Lottery Pool Agreement

About this form

The Lottery Pool Agreement is a legal form that establishes a binding contract between individuals participating in a lottery pool. This agreement outlines the responsibilities of each member, details how contributions and winnings will be managed, and ensures that all participants understand their rights and obligations. It is distinct from individual lottery ticket purchases, as it formalizes the collective effort to maximize the chance of winning by pooling resources together.

Main sections of this form

- Date of the agreement and the names of lottery pool participants.

- Designation of a Lottery Pool Manager responsible for purchasing lottery tickets.

- Contribution details outlining each participant's financial commitment.

- Instructions for the distribution of any winnings and the establishment of a temporary trust.

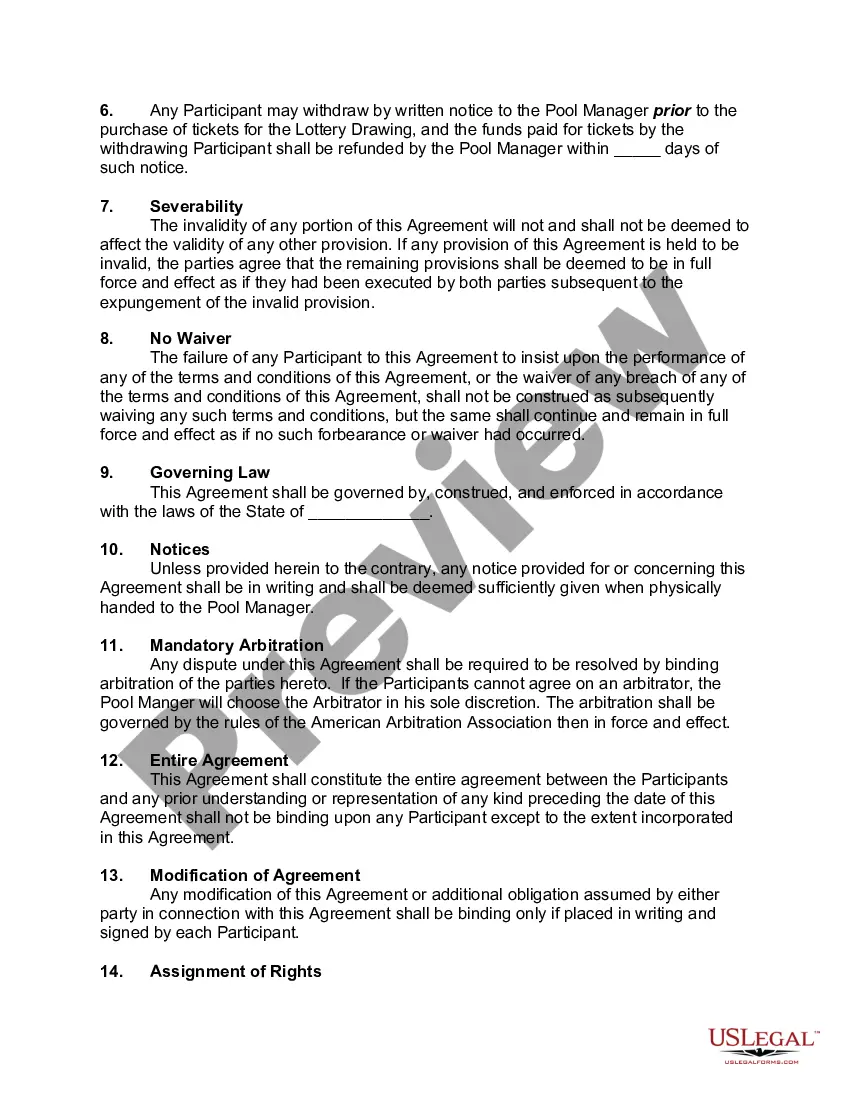

- Provisions for withdrawal from the agreement and refund of contributions.

- Clauses regarding the governing law and dispute resolution through arbitration.

When to use this form

This form should be used whenever a group of individuals decides to collectively participate in a lottery by pooling their money to buy tickets. It is particularly useful during specific lottery events, ensuring all participants agree on the terms of their collaboration, the distribution of any winnings, and procedures for managing contributions.

Who needs this form

- Friends or family members who would like to participate in a lottery together.

- Coworkers forming a lottery pool to increase their chances of winning.

- Any group of people wanting to ensure transparency and fairness in managing lottery ticket purchases and winnings.

How to complete this form

- Enter the date on which the agreement is made.

- List the names and addresses of all participants in the pool.

- Specify the month and year for which the pool is established.

- Name the participant who will act as the Lottery Pool Manager.

- Determine the amount each participant will contribute and set deadlines for payment.

- Include any conditions regarding the withdrawal of participants and the handling of winnings.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all participants' names, leading to disputes later.

- Not specifying contribution amounts clearly, causing misunderstandings.

- Overlooking the deadline for contributions, leading to last-minute issues.

- Neglecting to detail the process for handling potential winnings.

Why use this form online

- Convenient access to a legally sound document that can be downloaded, filled out, and used immediately.

- Editability allows for custom terms specific to your groupâs needs.

- Reliability ensured by attorney drafting, providing confidence in the legality and enforceability of the agreement.

Looking for another form?

Form popularity

FAQ

Consider options for trust control, beneficiaries, and other provisions. Draft and execute your trust agreement. Claim your lottery winnings as trustee of your new trust.

How is the lottery lump sum calculated? The lump sum for a lottery is equal to the total funds allocated to funding the jackpot. This is calculated as a percentage of the total revenue generated from ticket sales.

Each person can give away, during life or at death, a certain amount of property before the tax kicks in.So by claiming the lottery winnings as a family partnership, a winner can claim that they are not making a taxable gift, because it was a family investment. This could save millions in gift taxes.

Protect your ticket The standard advice from experts is to sign the back of the winning ticket so that if you are separated from it, your signature can help ensure you still get the prize. You want the ticket signed, because whoever signs it is the winner, Kurland said.

There are ways to reduce the amount of winnings that gets taxed, although not many. The charitably inclined can lower their taxable income by making a cash donation of up to 60% of their adjusted gross income and carry forward, up to five years, any excess amount.

Create a contract. Designate a leader. Welcome everyone to participate. Collect money electronically. Confirm participants before purchasing tickets. Make a copy of every ticket. Secure the original ticket.

To increase your probability of winning, you need to buy more tickets. Form a lottery syndicate where you gather money from lottery players. Don't choose consecutive numbers. Don't choose a number that falls in the same number group or ending with a similar digit.

The person will get to choose between taking the jackpot as an annuity spread out over three decades or as a lump sum of $254.6 million. For federal taxes, lottery officials automatically withhold 24 percent of the money.

For the Lottery to make payments to a trust, the prize winner must be the grantor of the revocable trust and the trust must be linked to the winner's social security number. The trust must be governed by the laws of the State of California.Keep in mind, a trust cannot claim a Lottery prize.