What is Probate?

Probate is the legal process of settling an estate after someone passes away. It involves validating the will, appointing executors, and distributing assets. Explore our state-specific templates for assistance.

Probate involves managing a deceased person's estate. Our attorney-drafted templates make the process quick and straightforward.

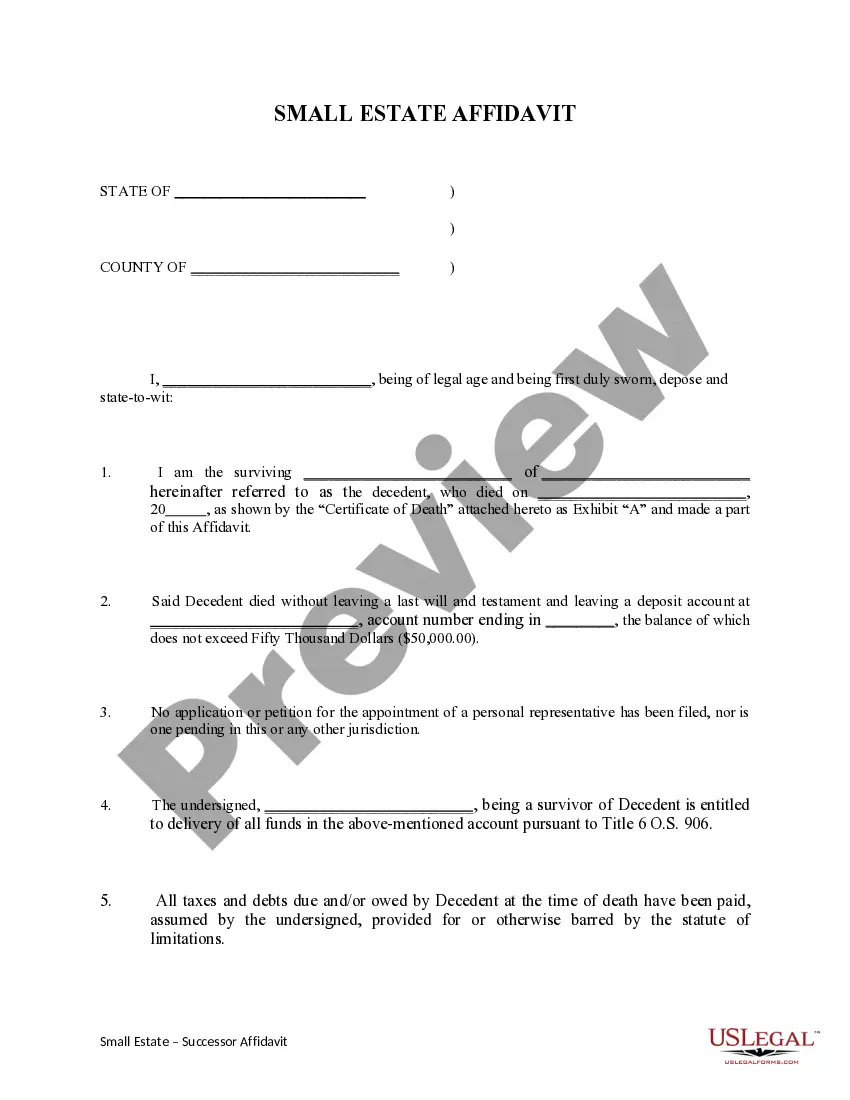

Use this affidavit to transfer assets from a deceased person’s estate without going through probate, as long as the total value is $50,000 or less.

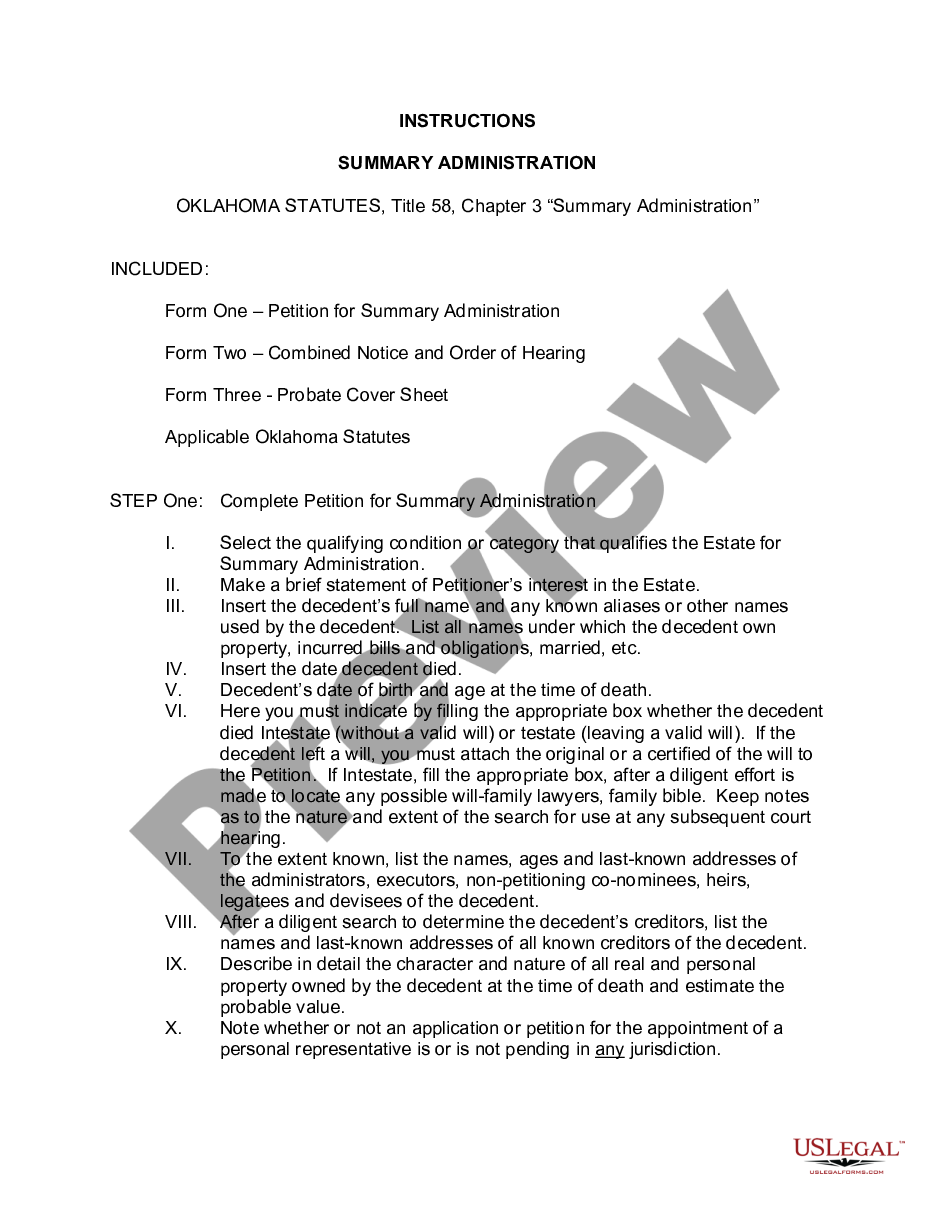

Use this to handle small estates valued under $200,000 quickly and efficiently, bypassing standard probate procedures.

Establish ownership of property during probate after someone's death, whether they left a will or not. This form ensures legal transfer of assets.

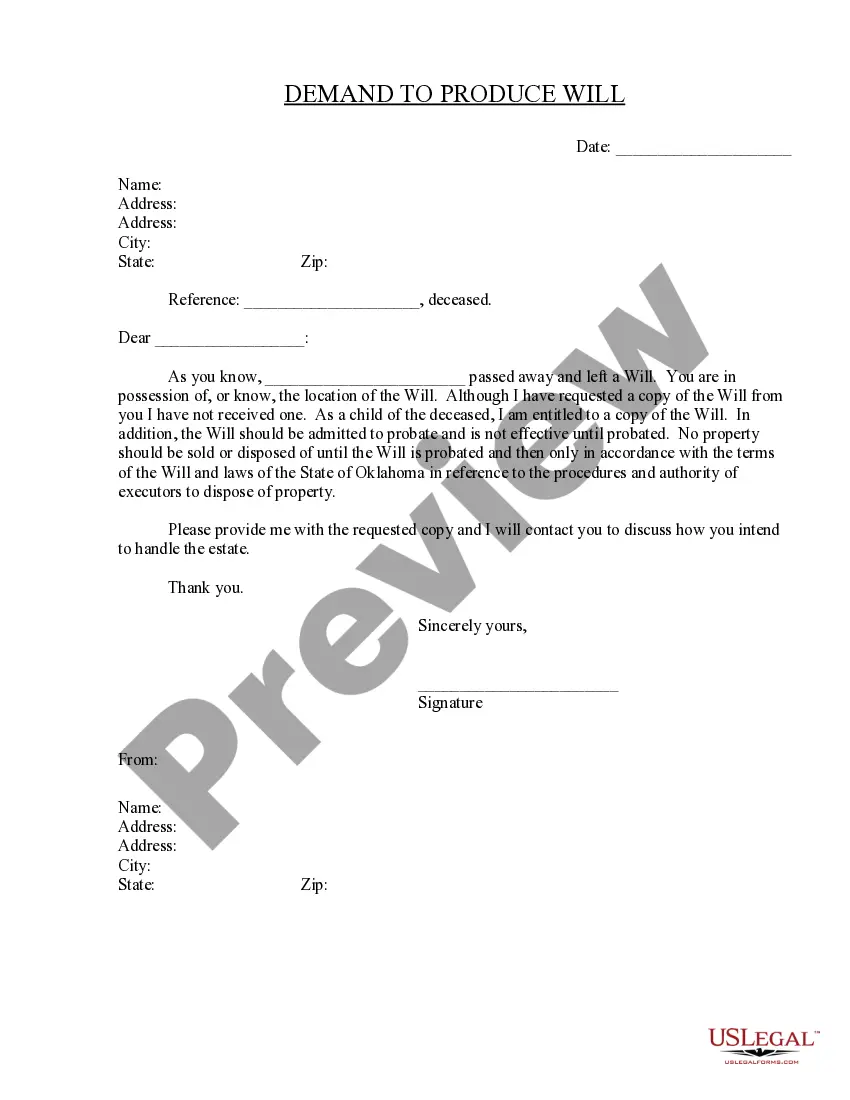

Request a copy of a deceased person's will to ensure your rights as an heir are protected.

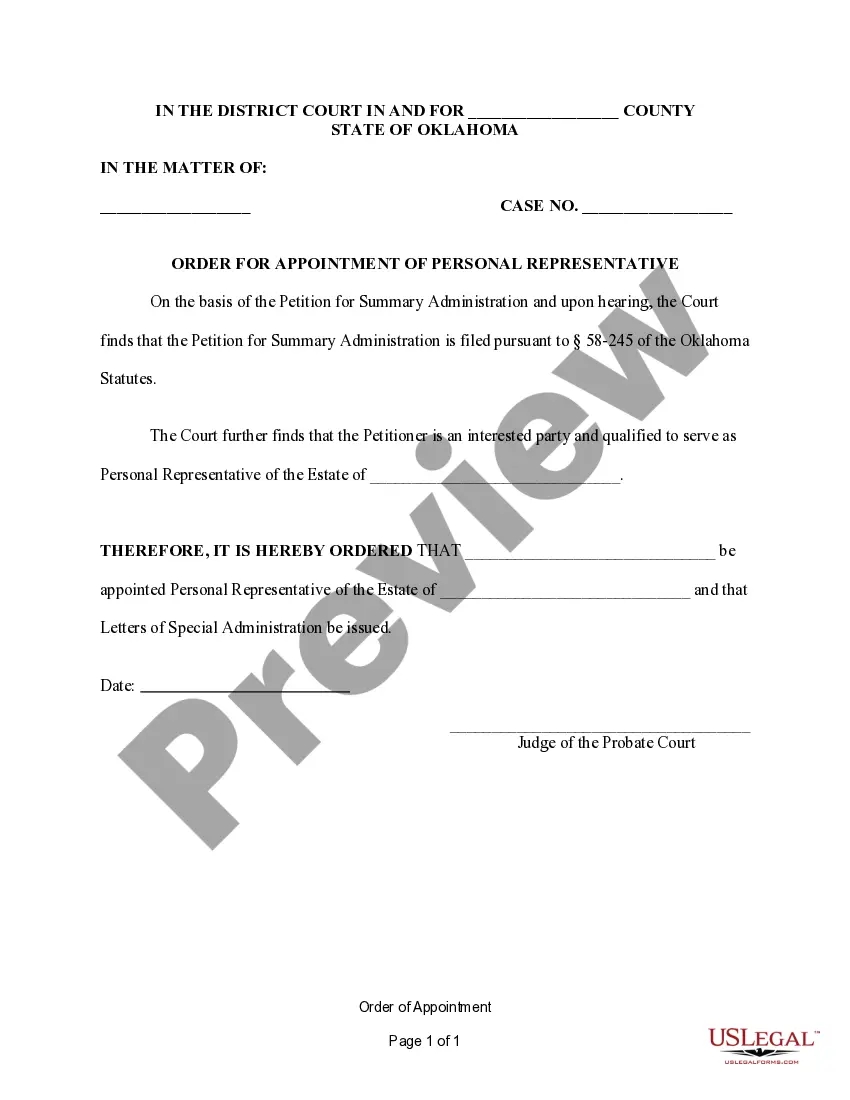

Use this legal document to establish a personal representative for managing estate affairs following a summary administration in Oklahoma.

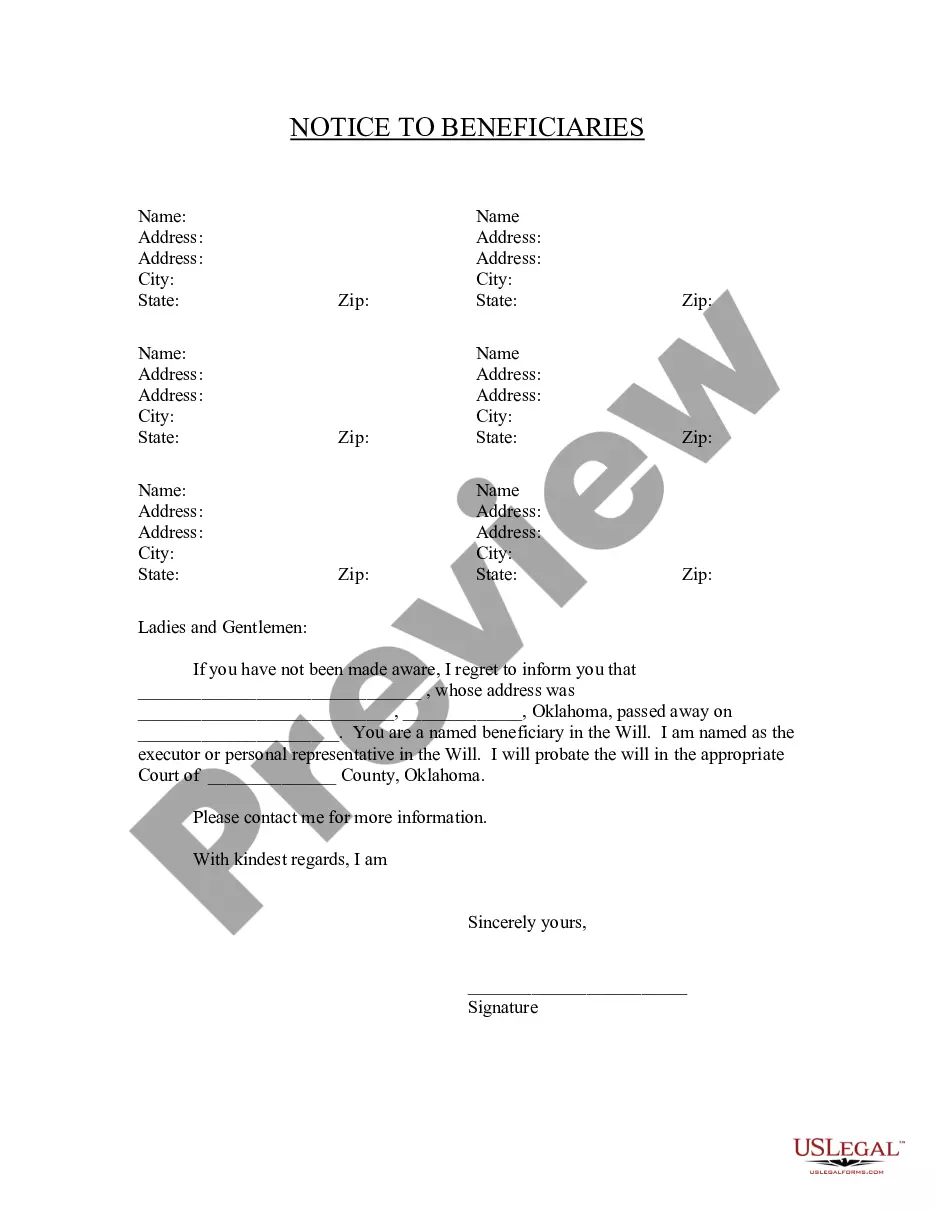

Inform beneficiaries about their status in a will and upcoming probate proceedings in Oklahoma.

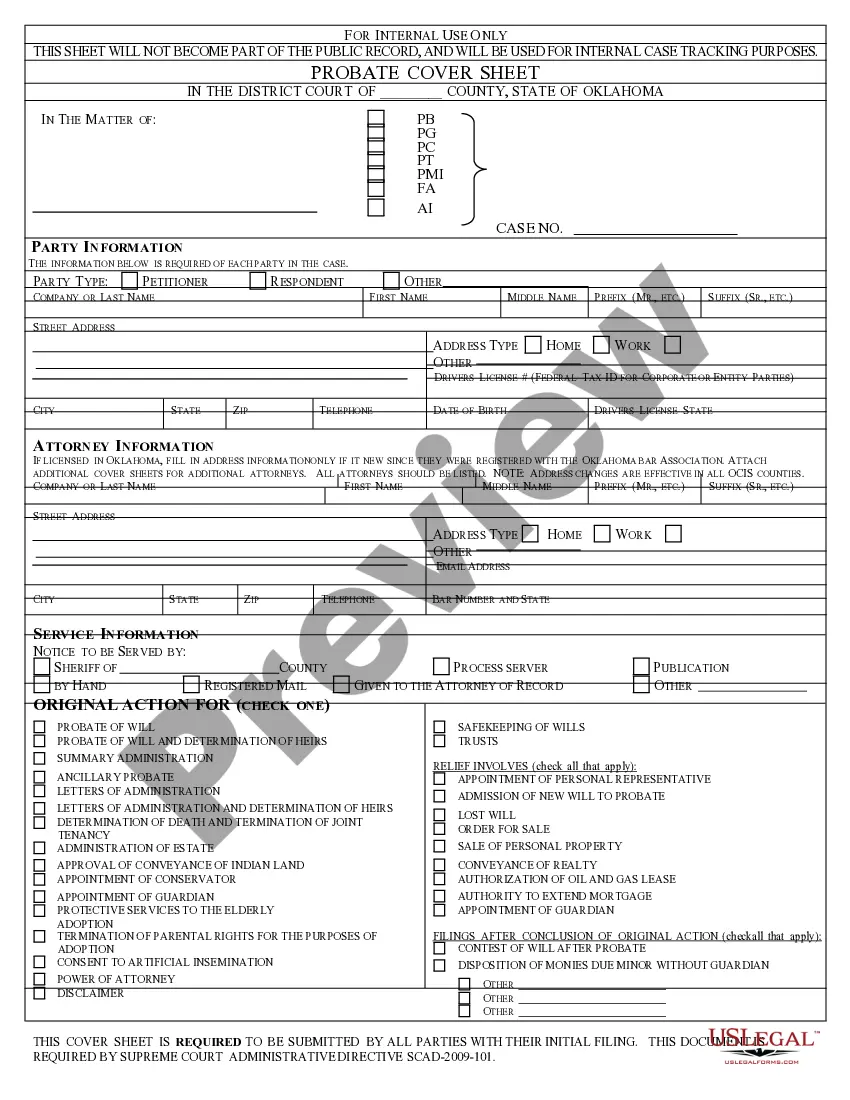

Essential for submitting probate cases, ensuring accurate internal tracking of parties involved.

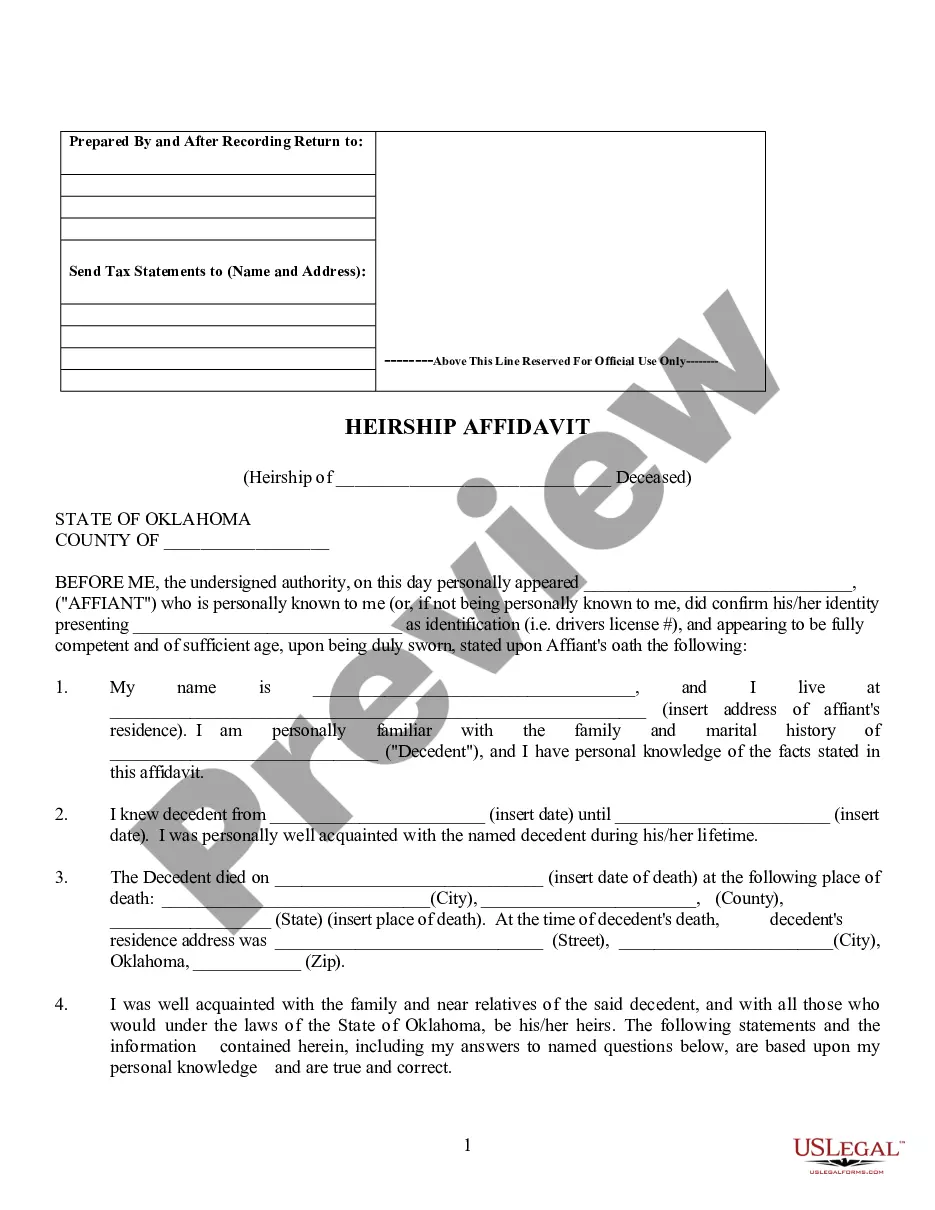

Use this form to establish key heirs of a deceased person, particularly when no will exists.

Disclaim any rights to inherit property from an estate or trust, allowing for clear distribution according to your wishes.

Clarify estate divisions among heirs to avoid disputes over inheritance.

Probate is necessary for asset distribution after death.

Wills must be validated in probate court.

Assets are distributed according to the will or state law if none exists.

Probate can be contested by interested parties.

Some assets may bypass probate through beneficiary designations.

Begin your probate process in just a few steps.

A trust can provide additional benefits, like avoiding probate, but is not mandatory.

If no estate plan exists, state laws will dictate asset distribution.

Review your plan regularly, especially after major life changes.

Beneficiary designations typically override wills, directing assets directly to named individuals.

Yes, you can appoint different individuals for financial and healthcare decisions.