An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

Key Concepts & Definitions

Assignment by beneficiary of an interest in the refers to the legal transfer of rights or interests in a certain asset or property from the beneficiary to another party. Often occurring in trusts, insurance policies, or estates, beneficiaries might opt to transfer their interests for managing their assets more suitably or strategically.

Step-by-Step Guide

- Identify the Interest: Determine the exact interest or asset the beneficiary holds and wishes to assign.

- Consult Legal Advice: Engage with a legal expert to understand the implications of the assignment.

- Draft the Assignment Agreement: Prepare a legally binding agreement detailing the assignment terms.

- Obtain Necessary Approvals: Depending on the nature of the interest, approvals from trustees or other stakeholders might be needed.

- Execute the Agreement: Have all involved parties sign the agreement.

- Register the Assignment: If required, register the assignment with relevant authorities for legal recognition.

Risk Analysis

- Legal Risks: Improper documentation or lack of approvals could invalidate the assignment.

- Financial Risks: The transfer might lead to unforeseen tax liabilities or reduce the financial benefits expected from the original asset.

- Relationship Risks: If not communicated properly, the assignment could strain relationships between the involved parties.

Key Takeaways

- Assignment requires careful planning: Legal advice and precise documentation are crucial.

- Understand the consequences: Both legal and financial repercussions should be clearly understood before proceeding.

- Communication is key: Clearly communicate the intentions and reasons for the assignment to all relevant parties.

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

Aren't you tired of choosing from numerous samples every time you need to create a Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary? US Legal Forms eliminates the wasted time countless American citizens spend surfing around the internet for ideal tax and legal forms. Our skilled crew of lawyers is constantly upgrading the state-specific Samples library, to ensure that it always provides the proper documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription should complete simple actions before being able to download their Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary:

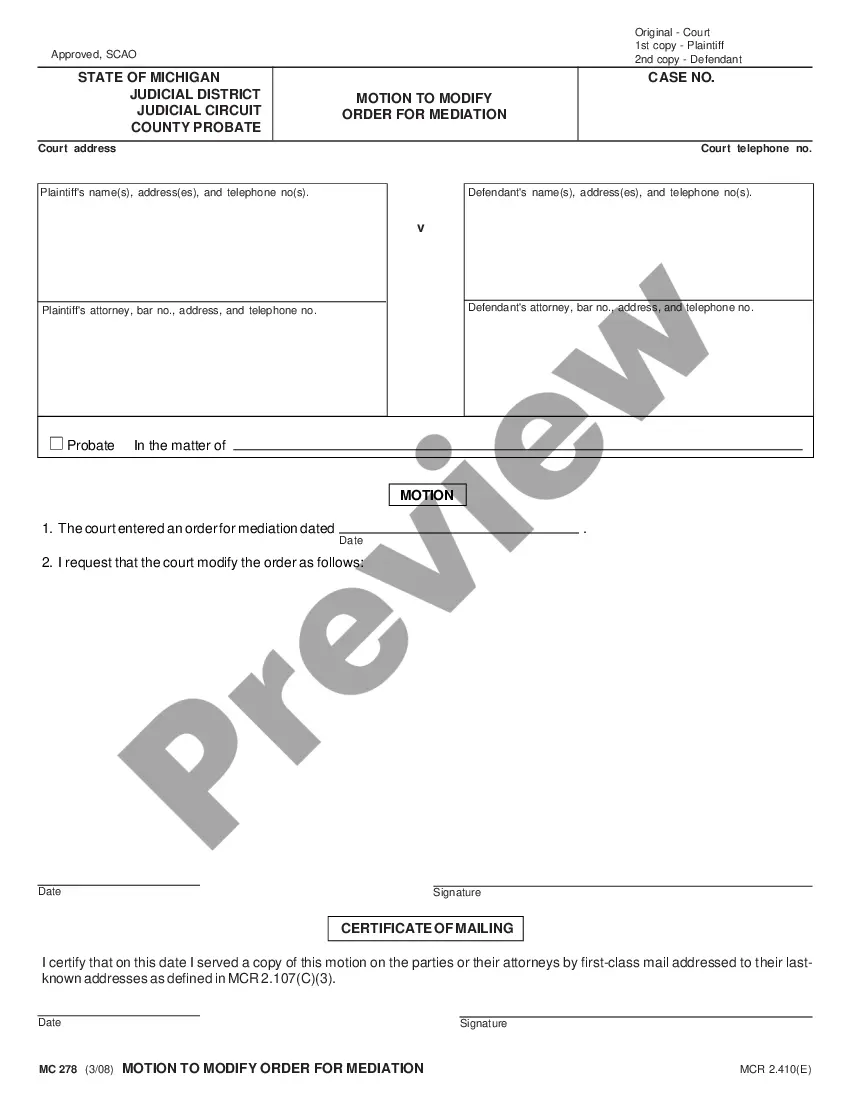

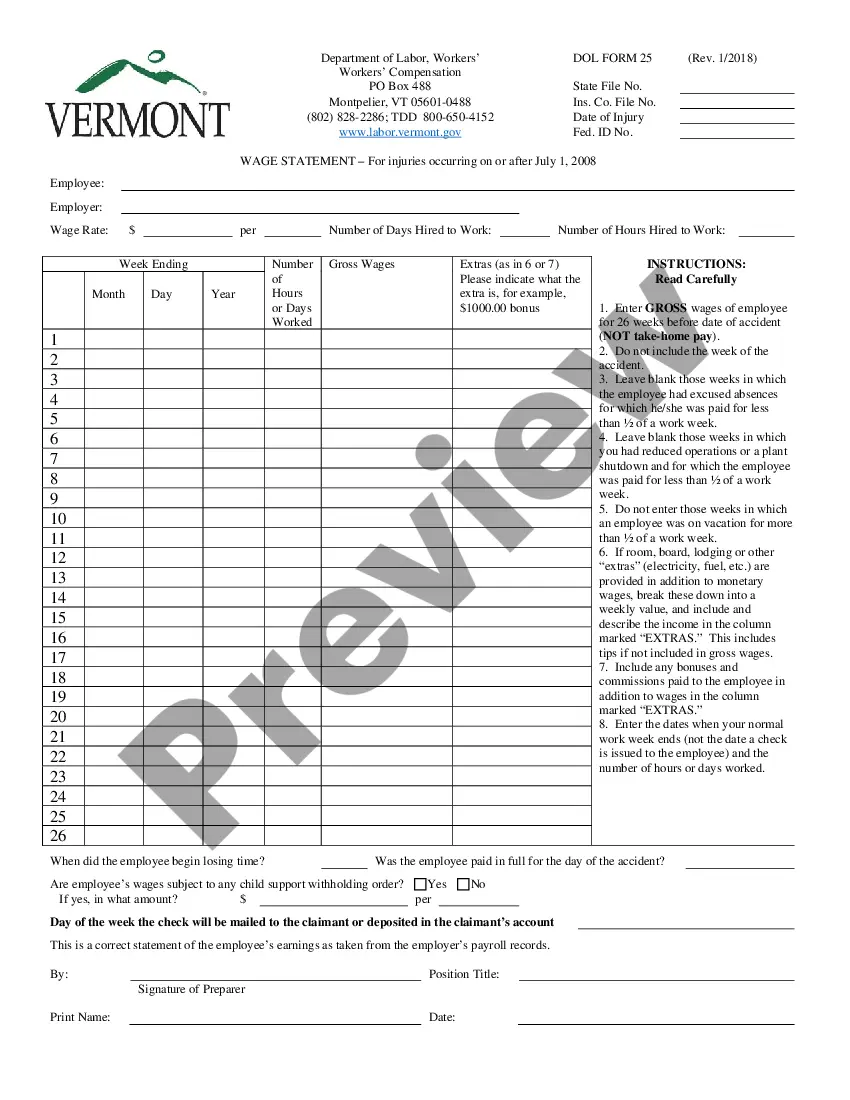

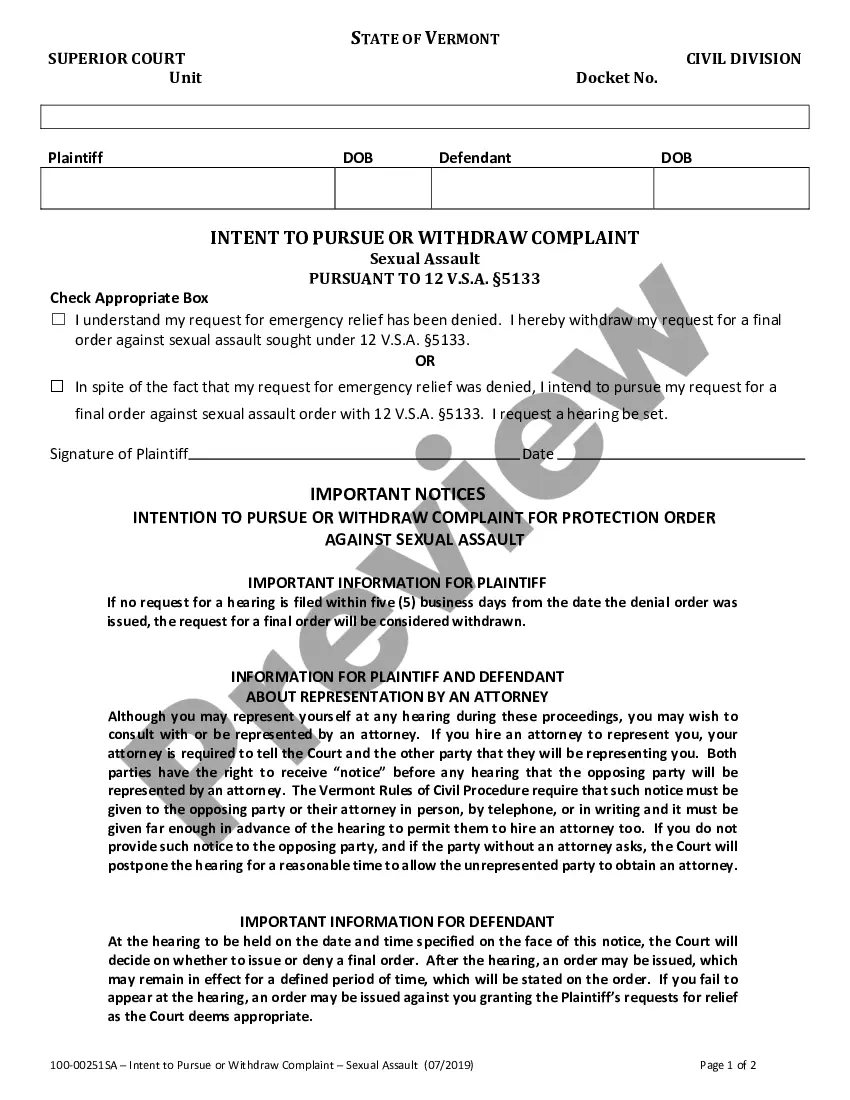

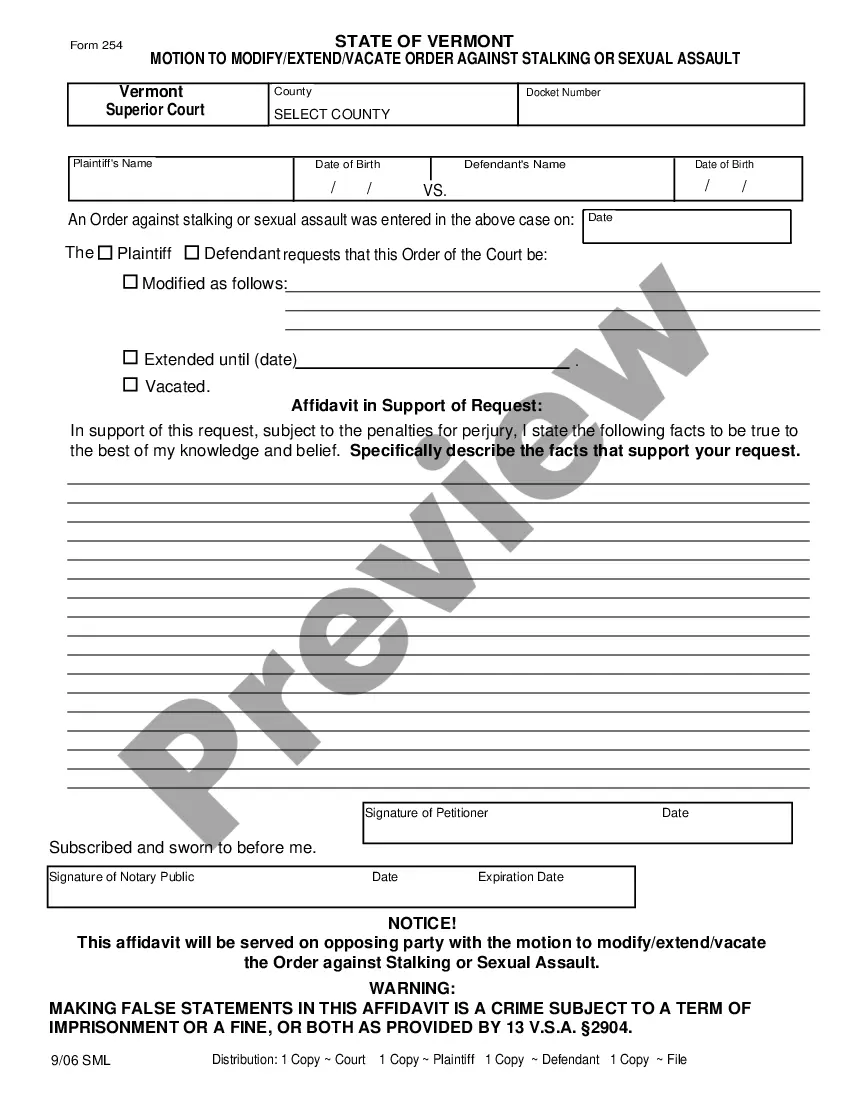

- Make use of the Preview function and read the form description (if available) to make sure that it’s the appropriate document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate example for the state and situation.

- Use the Search field on top of the web page if you want to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your template in a required format to finish, print, and sign the document.

When you have followed the step-by-step recommendations above, you'll always be capable of sign in and download whatever document you require for whatever state you need it in. With US Legal Forms, completing Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary templates or other legal documents is easy. Begin now, and don't forget to examine your samples with accredited lawyers!

Form popularity

FAQ

IMPORTANT: This form is a legal document and cannot include Whiteout. If you make a mistake, please cross it out and initial the correction. If you wish to change your Primary or Alternate Beneficiary, a new form must be completed.NOTARY REQUIRED: Form must be NOTARIZED in the Acknowledgment section below.

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write children on one of the lines; instead write the full names of each of your children on separate lines.

Starting to Write Mention the obvious and that you wish to change the current beneficiary to a new one. Provide accurate details of the new beneficiary and double check the spelling. Specify that if any documentation or details not included are needed that you may be contacted with contact information enclosed.

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Open the Account You must go to your bank in person to add the beneficiary to your account. Bring along your photo ID, bank account information and beneficiary information. If you want to name multiple beneficiaries, you will need each beneficiary's name and address.

A beneficiary may not transfer an interest in a trust in violation of a valid spendthrift provision and, except as otherwise provided in this chapter, a creditor or assignee of the beneficiary may not reach the interest or a distribution by the trustee before its receipt by the beneficiary.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.