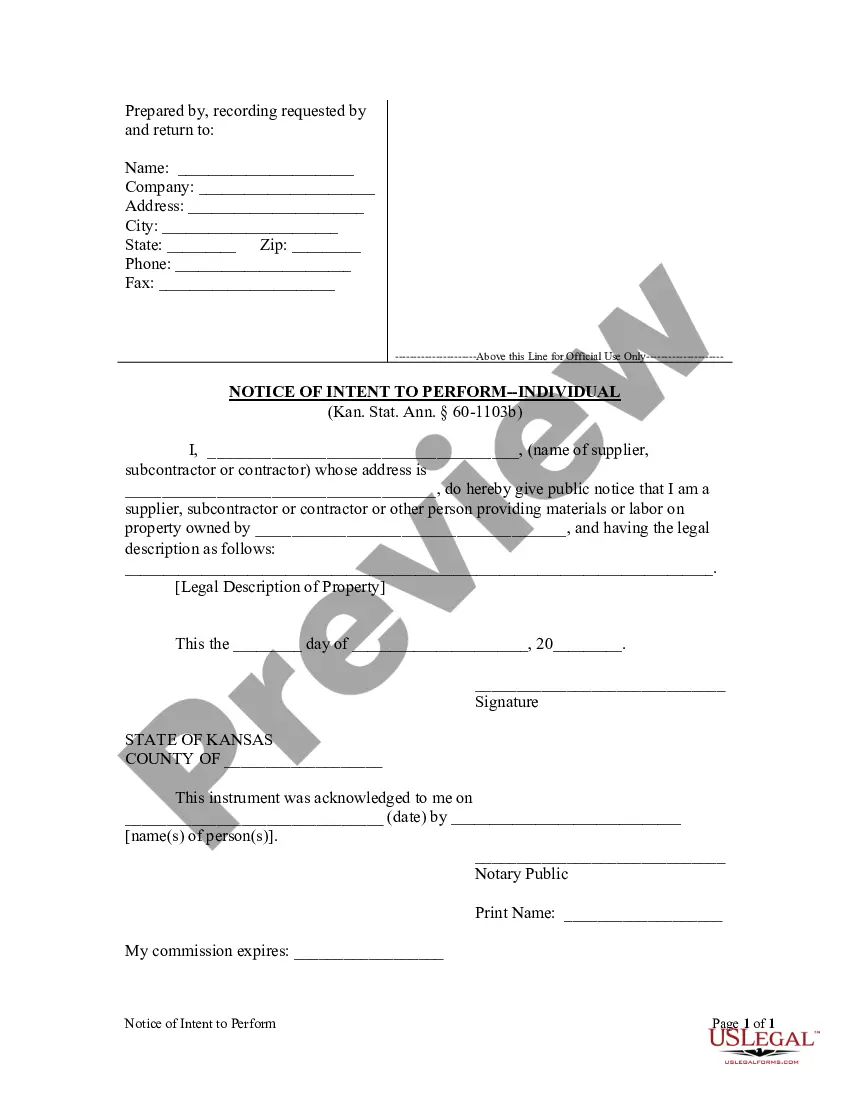

Kansas Notice of Intent to Perform by Corporation or LLC

Description

How to fill out Kansas Notice Of Intent To Perform By Corporation Or LLC?

Locating a sample Kansas Notice of Intent to Perform by Corporation or LLC and completing it can be somewhat daunting.

To conserve time, expenses, and effort, utilize US Legal Forms to discover the appropriate sample specifically tailored for your state in just a few clicks.

Our lawyers prepare each document so you only need to complete them. It's genuinely that straightforward.

You can now print the Kansas Notice of Intent to Perform by Corporation or LLC template or complete it using any online editor. Don't be concerned about making errors as your form can be utilized, submitted, and printed as many times as needed. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the sample.

- All your downloaded forms are stored in My documents and are available anytime for future use.

- If you haven't created an account yet, you will need to sign up.

- Review our detailed instructions on how to obtain the Kansas Notice of Intent to Perform by Corporation or LLC form in a matter of minutes.

- To obtain a valid sample, verify its eligibility for your state.

- Use the Preview function to examine the form (if available).

- If a description is present, read it to understand the specifics.

- Click Buy Now once you find what you are looking for.

- Choose your plan on the pricing page and create an account.

- Indicate if you want to pay with a credit card or via PayPal.

- Save the sample in your preferred file format.

Form popularity

FAQ

Transferring ownership of an LLC in Kansas involves several key steps. First, review your LLC's operating agreement to understand the specific procedures for transfers. Next, ensure all members agree on the change, and then update your records accordingly. For guidance on legal documentation during this process, including any notices like the Kansas Notice of Intent to Perform by Corporation or LLC, check out the resources available at USLegalForms.

Register the Business Entity. Register the Business Name. Business License Registration. Register the EIN. Business Tax Registration.

200bThe LLC annual fee is an ongoing fee paid to the state to keep your LLC in compliance and in good standing. It's usually paid every 1 or 2 years, depending on the state. This fee is required, regardless of your LLC's income or activity. Said another way: you have to pay this.

How much does it cost to form an LLC in Kansas? The Kansas Secretary of State charges $165 to file the Articles of Organization. You can reserve your LLC name with the Kansas Secretary of State for $30 when filing online or $35 when filing by mail.

The filing fee to form an LLC in Kansas is $165 by filing the Articles of Organization with the Secretary of State.

All LLCs doing business in Kansas must file an Annual Report every year. You need to file an Annual Report in order to keep your LLC in compliance with the state and to prevent it from being shut down. You can file your LLC's Annual Report by mail or online.

STEP 1: Name your Kansas LLC. STEP 2: Choose a Resident Agent in Kansas. STEP 3: File Your Kansas LLC Articles of Organization. STEP 4: Create Your Kansas LLC Operating Agreement. STEP 5: Get an EIN.

If money's tight, or you don't want to use a company formation service, we've got good news for you you can form an LLC yourself. Although you'll still need to pay your state filing fees (they're unavoidable!), you can save on the costs of having your LLC filed through a professional incorporation business.

STEP 1: Name your Kansas LLC. STEP 2: Choose a Resident Agent in Kansas. STEP 3: File Your Kansas LLC Articles of Organization. STEP 4: Create Your Kansas LLC Operating Agreement. STEP 5: Get an EIN.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.