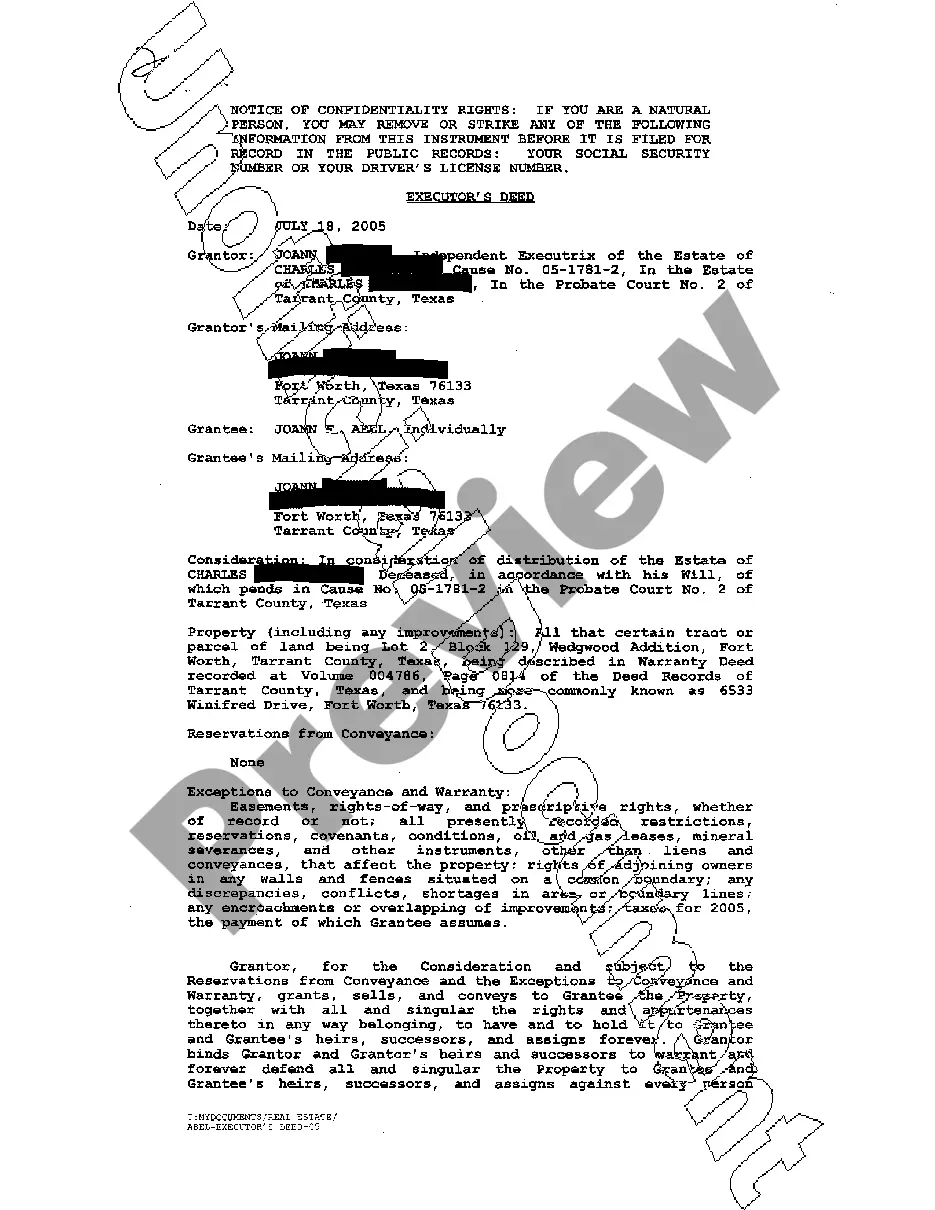

Odessa Texas Executor's Deed

Description

How to fill out Texas Executor's Deed?

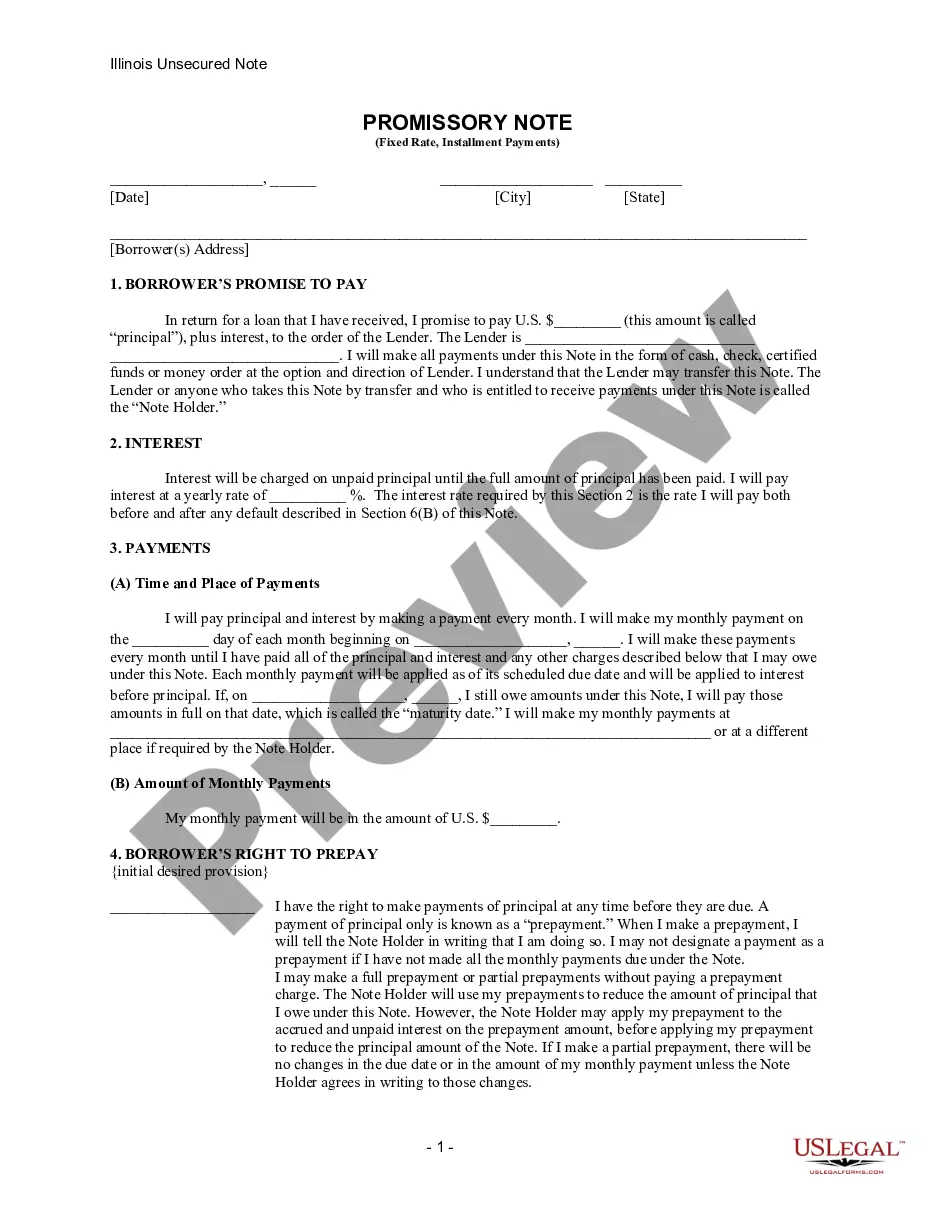

If you have previously employed our assistance, Log In to your account and store the Odessa Texas Executor's Deed on your device by pressing the Download button. Ensure your subscription is active. If it is not, renew it according to your payment arrangement.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have lifelong access to every document you have purchased: you can locate it in your profile under the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and store any template for your personal or business requirements!

- Ensure you’ve found a suitable document. Browse the description and utilize the Preview option, if available, to confirm it fulfills your needs. If it does not meet your expectations, utilize the Search tab above to find the right one.

- Acquire the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Odessa Texas Executor's Deed. Select the file format for your document and save it to your device.

- Complete your template. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Under the Texas Estates Code, the standard compensation is a five (5%) percent commission on (1) all amounts that the executor or administrator receives; or (2) pays out in cash in the administration of the estate (the Texas two-step on executor compensation).

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

In Texas, state and local court rules govern the various time periods that the executor must follow in probating a will. The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

For a simple estate, the entire probate process can be completed within six months. However, expect probate to go on for a year or more if the original will cannot be located or the will is contested.

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county clerk's office before your death. Otherwise, it won't be valid. The beneficiary's rights. The person you name in the TOD deed to inherit the property has no legal right to it until your death.

No probate will be necessary to transfer the property, although of course it will take some paperwork to show that title to the property is held solely by the surviving owner. In Texas, two forms of joint ownership have the right of survivorship: Joint tenancy.

As an executor, you will have a duty to ensure that you are selling the property for the best possible price, for the benefit of the estate. For example, you must not sell the property at an undervalue to yourself, a member of your family, or indeed to one of the beneficiaries in the will.

In order to remove the name of the deceased, Form DJP (Deceased Joint Proprietor) must be completed and filed along with a copy of the death certificate. There is no requirement to show the Grant of Representation to the Land Registry, which means updating the title deed can be done soon after death.