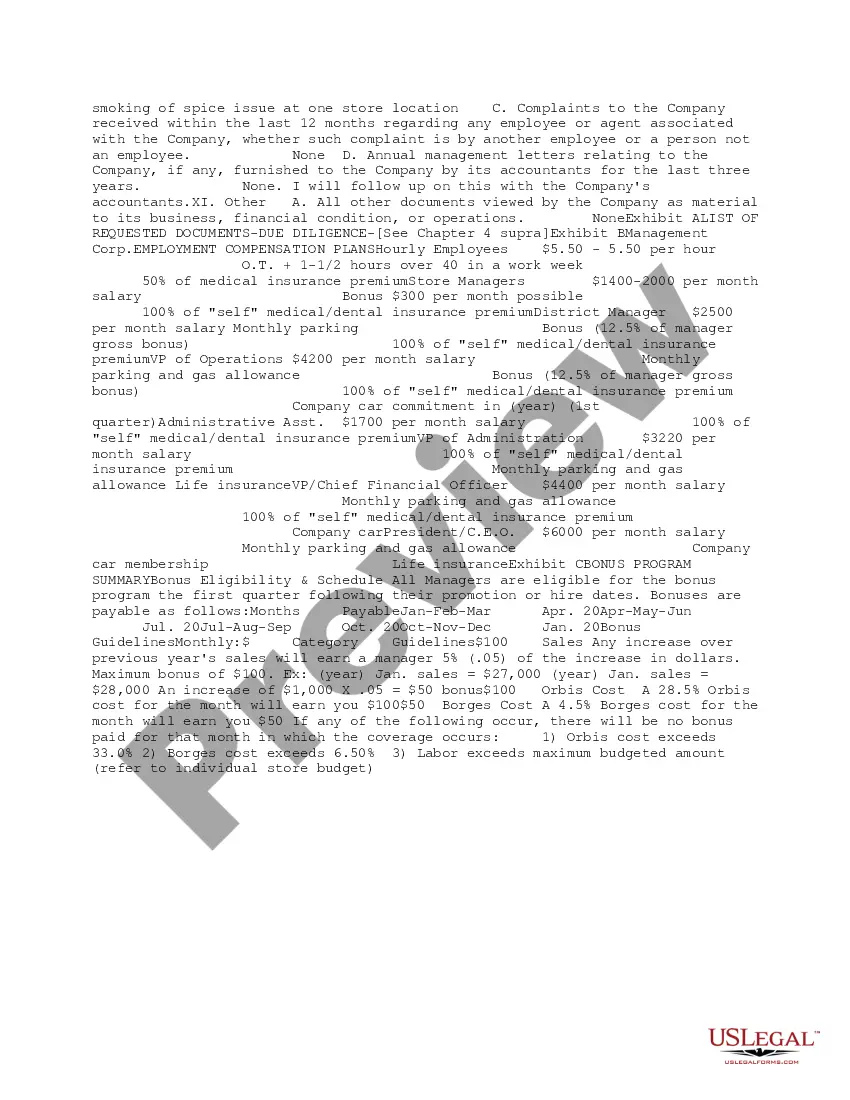

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Dallas Texas Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Dallas Texas Summary Initial Review Of Response To Due Diligence Request?

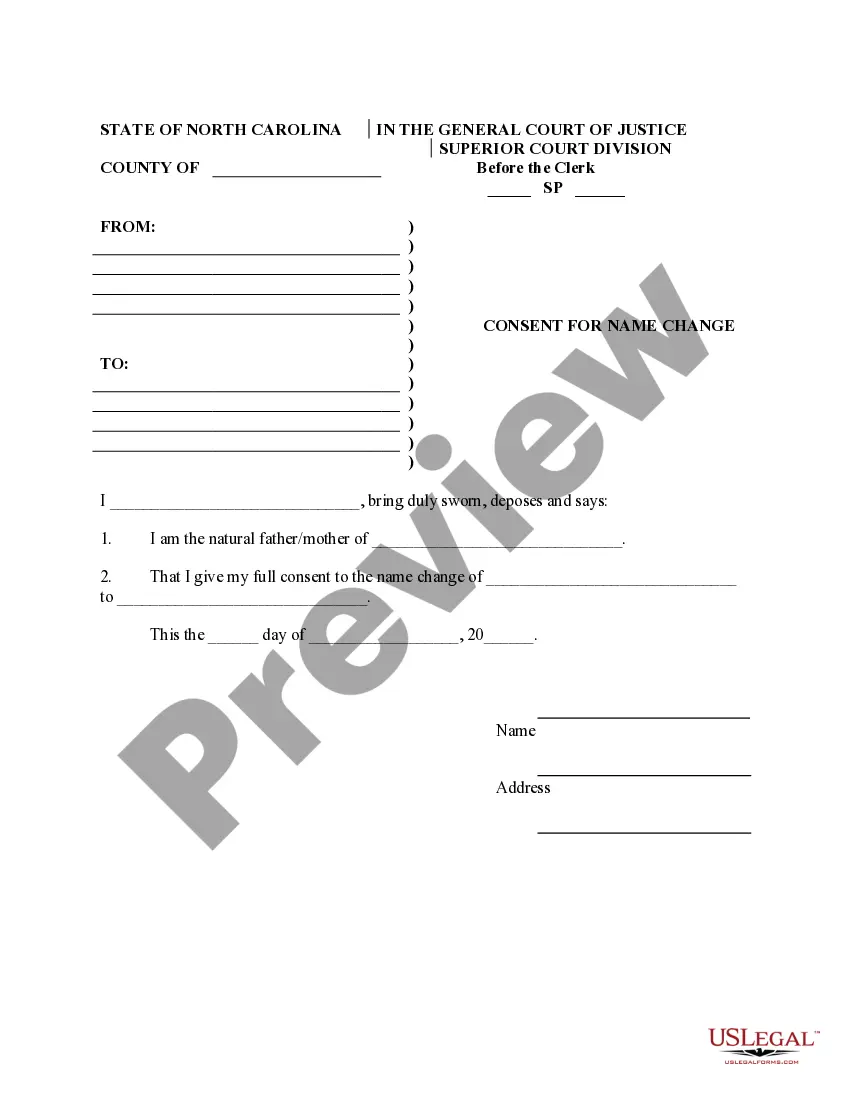

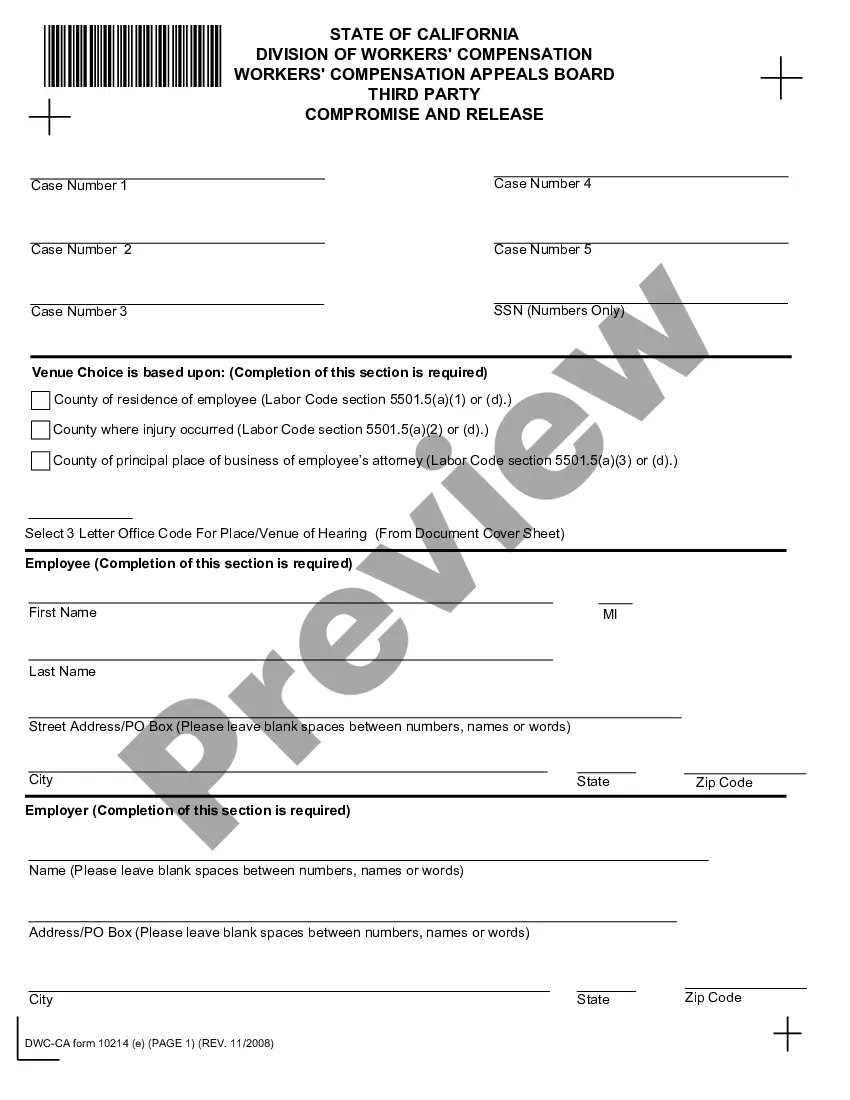

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life situation, finding a Dallas Summary Initial Review of Response to Due Diligence Request suiting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Apart from the Dallas Summary Initial Review of Response to Due Diligence Request, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Dallas Summary Initial Review of Response to Due Diligence Request:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Dallas Summary Initial Review of Response to Due Diligence Request.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Due Diligence Activities in an M&A Transaction Target Company Overview. Understanding why the owners of the company are selling the business Financials.Technology/Patents.Strategic Fit.Target Base.Management/Workforce.Legal Issues.Information Technology.

Generally speaking, any given response to a due diligence request should: Determine what question the potential buyer is truly trying to answer. Determine if existing / prior documents can satisfy their request. If necessary, reframe or refocus the request to align with available information.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

Due Diligence is a process that involves conducting an investigation, review, or audit to verify facts and information about a particular subject. In simple words, Due Diligence means doing your homework and acquisitions of required knowledge before entering into any agreement or contract with another company.

A due diligence questionnaire, referred to by the acronym DDQ, is a list of questions designed to evaluate aspects of an organization prior to a merger, acquisition, investment or partnership.

13 Critical Things To Do During The Due Diligence Period Research Home Prices.Look up Taxes.Find a Seasoned Real Estate Agent.Find a Lender.Read Disclosures.Home Inspection.Cost of Repairs.Insurance.

1. Company information Who owns the company? What is the company's organizational structure? Who are the company's shareholders?What are the company's articles of incorporation? Where is the company's certificate of good standing from the state in which the business is registered? What are the company bylaws?

What Is Due Diligence? Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

20 Key Due Diligence Activities In A Merger And Acquisition... Financial Matters.Technology/Intellectual Property.Customers/Sales.Strategic Fit with Buyer.Material Contracts.Employee/Management Issues.Litigation.Tax Matters.

Due Diligence is a process that involves conducting an investigation, review, or audit to verify facts and information about a particular subject. In simple words, Due Diligence means doing your homework and acquisitions of required knowledge before entering into any agreement or contract with another company.