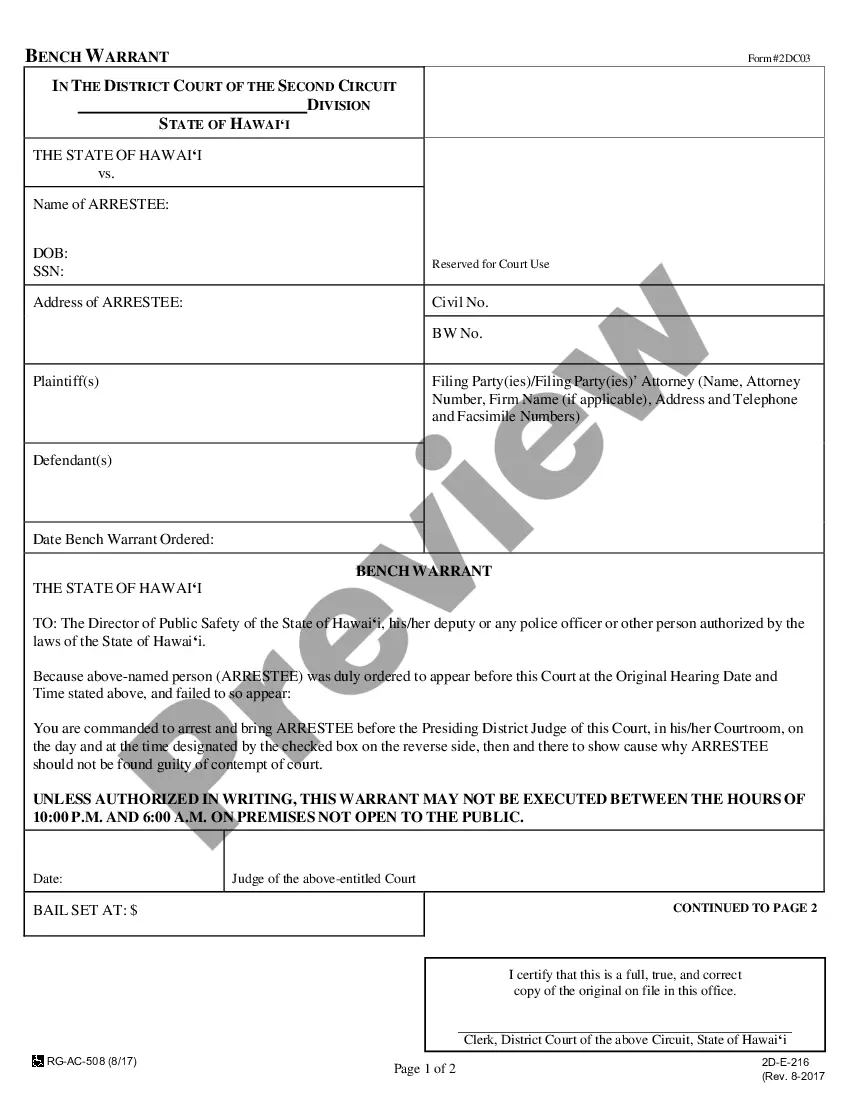

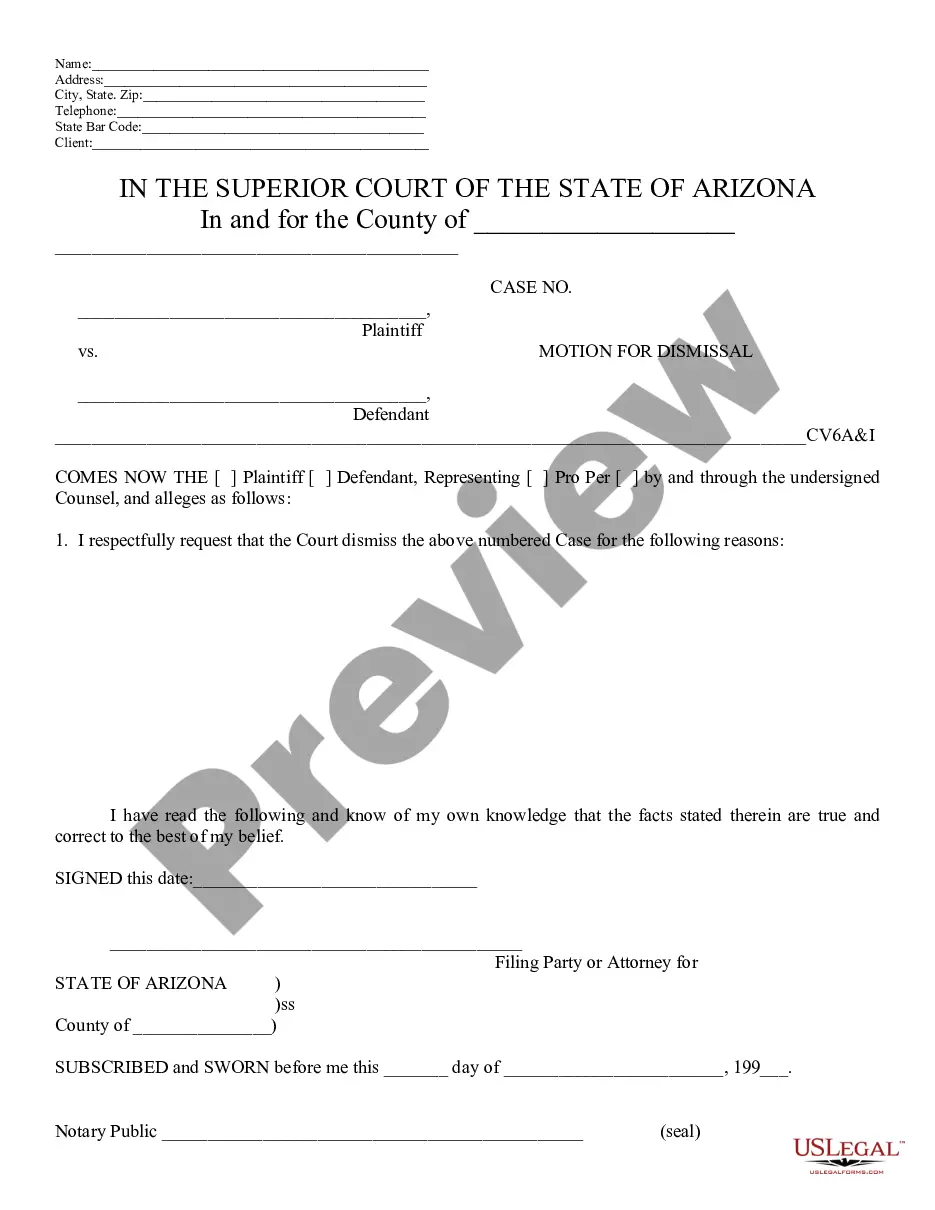

Claims Against Creditor Within 30 Days

Description

How to fill out Release Of Claims Against Estate By Creditor?

Managing legal documentation and tasks can be an arduous addition to your daily routine.

Claims Against Creditor Within 30 Days and forms of that nature often necessitate you to search for them and comprehend the best manner to fill them out correctly.

Thus, whether you are addressing monetary, legal, or personal affairs, having a comprehensive and accessible online directory of forms at your disposal will be extremely beneficial.

US Legal Forms is the premier online resource for legal templates, boasting over 85,000 state-specific forms and various tools to help you complete your documentation efficiently.

Simply Log In to your account, find Claims Against Creditor Within 30 Days and get it instantly in the My documents section. You can also access previously saved forms.

- Browse the collection of pertinent documents available to you with just one click.

- US Legal Forms provides state- and county-specific forms that are accessible for download at any time.

- Safeguard your document management tasks with exceptional support that enables you to prepare any form in minutes without any extra or concealed fees.

Form popularity

FAQ

Some creditors have in-house collection departments, but many will charge off the debt, close your account and sell the debt to a third-party collection agency. This typically happens when your payment is around 120 days late, but it can take up to six billing cycles for a credit card to be charged off.

If the collection agency failed to validate the debt, it is not allowed to continue collecting the debt. It can't sue you or list the debt on your credit report.

Can I dispute the debt if more than 30 days have passed since I received notice of the debt from the debt collector? Yes, but again the debt collector will be allowed to continue debt collection activities and will not have to verify the debt.

If you write a letter, instead of using the tear-off form, the debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or ...

A debt can go into collections as early as 31 days. Even if your account becomes a collections account after 30 days, it may still stay with the company for another month or two. After that, it may be turned over to a collection company at the three-month mark.