Riverside California Assignment of Assets

Description

How to fill out Assignment Of Assets?

How long does it typically take you to create a legal document.

Since every state has its statutes and regulations for various life circumstances, locating a Riverside Assignment of Assets that meets all local standards can be overwhelming, and procuring it from a qualified attorney is frequently expensive.

Many online platforms provide the most common state-specific templates for download, but utilizing the US Legal Forms library is the most advantageous.

Choose the subscription plan that best fits your needs, create an account on the platform or Log In to continue to payment methods, and make a payment via PayPal or credit card. Adjust the file format if required, then click Download to save the Riverside Assignment of Assets. Print the document or use any preferred online editor to fill it out electronically. Regardless of how many times you need to utilize the purchased document, you can find all the files you’ve saved in your profile by selecting the My documents tab. Give it a try!

- US Legal Forms is the most extensive online directory of templates, categorized by states and areas of application.

- In addition to the Riverside Assignment of Assets, you can find any particular document to manage your business or personal matters, adhering to your local regulations.

- Professionals verify all samples for their legitimacy, so you can be confident in preparing your documentation correctly.

- Utilizing the service is quite straightforward.

- If you already possess an account on the platform and your subscription is active, you merely need to Log In, select the desired sample, and download it.

- You can access the document in your profile at any later time.

- Alternatively, if you are new to the platform, there will be a few additional steps to take before acquiring your Riverside Assignment of Assets.

- Examine the content of the page you are viewing.

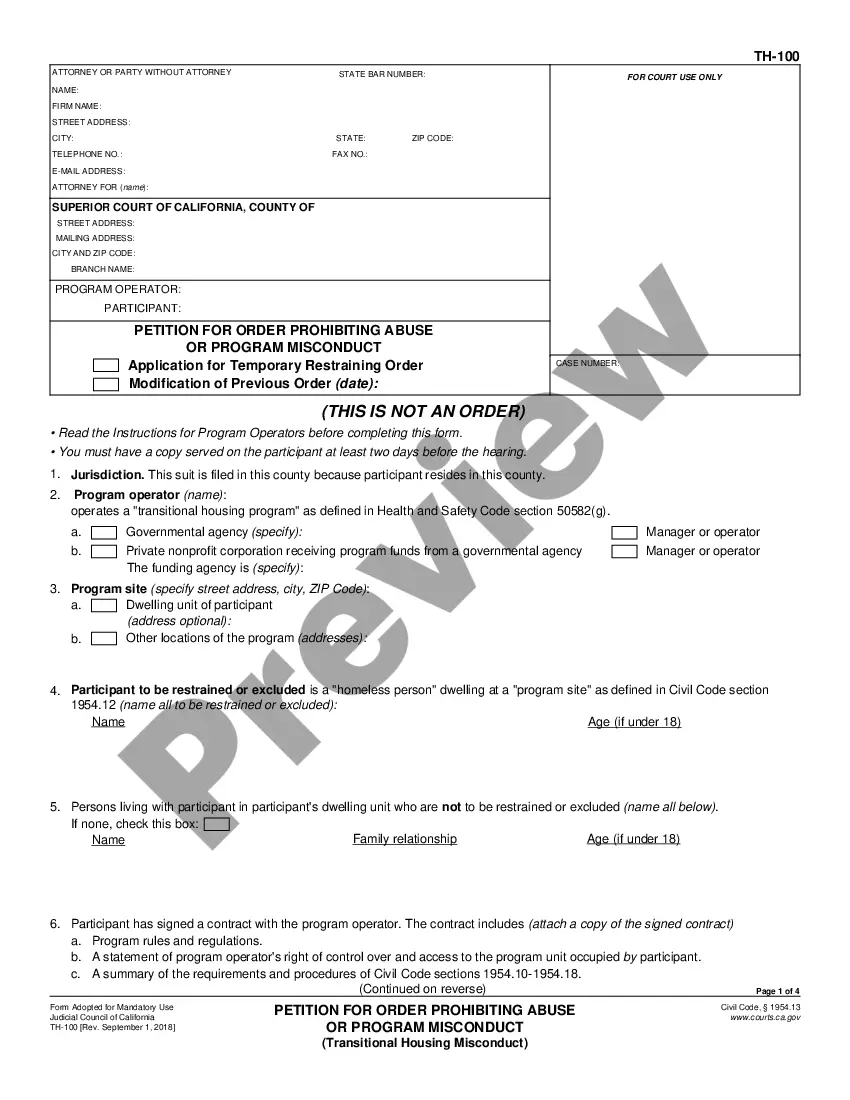

- Review the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you are certain about the selected document.

Form popularity

FAQ

A typical probate handled by other attorneys or persons representing himself or herself (pro per) takes longer, usually between eighteen months and two years.

You must go to court and start a probate case. To do this, you must file a Petition for Probate (form DE-111.NOTE: If there is no will and a court case is needed, the court will appoint an administrator to manage the estate during the probate process.

Riverside County, California County Administrative Center. 4080 Lemon St, 1st floor / PO Box 751, Riverside, California 92501 / 92502-0751.Gateway Office. 2724 Gateway Dr, Riverside, California 92507.Hemet Office.Palm Desert Office.Temecula Office.Blythe Office.

Pursuant to Code of Civil Procedure §1010.6 and the California Rules of Court, rule 2.253(b)(2), the Civil Division of the Riverside Superior Court is implementing electronic filing (eFiling). You can eFile documents 24/7 through an approved Electronic Filing Service Provider (EFSP).

Limited Phone Hours: Clerk's Office phone hours are Monday through Friday, a.m. to p.m., except court holidays....Please Note: The Blythe Courthouse is open on Tuesdays, Thursdays, & Fridays only. All Departments951.777.3147Enhanced Collections1.877.955.3463Jury Services951.275.5076Traffic951.222.0384

Upon taking effect, the recorder's office will impose a fee of $75.00 to be paid when recording every real estate instrument, paper, or notice required or permitted by law to be recorded, per each single transaction per single parcel of real property, not to exceed $225.00.

After a testator dies, the executor files a petition for probate in a California superior court in the county in which the decedent lived. The petition provides information about the person who died, the named executor and the heirs under the will.

Recording Requirements The property must be located in Riverside County.The document must be authorized or required by law to be recorded.The document must be submitted with the proper fees and taxes.The document must be in compliance with state and local laws.

Applications for ex parte relief are to be submitted for filing at the probate clerk's office located: Riverside Probate Court. 4050 Main Street. Riverside, Ca. 92501.Temecula Probate Court. 41002 County Center Drive #100. Temecula, Ca. 92591.Palm Springs Court. 3255 E Tahquitz Canyon Way. Palm Springs, CA. 92262.

Currently, Contra Costa only accepts eFiling in complex civil cases. However, the court's expansion of its approved eFile providers is a likely indication that Contra Costa Superior Court is planning on rolling out eFiling as an option for all case types.