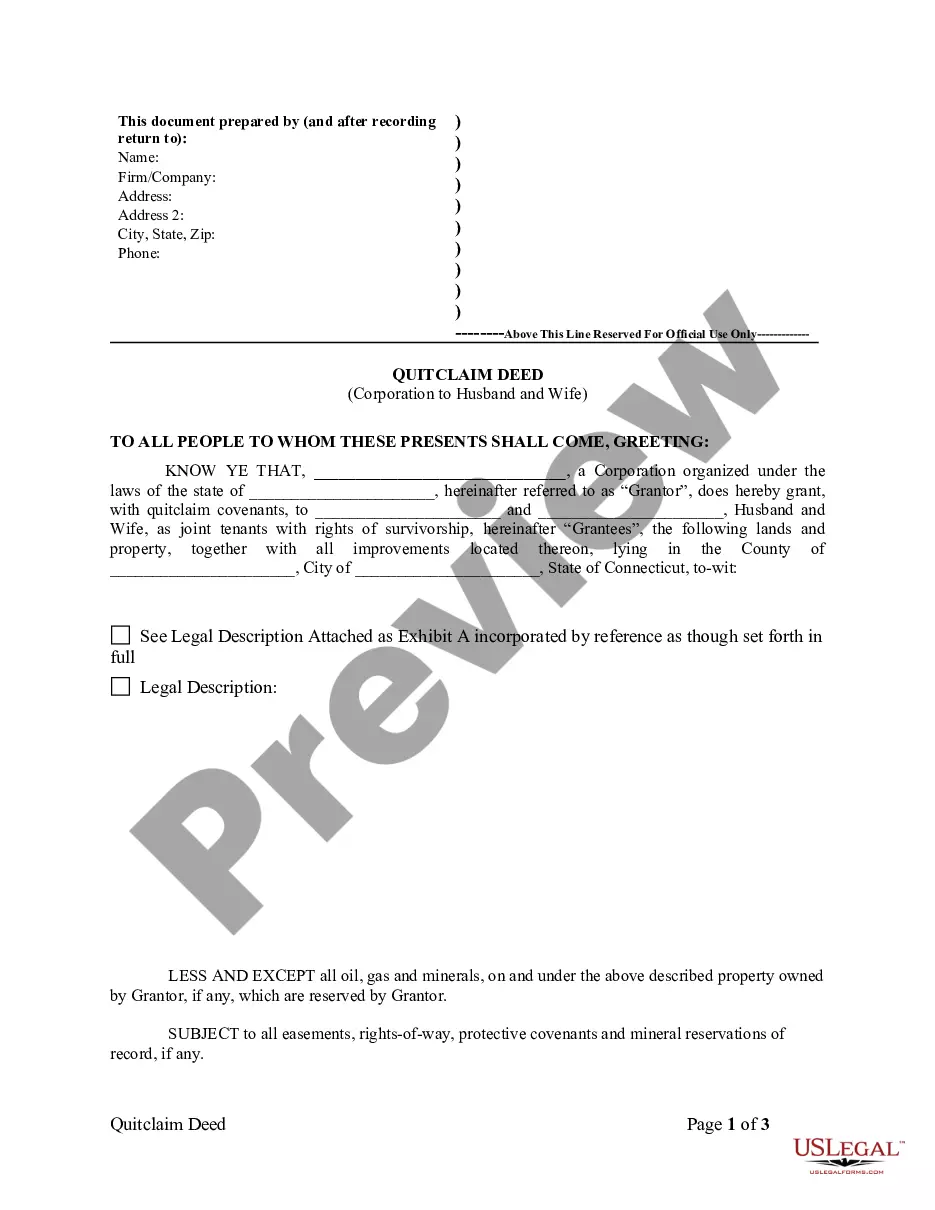

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Connecticut Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Connecticut Quitclaim Deed From Corporation To Husband And Wife?

The more documentation you must complete, the more anxious you become.

You can discover numerous Connecticut Quitclaim Deed from Corporation to Husband and Wife samples online, but you're unsure which ones to trust.

Eliminate the inconvenience of locating examples more easily by utilizing US Legal Forms.

Click on Buy Now to initiate the enrollment process and select a pricing plan that meets your needs. Provide the required information to create your account and pay for your order via PayPal or credit card. Choose a suitable file format and obtain your template. You can find each document you download in the My documents section. Simply go there to generate a new copy of the Connecticut Quitclaim Deed from Corporation to Husband and Wife. Even when utilizing expertly prepared forms, it is still advisable to consider consulting a local attorney to double-check the completed document to ensure that your paperwork is filled accurately. Achieve more for less with US Legal Forms!

- Obtain professionally prepared documents tailored to fulfill state regulations.

- If you already have a US Legal Forms membership, Log In to your account and you'll find the Download button on the Connecticut Quitclaim Deed from Corporation to Husband and Wife page.

- If you haven’t used our service before, complete the registration process by following these steps.

- Ensure the Connecticut Quitclaim Deed from Corporation to Husband and Wife is relevant in your residing state.

- Verify your selection by reviewing the description or utilizing the Preview option if available for the selected document.

Form popularity

FAQ

Filing a Connecticut Quitclaim Deed from Corporation to Husband and Wife involves several steps. First, you must complete the deed form accurately and make sure it is signed by the corporation's authorized representative. After that, take the completed deed to your local town clerk's office to record it. By using tools from US Legal Forms, you can simplify the process, ensuring everything follows Connecticut's rules for deed filings.

Yes, you can fill out a Connecticut Quitclaim Deed from Corporation to Husband and Wife yourself. It's essential to ensure you understand the specific requirements and format needed for the deed to be legally valid. Many people choose to use online platforms, like US Legal Forms, to obtain the correct template and guidance. This approach helps you avoid common mistakes and ensures your deed meets state requirements.

A spouse may choose to execute a quitclaim deed for several reasons, such as simplifying ownership or resolving disputes. It often occurs during updating estate plans, transferring property after divorce, or consolidating assets in marriage. Especially with a Connecticut Quitclaim Deed from Corporation to Husband and Wife, this enables clear separation of ownership interests. Utilizing platforms like USLegalForms can guide spouses through the necessary paperwork efficiently.

A quitclaim deed between husband and wife allows one spouse to transfer their interest in a property to the other spouse. This type of deed effectively changes the ownership on legal documents. It is particularly useful in situations like divorce, joint property ownership, or estate planning. For those interested in a Connecticut Quitclaim Deed from Corporation to Husband and Wife, this process ensures clarity in property rights.

The primary beneficiaries of a Connecticut Quitclaim Deed from Corporation to Husband and Wife are often families and individuals involved in informal transactions. It simplifies the transfer process without the need for extensive paperwork or legal fees. Additionally, it is particularly useful in situations like divorces or estate settlements where swift ownership changes are required. By using platforms like US Legal Forms, you can ensure the process is smooth and compliant with all necessary regulations.

A Connecticut Quitclaim Deed from Corporation to Husband and Wife may be considered detrimental because it lacks protections for the buyer. Without warranties, you could inherit unresolved issues linked to the property, such as liens or claims from other parties. Furthermore, if any part of the title was misrepresented, it could lead to costly legal battles. Understanding these potential pitfalls ensures that you make informed decisions regarding property transfers.

Quitclaim deeds are often frowned upon due to the lack of guarantee regarding the property's title. Since a Connecticut Quitclaim Deed from Corporation to Husband and Wife does not provide warranties, transferees may face unexpected legal or financial liabilities. This absence of assurances can lead to disputes and complications, making some prefer more secure types of property transfers. Awareness of these risks can guide your decision-making.

The usual reason for using a Connecticut Quitclaim Deed from Corporation to Husband and Wife is to transfer property ownership quickly and efficiently, often without a sale. This is particularly useful in familial transactions, such as when individuals wish to add or remove family members from the title. Additionally, it avoids the lengthy processes associated with other deed types, making it attractive for straightforward transfers. However, understanding the implications of this deed type is crucial for all parties involved.

To execute a Connecticut Quitclaim Deed from Corporation to Husband and Wife, you first need to draft the document according to state requirements. Both parties must sign the deed, and it should then be notarized for legitimacy. Next, you'll file the deed with the local town clerk’s office to record the transfer of ownership officially. This process ensures that the transaction is recognized legally and can protect the rights of the new owners.

A significant disadvantage of the Connecticut Quitclaim Deed from Corporation to Husband and Wife is that it does not offer any warranties on the property title. As a buyer, you assume all risks related to any existing liens or claims on the property. This means that you may not have clear ownership, which can create legal issues in the future. Therefore, it's crucial to conduct thorough due diligence before accepting this type of deed.