Harris Texas Performance Bond

Description

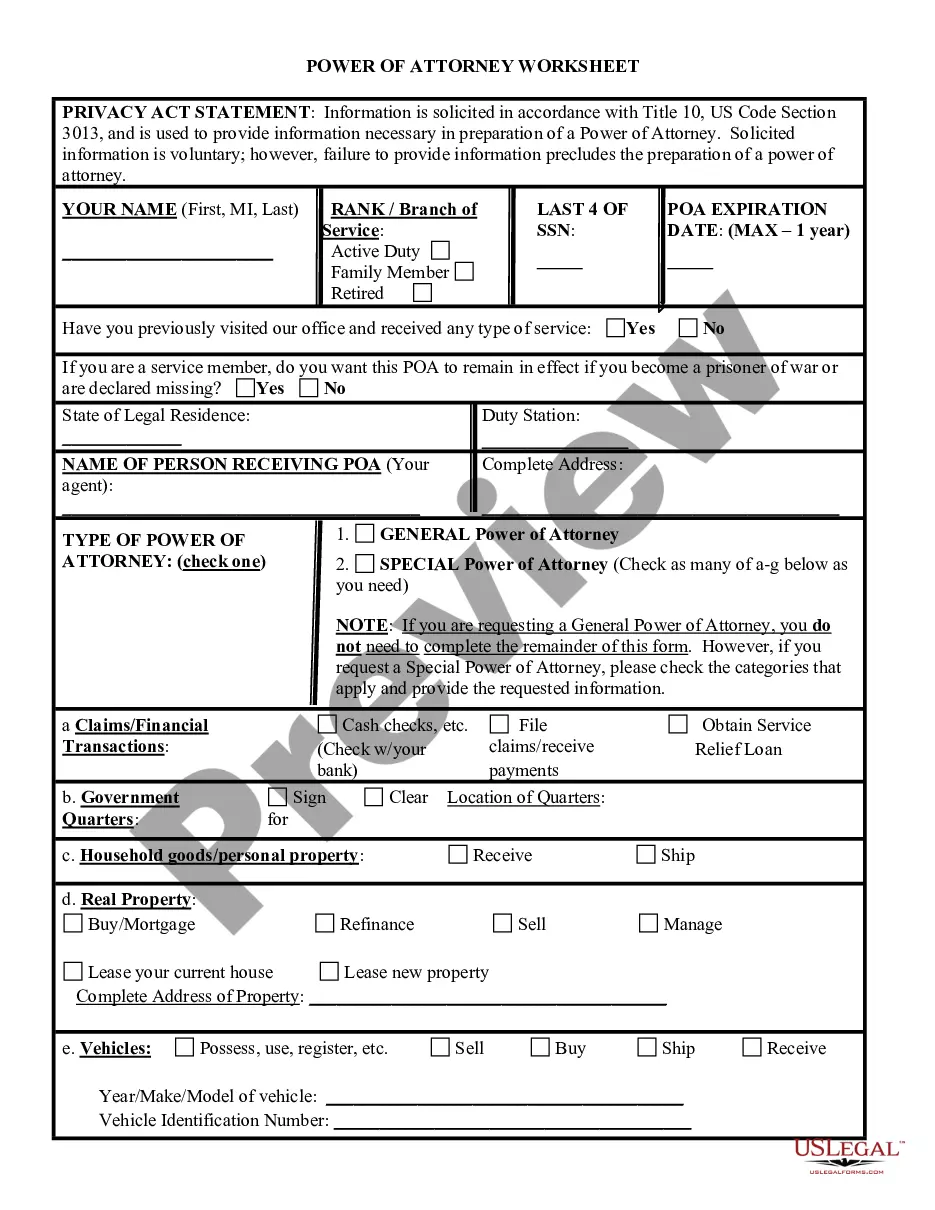

How to fill out Performance Bond?

If you are searching for a trustworthy legal document supplier to acquire the Harris Performance Bond, consider US Legal Forms. Whether you want to establish your LLC business or manage your asset distribution, we're here to assist you. You don't have to be an expert in law to find and download the necessary form.

You can effortlessly type to search or browse the Harris Performance Bond, either by a keyword or by the state/county the form is designated for.

After finding the required form, you can Log In and download it or save it in the My documents section.

Don't have an account? It's simple to set one up! Just find the Harris Performance Bond template and view the form's preview and concise introductory details (if available). If you feel confident about the template’s wording, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately available for download as soon as payment is confirmed.

Managing your legal issues doesn’t have to be costly or time-consuming. US Legal Forms is here to prove it. Our extensive selection of legal forms makes these tasks less expensive and more affordable. Initiate your first business, organize your advance care planning, draft a property agreement, or finalize the Harris Performance Bond - all from the comfort of your home. Join US Legal Forms today!

- You can explore over 85,000 forms categorized by state/county and case.

- The user-friendly interface, abundance of supporting resources, and dedicated customer service team make it easy to discover and complete various documents.

- US Legal Forms is a dependable service that has provided legal forms to millions of customers since 1997.

Form popularity

FAQ

What is a 50% performance bond? A performance bond is a financial guarantee that ensures the owner of the project will be compensated should their contractor fail to complete. The amount varies depending on what percentage level it's based on, but typically 50% or 100%.

What happens when a performance bond expires? Performance bonds are bound to contracts, so they expire when the contract timeframe ends. They only exist as long as the contract is in effect and disappear when it expires - which can be for any number of reasons including breaking up a team or company!

Who is protected with a surety bond vs insurance? Insurance protects the business owner, home owner, professional, and more from financial loss when a claim occurs. Surety bonds protect the obligee who contracted with the principal to perform specific work on a project by reimbursing them when a claim occurs.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract. It is also referred to as a contract bond.

The cost of a performance bond usually is less than 1% of the contract price; however, if the contract is under $1 million, the premium may run between 1% and 2%. Bonds may be more costly, depending upon the credit-worthiness of the contractor.

A performance bond is not an insurance policy, or an insurance contract, and it is not a payment bond, or a bid bond. These are all different instruments which may be required, and typically they are, for a construction project.

A payment bond guarantees a party pays all entities, such as subcontractors, suppliers, and laborers, involved in a particular project when the project is completed. A performance bond ensures the completion of a project.

The cost of a performance bond may go up by 1.5% to 2% on riskier contracts. The financial strength and credit worthiness of the principal are major considerations in the cost of the bond. For our small contractor bonds (those that are <$400,000) three percent (3%) is a pretty good rule to follow.

A bond is in fact different from commercial liability insurance primarily because of who is protected. You should also note that a bond covers only for specific obligations, unlike liability insurance which is a broader form of coverage against a range of liabilities.

A performance bond is a type of contract construction bond that guarantees a contractor will complete a project according to the terms outlined in a contract by the project owner, also called the obligee. The obligee can be a city, state, or local government, as well as the federal government or a private developer.