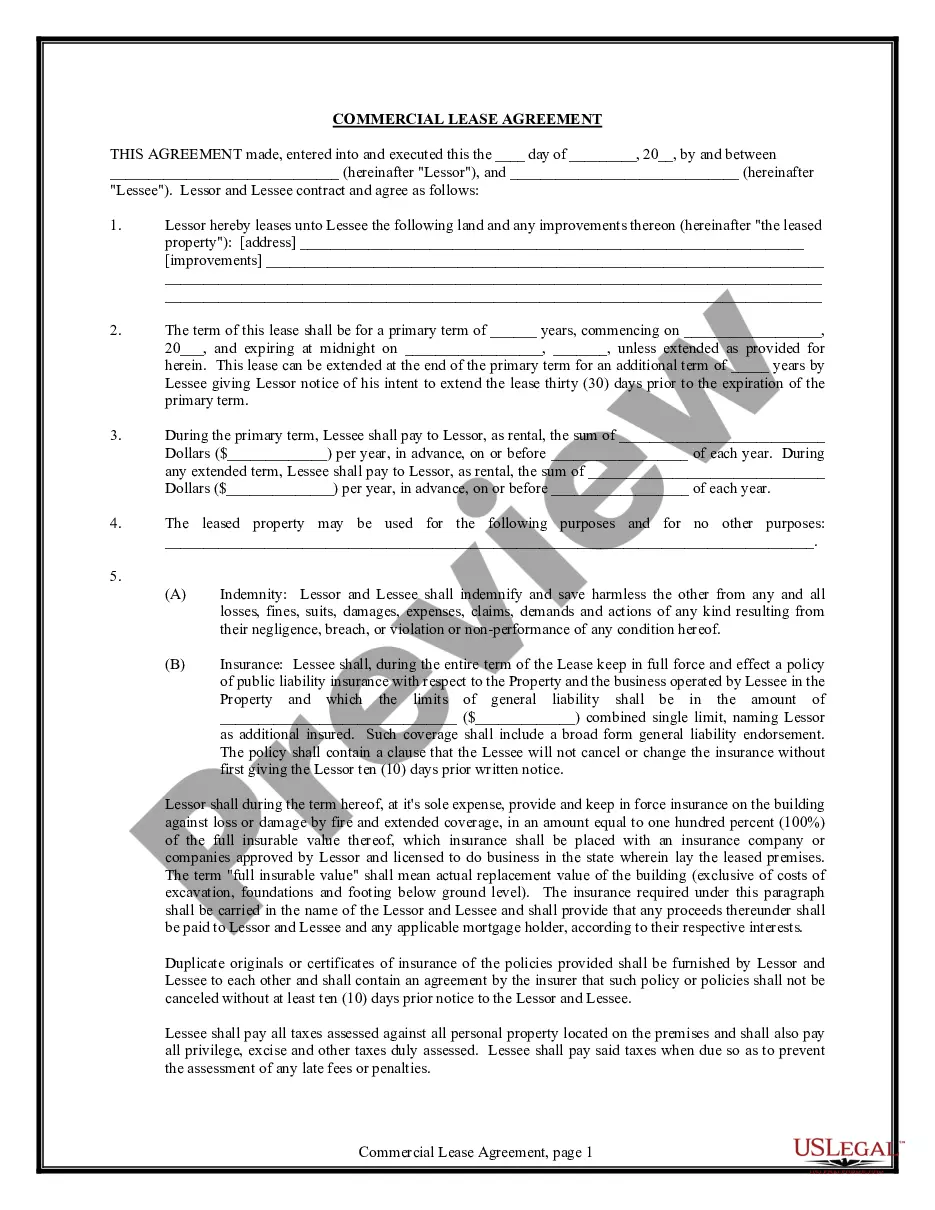

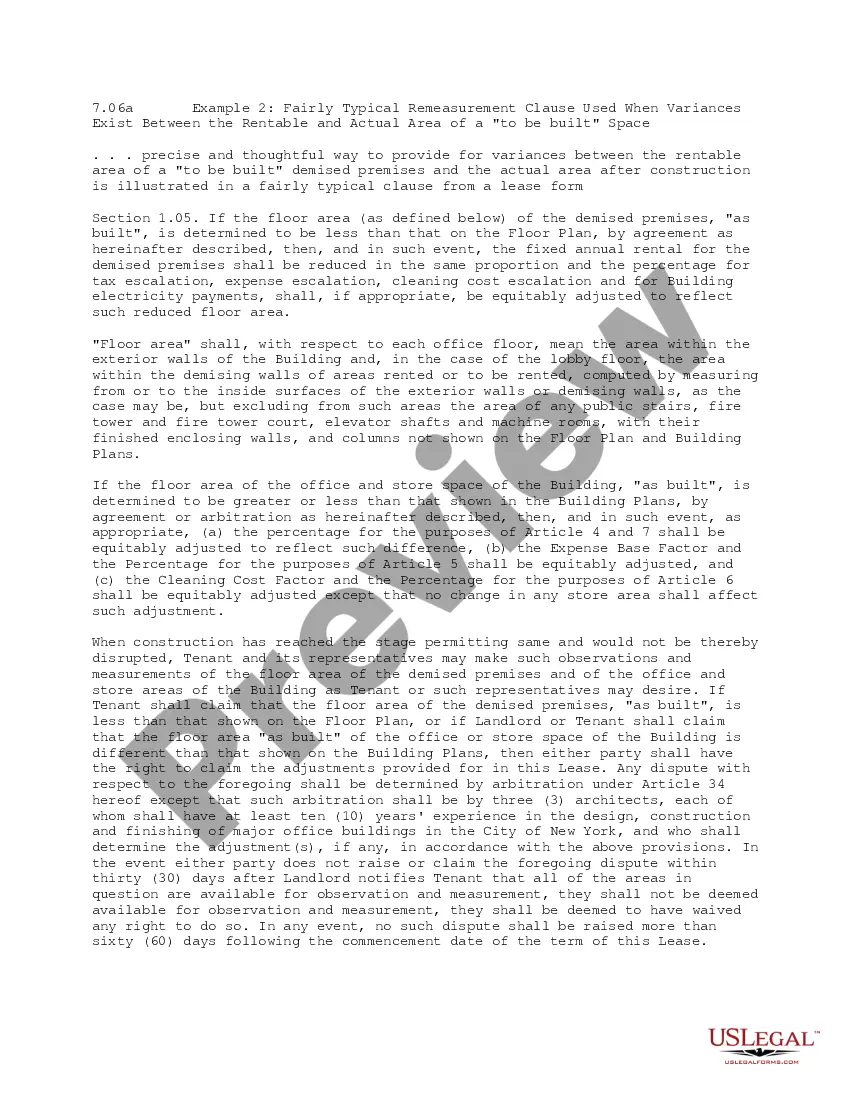

This office lease clause provides the standard for which the actual measurements are to be determined. This form also lists the importance of using a standard measurement method.

Allegheny Pennsylvania Clause Setting Forth the Standard Measuring Method to Be Used for Remeasurement

Description

How to fill out Clause Setting Forth The Standard Measuring Method To Be Used For Remeasurement?

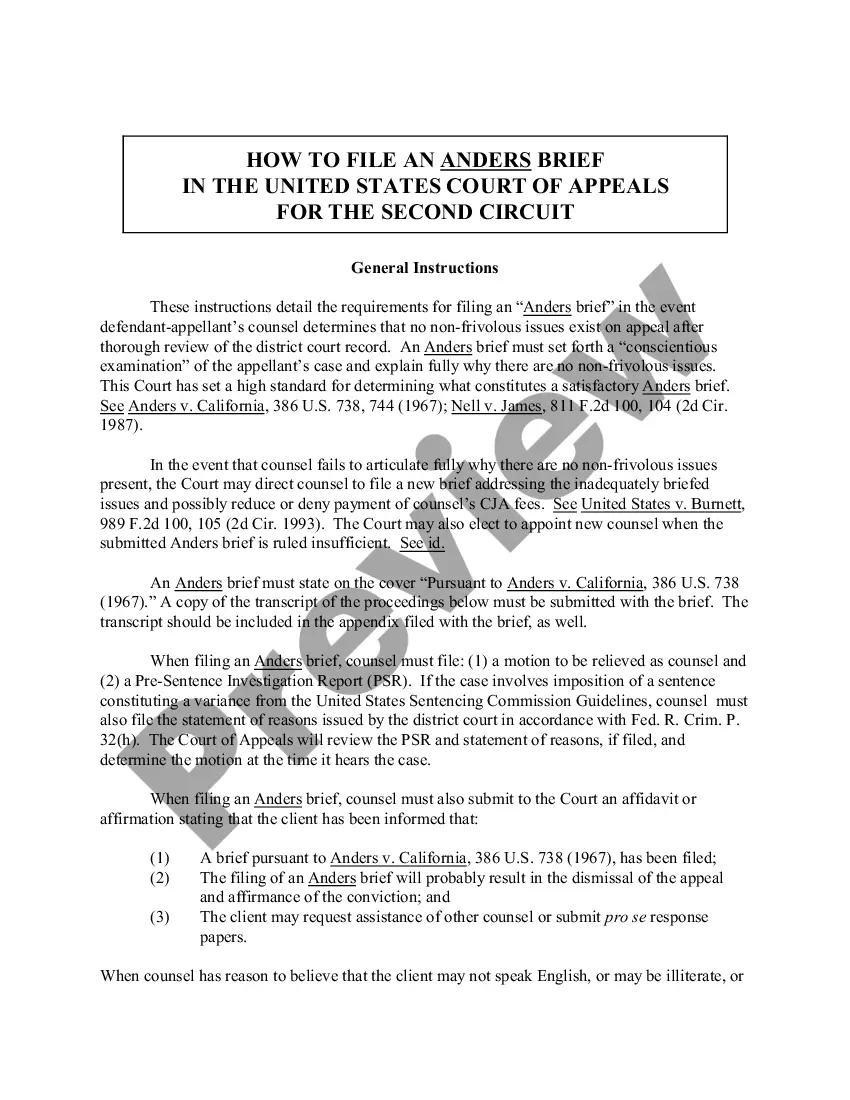

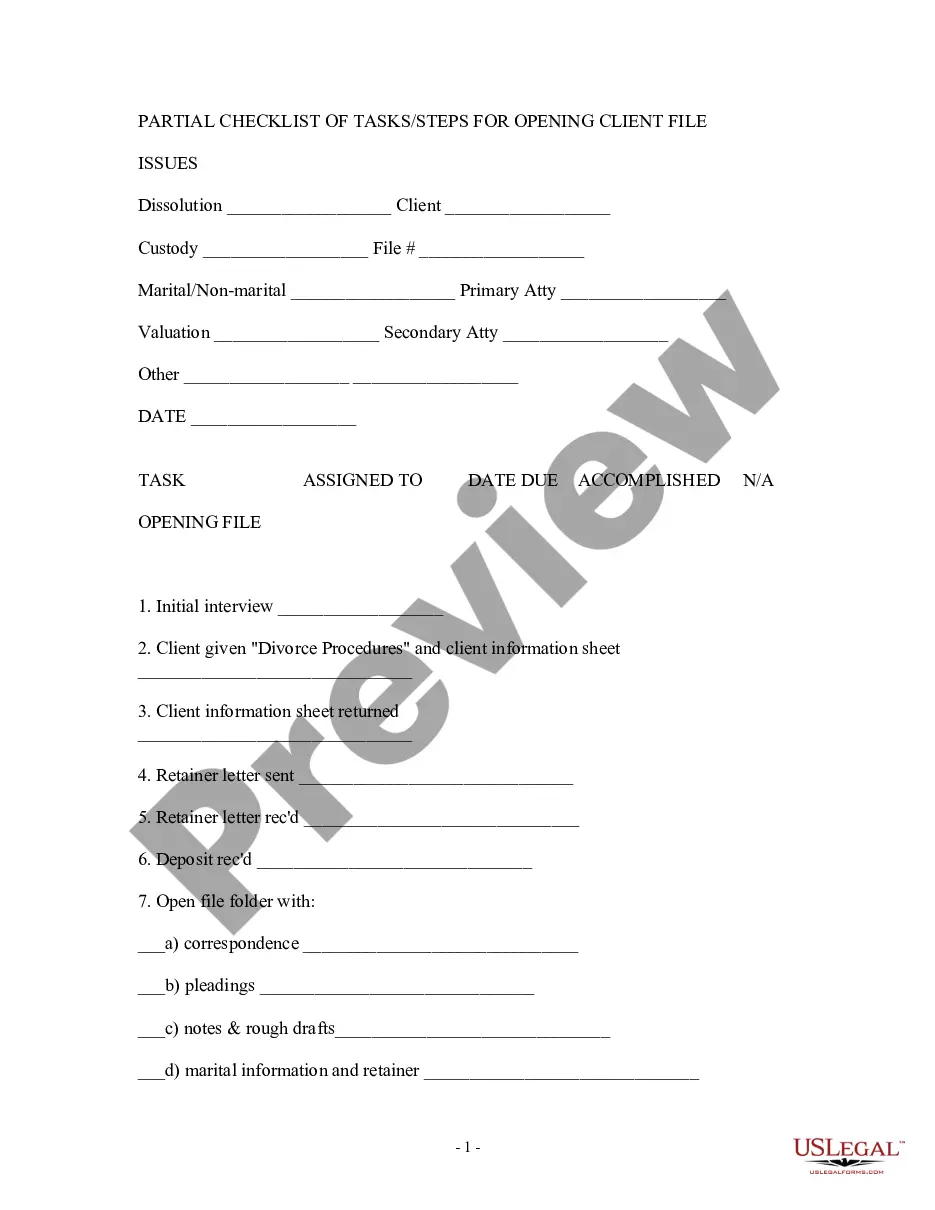

Whether you plan to establish your business, enter into a contract, request your ID modification, or address family-related legal matters, you must prepare specific documentation in accordance with your local laws and regulations.

Locating the right documents can require significant time and effort unless you utilize the US Legal Forms library.

This platform offers users access to over 85,000 expertly crafted and validated legal documents for any personal or commercial situation. All documents are organized by state and area of application, making it quick and easy to select a template such as the Allegheny Clause Setting Forth the Standard Measuring Method for Remeasurement.

Finally, download the Allegheny Clause Setting Forth the Standard Measuring Method for Remeasurement in your preferred file format. You can print the document or complete it and sign it electronically through an online editor to save time.

- Users of the US Legal Forms library simply need to Log In to their account and press the Download button next to the desired template.

- If you are a newcomer to the service, you will need to follow a few additional steps to obtain the Allegheny Clause Setting Forth the Standard Measuring Method for Remeasurement.

- Ensure that the sample meets your individual needs and complies with state law regulations.

- Review the form description and check the Preview if one is available on the page.

- Utilize the search bar above to enter your state and find another document.

- Click Buy Now to purchase the document once you've identified the right one.

- Choose the subscription plan that best fits your requirements to continue.

- Log in to your account and complete the payment using a credit card or PayPal.

Form popularity

FAQ

Simply put, translation accounting is the process used to turn foreign functional currency financial statements into U.S. dollar-denominated financial statements for consolidation and reporting purposes.

The temporal method is used to convert the currency of a foreign subsidiary into the same currency as the parent company. The parent company's currency is called the functional currency.

The current rate method is utilized in instances where the subsidiary isn't well integrated with the parent company, and the local currency where the subsidiary operates is the same as its functional currency.

There are two main methods of currency translation accounting: the current method, for when the subsidiary and parent use the same functional currency; and the temporal method for when they do not.

Foreign currency remeasurement is a procedure that restates the value of payables, receivables, and cash balances posted in a foreign currency to the company currency at period end. The key day for foreign currency remeasurement is the last day of the period or fiscal year.

The key difference is that a foreign currency transaction is when the company transacts with an unaffiliated 3rd party. Foreign currency remeasurement/translation occurs internally between the parent and subsidiaries.

Understanding Remeasurement Remeasurement is the process of re-establishing the value of an item or asset to provide a more accurate financial record of its value. Companies use remeasurement when translating the value of revenues and assets from a foreign subsidiary that is denominated in another currency.

What is the difference between foreign currency remeasurement and translation? Remeasurement focuses on converting foreign currencies into the subsidiary's functional currency. Translation focuses on converting the functional currency for a subsidiary into the reporting currency for the parent company.

What is the difference between foreign currency remeasurement and translation? Remeasurement focuses on converting foreign currencies into the subsidiary's functional currency. Translation focuses on converting the functional currency for a subsidiary into the reporting currency for the parent company.

The key difference between transaction and translation risk is that transaction risk is the exchange rate risk resulting from the time lag between entering into a contract and settling it whereas translation risk is the exchange rate risk resulting from converting financial results of one currency to another currency.