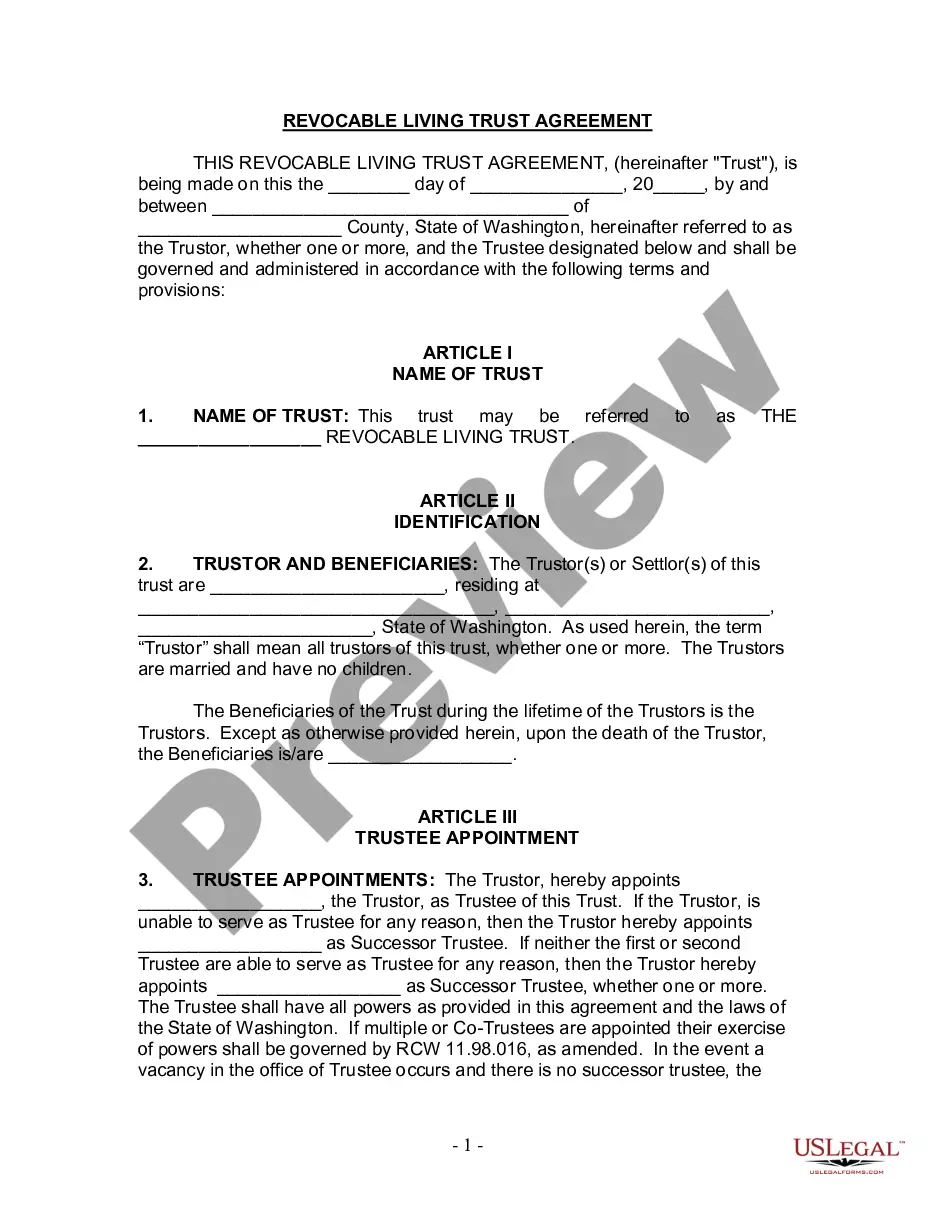

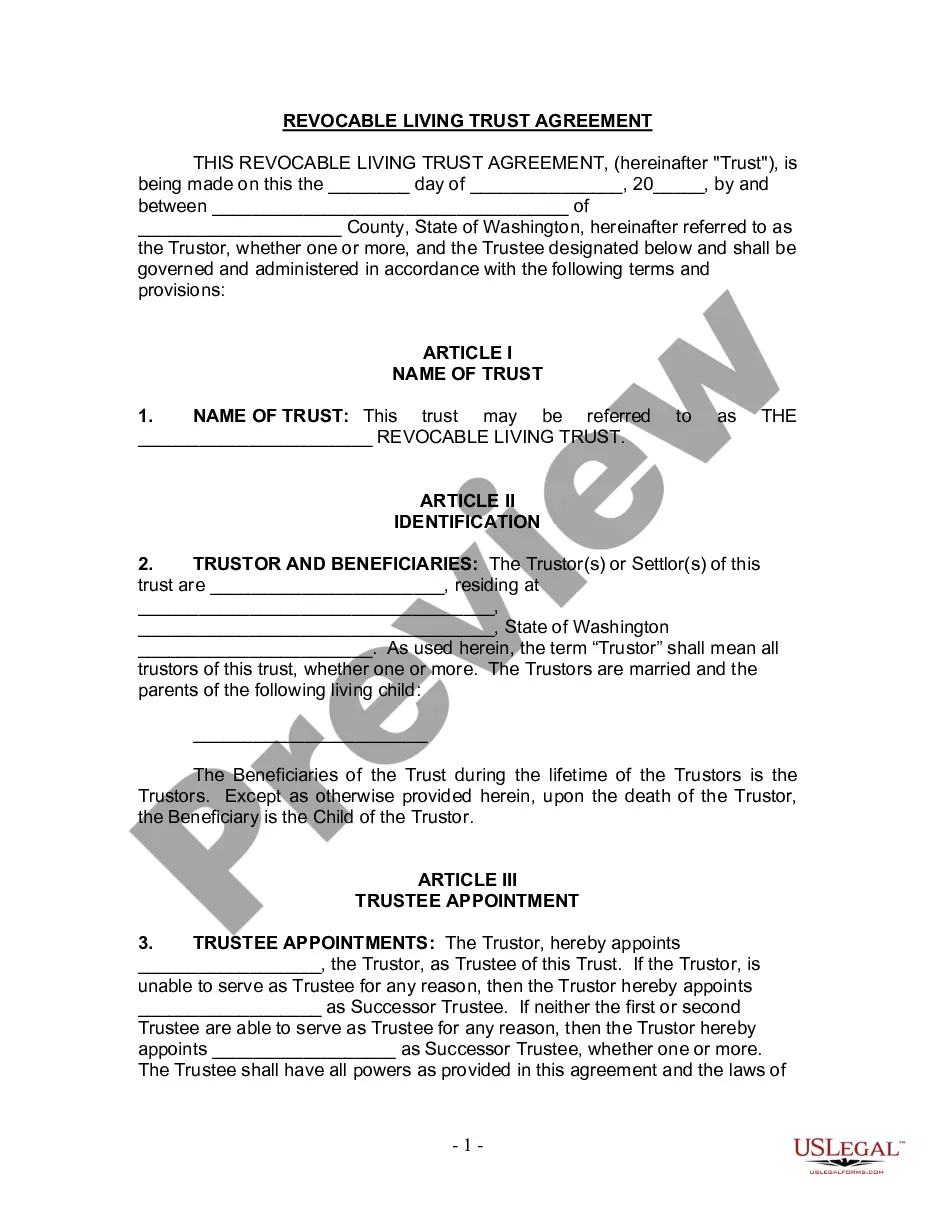

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Vancouver Washington Living Trust for Husband and Wife with No Children

Description

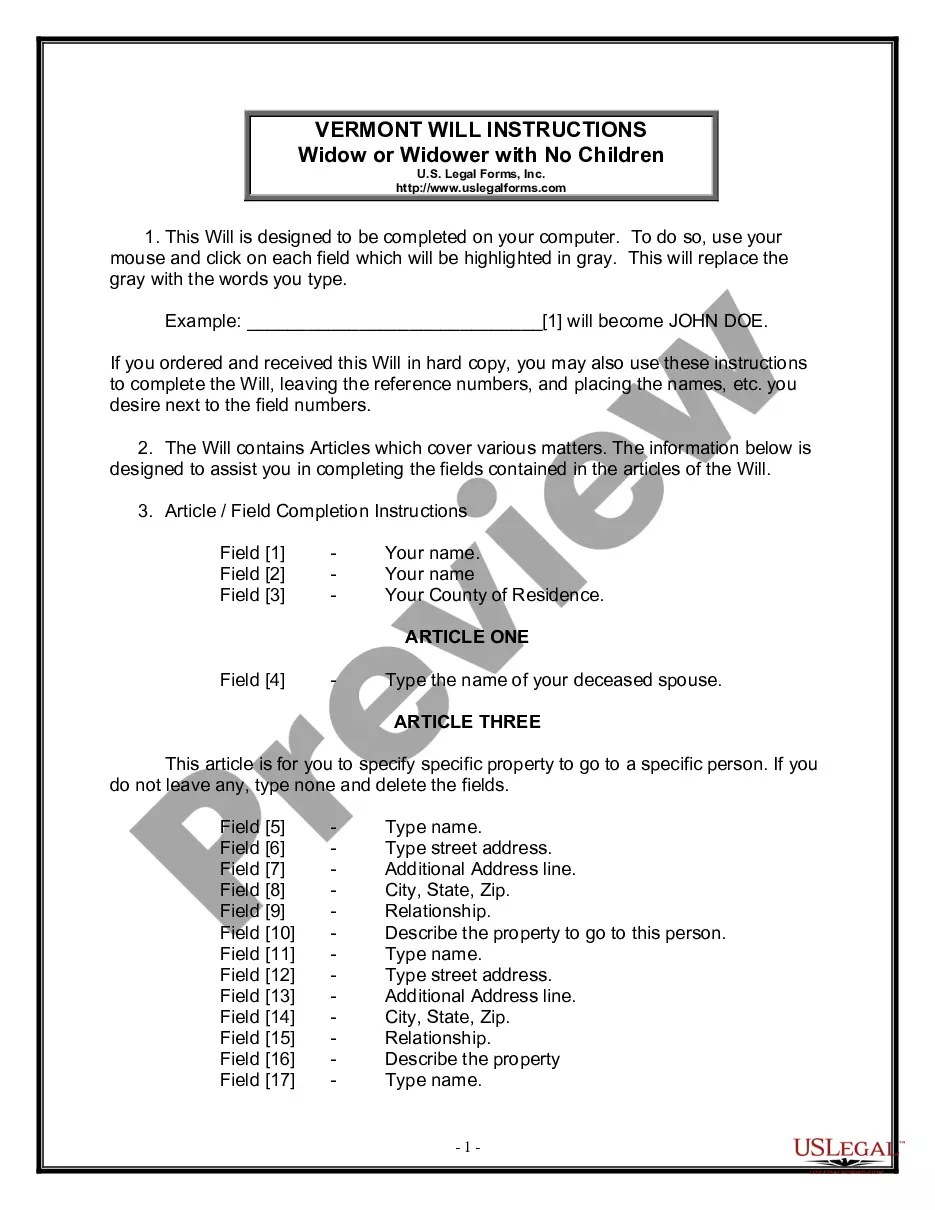

How to fill out Washington Living Trust For Husband And Wife With No Children?

Utilize the US Legal Forms and gain instant access to any form template you desire.

Our helpful website featuring a vast selection of document templates enables you to discover and acquire nearly any document sample you require.

You can export, fill out, and sign the Vancouver Washington Living Trust for Husband and Wife with No Children in just minutes instead of spending hours searching for a suitable template online.

Using our catalog is an excellent method to enhance the safety of your documentation process.

If you don’t have an account yet, follow the steps below.

Open the page with the form you need. Ensure that it is the template you were looking for: review its title and description, and employ the Preview feature if available. Alternatively, use the Search box to find the required one.

- Our skilled attorneys frequently evaluate all documents to guarantee that the templates are fitting for a specific state and adhere to current laws and regulations.

- How can you obtain the Vancouver Washington Living Trust for Husband and Wife with No Children.

- If you possess a profile, simply Log In to your account.

- The Download option will be activated on all the samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

A surviving spouse trust is designed to protect the financial interests of a spouse after one partner passes away. In the context of a Vancouver Washington Living Trust for Husband and Wife with No Children, this trust allows the surviving spouse to access and manage the assets within the trust without the complexities of probate. This setup not only ensures a smooth transition of assets but also offers various tax benefits. Utilizing tools like the uslegalforms platform can help you create a well-structured surviving spouse trust tailored to your needs.

When considering a Vancouver Washington Living Trust for Husband and Wife with No Children, the minimum amount can vary based on your individual needs and state requirements. Typically, many experts recommend establishing a trust with at least $100,000 in assets to ensure that it is worth your time and effort. This amount can help provide a clear direction for managing and distributing your assets efficiently. However, even smaller amounts can be placed in a living trust depending on your situation, so consulting a professional can provide clarity.

Remarried couples may find the Qualified Terminable Interest Property (QTIP) trust to be especially appropriate. This type of trust allows a spouse to benefit from the trust income while preserving the principal for children from the previous marriage. If you are looking for solutions, consider a Vancouver Washington Living Trust for Husband and Wife with No Children, which can be tailored to fit your unique circumstances.

The best type of trust for a married couple often depends on their financial situation and goals. A revocable living trust is frequently chosen for its flexibility, as it can be amended or revoked at any time. When considering a Vancouver Washington Living Trust for Husband and Wife with No Children, a revocable trust can efficiently manage assets and ensure they are passed on according to your wishes.

The most common living trust is the revocable living trust. This type of trust allows individuals to retain control over their assets while providing a mechanism for smooth asset transfer after death. If you're exploring a Vancouver Washington Living Trust for Husband and Wife with No Children, this common option ensures your wishes are honored while simplifying the process.

The most popular form of marital trust is the A/B trust, also known as a marital and bypass trust. This arrangement allows spouses to maximize tax benefits, while ensuring that assets are distributed according to their wishes. If you fit the category of a couple without children, you might find a Vancouver Washington Living Trust for Husband and Wife with No Children beneficial for securing your financial future.

For a single person, a revocable living trust often serves as the best option. This type of trust allows for control over assets during one's lifetime and facilitates a smooth transition of those assets upon death. If you're considering a Vancouver Washington Living Trust for Husband and Wife with No Children, this option can offer similar benefits tailored to individuals as well.

Yes, you can create your own living trust in Washington state, particularly a Vancouver Washington Living Trust for Husband and Wife with No Children. There are various online resources and templates available that can guide you through the process. However, it's advisable to consult with an attorney to ensure that your trust meets all legal requirements and effectively addresses your unique situation.

Deciding between a will and a trust in Washington state depends on your specific needs. Generally, a trust provides benefits like avoiding probate, whereas a will is often simpler to set up. For a Vancouver Washington Living Trust for Husband and Wife with No Children, many couples prefer a trust for its ability to streamline the distribution of assets and provide flexibility for their estate planning.

A trust does not automatically avoid Washington state estate tax. However, a properly structured trust can help minimize tax liabilities for your estate. For couples utilizing a Vancouver Washington Living Trust for Husband and Wife with No Children, working with a tax professional can provide clarity on how to maximize your estate's tax efficiency while ensuring that your wishes are honored.