Salt Lake Utah Claim for Dependents Benefits and/or Burial Benefits

Description

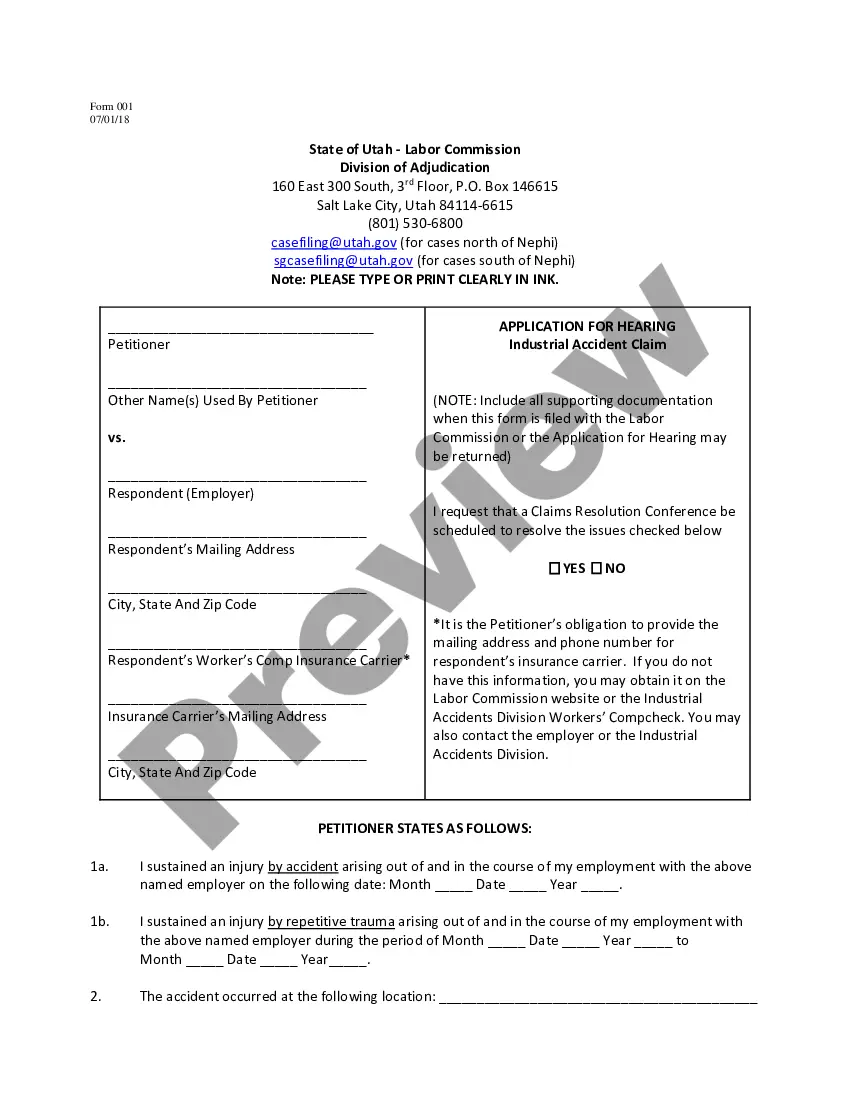

How to fill out Utah Claim For Dependents Benefits And/or Burial Benefits?

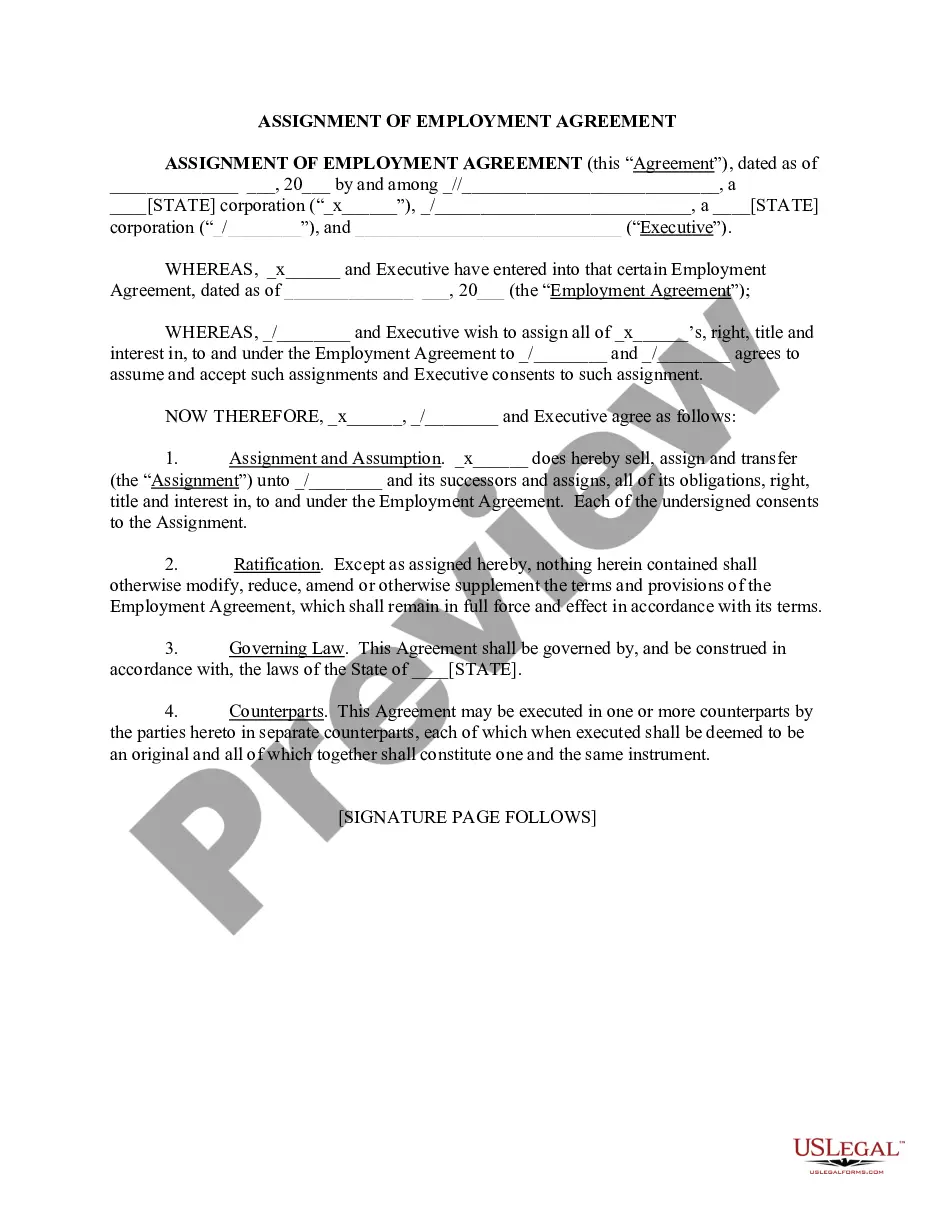

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our efficient platform with a vast array of documents enables you to discover and acquire virtually any document example you desire.

You can download, fill out, and verify the Salt Lake Utah Claim for Dependents Benefits and/or Burial Benefits in a matter of minutes rather than spending hours online searching for the appropriate template.

Using our collection is an excellent method to enhance the security of your document submissions.

If you have not yet created an account, follow the instructions outlined below.

Locate the template you need. Ensure that it is the template you were looking for: confirm its title and description, and use the Preview feature when available. If not, use the Search box to find what you require.

- Our knowledgeable attorneys frequently review all the paperwork to ensure that the forms are suitable for a specific region and adhere to current laws and regulations.

- How can you access the Salt Lake Utah Claim for Dependents Benefits and/or Burial Benefits.

- If you already possess an account, simply Log In to your account. The Download feature will be activated for all the templates you view.

- Additionally, you can locate all previously stored documents in the My documents section.

Form popularity

FAQ

All enrolled Veterans receive the Department of Veterans Affairs (VA's) comprehensive Medical Benefits Package which includes preventive, primary and specialty care, diagnostic, inpatient and outpatient care services.

Veterans with a full 100% disability rating are fully exempt from property taxes. A disabled veteran in Utah may receive a property tax exemption on his/her primary residence if the veteran is 10 percent or more disabled as a result of service.

Utah State Veteran Benefits Armed Forces Property Tax Exemption. Active duty and reserve members with at least 200 days active service may qualify for a total exemption from real property tax.CDL Driving Skills Test Waiver.Scott B Lundell Tuition Waiver for Military Members' Surviving Dependents.

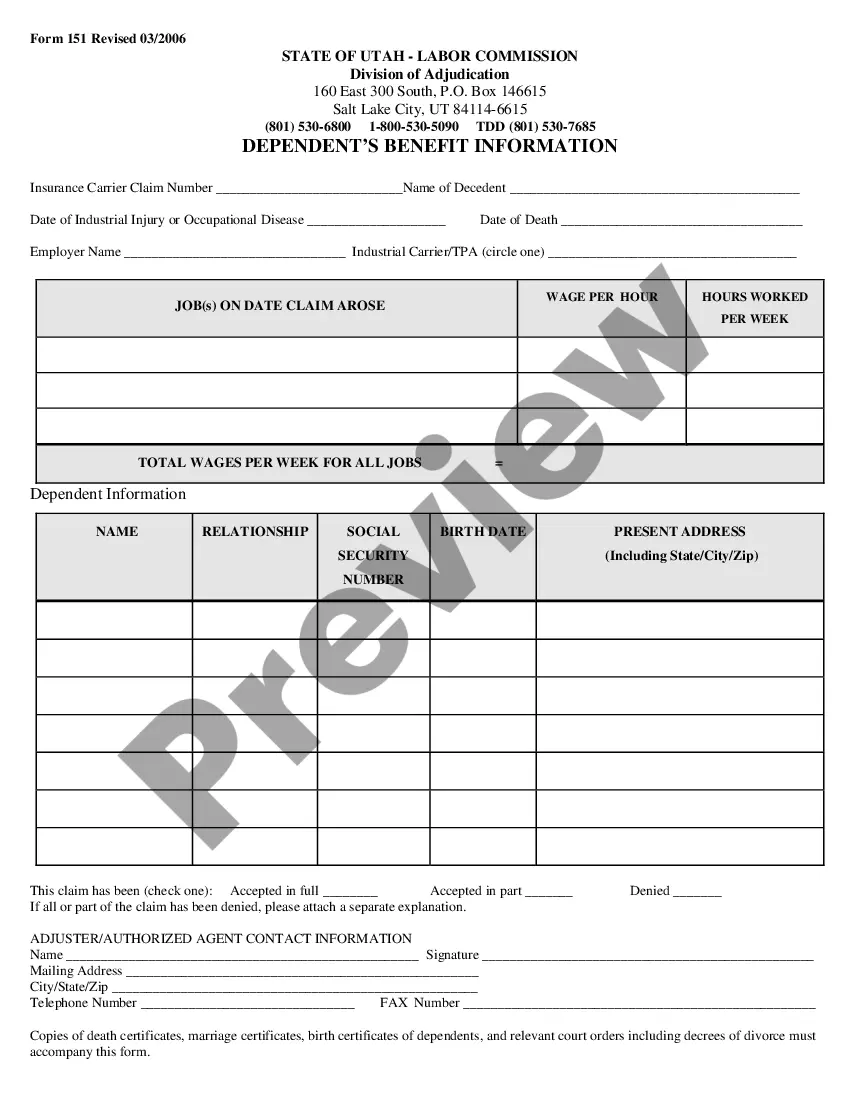

Workers' Compensation provides benefits to workers injured onthejob without regard to fault. Pain and suffering are not covered under Workers' Compensation.

An injury that has occurred anywhere not recognized/declared as the place of business as per the terms of the contract. An injury caused by war or associated perils. Any disease caused by war or associated perils. An injury that does not lead to fatality or partial disability after 3 days will not cover.

The main categories of workers that are not covered by traditional workers' compensation are business owners, volunteers, independent contractors, federal employees, railroad employees, and longshoremen.

Veterans with a full 100% disability rating are fully exempt from property taxes. A disabled veteran in Utah may receive a property tax exemption on his/her primary residence if the veteran is 10 percent or more disabled as a result of service.

Summary of Utah Military and Veterans Benefits: Utah offers special benefits for Service members, Veterans and their Families including disabled Veteran property tax exemption, Utah Service member tuition scholarship program, Veterans' hiring preference, state education and tuition assistance, free admission to state

For assistance, an injured worker, employer, medical provider or insurance carrier may contact the Industrial Accidents Division at (801) 530-6800 or toll free (in Utah) at (800) 530-5090.

Normal fees for plate transfer, registration, and property taxes still must be paid upon initial application and renewal of disability license plates. Upon request, one additional disability windshield placard may be issued to disabled persons applying for or already possessing disability special group license plates.