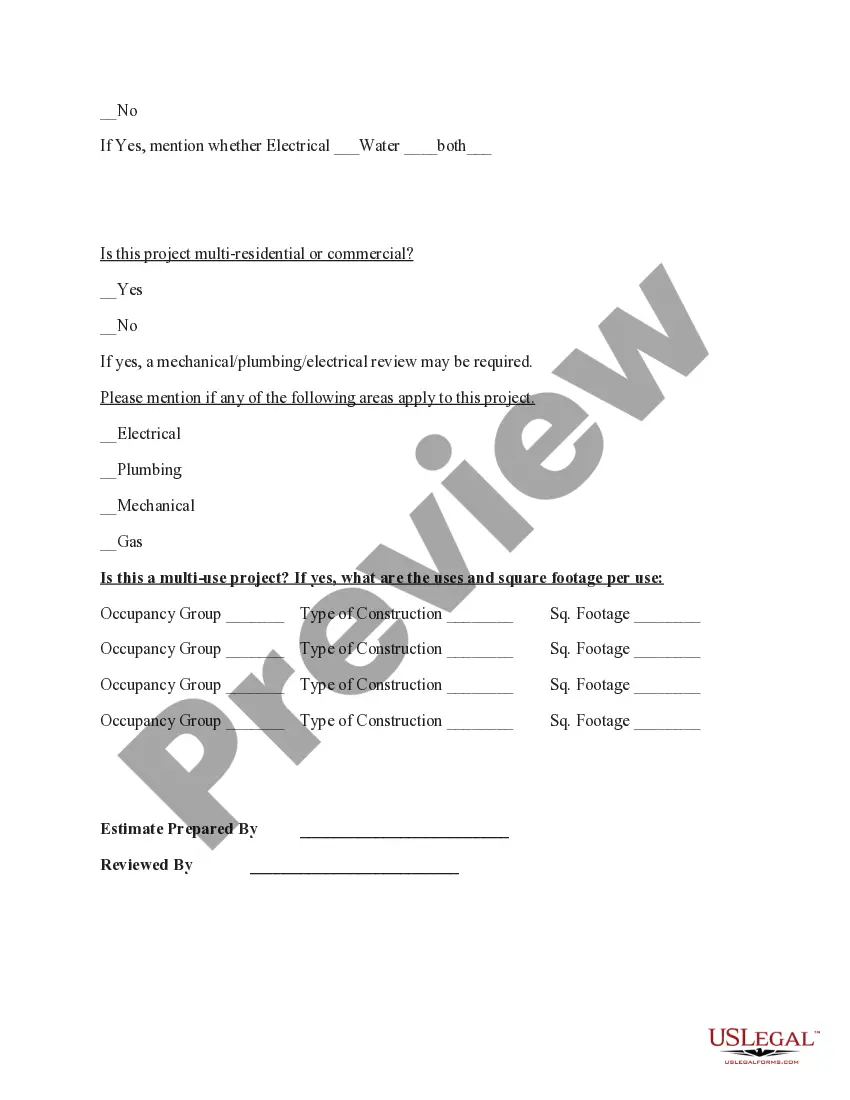

Oklahoma City Oklahoma Fee Estimate Worksheet

Description

Form popularity

FAQ

Setting up a payment plan for Oklahoma taxes involves contacting the Oklahoma Tax Commission to discuss your options. You can often arrange for monthly payments based on your tax liability and financial situation. Utilizing tools like the Oklahoma City Oklahoma Fee Estimate Worksheet can aid in estimating your tax obligations. This preparation enhances your ability to negotiate a feasible payment plan that fits your budget.

The PTE tax, or Pass-Through Entity tax, applies to businesses like partnerships and S corporations in Oklahoma. This tax allows these entities to pass income directly to their owners, who then report it on their personal tax returns. Understanding the PTE tax is crucial when using resources like the Oklahoma City Oklahoma Fee Estimate Worksheet. It helps you calculate potential liabilities and plan your finances accurately.

The assessment rate in Oklahoma typically refers to the percentage of property value used for tax purposes. This rate is often set at a uniform level across the state. Utilizing the Oklahoma City Oklahoma Fee Estimate Worksheet can assist you in understanding how to apply this assessment rate to your property tax calculations.

Oklahoma calculates apportionment through a three-factor formula including sales, payroll, and property. This method helps determine the proportion of a company’s income that is attributable to the state. Simplifying this process, the Oklahoma City Oklahoma Fee Estimate Worksheet enables businesses to accurately estimate their apportionment and tax dues.

Oklahoma has a flat tax rate for individual income taxes, with rates that span from 0.5% to 5%. Additionally, various sales, property, and other taxes contribute to the overall tax landscape in the state. By using the Oklahoma City Oklahoma Fee Estimate Worksheet, you can gain a clearer understanding of your total tax rate and obligations.

Oklahoma offers a standard deduction for taxpayers that can reduce taxable income. For single taxpayers, it is typically around $4,600, while married couples filing jointly can expect a higher amount. Utilizing the Oklahoma City Oklahoma Fee Estimate Worksheet can help you understand how to apply this deduction effectively.

Apportionment factors in Oklahoma include property, payroll, and sales. Businesses use these factors to determine how much of their income is taxable in the state. To navigate these complexities, the Oklahoma City Oklahoma Fee Estimate Worksheet offers clear guidance and estimation for your business’s tax liabilities.

The Personal Income Tax rate in Oklahoma varies based on income brackets. It typically ranges from 0.5% to 5%, depending on your taxable income. Understanding this rate is crucial for your financial planning, and the Oklahoma City Oklahoma Fee Estimate Worksheet can simplify this calculation for you.

Yes, Oklahoma does have Personal Income Tax, known as PTE. This tax applies to individuals residing in the state and affects the overall tax liability. The Oklahoma City Oklahoma Fee Estimate Worksheet can help you accurately assess your PTE obligations and calculate your tax responsibilities.

As of now, the total sales tax rate in Oklahoma City is 8.625%, which includes the state tax and local taxes. This rate applies to most purchases made within city limits. Always check for any changes or adjustments by local government to stay updated. Using tools like the Oklahoma City Oklahoma Fee Estimate Worksheet can assist you in budgeting accordingly.