What is Probate?

Probate is the legal process of settling an estate after someone passes away. It includes distributing assets, paying debts, and validating wills. Explore state-specific templates to guide you.

Probate involves managing a deceased person's estate. Using attorney-drafted templates can make this process quick and easy.

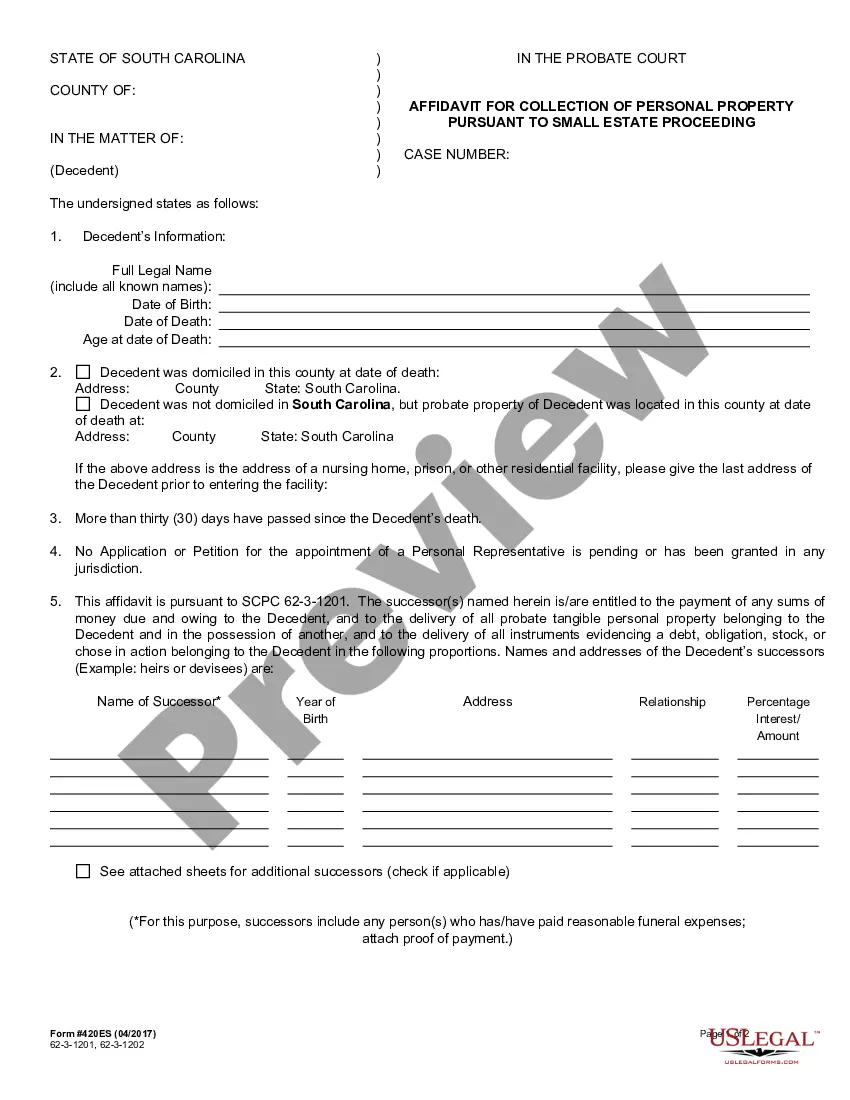

Utilize this document to settle a small estate valued under $25,000 without the complexities of full probate.

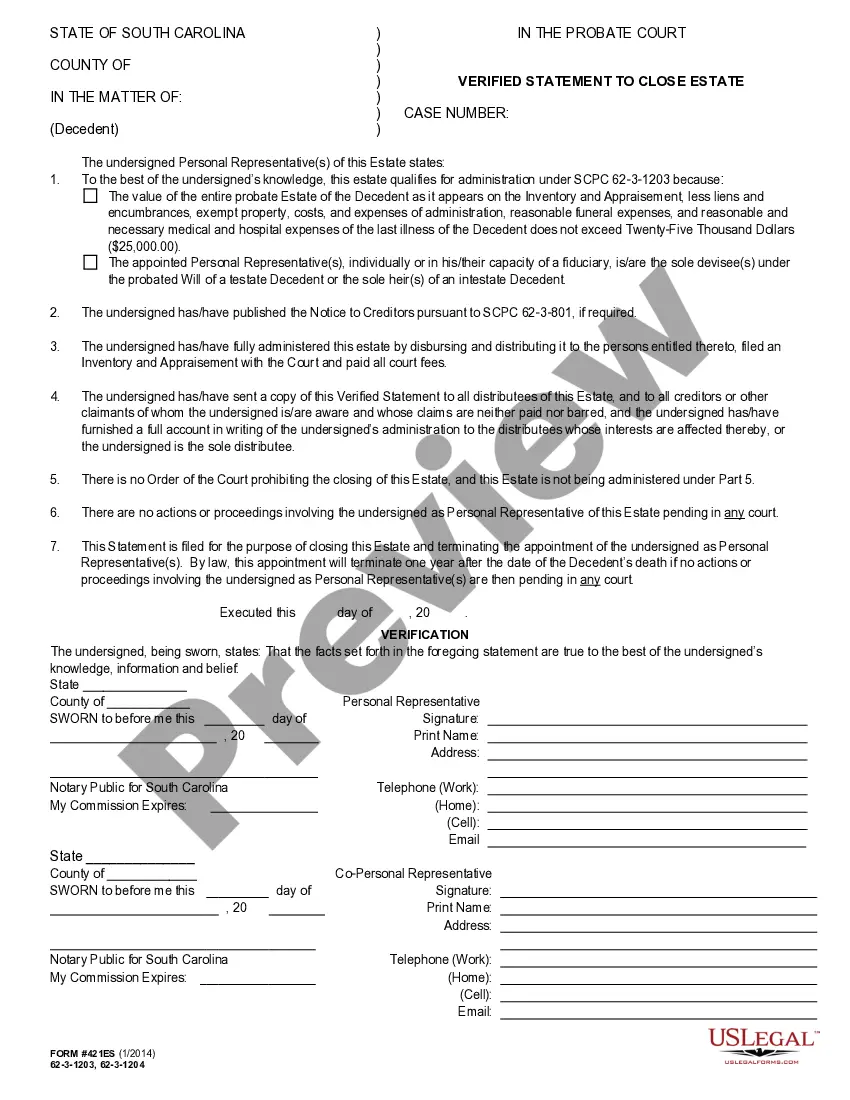

Efficiently close a small estate without complex probate processes when total assets are under $25,000.

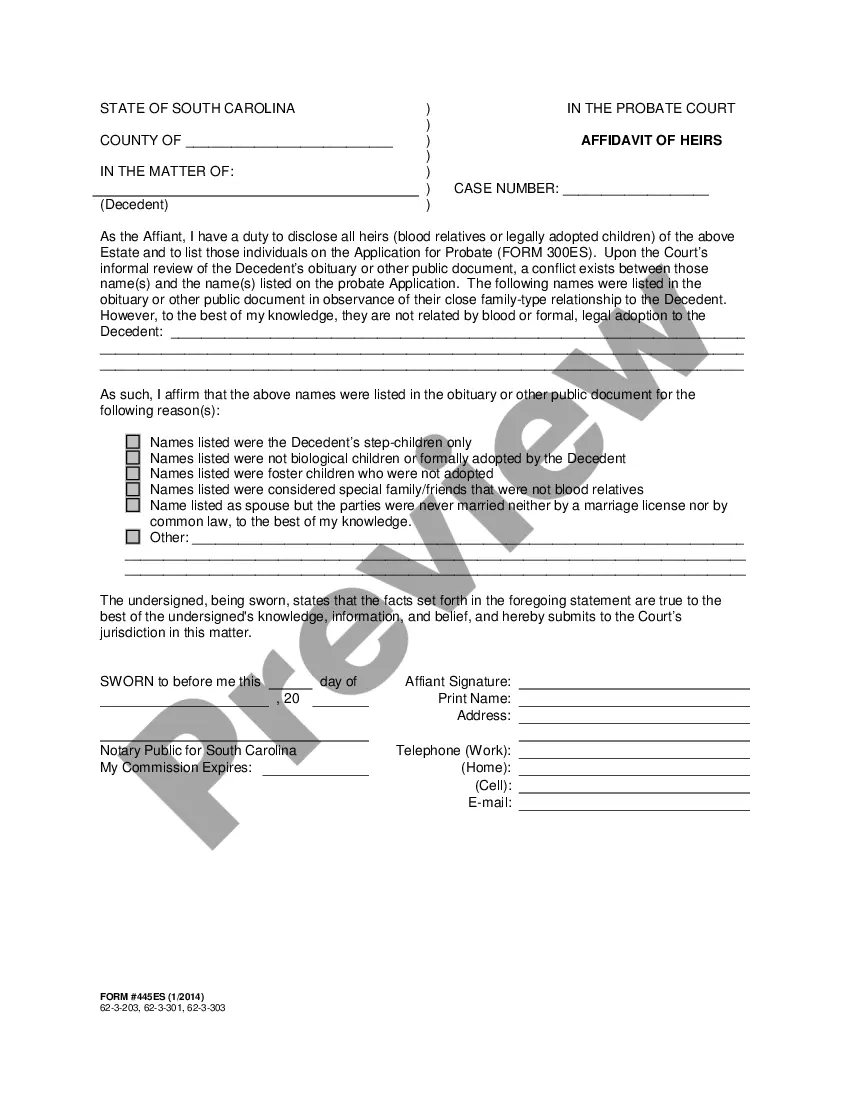

Establish heirship when a loved one passes without a will. This affidavit clarifies inheritance rights in South Carolina.

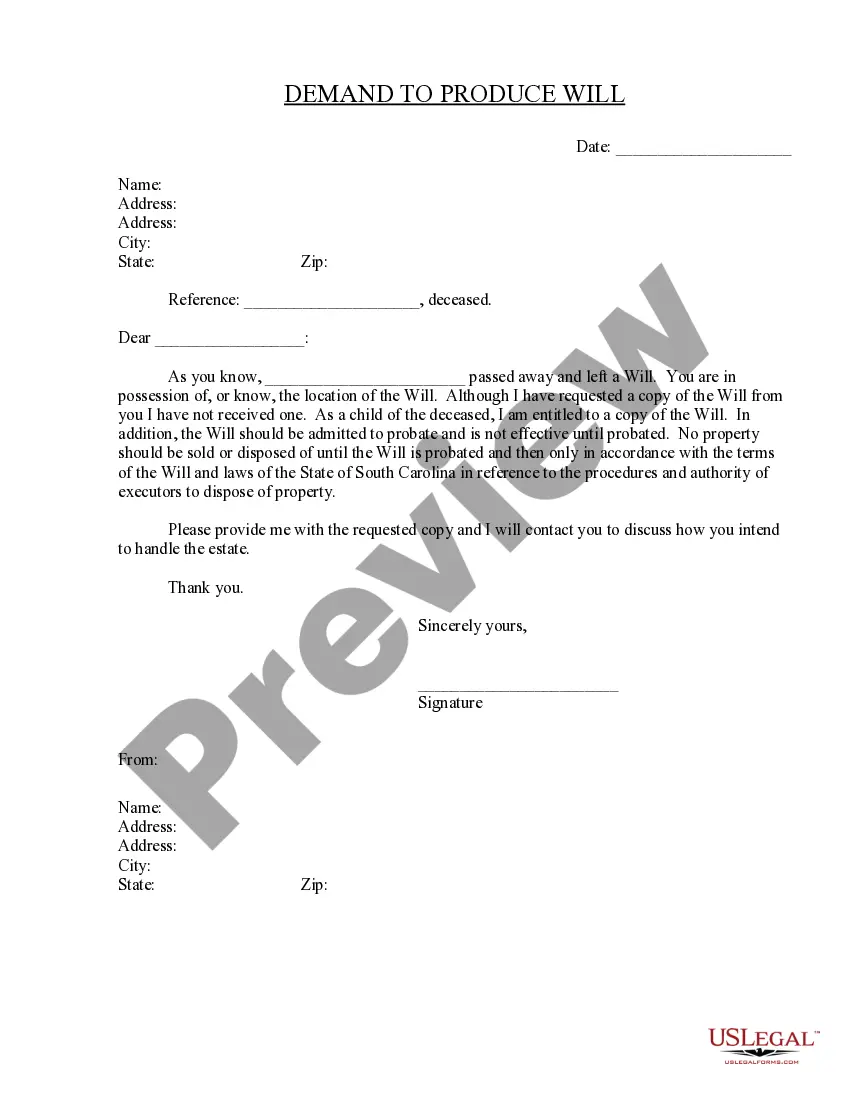

Request a copy of a deceased person's Will to ensure your rights as an heir are protected.

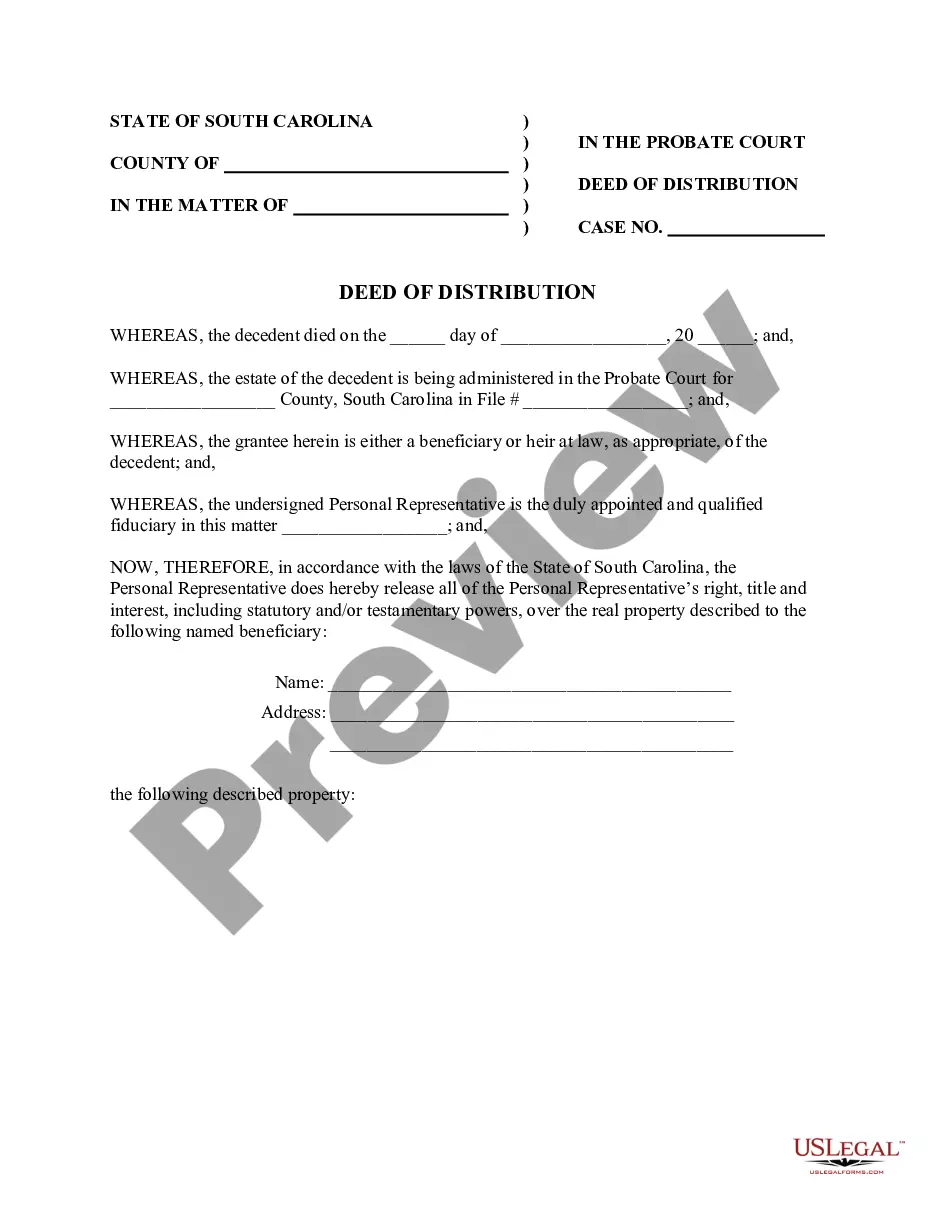

Use this document to formally transfer property from an estate to a beneficiary or heir after probate.

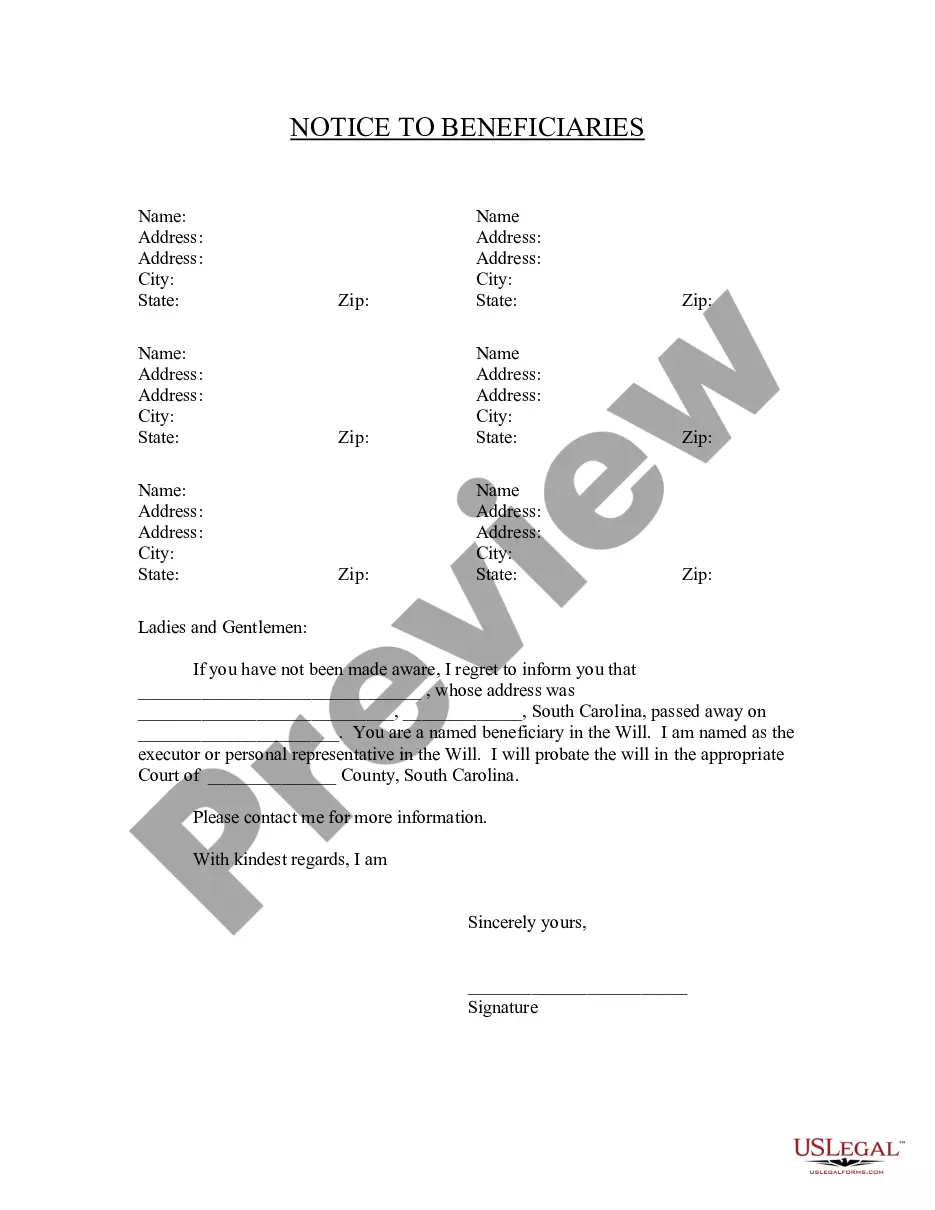

Inform beneficiaries of their status in a will and provide vital contact details about the deceased.

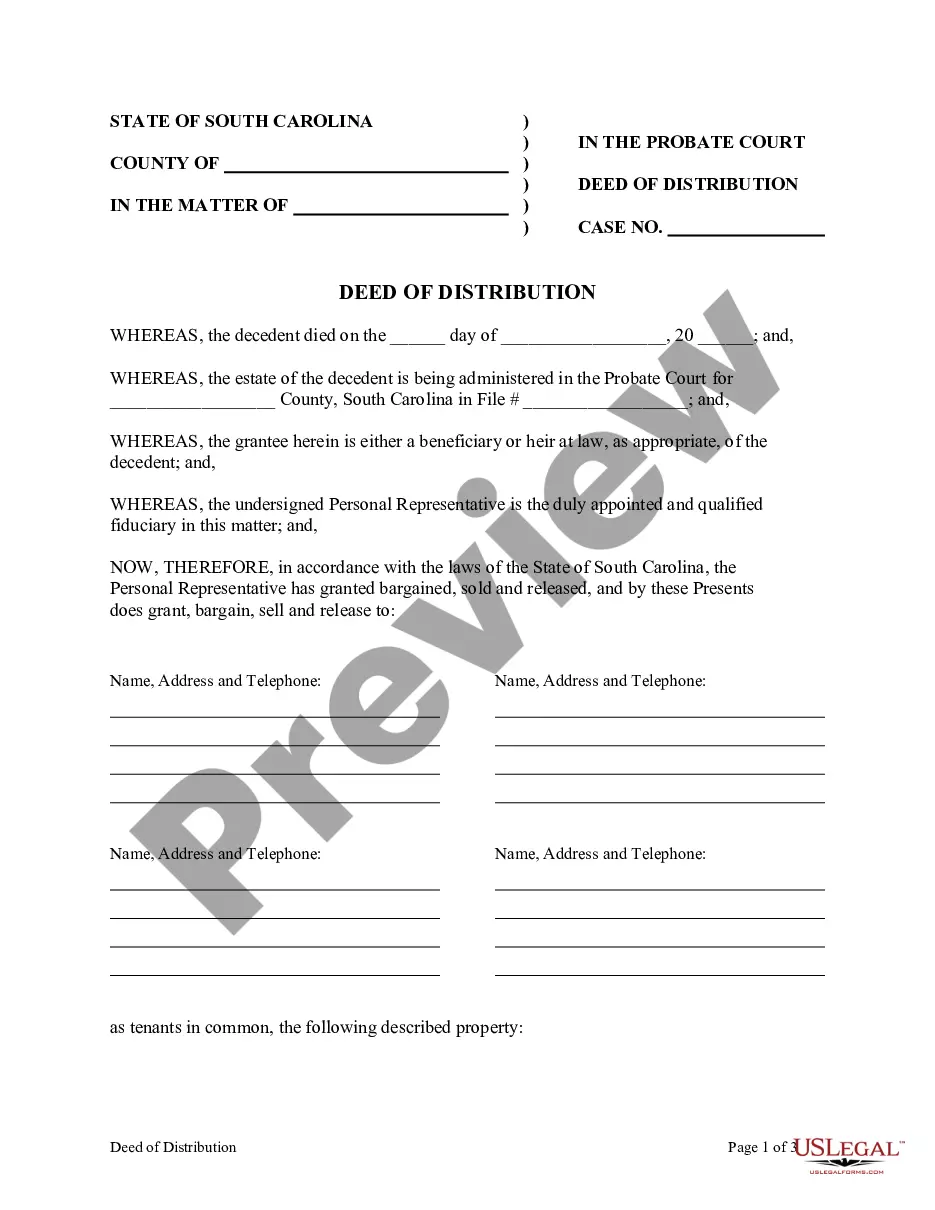

Facilitate the distribution of an estate's assets among beneficiaries, ensuring a legal transfer of ownership after probate.

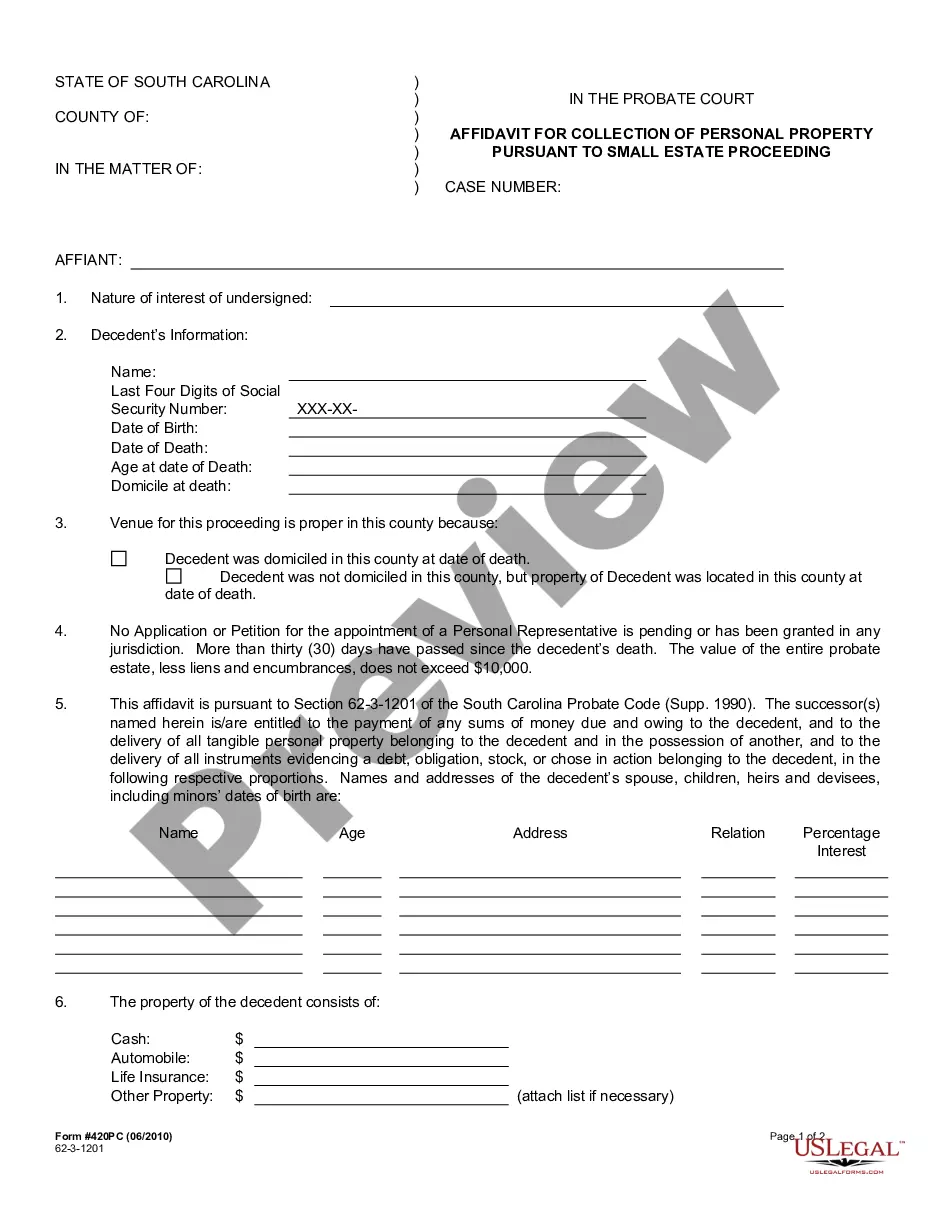

Useful for gathering personal property from a decedent's estate without extensive probate proceedings, especially when the estate's value is under $10,000.

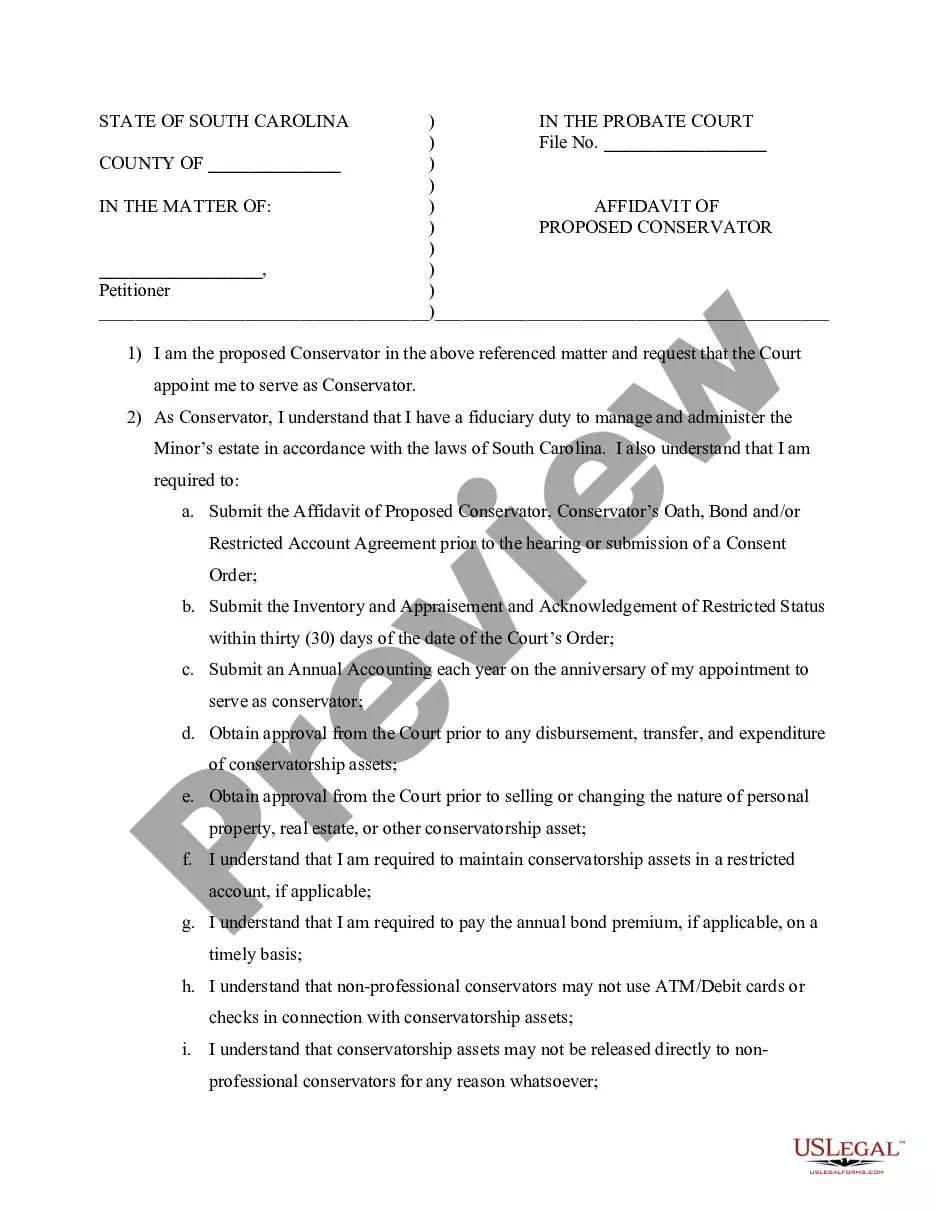

Use this form to request appointment as a conservator, ensuring responsible management of a minor's estate under South Carolina law.

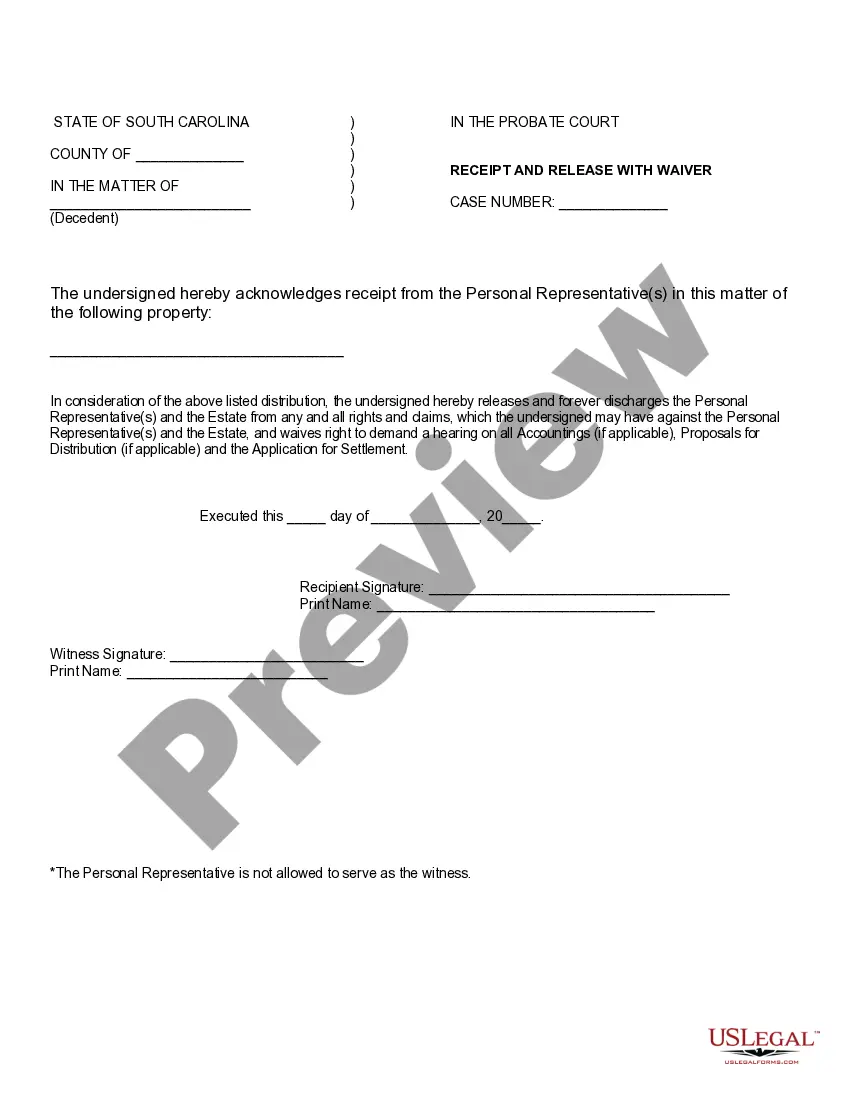

Use this document to acknowledge receipt of property from an estate while releasing any claims against the estate or personal representatives.

Probate is necessary to validate a will in most cases.

Not all assets require probate; many can bypass the process.

The probate process can vary significantly by state.

Heirs and beneficiaries may need to be notified during probate.

Debts of the deceased generally must be settled before assets are distributed.

Begin the process with these simple steps.

A trust is not necessary if a will meets your estate planning goals.

If no estate plan exists, state laws will determine asset distribution.

It's wise to review your plan every few years or after major life changes.

Beneficiary designations can override your will for certain assets.

Yes, you can designate separate individuals for financial and healthcare decisions.