Complaint for Accounting, Conversion, Damages Declaratory Judgment and for Specific

About this form

The Complaint for Accounting, Conversion, Damages, Declaratory Judgment, and for Specific Performance of Contract is a legal document used to initiate a civil lawsuit when one party believes their rights under a contract have been violated. This form allows Plaintiffs to seek an accounting of transactions, damages for conversion of property, and specific performance, which assures compliance with the contractual obligations. This form differs from other complaint forms due to its focus on both legal remedies and performance enforcement related to business transactions.

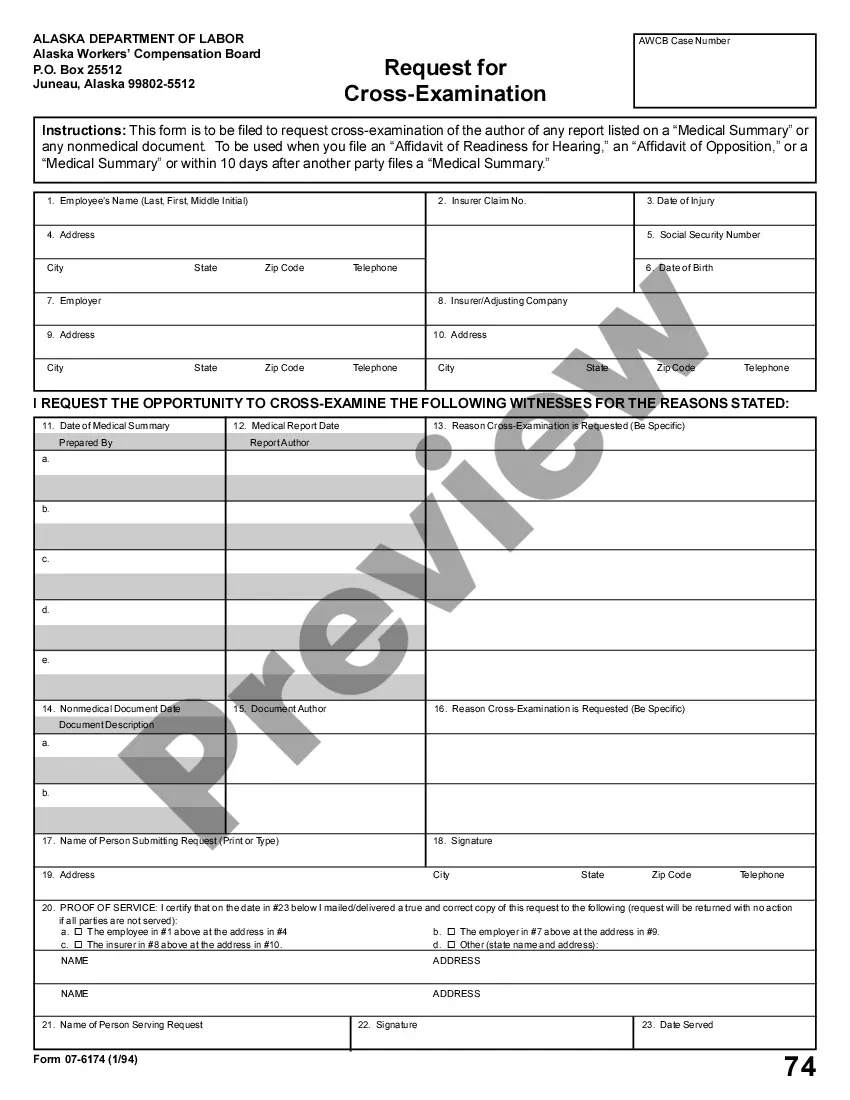

Main sections of this form

- Identification of parties involved, including Plaintiffs and Defendants.

- Statement of the facts leading to the complaint, including contracts and agreements.

- Description of specific counts, such as accounting, conversion, specific performance, and damages.

- Requests for declaratory relief regarding payment addresses and liabilities.

- Signature section for the Plaintiff and attorney, if applicable.

When to use this form

This form is used when individuals or businesses are unable to resolve disputes related to contracts regarding the sale of assets, liabilities, or property. It is applicable in situations of alleged wrongful acts by a seller, such as unauthorized withdrawal of funds, failure to disclose liabilities, or failure to comply with the terms of a sales contract.

Intended users of this form

- Business owners seeking legal recourse after a failed transaction.

- Individuals who have entered into contracts and experienced breaches.

- Parties involved in disputes regarding property ownership or liability.

- Those who require a legally binding remedy to enforce compliance with contractual terms.

Steps to complete this form

- Identify the parties involved by providing their names and addresses.

- Clearly state the events leading to the dispute, including the terms of the underlying contract.

- Fill in the details for each count, including the damages sought and specifics of the wrongful actions.

- Include any supporting documents, such as contracts and addendums, as exhibits.

- Sign the document, preferably with legal counsel to ensure completeness and accuracy.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to clearly identify all parties involved in the complaint.

- Omitting relevant details regarding the contract and related disputes.

- Not including necessary exhibits or supporting documentation.

- Neglecting to sign the complaint or include an attorneyâs signature when required.

Advantages of online completion

- Convenience of completing the form from anywhere at any time.

- Editable templates allow for tailored responses to fit specific situations.

- Access to attorney-drafted forms ensures legal compliance and accuracy.

- Quick download options for immediate use in legal proceedings.

Looking for another form?

Form popularity

FAQ

If you are unsure if the FRC will be able to deal with your complaint, you can email us at complaints@frc.org.uk We usually ask complainants to submit an online complaints form so we may ask you to fill this out or to provide further specific information to help us decide if we can look into your complaint further.

Under Florida law, an accounting is a cause of action in which a party requests an equitable settlement of claims and liabilities arising out of its relationship with another party.The most common equitable accounting action stems from lawsuits concerning partnership disputes.

If you need to report the unethical or illegal behavior of your accounting colleague or employer, seek legal counsel either in-house or from an independent firm or access your company's whistleblowing resources.

The Financial Reporting Council (FRC) promotes transparency and integrity in business. It regulates auditors, accountants and actuaries, and sets the UK's Corporate Governance and Stewardship Codes.

If you want to make a complaint about your accountant/auditor or a firm of accountants/auditors, you should initially contact the Prescribed Accountancy Body ('PAB') of which the accountant/auditor/firm is a member. Please click here for contact details for the PABs.

If your accountant is insured You can sue your accountant irrespective of whether they have professional indemnity insurance, but if they are not covered, the likelihood of receiving compensation is much lower.

If you are unsure if the FRC will be able to deal with your complaint, you can email us at complaints@frc.org.uk We usually ask complainants to submit an online complaints form so we may ask you to fill this out or to provide further specific information to help us decide if we can look into your complaint further.

An action for an accounting is an equitable cause of action. As discussed below, for statute of limitations purposes, the cause of action for an accounting must sometimes be distinguished from the remedy of an accounting.

An account of profits (sometimes referred to as an accounting for profits or simply an accounting) is a type of equitable remedy most commonly used in cases of breach of fiduciary duty.