Collin Texas Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage

Description

How to fill out Sample Letter For Intentions Regarding Defense Of Priority Of Insured Mortgage?

A document procedure consistently accompanies any legal action you undertake.

Launching a business, applying for or accepting a job proposal, transferring ownership, and many other life circumstances necessitate the preparation of official paperwork that varies by region.

That is why having everything gathered in one location is incredibly beneficial.

US Legal Forms is the largest online compilation of current federal and state-specific legal documents.

Choose an appropriate subscription plan, then Log In or create an account. Select the preferred payment option (via credit card or PayPal) to proceed. Determine the file format and save the Collin Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage on your device. Utilize it as required: print it or fill it out digitally, sign it, and submit it wherever needed. This is the easiest and most reliable method to obtain legal documents. All templates offered by our repository are professionally crafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters effectively with US Legal Forms!

- On this platform, you can effortlessly find and download a document for any personal or business intent required in your locality, including the Collin Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage.

- Finding samples on the site is exceedingly straightforward.

- If you already have a subscription to our service, Log In to your account, locate the sample through the search bar, and click Download to save it onto your device.

- Subsequently, the Collin Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage will be accessible for further use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, adhere to this straightforward guide to acquire the Collin Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage.

- Ensure you have accessed the appropriate page with your local form.

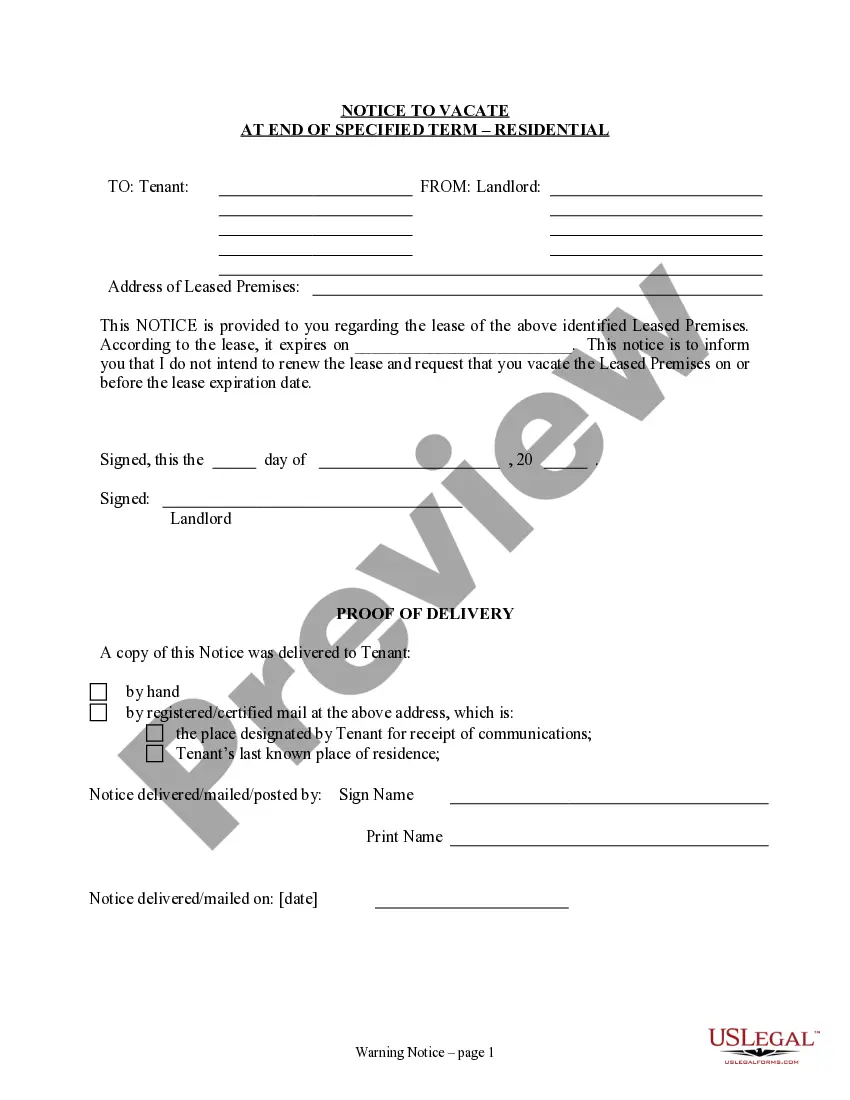

- Utilize the Preview mode (if available) and review the sample.

- Examine the description (if provided) to confirm the form meets your needs.

- Search for another document using the search option in case the sample is not suitable.

- Click Buy Now once you find the necessary template.

Form popularity

FAQ

Federal law gives borrowers what is known as the "right of rescission." This means that borrowers after signing the closing papers for a home equity loan or refinance have three days to back out of that deal.

When you are shopping for a loan, you may contact more than one potential lender to compare available options. If you intend to proceed with a particular mortgage application, you must notify your lender of your intent to proceed by telling the lender you want to move forward with the application for that loan.

A letter of explanation is a brief document you can use to explain anything in your financial or employment documents that might make an underwriter pause, like a previous bankruptcy.

What Should A Letter Of Intent To Occupy A Home Include? To write an intent to occupy letter, you should include your name, the home's address, your decision to apply for a mortgage and your intent to occupy the home as the owner. You should also include any specific details that your lender requests.

Intent to proceed is only required once and not for subsequent revised Loan Estimates, therefore there is no mandate for changing the initial closing cost expiration date.

A letter of intent to occupy is a concise legal document that you write stating your intention to live in the home you're mortgaging as your primary residence. Your primary residence is important because it ties directly to certain tax benefits and usually a better mortgage rate.

How to write a letter of explanation The lender's name and address. Your name and your application number. The date you're submitting the letter and expected closing date (if you know it) A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

The critical moment is when the Buyer decides to work with a lender, and that only happens when you confirm you intend to proceed with them. It is at that moment (acknowledging your Intent to Proceed) is when the lender can collect your appraisal fee (not before) and get the appraisal ordered.

What does "intent to proceed" mean? Think of it as your commitment to a lender. It means you applied for a loan, maybe with a few lender. You compared Loan Estimates and decided to go with one home loan and one lender. Don't pay any loan fees before you choose a loan and a lender.