This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

Form popularity

FAQ

The order of payments from a deceased estate typically begins with administrative costs, then moves to secured debts, and finally to unsecured creditors. This process is designed to ensure that the estate’s obligations are met systematically. Understanding this hierarchy is essential for anyone involved in the Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. US Legal Forms can assist you with the necessary documentation to facilitate these payments smoothly.

In liquidation, the order of priority for paying debts usually starts with administrative expenses, followed by secured claims, and then unsecured debts. This structured approach ensures that creditors receive payments in a fair manner. Knowing this order is important when dealing with the Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, as it impacts the distribution of assets. US Legal Forms can offer templates and resources to help you manage these payments properly.

The order of priority for estate debts generally follows a specific hierarchy under Texas law. This includes funeral expenses, medical bills, and secured debts, among others. Understanding this order is vital when addressing the Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, as it affects how funds are allocated. For clarity and assistance, consider using US Legal Forms to navigate these priorities effectively.

Section 256.204 of the Texas Estates Code outlines the process for handling certain claims against an estate, particularly those that arise from a decedent's debts. It provides guidelines for how these claims should be managed and prioritized. Familiarizing yourself with this section is essential when dealing with the Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. US Legal Forms can provide the necessary documents and guidance to help you comply with these regulations.

Section 53.104 of the Texas Estates Code addresses the assignment of a decedent’s expected interest in their estate to pay off debts. This section allows the executor or administrator to assign rights to future income or property to satisfy claims against the estate. Understanding this section is crucial for navigating the complexities of the Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. Utilizing resources like US Legal Forms can help you understand the legalities involved.

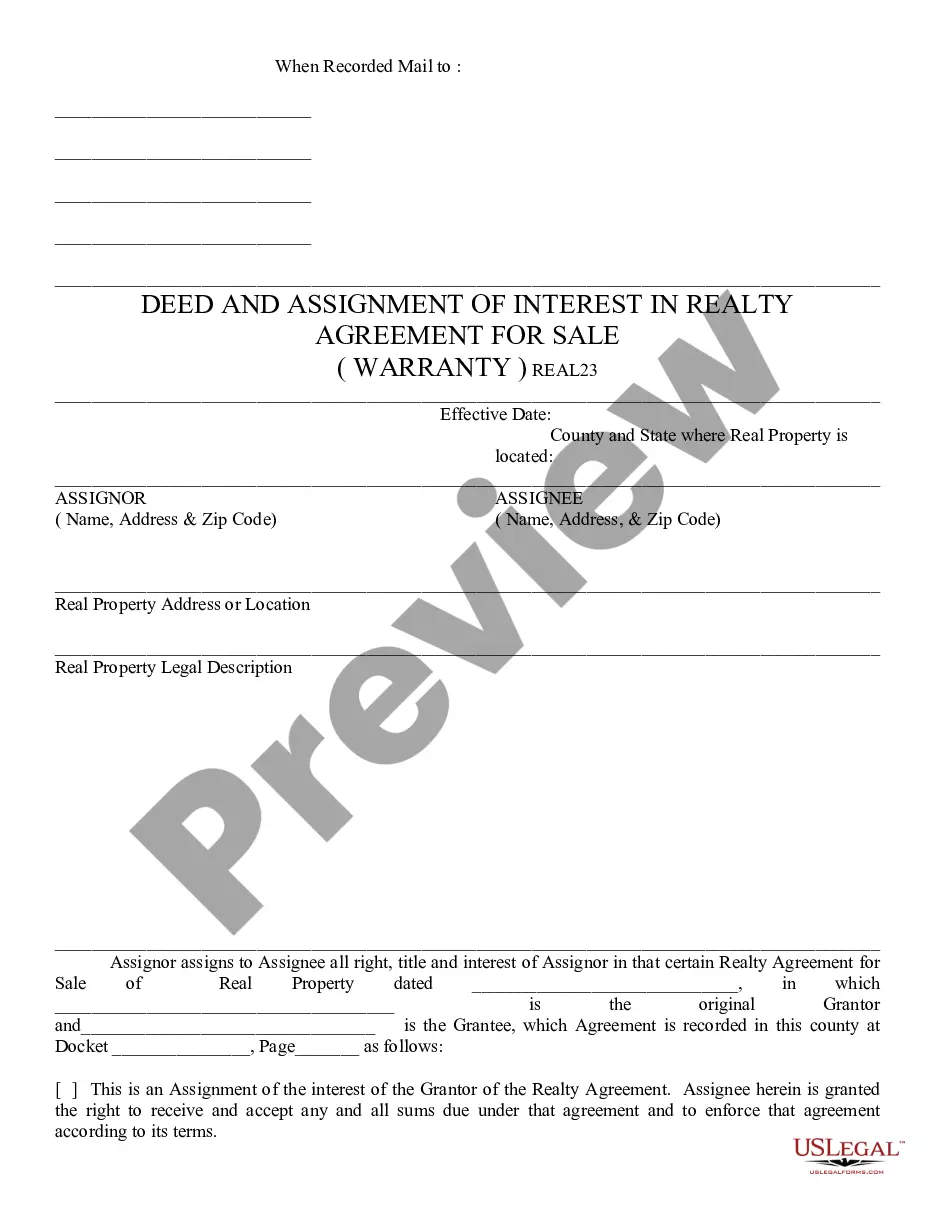

Assignment of interest refers to the process of transferring a person's legal rights or benefits in a particular asset, such as an inheritance or property, to another individual. In the case of the Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, this means that the beneficiary assigns their rights to the estate, enabling them to address outstanding debts. Understanding this concept is crucial for anyone navigating estate issues or financial challenges. For clarity and support, uslegalforms offers resources and templates to guide you through the assignment process.

The assignment of interest in the estate form is a legal document used to transfer a beneficiary's rights in an estate to another party. This process often occurs when a beneficiary faces financial difficulties and needs to pay off debts. In the context of Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, this form allows individuals to effectively manage their financial obligations while ensuring the estate is settled appropriately. Utilizing platforms like uslegalforms can simplify this process, providing you with the necessary templates and guidance.

Section 362.011 addresses the disposition of property in an estate when debts need to be settled. This section provides guidelines for the sale or transfer of property to meet obligations. For individuals navigating an Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, understanding this section can provide essential insights.

Section 752 details how an estate may be managed when it comes to the payment of debts and obligations. This section governs the rights of the personal representative and the prioritization of claims made against the estate. It is particularly relevant for those looking into an Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness.

Section 308.054 of the Texas Estates Code outlines the rights of an estate's beneficiaries regarding any assignment of interests. It specifically addresses the procedures for assigning all expected interest in an estate to satisfy debts. Understanding this section is crucial for anyone involved with an Austin Texas Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness.