Nassau New York Assignment of Partnership Interest with Consent of Remaining Partners

Description

How to fill out Assignment Of Partnership Interest With Consent Of Remaining Partners?

Producing legal documents is essential in contemporary society.

However, one doesn't always have to seek professional help to formulate some of them from scratch, including Nassau Assignment of Partnership Interest with Consent of Remaining Partners, by using a service like US Legal Forms.

US Legal Forms boasts over 85,000 templates to choose from across diverse categories ranging from living wills to real estate documents to divorce filings. All templates are categorized based on their valid state, simplifying the search process.

If you're currently subscribed to US Legal Forms, you can identify the correct Nassau Assignment of Partnership Interest with Consent of Remaining Partners, Log In to your account, and download it.

It’s important to mention that our platform cannot completely replace a legal expert. If you are managing an especially complex issue, we advise engaging the services of an attorney to examine your document prior to signing and filing it.

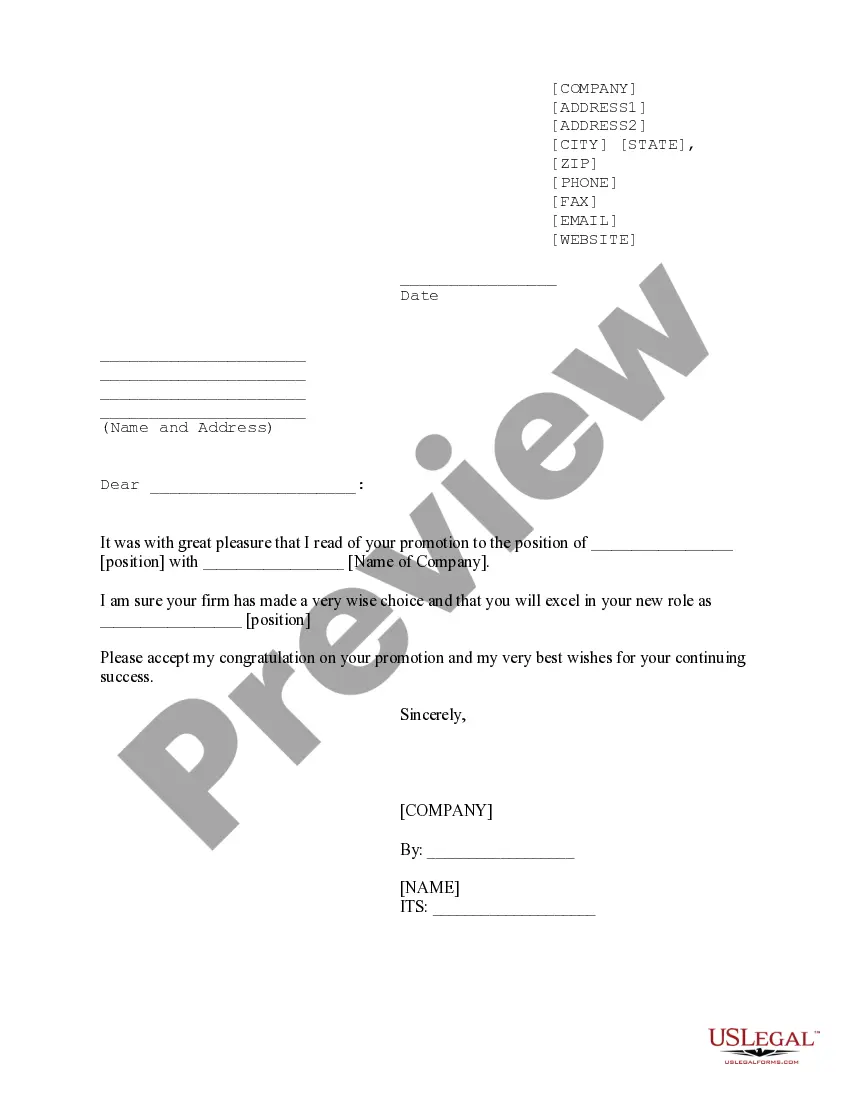

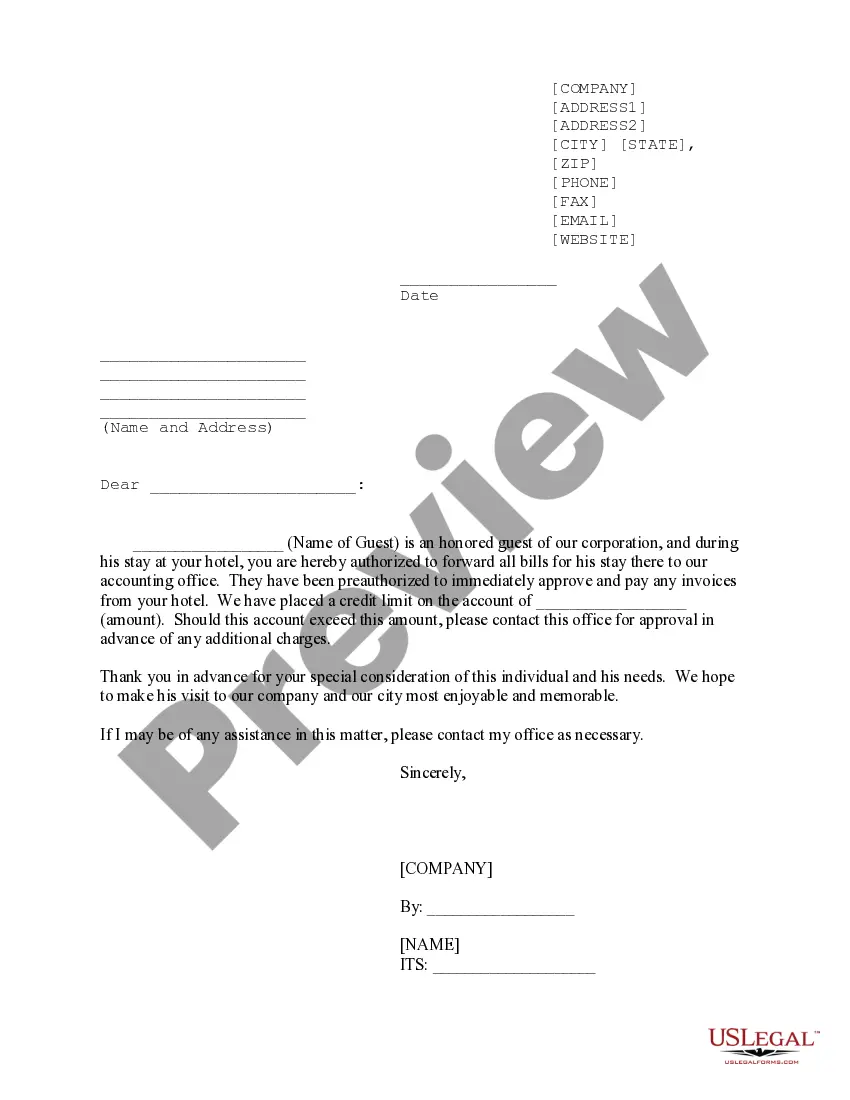

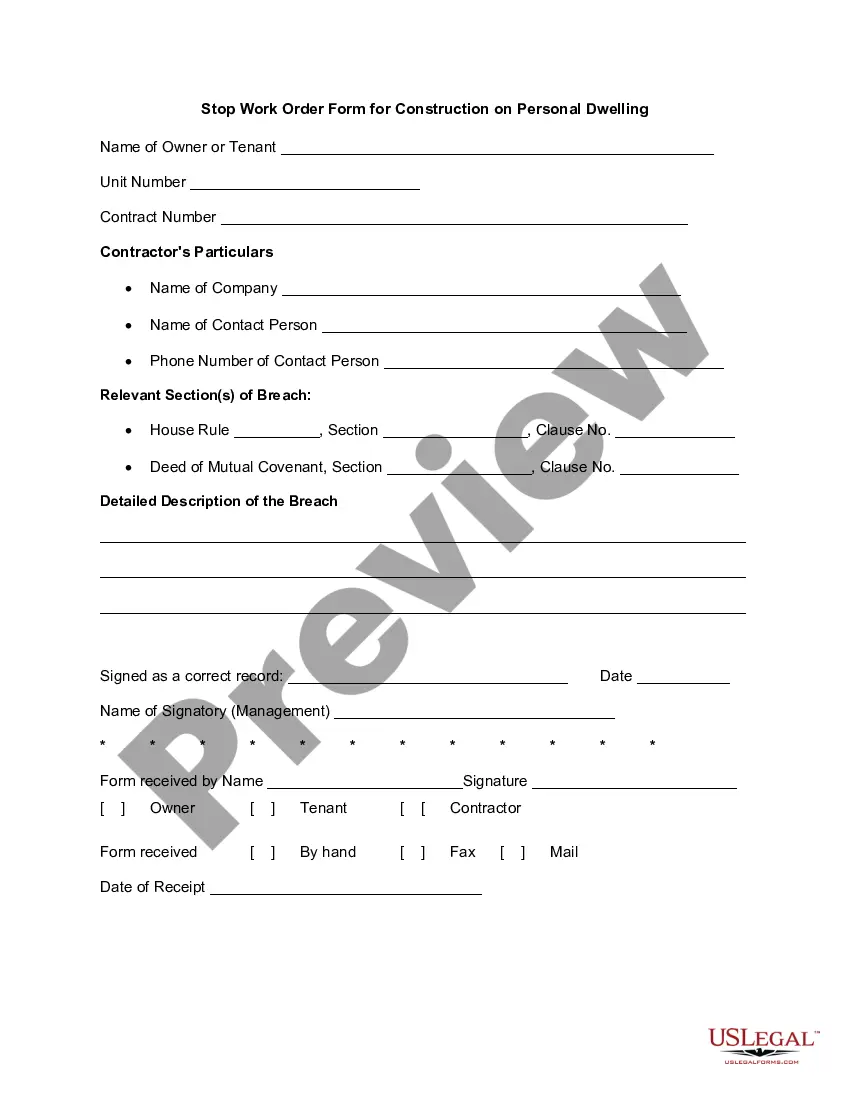

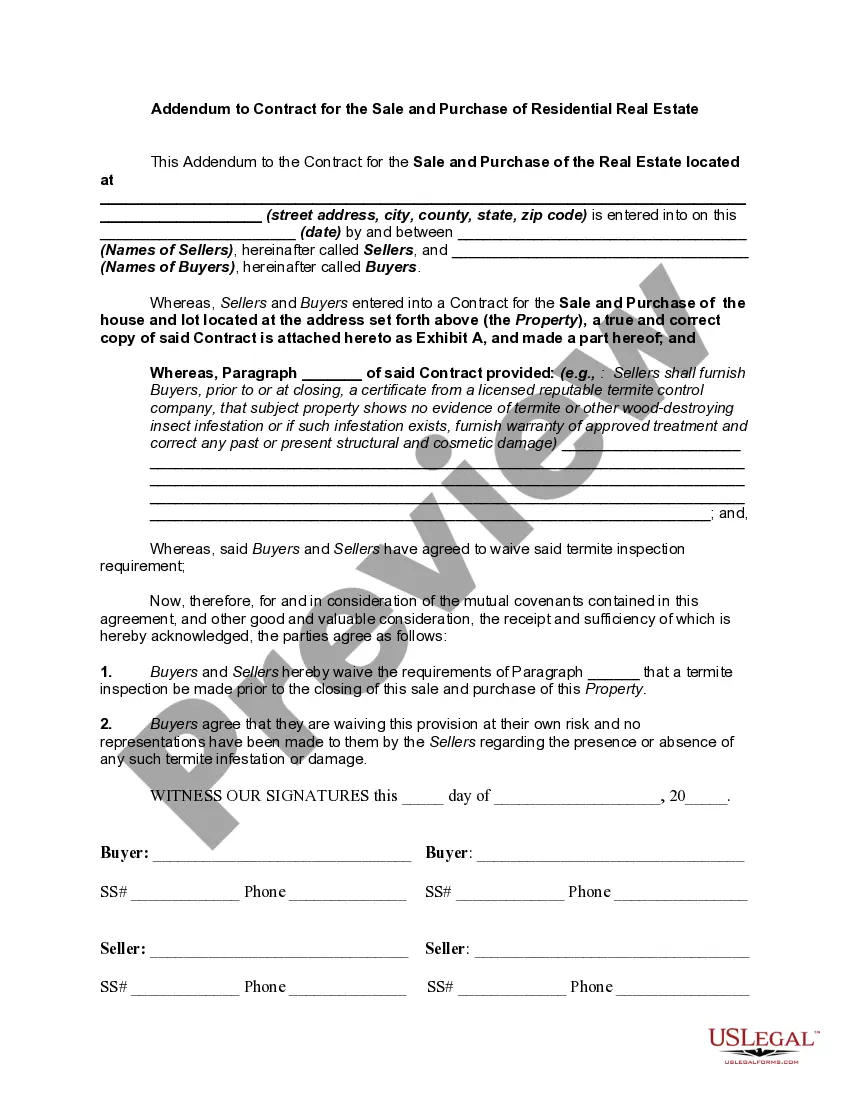

- Review the document's preview and outline (if accessible) to acquire a fundamental understanding of what you’ll receive after obtaining the form.

- Ensure that the document you select is tailored to your state/county/area since regional laws can influence the legitimacy of some documents.

- Examine the associated forms or restart your search to locate the necessary file.

- Click Buy now and create your account. If you already possess an account, opt to Log In.

- Select the option, then a suitable payment approach, and acquire Nassau Assignment of Partnership Interest with Consent of Remaining Partners.

- Decide to save the form template in any available format.

- Visit the My documents tab to re-download the document.

Form popularity

FAQ

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

A partner's interest in the partnership may be assigned by the partner. However, the assignee does not become a partner without the consent of the other partners.

Interests in partnerships may change in a number of ways, including the retirement of an existing partner, the admission of a new partner, a transfer or assignment of an interest in a partnership, or a change in the capital sharing ratio of a partnership.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

If an existing partner purchases the interest of the retiring partner, the partnership records an entry to close out the capital account balance of the retiring partner and adds the amount to the capital account balance of the partner who purchased the interest.

An assignment of membership interest is a legal document that allows members of a Limited Liability Company (or LLC) to reassign their interest in the company to a different party. LLC laws are different from state to state, so what's required in an assignment of membership agreement changes.

A partner's interest in a partnership is considered personal property that may be assigned to other persons. If assigned, however, the person receiving the assigned interest does not become a partner.

An assignment of interest form allows a limited liability company (LLC) member to assign their interest or ownership stake in the company to another person. The information that you will need to include in this form depends on the laws governing LLCs in your state.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

Assignment of interest in LLCs happens when a member communicates to other members his/her intention to transfer part or all of his ownership rights in the LLC to another entity. The assignment is usually done as a means for members to provide collateral for personal loans, settle debts, or leave the LLC.