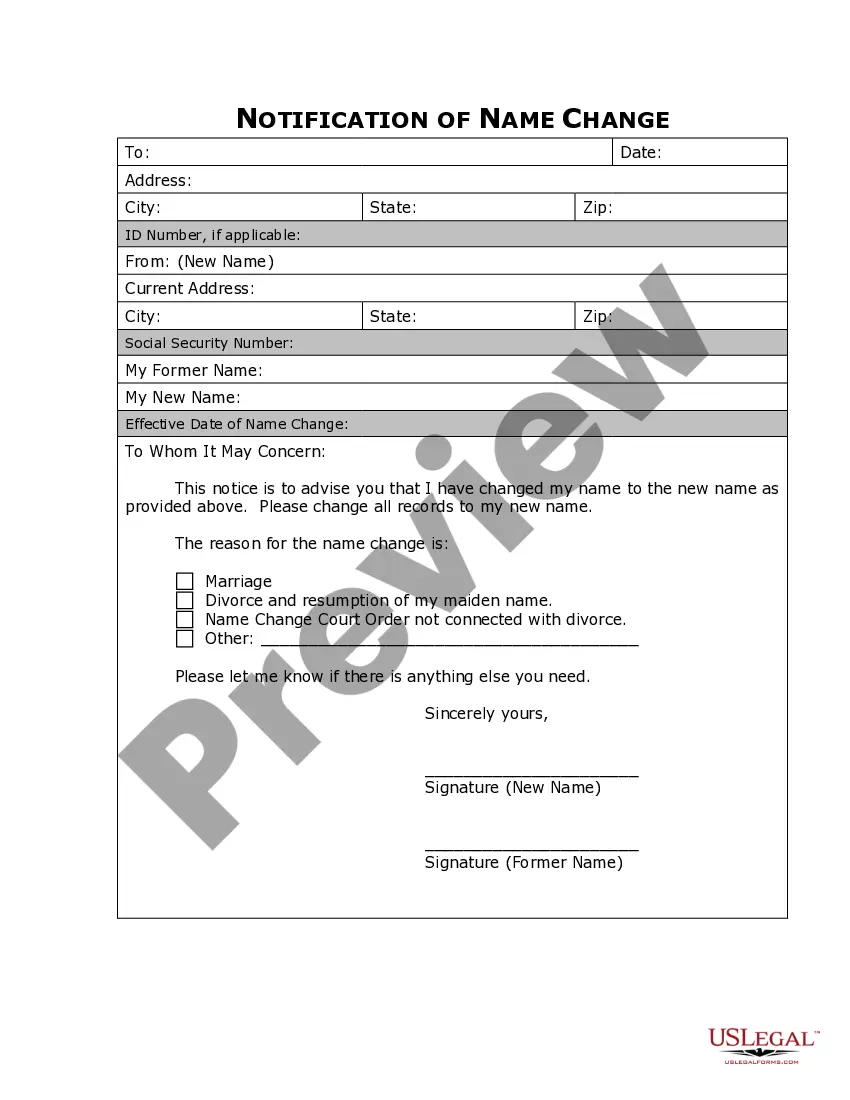

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

Form popularity

FAQ

Section 360.001 of the Texas Estates Code outlines the rights of beneficiaries regarding the distribution of the estate. It ensures that beneficiaries receive their fair share, while also addressing the need to settle any outstanding debts. This section is important for anyone navigating the Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, providing clarity on how estate distributions should occur.

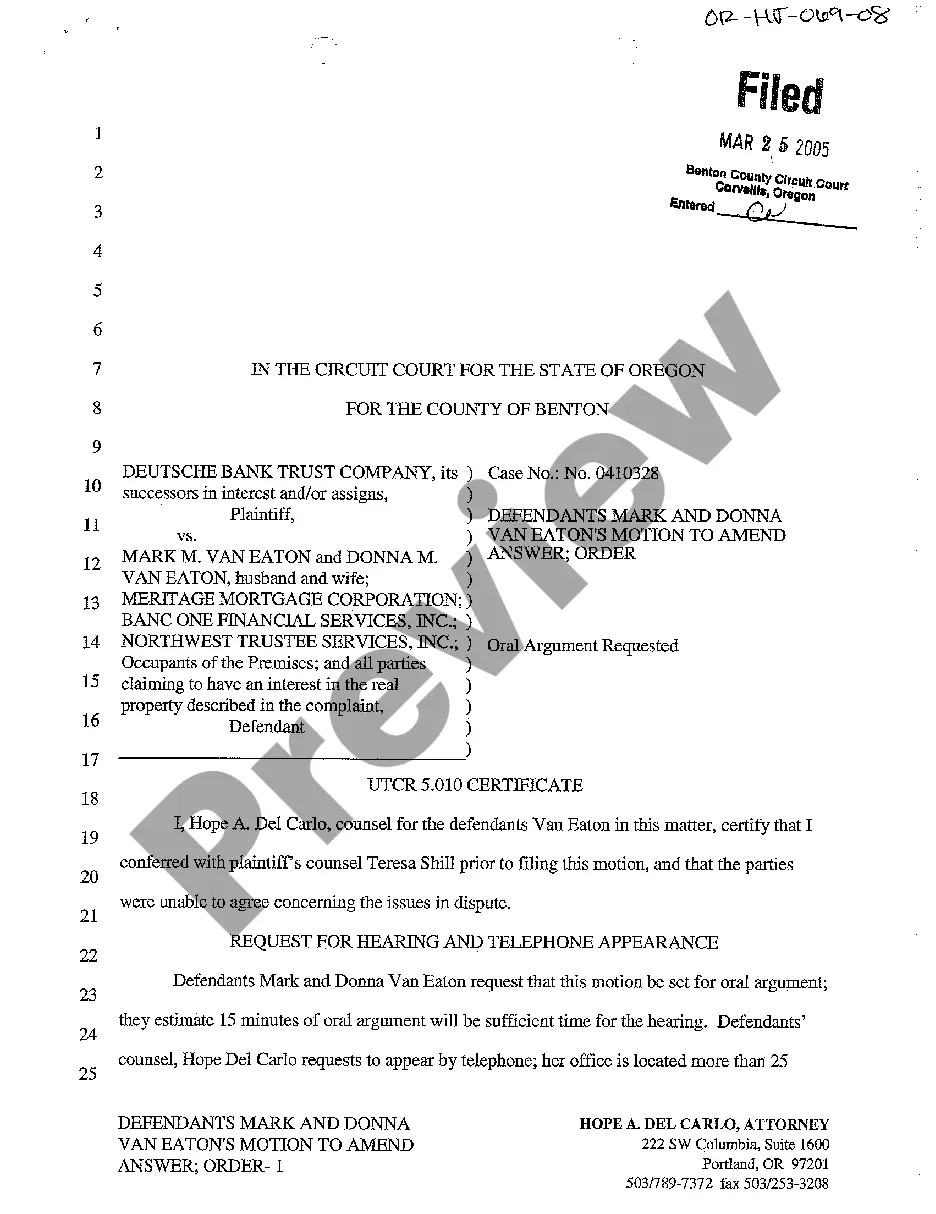

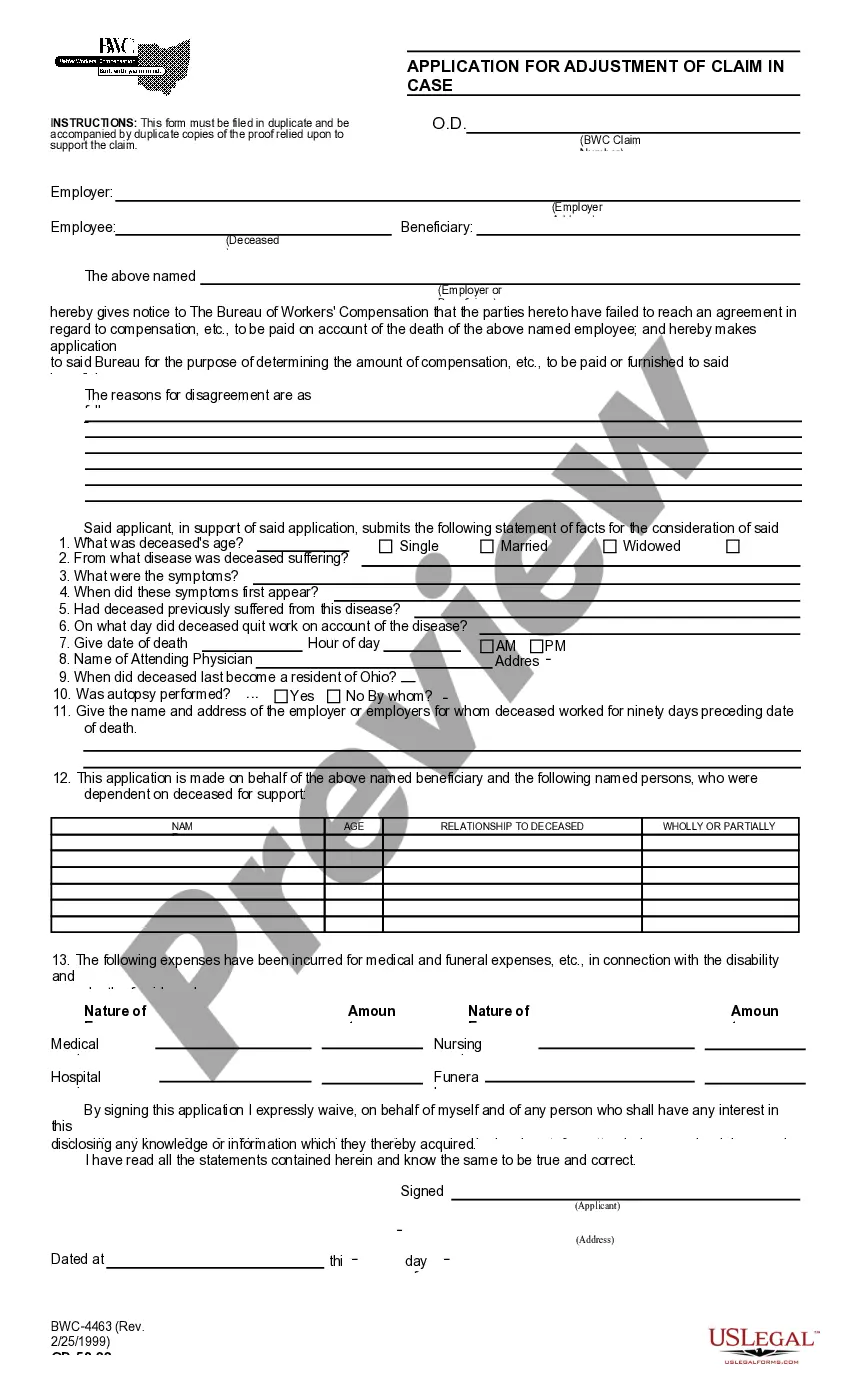

An assignment for the benefit of creditors is a legal process where a debtor transfers their assets to a trustee. This trustee then manages the assets and distributes the proceeds to creditors. This option is particularly relevant in situations involving the Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, offering a structured way to handle financial obligations efficiently.

In Texas, the order of payment for estate debts typically follows a structured hierarchy. First, funeral expenses and last illness costs are settled, followed by secured debts, and then general creditor claims. Understanding this order is crucial, especially for those involved in the Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, as it affects how funds are allocated to creditors.

Section 201.054 of the Texas Estates Code addresses the process of assigning a portion of an estate to pay off debts. This section allows the executor or administrator to assign specific assets to creditors, ensuring that debts are settled efficiently. By utilizing this provision, individuals can navigate the complexities of estate management, especially in the context of Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

Writing a letter of instruction for heirs and beneficiaries involves clear communication about your estate and wishes. Start by outlining your assets, including any Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. Then, provide specific guidance on how you want these assets distributed and the responsibilities of each beneficiary. Using a platform like USLegalForms can help you create a structured and legally sound document to ensure your intentions are clearly conveyed.

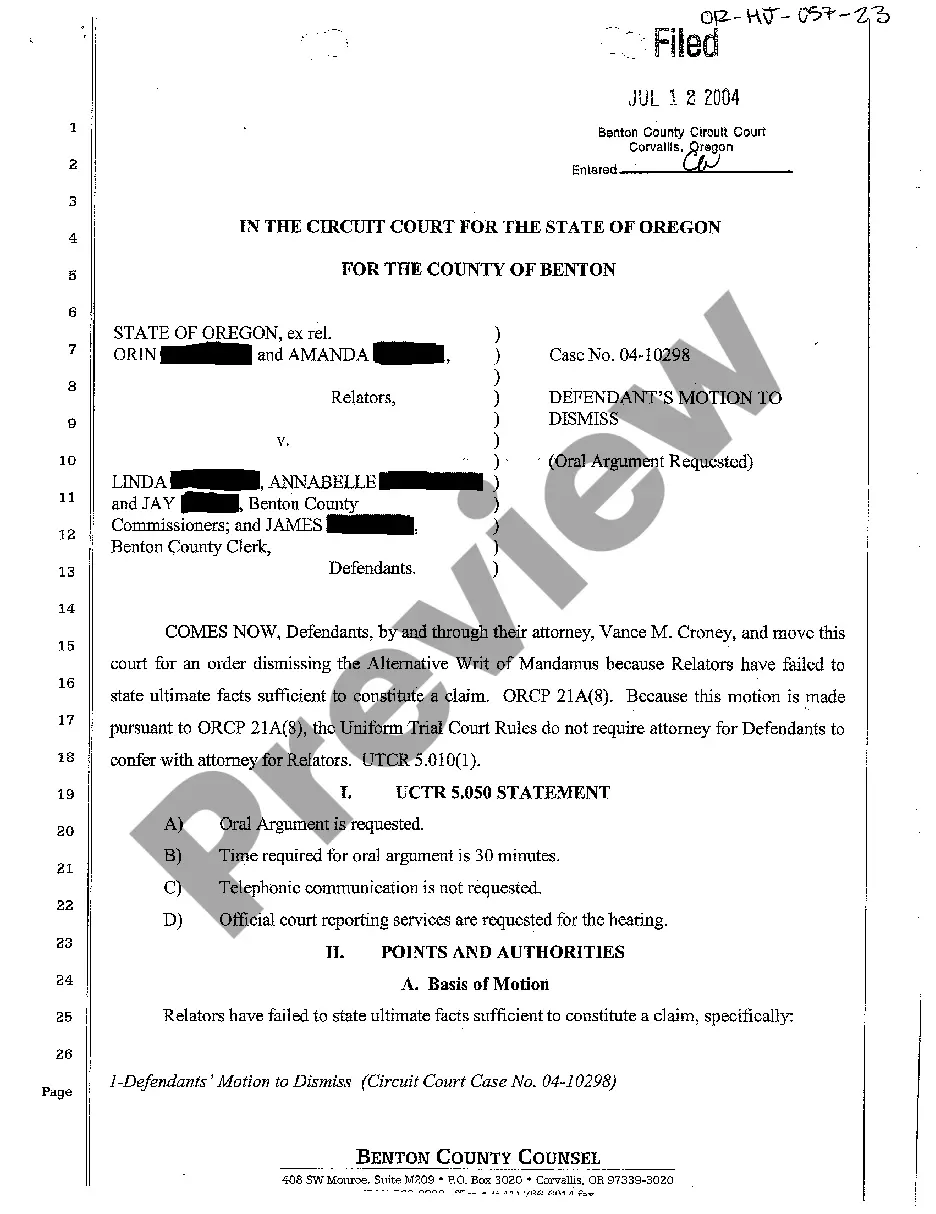

Section 53.104 of the Texas Estates Code deals with the enforcement of claims against an estate. This section provides a framework for creditors seeking payment from an estate's assets. Understanding this law can help you navigate your responsibilities and rights effectively, especially when you are dealing with the Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

Recent changes in Texas inheritance laws have clarified the rights of heirs and the distribution of estates. These laws aim to protect the interests of beneficiaries while ensuring that debts are addressed. It's essential to understand how these changes may affect your estate planning, especially when considering the Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

Section 308.053 of the Texas Estates Code outlines the guidelines for the assignment of a portion of an estate to pay debts. This section is particularly important when dealing with financial obligations linked to an estate. By utilizing the Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, beneficiaries can effectively manage estate debts while ensuring compliance with the law.

In Texas, a will can be contested within two years after the probate process has begun. However, if you believe the will is invalid, you should act promptly to file a contest. Delaying may limit your ability to assert your rights. Understanding the implications of the Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness can be crucial in such situations.

An assignment for the benefit of creditors in Texas is a legal process whereby a debtor assigns their assets to a third party to settle outstanding debts. This arrangement allows creditors to recover some of the owed amounts while providing a structured way for debtors to meet their obligations. If you are considering this approach, understanding the implications of the Austin Texas Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness is crucial, and resources like uslegalforms can guide you through the process.