What is Deed?

Deeds are legal documents that transfer property ownership from one person to another. They are commonly used in real estate transactions. Explore state-specific templates for your needs.

Deeds are essential documents for transferring property ownership. Our attorney-drafted templates are quick and easy to complete.

Effortlessly manage owner-financed real estate transactions with multiple related legal forms included in one convenient package.

Effortlessly manage owner-financed real estate transactions with multiple related legal forms included in one convenient package.

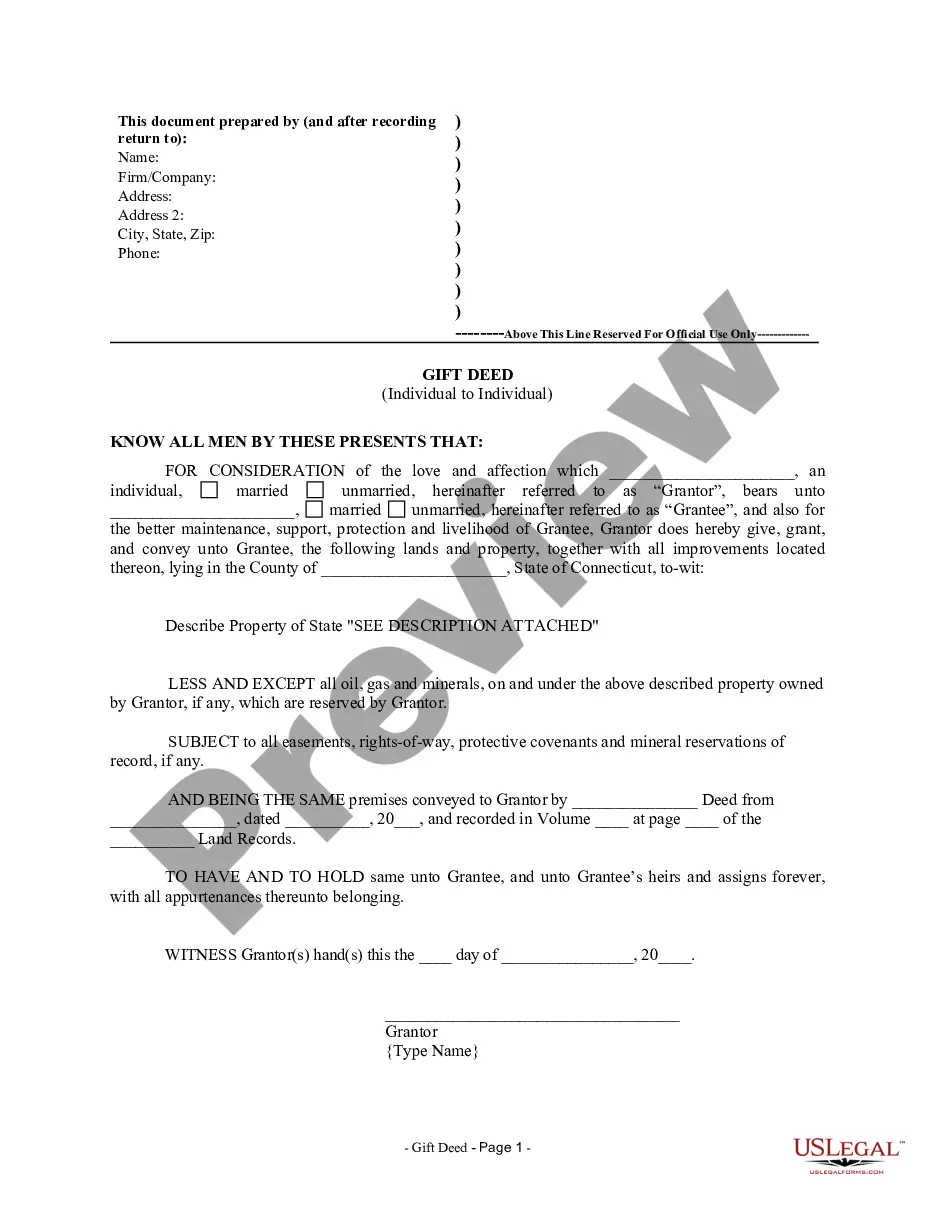

Transfer property rights easily between two individuals and one individual with this simple legal form.

Use this to outline terms for buying or selling real estate with payment plans, ensuring both parties understand their obligations.

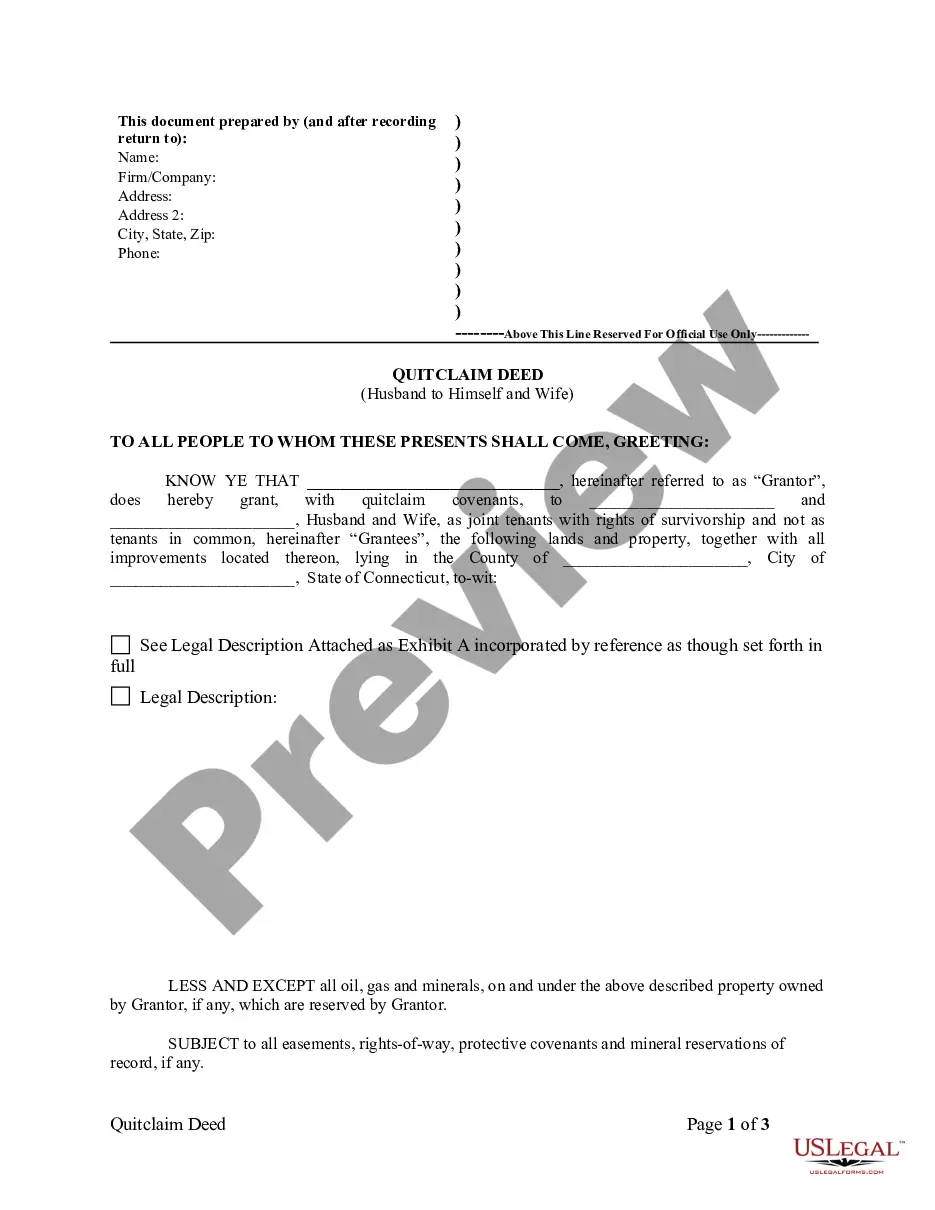

Utilize this document to transfer property ownership between individuals without warranties, ensuring a clear title for the recipient.

Transfer property ownership between individuals, ensuring a clear title and protection against future claims.

Ideal for transferring property ownership between spouses, this form simplifies the process without the need for a third party.

Ideal for transferring property while retaining life use, this deed offers flexibility and safeguards for property owners.

Transfer property ownership between individuals with this legal document, ensuring all rights and obligations are clearly outlined.

Transfer property to your child while retaining a life estate. Perfect for parents looking to manage their estate planning.

Transfer property ownership from one individual to three others with this simple document, making it ideal for family or friendly arrangements.

Deeds must be executed and delivered to be effective.

Most deeds require notarization for validity.

Property deeds can include various warranties.

Different types of deeds serve different purposes.

Deeds are recorded in public records to establish ownership.

Transfer tax may apply when executing a deed.

All parties must have the legal capacity to sign.

Begin your process in a few simple steps.

Yes, a deed is necessary to legally transfer ownership of real estate.

A warranty deed guarantees clear title, while a quitclaim deed transfers any interest without warranties.

The type of deed depends on the transaction's nature and the level of title assurance required.

Yes, changing names on a deed typically involves executing a new deed.

If a deed is not recorded, it may be difficult to prove ownership against third parties.