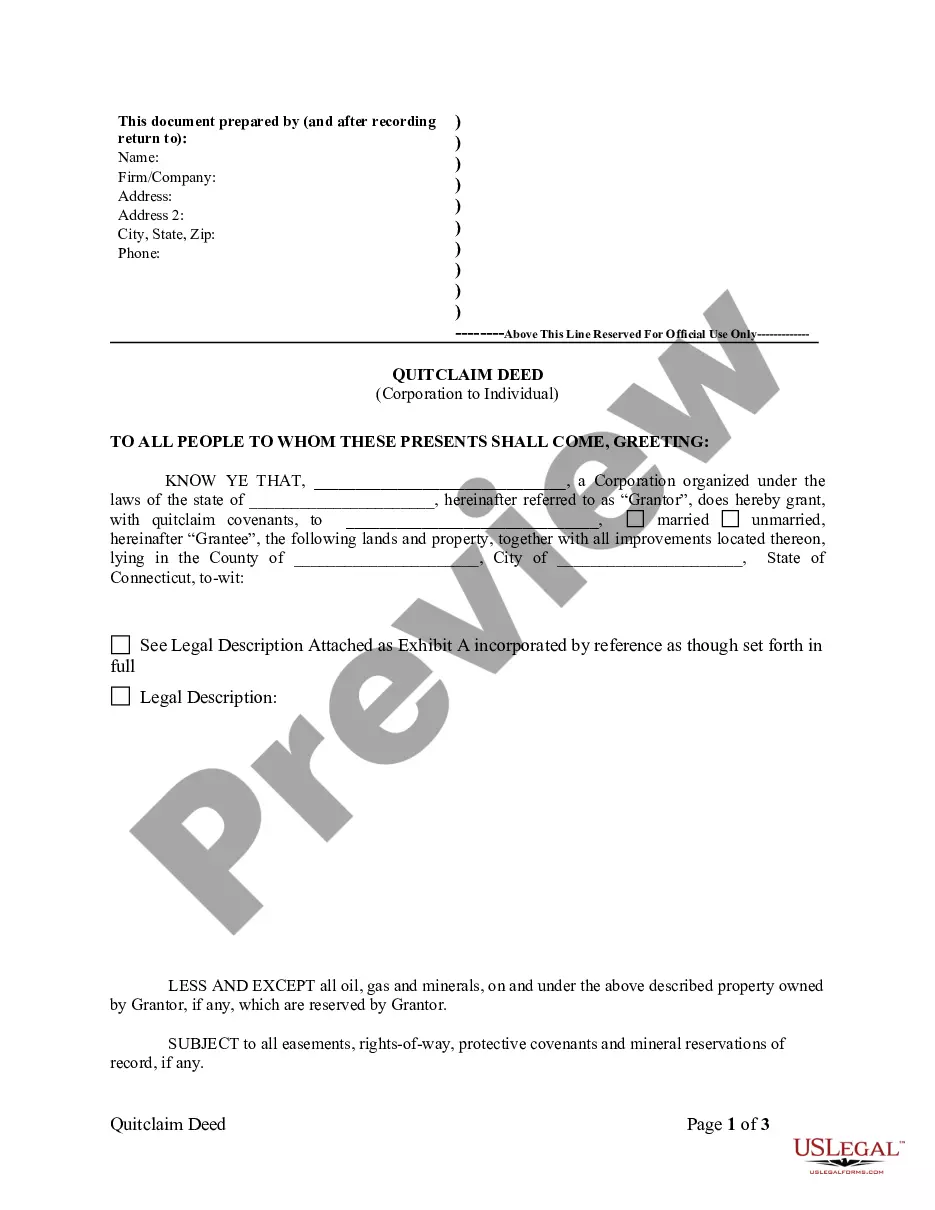

This Quitclaim Deed from Corporation to Individual form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Connecticut Quitclaim Deed from Corporation to Individual

Description

How to fill out Connecticut Quitclaim Deed From Corporation To Individual?

The greater the amount of documentation you need to complete - the more stressed you become.

You can discover countless Connecticut Quitclaim Deed from Corporation to Individual samples on the internet, but you can't tell which to rely on.

Eliminate the stress and simplify the process of finding examples using US Legal Forms.

Proceed by clicking Buy Now to initiate the registration process and choose a pricing plan that suits your needs. Input the required information to create your account and pay for your order using PayPal or a credit card. Select a convenient document format and obtain your copy. Access all documents in the My documents section. Visit there to prepare a new version of your Connecticut Quitclaim Deed from Corporation to Individual. Even with professionally drafted templates, it's still advisable to consult your local attorney to double-check the completed document to ensure it is accurately filled out. Achieve more with less utilizing US Legal Forms!

- Obtain accurately composed documents that meet state regulations.

- If you already possess a US Legal Forms subscription, Log In to your account, and you'll see the Download option on the Connecticut Quitclaim Deed from Corporation to Individual’s page.

- If you haven't utilized our service before, complete the registration process with these steps.

- Ensure the Connecticut Quitclaim Deed from Corporation to Individual is valid in your state.

- Review your choice by reading the details or using the Preview mode if available for the selected document.

Form popularity

FAQ

Yes, you can file a quit claim deed yourself in Connecticut. The process does not require a lawyer, making it accessible for individuals who are comfortable handling the paperwork. A Connecticut Quitclaim Deed from Corporation to Individual is straightforward, and platforms like US Legal Forms can provide the necessary templates and guidance. This option simplifies the process and helps ensure that your filing meets all legal requirements.

To file a Connecticut Quitclaim Deed from Corporation to Individual, start by obtaining the necessary form, which can be found online or through local government offices. Next, complete the form with accurate information about the property and the parties involved. After signing the deed in front of a notary, you will need to file it with the town clerk in the municipality where the property is located. This process ensures that the transaction is legally recognized and properly documented.

Yes, when a corporation transfers ownership of property via a deed, the document must be signed by an authorized representative of the corporation. This is crucial because it validates the transaction and protects the rights of both parties in a Connecticut Quitclaim Deed from Corporation to Individual.

An example of a quitclaim deed is when a corporation transfers a parcel of land to an individual for personal use. This deed conveys any interest the corporation has in the property, but it does not guarantee clear title. Therefore, it’s wise for the individual to conduct due diligence to understand the property’s status before accepting a Connecticut Quitclaim Deed from Corporation to Individual.

When preparing the quitclaim deed form, start by accessing the correct form for Connecticut. Fill in the names of the corporation transferring the property and the individual receiving it. Accurately describe the property location, and include the date of transfer. Finally, ensure all signatures are complete before you move on to the filing process.

To fill out a Connecticut Quitclaim Deed from Corporation to Individual, begin by entering the names of both the grantor and grantee correctly. Make sure to include the property’s legal description, which identifies the exact location and boundaries. After you’ve filled in all required details, both parties should sign the deed, and it’s highly recommended to have it notarized to ensure legality.

Many real estate professionals express caution towards quitclaims due to the inherent risks involved. Since this type of deed does not offer any guarantees about the property’s title, it may expose the grantee to unforeseen liabilities. To navigate these risks effectively, users can consult the resources available through US Legal Forms for informed decisions regarding quitclaim deeds.

A significant disadvantage for a buyer receiving a Connecticut Quitclaim Deed from Corporation to Individual is the lack of protection against title defects. Without warranties, buyers may face unexpected legal challenges regarding ownership or title claims after the transfer. This uncertainty can make it a risky option compared to other deed types that provide greater assurance.

The primary beneficiaries of a quitclaim deed are often individuals involved in informal transactions, such as family members or closely trusted associates. This method provides a quick way to transfer property without extensive legal complexities, making it ideal for those who understand the terms. In many cases, businesses looking to streamline internal transfers also find it beneficial.

Although a Connecticut Quitclaim Deed from Corporation to Individual can be efficient, it has potential drawbacks. Primarily, this deed does not guarantee that the grantor holds clear title to the property, meaning the grantee may inherit outstanding claims or liens. This uncertainty can lead to problems if complications arise in the future.