Palm Beach Florida Demand for Payment of an Open Account by Creditor

Description

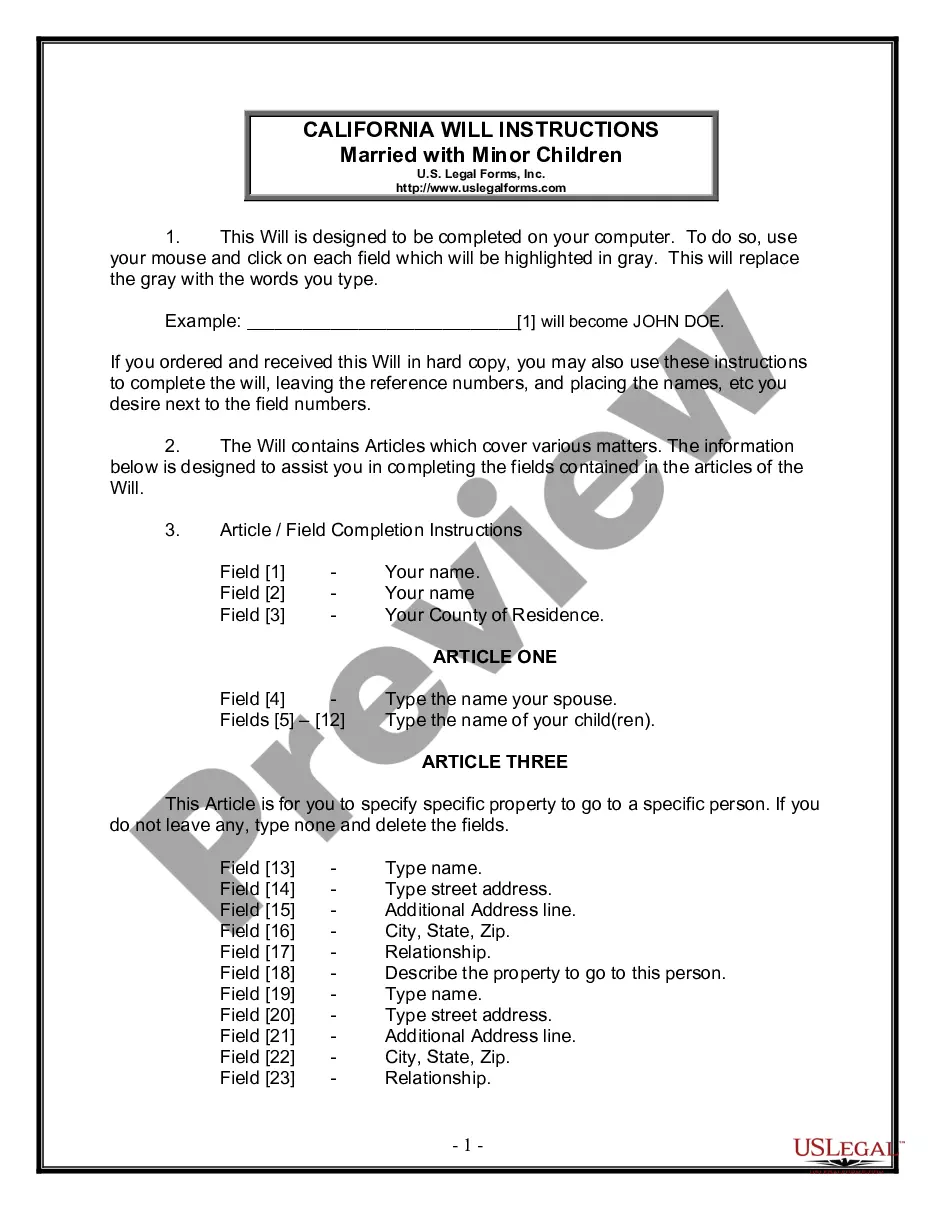

How to fill out Demand For Payment Of An Open Account By Creditor?

Creating legal documents, such as Palm Beach Demand for Payment of an Open Account by Creditor, to address your legal issues is a difficult and time-consuming endeavor.

Numerous situations necessitate the involvement of a lawyer, which also renders this task quite costly.

However, you can take control of your legal affairs and handle them independently.

The process for onboarding new clients is quite straightforward! Here’s what you need to do before downloading the Palm Beach Demand for Payment of an Open Account by Creditor.

- US Legal Forms is here to assist you.

- Our platform offers over 85,000 legal forms designed for a variety of situations and life events.

- We ensure that each document adheres to state regulations, relieving you of concerns regarding possible legal compliance issues.

- If you are already familiar with our services and have a subscription with US, you know how simple it is to obtain the Palm Beach Demand for Payment of an Open Account by Creditor template.

- Simply Log In to your account, download the template, and customize it to fit your requirements.

- Lost your document? No problem. You can retrieve it from the My documents section in your account, whether on desktop or mobile.

Form popularity

FAQ

If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

In many states, some IRS-designated trust accounts may be exempt from creditor garnishment. This includes individual retirement accounts (IRAs), pension accounts and annuity accounts. Assets (including bank accounts) held in what's known as an irrevocable living trust cannot be accessed by creditors.

Most Sheriffs will not serve levies out of state, except for government workers. For those with a judgment, you might want to learn the bank your debtor uses; and find out the bank's policies, in case you ever need to utilize that information. Ask the bank when a walked-in deposit is credited to an account.

Statute of Limitations in Florida for Debt The statute of limitations for debt in Florida is usually five years. A creditor has five years to sue you for the money you owe.

A debt collector ultimately could garnish your bank account or your wages if you live in Florida. The first thing they would need to do is file a lawsuit against you for the debt, once they obtained a judgment, they can record that judgment and proceed with debt collection.

Debt collectors can ONLY withdraw funds from your bank account with YOUR permission. That permission often comes in the form of authorization for the creditor to complete automatic withdrawals from your bank account.

A debt collector must first file a lawsuit against you and obtain a monetary judgment before it can take any money from your bank account. Until a judgment is obtained in a court proceeding, a debt collector cannot take money from your account.

A debt collector ultimately could garnish your bank account or your wages if you live in Florida. The first thing they would need to do is file a lawsuit against you for the debt, once they obtained a judgment, they can record that judgment and proceed with debt collection.

Florida Wage Garnishment Laws All of your disposable earnings less than or equal to $750 a week are totally exempt from attachment or garnishment. So, if you're a head of family and are making less than $750 per week, creditors can't garnish your wages in Florida.

In Florida, a judgment lasts for 20 years. It can be renewed after the 20 year period, although this is rarely done. Judgments that are not recorded as liens, or are recorded as junior liens, are still valid judgments that can be executed against the debtor's property.