Santa Clara California Charitable Contribution Payroll Deduction Form

Description

How to fill out Charitable Contribution Payroll Deduction Form?

A document procedure consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job proposal, transferring ownership, and numerous other life situations necessitate you prepare formal documentation that differs from state to state.

That is the reason having it all gathered in one location is immensely advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal templates.

This is the easiest and most reliable way to procure legal documentation. All the samples available in our library are expertly drafted and validated for compliance with local laws and regulations. Prepare your documents and manage your legal matters effectively with US Legal Forms!

- On this site, you can effortlessly locate and acquire a document for any personal or business intent utilized in your area, including the Santa Clara Charitable Contribution Payroll Deduction Form.

- Finding templates on the site is exceptionally straightforward.

- If you already hold a subscription to our library, Log In to your account, search for the sample via the search bar, and click Download to save it on your device.

- Subsequently, the Santa Clara Charitable Contribution Payroll Deduction Form will be accessible for further utilization in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this uncomplicated guide to obtain the Santa Clara Charitable Contribution Payroll Deduction Form.

- Verify that you have accessed the correct page containing your localized form.

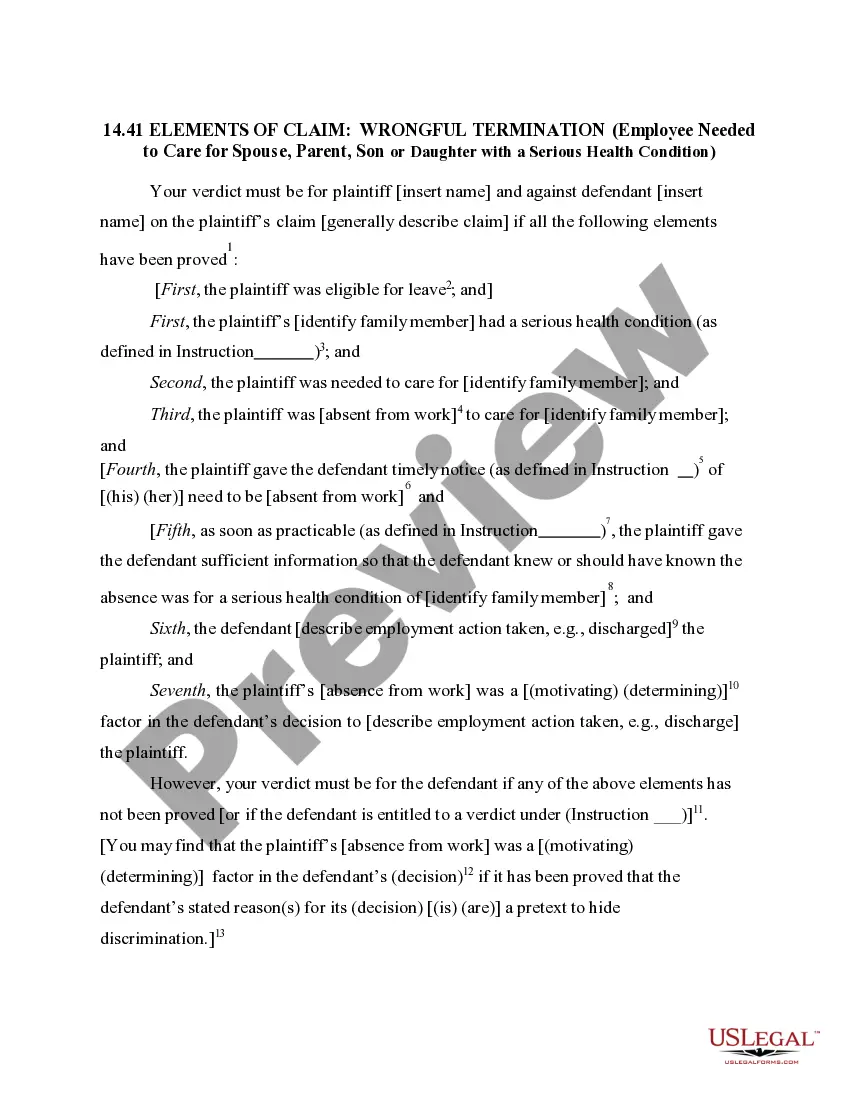

- Utilize the Preview mode (if accessible) and explore the template.

- Examine the description (if present) to confirm the form satisfies your requirements.

- Search for an alternative document via the search tab if the sample does not suit you.

- Select Buy Now when you discover the required template.

- Choose the suitable subscription plan, then Log In or create an account.

- Select the preferred payment method (using a credit card or PayPal) to advance.

- Select file format and download the Santa Clara Charitable Contribution Payroll Deduction Form on your device.

- Utilize it as necessary: print it or complete it electronically, sign it, and submit where needed.

Form popularity

FAQ

You cannot e-file Form 8283 if you have a noncash contribution that requires a qualified appraisal. Since the Santa Clara California Charitable Contribution Payroll Deduction Form tracks contributions, it can help you gather the necessary information. In these cases, you must file a paper return and include the form with your submission. Ensuring you follow these guidelines helps to avoid issues with your tax return.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

While taxes are a certainty of life, and business taxes can cause many a headache, when it comes to deducting employer payroll tax contribution, it is quite cut and dry: you are given the right to deduct the full employer contribution (one half of Social Security and Medicare taxes, 100% of Federal and/or State

Deductible Charitable Contributions Generally, you can deduct any cash contributions you make and/or the fair market value of any donated property, such as clothing, household items, or vehicles. You can also claim a deduction for the contribution of stocks.

To deduct donations, you must file a Schedule A with your tax form. With proper documentation, you can claim vehicle or cash donations. Or, if you want to deduct a non-cash donation, you'll also have to fill out Form 8283.

Federal law does not allow for charitable donations through payroll deduction (CFC or any other payroll deduction program) to be done pre-tax. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC.

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.

They include things like 401(k) contributions, health insurance premiums for employer-sponsored health insurance, pre-tax commuter benefits and more. There are both pre- and post-tax payroll tax deductions.

While payroll deductions are a common way for donors to give to their charities of choice, federal law does not allow for charitable donations through payroll deduction to be done pre-tax. That means you don't get the deduction each pay period. Instead, your charitable donations come out of your after-tax earnings.

Employers withhold (or deduct) some of their employees' pay in order to cover payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits.