Nassau New York Provisions That May Be Added to A Pooling Or Unit Designation

Description

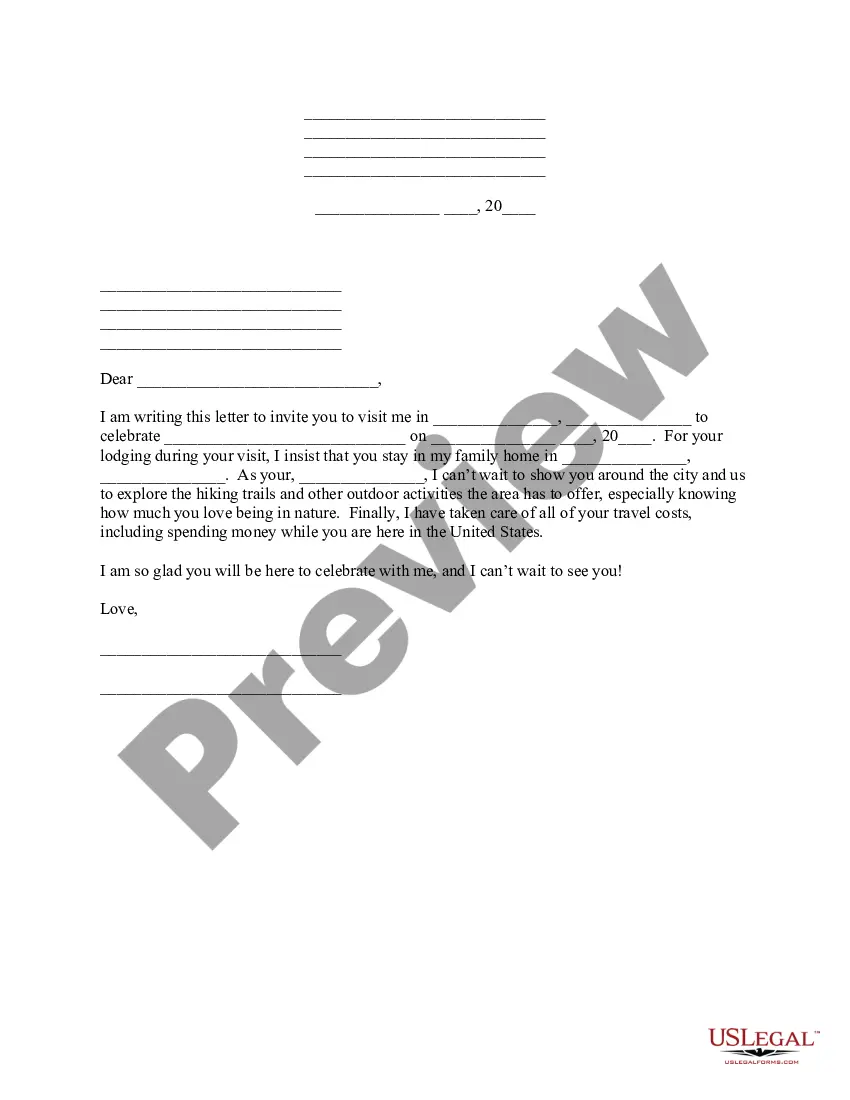

How to fill out Provisions That May Be Added To A Pooling Or Unit Designation?

Are you seeking to swiftly create a legally enforceable Nassau Provisions That May Be Added to A Pooling Or Unit Designation or perhaps any other document to manage your personal or business affairs.

You have two choices: reach out to a legal consultant to draft a legal document for you or compose it entirely on your own. Fortunately, there’s a third choice - US Legal Forms. It will assist you in obtaining expertly crafted legal documents without incurring exorbitant costs for legal services.

Restart the search if the form isn’t what you needed using the search bar in the header.

Select the option that best meets your requirements and proceed to the payment. Choose the file format you want to receive your document in and download it. Print it, complete it, and sign where indicated.

- US Legal Forms provides an extensive library of over 85,000 state-specific document templates, including Nassau Provisions That May Be Added to A Pooling Or Unit Designation and form bundles.

- We supply documents for a variety of life situations: from divorce documentation to real estate papers.

- Having been in the industry for over 25 years, we have established a solid reputation among our clientele.

- Here’s how you can join them and secure the necessary document hassle-free.

- To begin, ensure that the Nassau Provisions That May Be Added to A Pooling Or Unit Designation complies with your state's or county's laws.

- If the document contains a description, ensure it fits your needs.

Form popularity

FAQ

Property Values Are Higher In comparison, the median price of homes across the USA is about $250,000. This means that property values in Long Island are more than twice the national average. For this reason, those who live here will naturally have higher property assessment rates.

Planning permission is not usually required to install an outdoor domestic swimming pool as a pool is often considered as a garden project.

No permission shall be granted for the installation of any swimming pool, unless the plans therefor meet the minimum Town of Hempstead Building Department construction requirements or until the owner of the premises has filed with the Building Department a certification, approved by the Town Engineer, by a professional

DiNapoli announced that annual local property tax levy increases will be capped at 2 percent throughout New York State in 2022. This tax cap applies to the Nassau County general tax levy, which is a portion of all homeowners' tax bills.

How property taxes are calculated Taxes owed = taxable assessment x property tax rate per thousand. Taxable assessment: Your property's taxable assessment is the assessed value of your property as determined by your local assessor minus any exemptions that have been granted to you.

Nassau County Property Taxes by Town. The 2021 Nassau County tax rate was 5.15 per $1,000 of full market value. Most Nassau County property owners also pay a municipal tax rate for their city or town plus school district taxes. Some villages and special tax districts have additional tax levies.

The tax revenue required is divided by the assessed value of all property in the district to determine the tax rate. In most districts separate rates are determined for each class of property.

A swimming pool permit is required for all pools including storable or inflatable pools unless: - the pool is less than 24 inches deep and - does not exceed 5,000 gallons and - is installed entirely above ground.

A swimming pool permit is required for all pools including storable or inflatable pools unless: - the pool is less than 24 inches deep and - does not exceed 5,000 gallons and - is installed entirely above ground.

How is My Property Tax Rate Determined? The jurisdiction divides the tax levy by the total taxable assessed value of properties within your municipality. So, the tax rate is equal to the tax levy divided by all taxable assessments in the jurisdiction multiplied by $1,000.