The Bexar Texas Restructuring Agreement, also known as the Bexar County Bond Restructuring Agreement, is a legal document that outlines the terms, conditions, and procedures for the restructuring of debt obligations within Bexar County, Texas. It is designed to provide financial stability and address any financial challenges faced by the county. Keywords: Bexar Texas, Restructuring Agreement, Bexar County, debt obligations, financial stability, financial challenges. There are different types of Bexar Texas Restructuring Agreements, which include: 1. Debt Consolidation Agreement: This type of agreement consolidates multiple outstanding debts into a single new debt structure. It aims to simplify payment processes and potentially reduce interest rates or extend repayment terms. 2. Debt Modification Agreement: This agreement involves modifying the terms of existing debt obligations. It may include changes such as modifying interest rates, extending maturity dates, or adjusting repayment schedules to make them more manageable for the county. 3. Debt Refinancing Agreement: This type of agreement replaces existing debt with new debt that offers more favorable terms. It allows the county to lower interest rates, obtain longer repayment periods, or improve the overall debt structure, ultimately reducing financial burden. 4. Debt Restructuring Agreement: This agreement encompasses a comprehensive restructuring plan that may involve a combination of debt consolidation, modification, and refinancing. Its purpose is to provide a comprehensive solution to address the county's financial challenges and optimize debt management strategies. Overall, the Bexar Texas Restructuring Agreement serves as a crucial tool for effective debt management and financial stability within Bexar County, Texas. It provides a structured framework for negotiations and agreements between the county and its creditors, aiming to ensure a sustainable and manageable debt repayment plan.

Bexar Texas Restructuring Agreement

Description

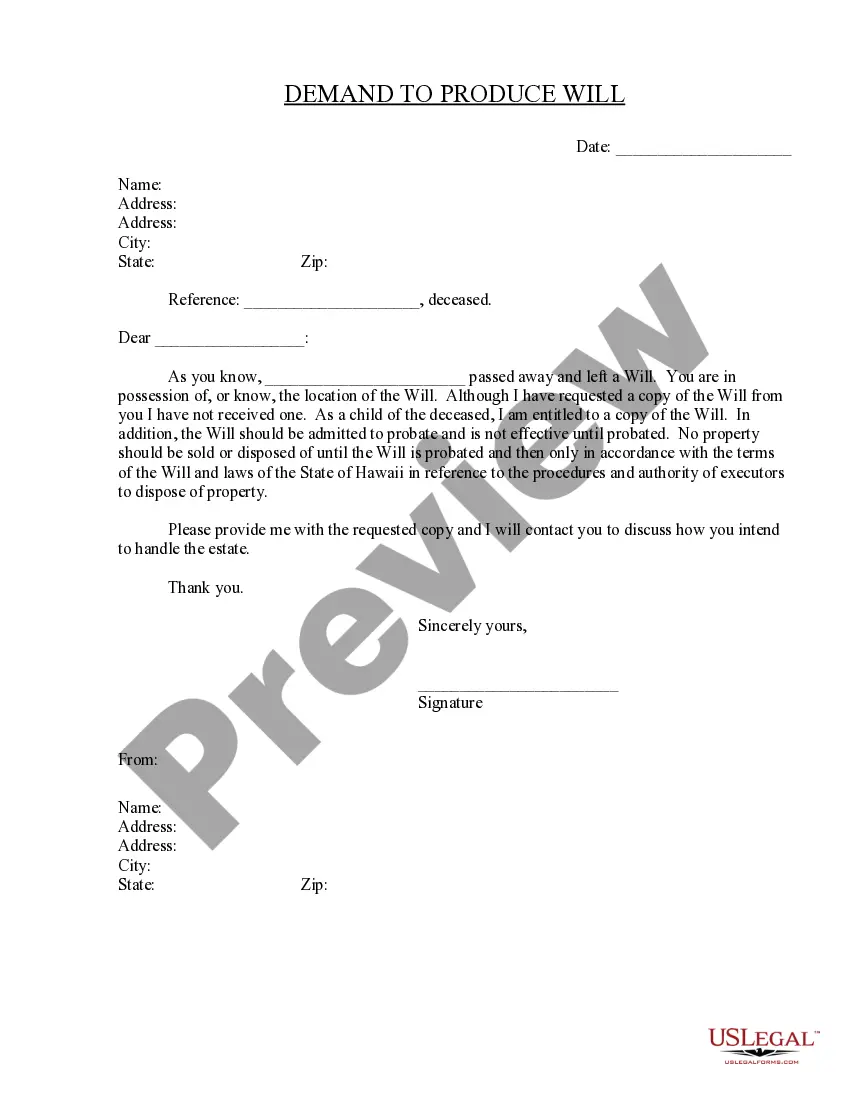

How to fill out Bexar Texas Restructuring Agreement?

Are you looking to quickly draft a legally-binding Bexar Restructuring Agreement or probably any other document to take control of your personal or business affairs? You can go with two options: contact a professional to draft a legal document for you or draft it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Bexar Restructuring Agreement and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Bexar Restructuring Agreement is adapted to your state's or county's laws.

- If the document comes with a desciption, make sure to verify what it's intended for.

- Start the searching process over if the template isn’t what you were looking for by using the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Bexar Restructuring Agreement template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the templates we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other information online.

Fee Schedule FAMILY2022 FEEChange of name (minor or adult)$350.00Application for writ of habeas corpus (Child)$350.00Adoption (adult)$350.00Grandparent access$350.0011 more rows

You may make your request by E-filing, Mail or in person. Checks or money orders are to be made payable to: Lucy Adame-Clark, Bexar County Clerk. Jury duty is located in the basement of the Justice Center (300 Dolorosa Street), across the hall from the cafeteria.

You may make your request by E-filing, Mail or in person. Checks or money orders are to be made payable to: Lucy Adame-Clark, Bexar County Clerk. Jury duty is located in the basement of the Justice Center (300 Dolorosa Street), across the hall from the cafeteria.

2022 Document Fee Schedule Document TitleService FeeFiling FeeSmall Claim Petition (small claims petition form)$85.00$54.00Small Counter/Cross/3rd Party Claim$85.00$54.00Subpoena (subpoena form)$85.00 + $10 cashN/ASummons$85.00N/A21 more rows

Choose an electronic filing service provider (EFSP) at eFileTexas.gov. An electronic filing service provider (EFSP) is required to help you file your documents and act as the intermediary between you and the eFileTexas.gov system. For eFiling questions you may call 210-335-2496 or 855-839-3453.

For Pro Se filers, a Petition for Non-Disclosure can be filed with the County Clerk's Criminal Filing Department located in the basement of the Bexar County Courthouse. The filing fee for a Petition of Non-disclosure is $260.00.