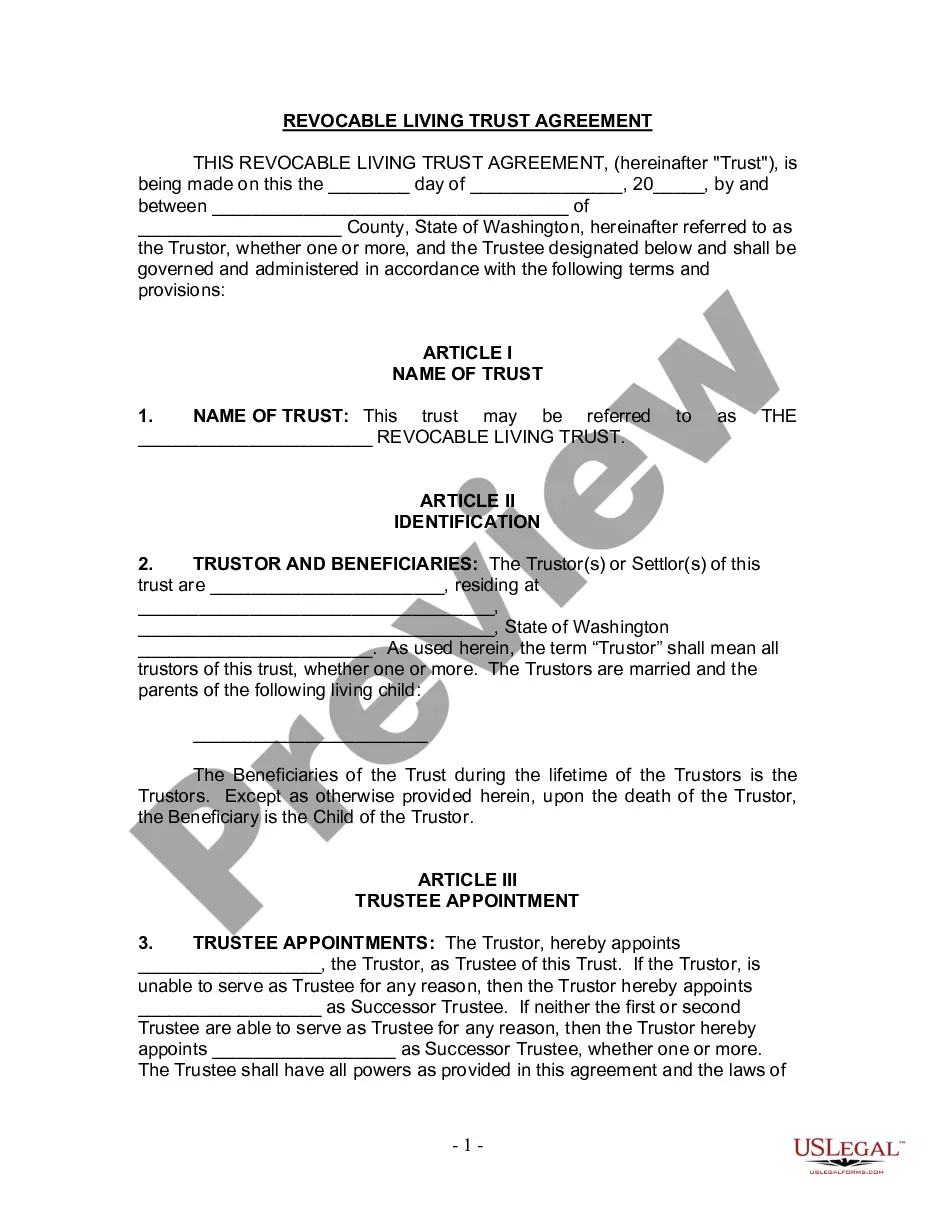

This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Seattle Washington Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Washington Living Trust For Husband And Wife With Minor And Or Adult Children?

Regardless of social or professional standing, filling out legal documents is a regrettable obligation in today’s society.

Frequently, it is nearly impossible for individuals lacking legal training to draft such documents from scratch, primarily due to the complex terminology and legal nuances they include.

This is where US Legal Forms proves to be invaluable.

If the one you chose does not satisfy your needs, you can restart and look for the required document.

Select the payment method and proceed to download the Seattle Washington Living Trust for a Husband and Wife with Minor or Adult Children as soon as the payment is completed.

- Whether you require the Seattle Washington Living Trust for a Husband and Wife with Minor or Adult Children or any other documentation suitable for your state or county, US Legal Forms has everything readily available.

- Here’s how to quickly obtain the Seattle Washington Living Trust for a Husband and Wife with Minor or Adult Children using our reliable service.

- If you are already a registered member, you can proceed to Log In to your account and download the necessary paperwork.

- However, if you are not acquainted with our repository, make sure to follow these instructions prior to acquiring the Seattle Washington Living Trust for a Husband and Wife with Minor or Adult Children.

- Ensure that the form you have located is valid for your area since the regulations of one state or county do not apply to another region.

- Examine the form and review a brief synopsis (if available) of situations for which the document can be utilized.

Form popularity

FAQ

The price of creating a living trust in Washington depends on how you go about making it. The first option is to use an online service and draw the trust up yourself. This will cost a few hundred dollars at most. The other option is to hire an attorney, which could cost more than $1,000.

A married couple has many reasons to establish a living trust. A living trust can help their estate survive onerous estate taxes, avoid probate if they both die, and side step the need for a conservatorship if either one (or both) become incapacitated.

A Washington living trust holds your assets in trust while you continue to use and control them. After your death, the trust passes assets to your beneficiaries according to your instructions. A revocable living trust can provide flexibility and control.

Separate trusts may offer better protection from creditors, if this is a concern. For example, at the death of the first spouse, the deceased spouse's trust becomes irrevocable, which makes it harder to access by creditors. And yet the surviving spouse can still access it for income and other needs.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

The price of creating a living trust in Washington depends on how you go about making it. The first option is to use an online service and draw the trust up yourself. This will cost a few hundred dollars at most. The other option is to hire an attorney, which could cost more than $1,000.

Disadvantages of a Family Trust You must prepare and submit legal documents, which the court charges a fee to process. The second financial disadvantage of a family trust is the lack of tax benefits, especially when it comes to filing income taxes. When the grantor dies, the trust must file a federal tax return.

Protecting your assets A family trust holds property on behalf of the beneficiaries and protects it from creditors. The trust assets cannot be seized following a lawsuit or personal bankruptcy. It's important to remember, however, that the trust must be created when everything is going well.

Yes, but naming the surviving spouse, as a Trustee should be done only after reviewing all the facts and counseling with your advisors. In a ?first time? marriage where both spouses have great confidence in each other, it is common for the surviving spouse to be designated as a Trustee of the Family and Marital Trusts.

Family trusts protect your investment assets A family trust can protect the assets of a family group, as assets aren't held in your personal name. A family trust is a separate legal entity, meaning you can access a certain level of protection if you face financial difficulty or legal action.