Expunge Record In Texas

Description

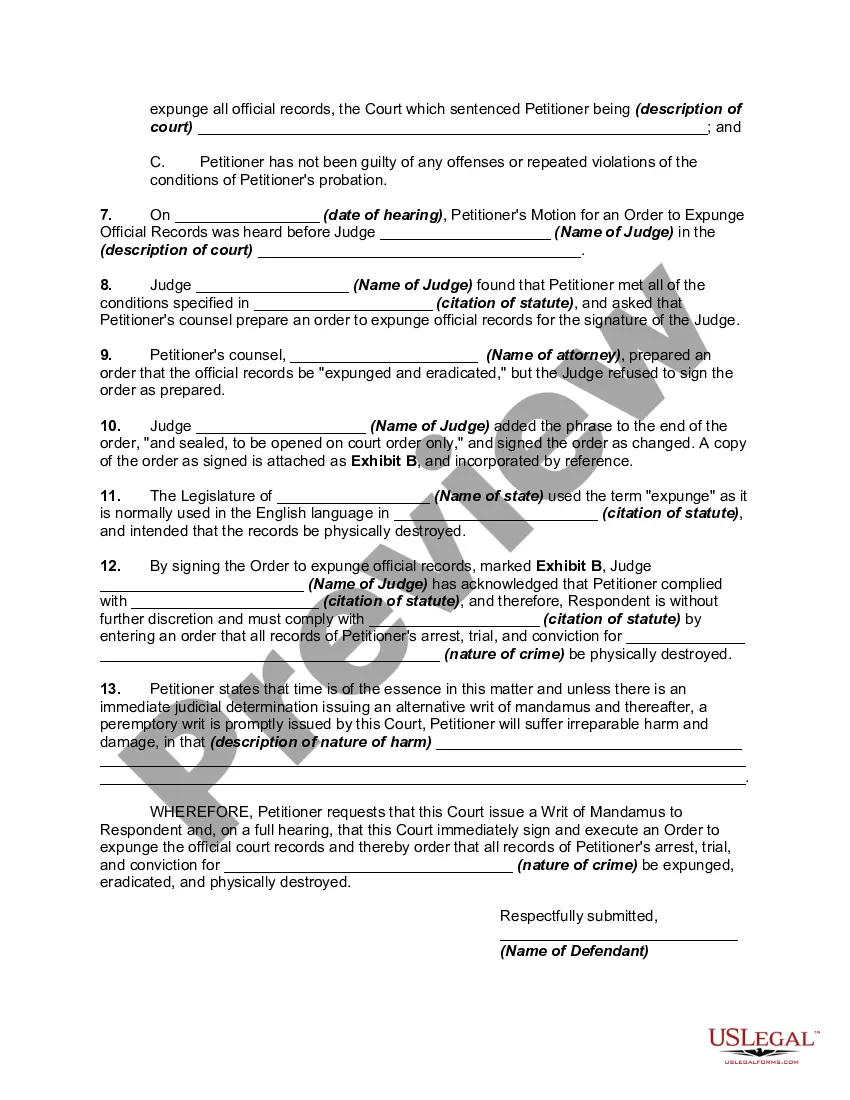

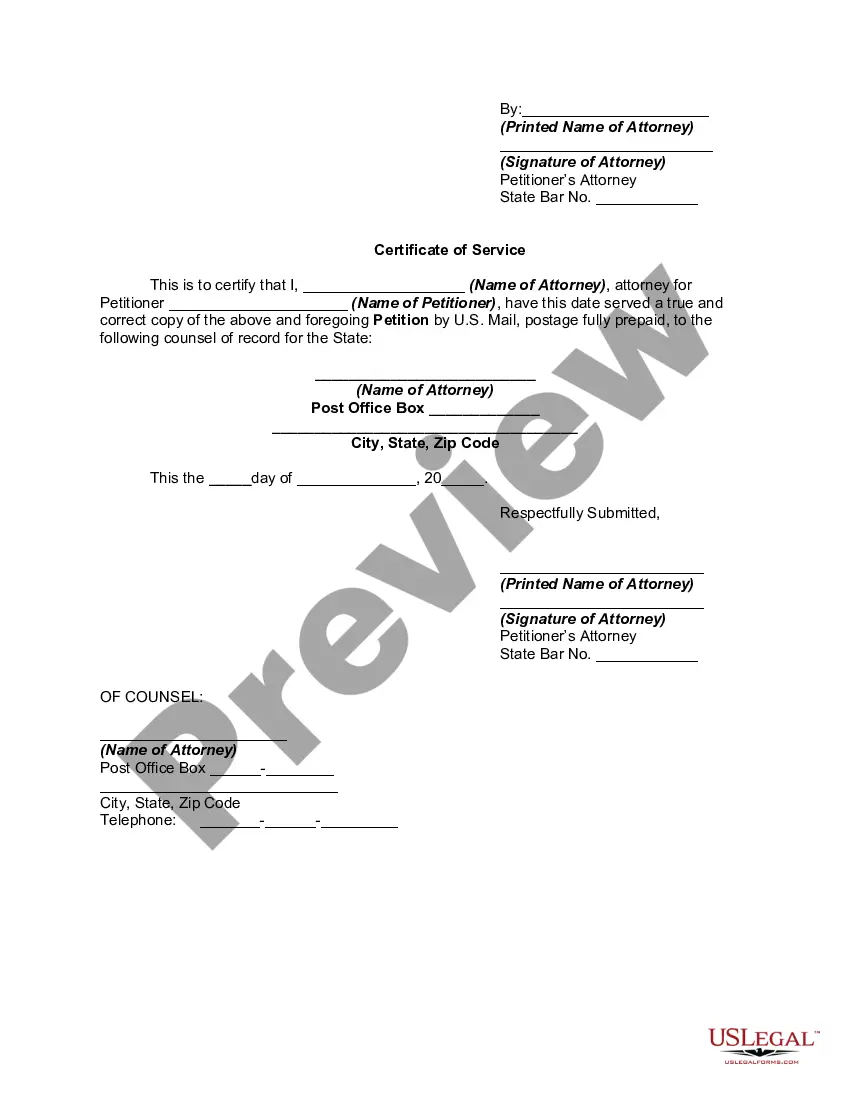

How to fill out Petition For Writ Of Mandamus Or Mandate To Compel Court To Expunge Record Of Arrest, Trial, And Conviction - Expungement?

Managing legal documents can be overwhelming, even for seasoned professionals.

When you are searching for an Expunge Record In Texas and lack the time to invest in finding the correct and updated version, the process can be challenging.

US Legal Forms encompasses all requirements you might have, from personal to business documentation, all in one location.

Utilize advanced tools to complete and manage your Expunge Record In Texas.

Here are the steps to follow after obtaining the form you need: Verify that this is the right form by previewing it and checking its details.

- Access a valuable repository of articles, guides, handbooks, and materials related to your situation and needs.

- Save time and energy searching for the documents you require, and use US Legal Forms' advanced search and Review feature to locate and download Expunge Record In Texas.

- If you have a membership, Log In to your US Legal Forms account, find the form, and download it.

- Check the My documents tab to see the documents you've previously saved and manage your folders as desired.

- If this is your first experience with US Legal Forms, create a free account and gain unrestricted access to all the platform's benefits.

- A robust online form catalog can revolutionize how individuals handle these matters efficiently.

- US Legal Forms is a leading provider of online legal documents, offering more than 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can access various state- or county-specific legal and business documents.

Form popularity

FAQ

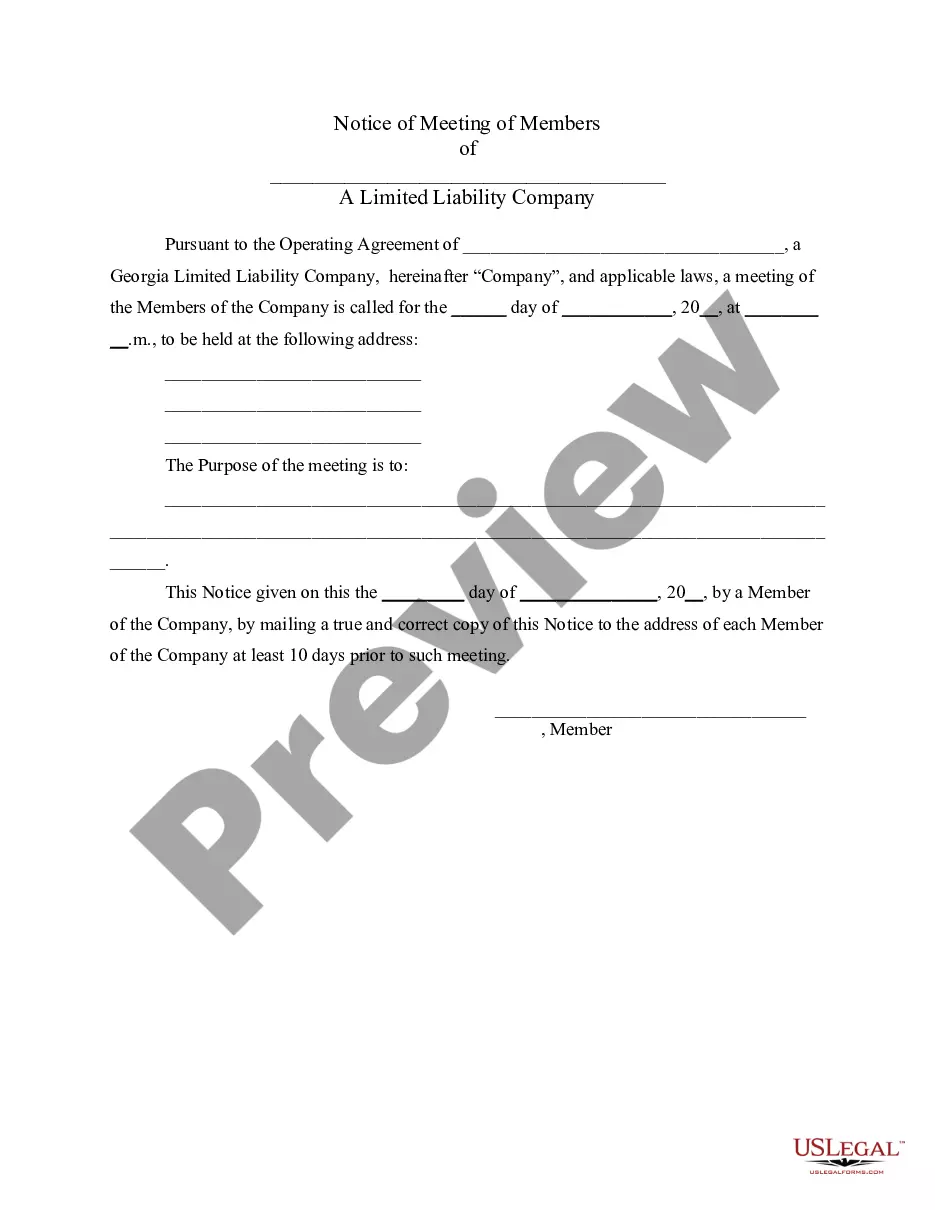

LLCs require paperwork and administrative tasks such as filing articles of organization, creating an operating agreement and maintaining proper record-keeping. Forming an LLC in Texas involves paying various fees, such as any state fees, legal fees or annual fees, etc.

Form 205 (Revised 12/21)Certificate of Formation Limited Liability CompanyThis space reserved for office use.Submit in duplicate to: Secretary of State P.O. Box 13697 Austin, TX 78711-3697 512 463-5555Filing Fee: $300

Forming a Limited Liability Company in Texas Choose a unique name for your LLC in Texas. Appoint a registered agent to receive important notices for your business. File a Certificate of Formation with the Texas Secretary of State. Create an operating agreement to establish the rules for your LLC.

Start a Texas LLC in 5 Steps Name Your LLC. You need to name your business. ... Hire a Registered Agent. ... File the Texas Certificate of Formation?Limited Liability Company. ... Obtain a Texas LLC Employer Identification Number (EIN) ... Create an LLC Operating Agreement.

Any person or business can form an LLC in Texas. You might have a sole proprietorship already or are about to open a business. In either of those situations, you can file for an LLC. Partnerships can also form as LLCs, and there is no limit on the number of partners.

The basic total cost of forming an LLC in Texas is $300. The basic total cost of registering a foreign LLC in Texas is $750. The optional costs of a certified copy of the filing document, a certificate of status, and hiring an outside registered agent could raise this total by between $85 and $535.

While there is no legal requirement to use an attorney when starting an LLC, it is highly advisable to do so. At the Weisblatt Law Firm, LLC, we regularly help all types of business owners decide whether forming an LLC is right for them, as well as helping them navigate every step of the formation process.

Unlike informal business structures such as sole proprietorships or partnerships, structuring your business as an LLC in Texas grants your business certain tax benefits as well as personal liability protection ? meaning you won't be personally liable for your business's debts or in the event that your business is sued.