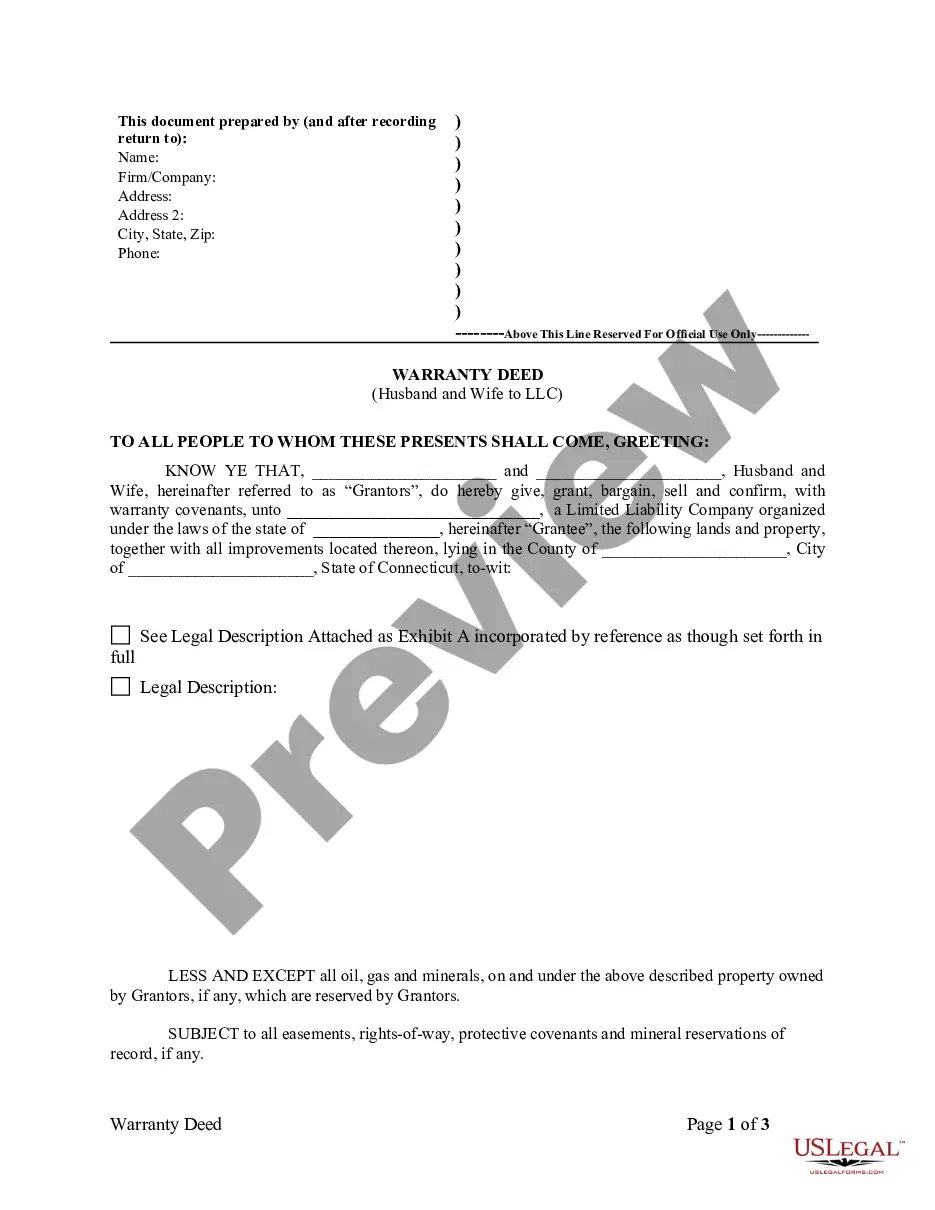

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Connecticut Warranty Deed from Husband and Wife to LLC

Description

How to fill out Connecticut Warranty Deed From Husband And Wife To LLC?

The greater the number of documents you need to create, the more uneasy you become.

You can locate countless Connecticut Warranty Deed from Husband and Wife to LLC samples online; however, it's hard to determine which ones are reliable.

Streamline the process and make finding examples significantly easier with US Legal Forms. Obtain expertly crafted documents that comply with state regulations.

Provide the necessary details to set up your account and complete your payment using PayPal or a credit card. Choose a preferred document format and download your copy. Access each template you acquire in the My documents section. Simply head there to create a new version of your Connecticut Warranty Deed from Husband and Wife to LLC. Even with professionally prepared forms, it remains essential to consider consulting your local attorney to verify that your document is properly filled out. Achieve more for less with US Legal Forms!

- If you already possess a subscription to US Legal Forms, Log In to your account, and you will find the Download button on the Connecticut Warranty Deed from Husband and Wife to LLC page.

- If this is your first time on our website, follow the sign-up steps outlined here.

- Ensure that the Connecticut Warranty Deed from Husband and Wife to LLC is valid in your state.

- Verify your choice by reading the description or utilizing the Preview mode if it is available for the chosen file.

- Click Buy Now to initiate the registration process and choose a pricing plan that meets your needs.

Form popularity

FAQ

People often put their houses under an LLC to gain asset protection and to manage risks more effectively. By doing so, individuals can shield their personal assets from liabilities related to the property. Additionally, an LLC can facilitate smoother transfers of ownership through a Connecticut Warranty Deed from Husband and Wife to LLC, which streamlines estate planning. Ultimately, this strategy can provide peace of mind and financial security.

One major disadvantage of an LLC is the potential for higher costs and administrative burdens. Operating an LLC often involves state fees, annual reports, and adherence to specific regulations. This complexity can be daunting for some owners. Hence, when contemplating a Connecticut Warranty Deed from Husband and Wife to LLC, consider whether the benefits outweigh these possible challenges.

Putting a property in an LLC using a Connecticut Warranty Deed from Husband and Wife to LLC has its pros and cons. On the positive side, it provides liability protection and simplifies estate planning. However, on the downside, transferring a property into an LLC may incur additional costs and administrative tasks, such as filing fees and annual reports. It’s essential to weigh these factors carefully before deciding on this route.

When an LLC owns property, it can benefit from various tax advantages. One significant benefit is that rental income generated by the property typically passes through to the owners, allowing them to report it on their personal tax returns. Furthermore, LLCs can deduct expenses related to property management, which can lower taxable income. Consequently, this structure can make owning property through a Connecticut Warranty Deed from Husband and Wife to LLC tax-efficient.

To fill out a warranty deed form for a Connecticut Warranty Deed from Husband and Wife to LLC, start by identifying the grantors and grantee. Clearly state the property's legal description, including its location and boundaries. Additionally, ensure you include the date of the transfer and any required notarization. Using platforms like USLegalForms can simplify this process by providing templates that guide you through each step.

Two names can go on a deed, allowing shared ownership of the property involved. This can also provide legal protections and clarify responsibilities between the parties. When completing a Connecticut Warranty Deed from Husband and Wife to LLC, ensuring that both names are accurately represented simplifies any future dealings and strengthens ownership claims.

Yes, two people can indeed be on a warranty deed, and this is often used in property transactions among couples, business partners, or family members. Including both names provides protection and clarity regarding ownership rights. When creating a Connecticut Warranty Deed from Husband and Wife to LLC, this ensures that both parties are recognized as tenants and can share responsibilities related to the property.

When two people are on a deed, it generally means that both individuals share ownership of the property. If one person wants to sell or transfer their interest, they typically need the consent of the other. This arrangement can become critical when dealing with a Connecticut Warranty Deed from Husband and Wife to LLC, ensuring that both parties agree on future actions related to the property.

To transfer ownership from husband to wife, you can create a warranty deed that outlines the new ownership structure. This process may involve legally drafting the deed with the appropriate information, signing it in front of a notary, and then filing it with the local government. This is particularly relevant when you are considering a Connecticut Warranty Deed from Husband and Wife to LLC, as it provides a clear legal record of the transfer.

Joint tenants on a warranty deed refers to a form of property ownership where two or more individuals hold title to a property together. This means that if one joint tenant passes away, their share automatically transfers to the surviving tenant(s). It’s a common arrangement in marital situations and can be an essential aspect when creating a Connecticut Warranty Deed from Husband and Wife to LLC.