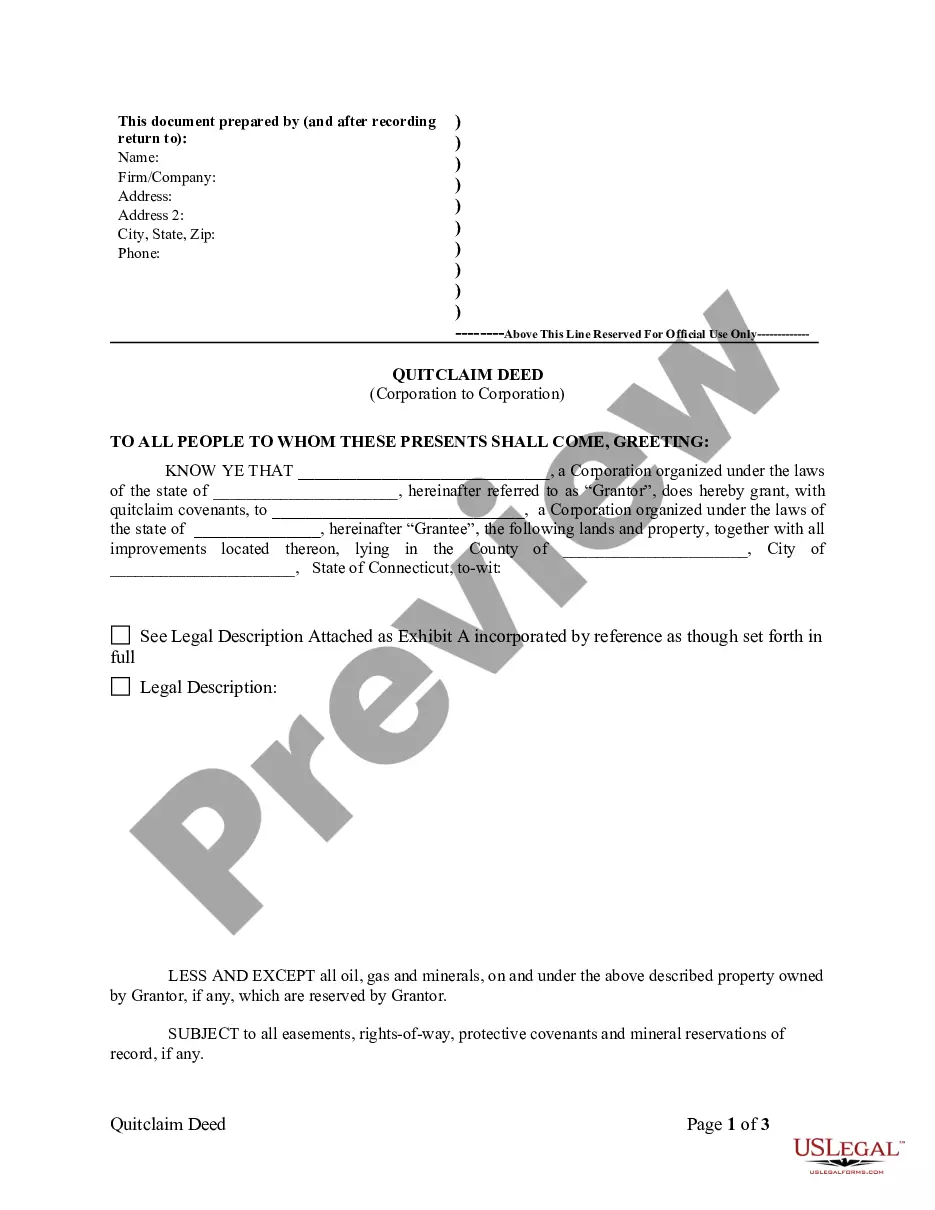

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Connecticut Quitclaim Deed from Corporation to Corporation

Description

How to fill out Connecticut Quitclaim Deed From Corporation To Corporation?

The larger quantity of documents you ought to produce - the more anxious you become.

You can obtain countless Connecticut Quitclaim Deed from Corporation to Corporation templates online, yet, you are uncertain which ones to trust.

Eliminate the frustration of finding templates more easily with US Legal Forms.

Even when you have well-prepared templates, it’s still crucial to consider consulting a local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- Acquire professionally created forms that are designed to meet the state's requirements.

- If you already possess a US Legal Forms membership, Log In to your account, and you'll find the Download button on the Connecticut Quitclaim Deed from Corporation to Corporation’s webpage.

- If you’ve never utilized our platform before, complete the registration process by following these instructions.

- Ensure the Connecticut Quitclaim Deed from Corporation to Corporation is legitimate in your state.

- Verify your selection by reviewing the description or by using the Preview option if it's available for the selected document.

Form popularity

FAQ

Filing a quitclaim deed in Connecticut involves completing the deed form correctly and ensuring it's signed by the grantor. Afterward, you need to file the deed with the town clerk in the municipality where the property is located. For assistance, you might consider using uslegalforms to make the process easier, ensuring you comply with all necessary requirements for a Connecticut Quitclaim Deed from Corporation to Corporation.

A corporation conveys real estate by formally executing a deed, typically done by a designated officer. In the case of a Connecticut Quitclaim Deed from Corporation to Corporation, the deed must specify the granting corporation and the receiving corporation. It’s important to follow the legal requirements, including proper authorization and recording the deed, to ensure a valid transfer.

The transfer of property without the owner's consent is referred to as adverse possession. However, in the context of corporate transactions such as a Connecticut Quitclaim Deed from Corporation to Corporation, this normally does not occur, since both parties must agree to the deed's terms. It's essential to have consent from both corporations during property transfers to ensure legality and clarity.

To ensure a deed is valid, it must be in writing, identify the parties involved, and outline a clear description of the property. Additionally, the deed needs to be signed by the grantor, which in the case of a Connecticut Quitclaim Deed from Corporation to Corporation, means an authorized representative of the corporation must sign. Remember, proper execution and witnessing may also be necessary, depending on state laws.

People commonly use a Connecticut Quitclaim Deed from Corporation to Corporation to transfer property rights without guarantees. This method is straightforward and efficient, making it ideal for corporate transactions where trust exists between parties. Corporations often utilize this type of deed to streamline the transfer process, especially during mergers or property consolidations. By using a quitclaim deed, companies can quickly change property ownership while minimizing the complexities of traditional deeds.

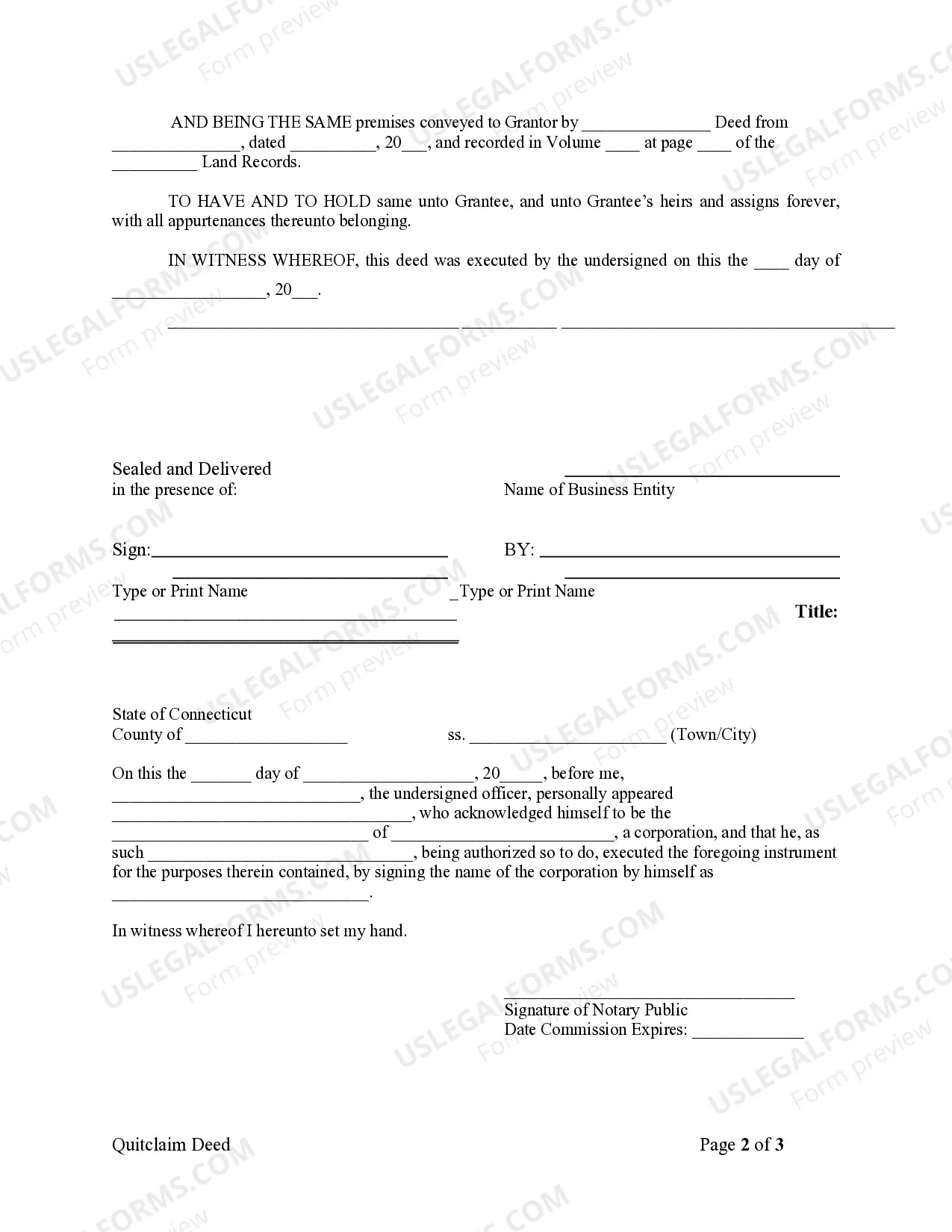

Yes, when a corporation transfers ownership using a Connecticut Quitclaim Deed from Corporation to Corporation, the deed must be signed. It must be signed by an authorized officer representing the corporation, ensuring that the transfer is legally binding. This signature verifies consent and allows for the proper documentation of the transaction in public records.

In Connecticut, a Quitclaim Deed from Corporation to Corporation must meet specific requirements. It should include the names of the grantor and grantee, a clear description of the property, and should be signed by an authorized officer of the corporation transferring the property. Additionally, the deed needs to be acknowledged before a notary public and filed with the appropriate town clerk.

The process for a Connecticut Quitclaim Deed from Corporation to Corporation begins with drafting the deed document. This deed must clearly outline the properties being transferred and be signed by the authorized representatives of both corporations. After signing, the deed should be filed with the local town clerk's office to make the transfer official and to ensure public records are updated.