Oklahoma Heirship Affidavit - Descent

About this form

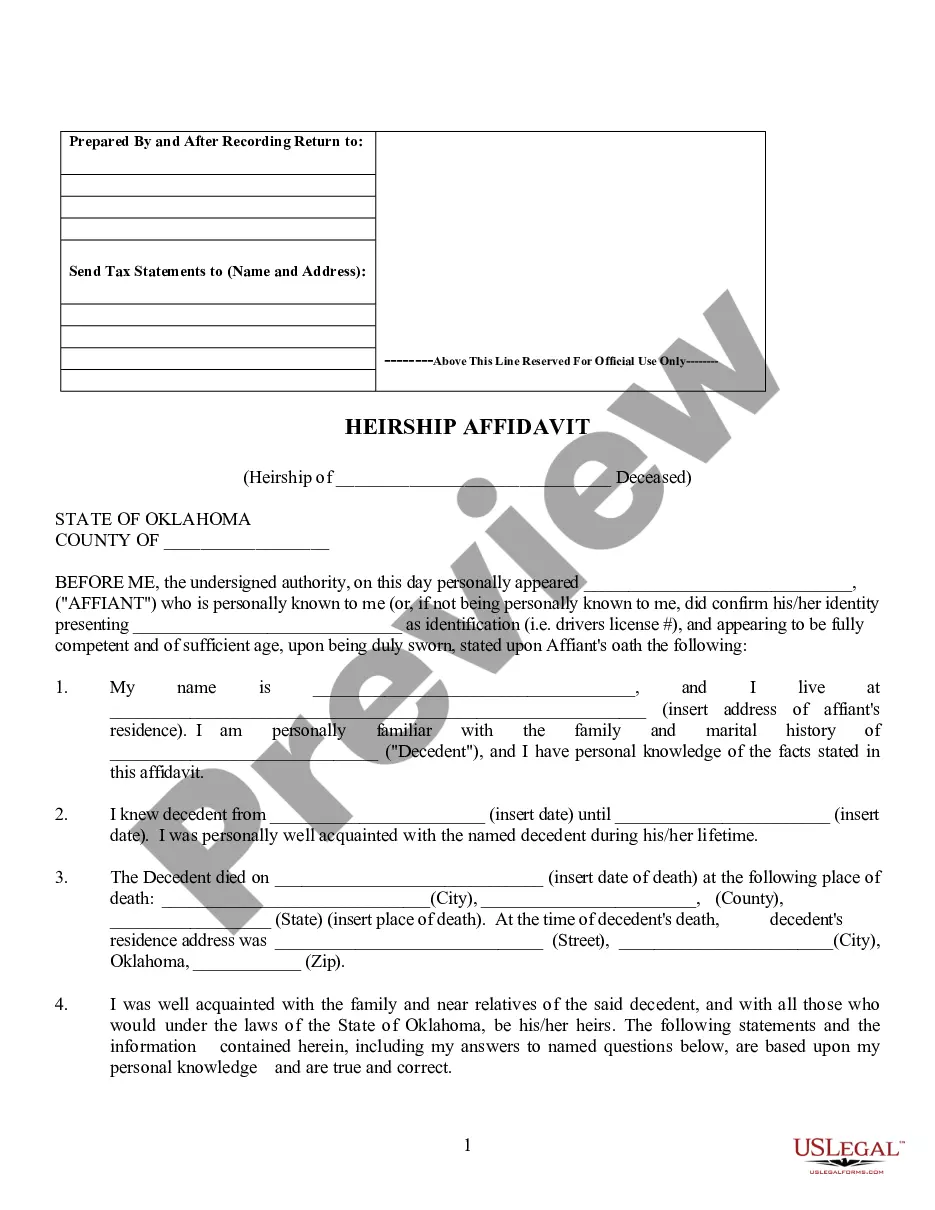

The Heirship Affidavit - Descent is a legal document used to declare the heirs of a deceased person. This affidavit is essential when someone dies without a will, as it helps establish rightful ownership of personal and real property. Unlike other forms, the Heirship Affidavit is typically executed by a non-heir with knowledge of the deceased's family history, providing a credible source of information about who inherits the deceased's belongings.

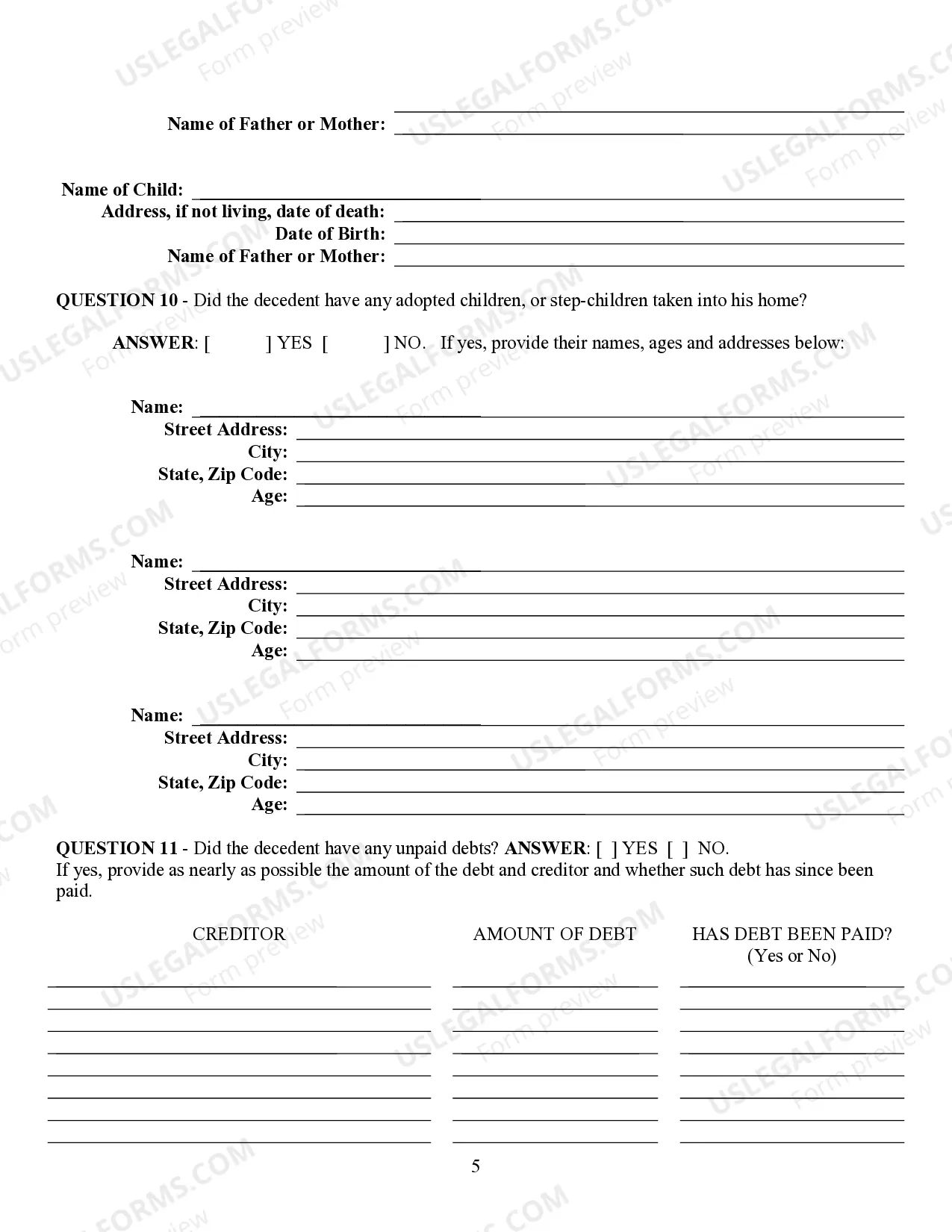

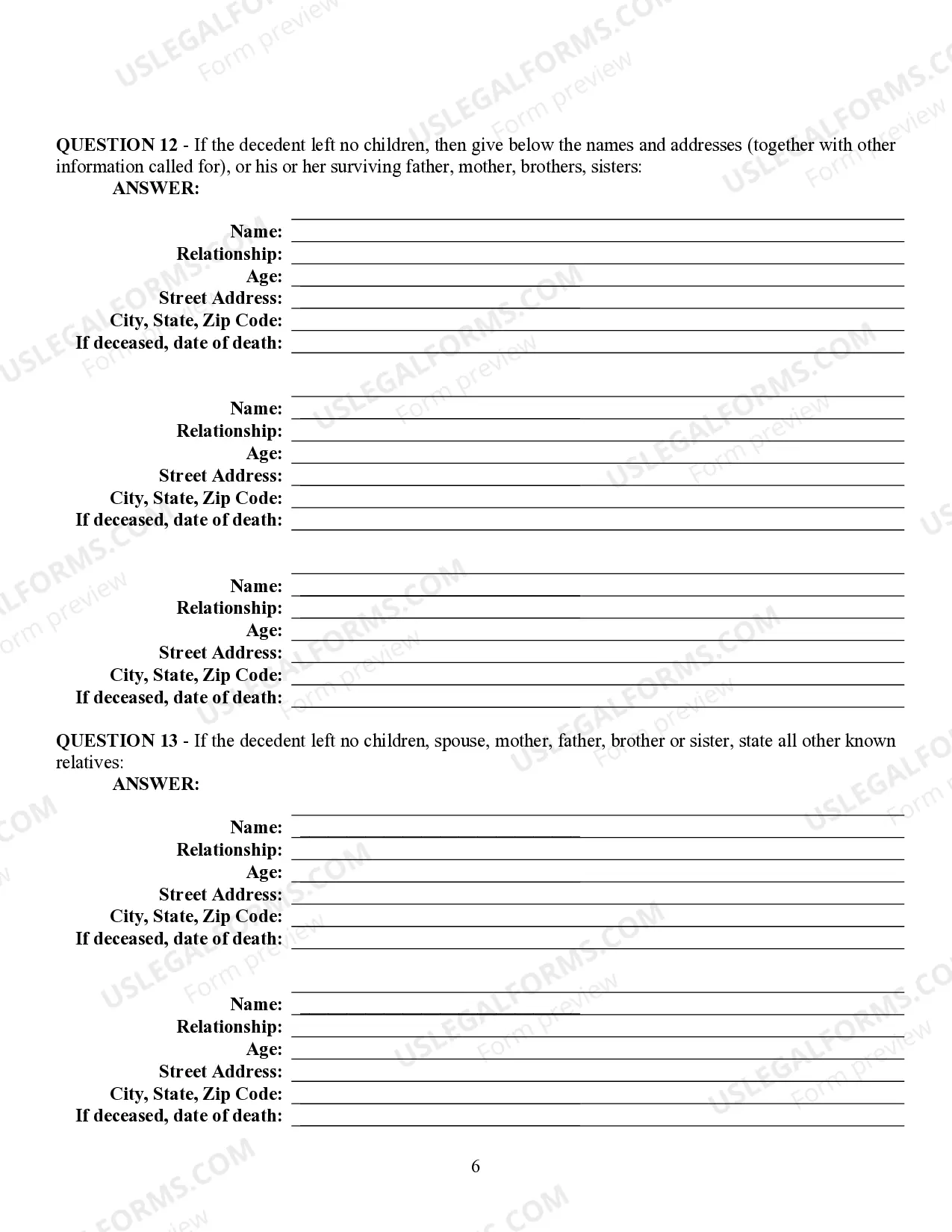

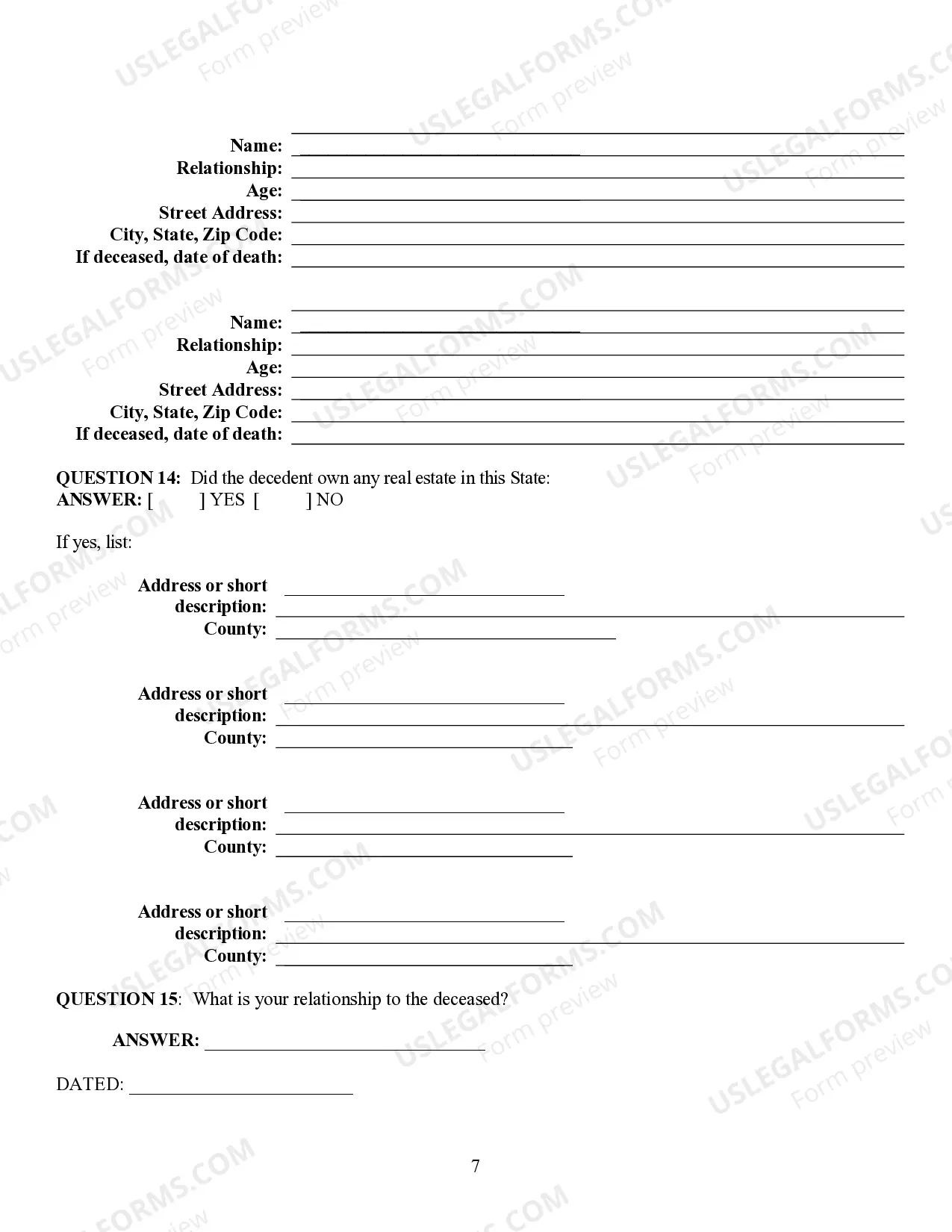

Key parts of this document

- Affiant's personal details and relationship to the decedent.

- Information about the decedent, including their date of death and residence.

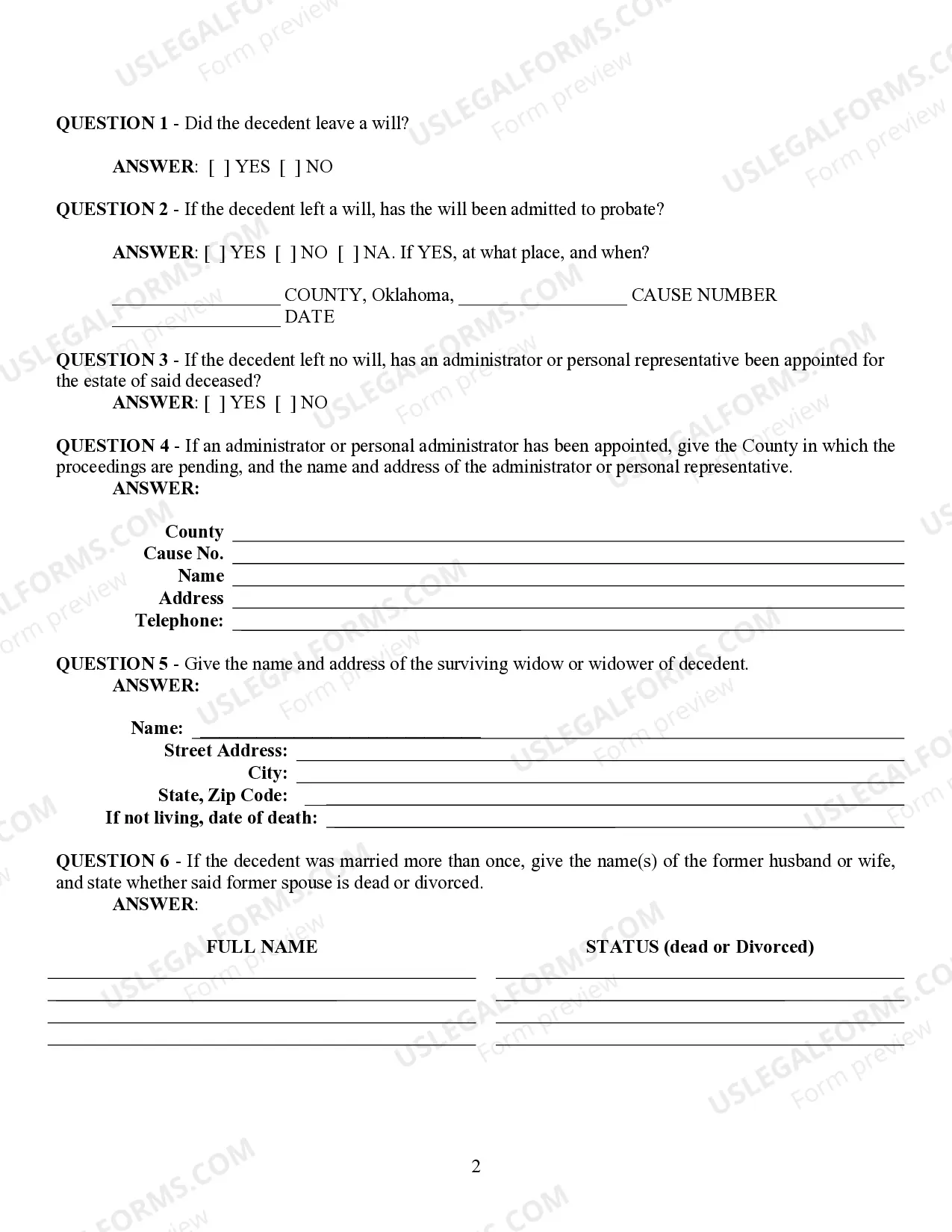

- Questions regarding the existence of a will and probate status.

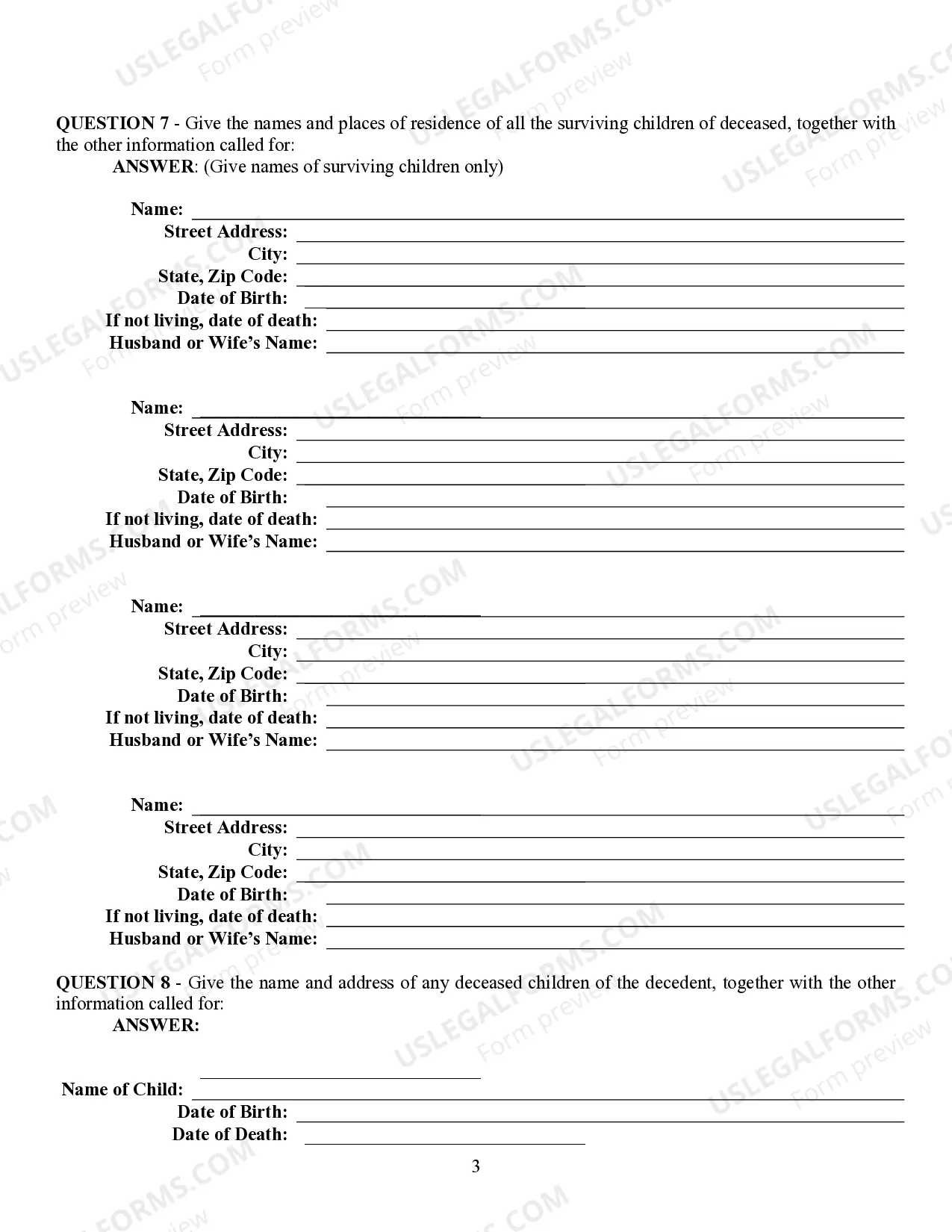

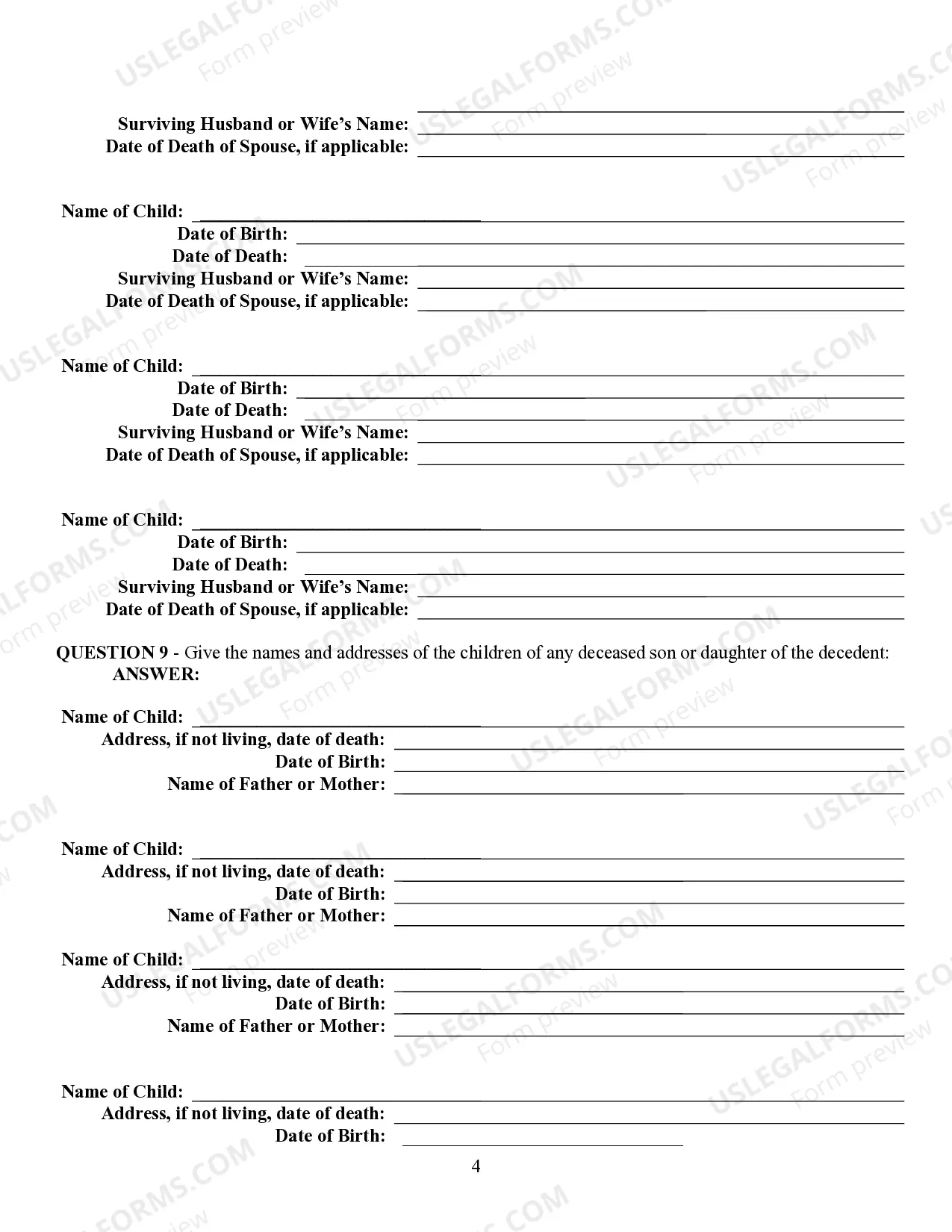

- Details about surviving relatives, including widow/widower and children.

- Information about any debts owed by the decedent and their real estate ownership.

Situations where this form applies

This form is used in situations where an individual has passed away without leaving a will. It is particularly useful when heirs need to establish their rights to the deceased's assets, such as selling property or claiming inheritance. For example, if a son wishes to sell his late father's land and no estate has been opened, he can use this affidavit to prove his claim to the property.

Who should use this form

- Individuals who need to clarify the heirs of a deceased family member.

- Non-heirs who can provide credible information about the decedent's family history.

- Anyone involved in the sale or transfer of property owned by a deceased person.

Steps to complete this form

- Provide your personal information, including your name and address.

- Detail your relationship with the deceased and your knowledge of their family.

- Answer questions regarding the existence of a will and any probate proceedings.

- List all surviving relatives and any deceased children of the decedent.

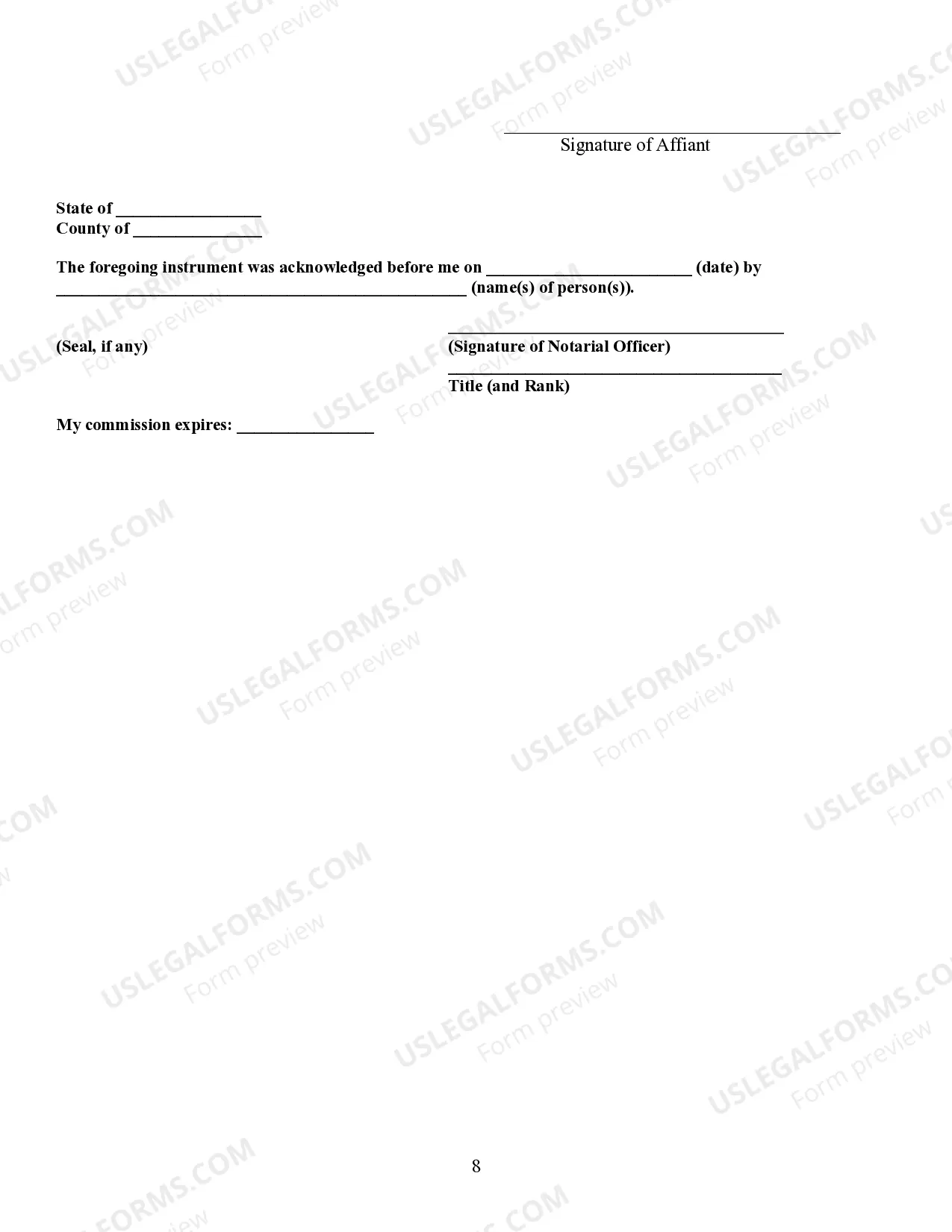

- Sign the document in the presence of a notary public to ensure its legality.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include complete information about surviving family members.

- Not notarizing the affidavit if required for legal validity.

- Providing inaccurate or outdated contact information for heirs.

Benefits of using this form online

- Convenience of completing the form at your own pace from home.

- Editability allows you to correct any mistakes easily before finalizing.

- Access to legal templates created by licensed attorneys ensures reliability.

Looking for another form?

Form popularity

FAQ

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor). Create the new deed. Sign and notarize the deed. File the deed in the county land records.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.