Pima Arizona Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Whether you intend to launch your enterprise, engage in a contract, request your identification update, or address family-related legal matters, you need to prepare certain documentation that complies with your local statutes and regulations.

Locating the appropriate documents may require significant time and effort unless you utilize the US Legal Forms library.

This service offers users over 85,000 professionally crafted and verified legal templates for any personal or business occasion. All files are categorized by state and intended use, making it quick and simple to select a document such as the Pima Qualified Written RESPA Request to Challenge or Verify Debt.

The forms available on our site are reusable. With an active subscription, you can access all your previously obtained documentation at any time in the My documents section of your account. Stop wasting time in a relentless search for current official documents. Register for the US Legal Forms platform and manage your paperwork efficiently with the most comprehensive online form library!

- Ensure the document meets your specific needs and state law requirements.

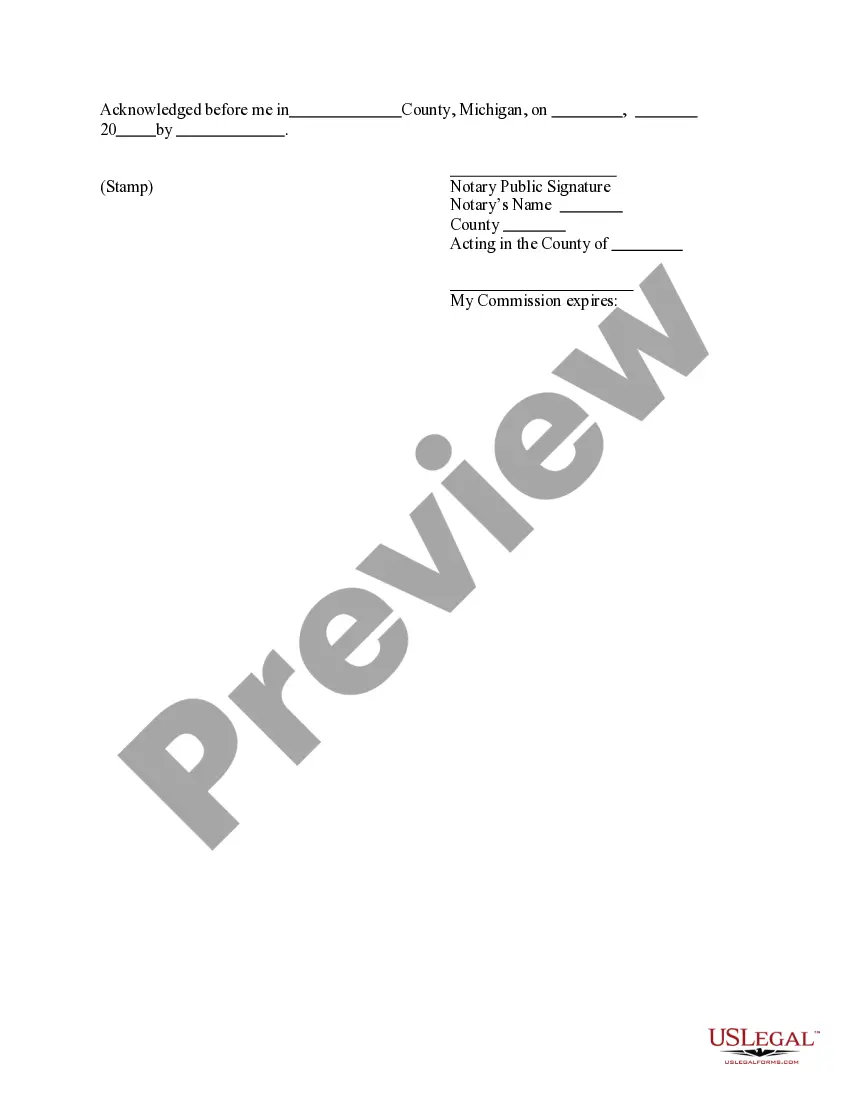

- Review the form description and check the Preview if available on the page.

- Utilize the search bar at the top to find another template pertinent to your state.

- Click Buy Now to acquire the document once you locate the correct one.

- Select the subscription plan that best fits your needs to proceed.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Pima Qualified Written RESPA Request to Challenge or Verify Debt in your preferred file format.

- Print the document or complete it and sign it electronically via an online editor to save time.

Form popularity

FAQ

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

A Qualified Written Request, or QWR, is written correspondence that you or someone acting on your behalf can send to your mortgage servicer. Instead of a QWR, you can also send your servicer a Notice of Error or a Request for Information.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

What Happens Now? If a debt collector can't verify your debt, then they must stop contacting you about it. And they have to let credit bureaus know so they can remove the debt from your credit report.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

If you don't receive a validation notice within 10 days of the first contact, request one from the debt collector the next time you're contacted. Ask for the debt collector's mailing address at this time as well, in case you decide to request a debt verification letter.