This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

McKinney Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary

Description

How to fill out Texas Executor's Deed Of Distribution - Individual Executor To Individual Beneficiary?

We consistently aspire to reduce or avoid judicial harm when handling intricate legal or financial matters.

To achieve this, we seek legal counsel services that are typically very expensive.

However, not all legal issues are equally complex.

The majority can be addressed independently.

Utilize US Legal Forms whenever you need to obtain and download the McKinney Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary or any other document promptly and securely.

- US Legal Forms serves as an online directory of current DIY legal documents encompassing everything from wills and power of attorneys to incorporation articles and dissolution petitions.

- Our collection empowers you to manage your matters without requiring a lawyer's assistance.

- We provide access to legal document templates that aren’t always accessible to the public.

- Our templates are specific to state and region, which greatly eases the search process.

Form popularity

FAQ

The executor may also be a beneficiary of the Will, though he or she must treat all beneficiaries fairly and in accordance with the provisions of the Will. The duties of an independent executor are those of a trustee. He holds property interests, not his own, for the benefit of others.

Technically speaking, there aren't any legal beneficiary rights, as such. What they do have is the ability to force the executor to perform their duties, and with that comes the understanding that beneficiaries can't act on behalf of the executor. They don't have the same authority.

The Will will also name beneficiaries who are to receive assets. An executor can override the wishes of these beneficiaries due to their legal duty. However, the beneficiary of a Will is very different than an individual named in a beneficiary designation of an asset held by a financial company.

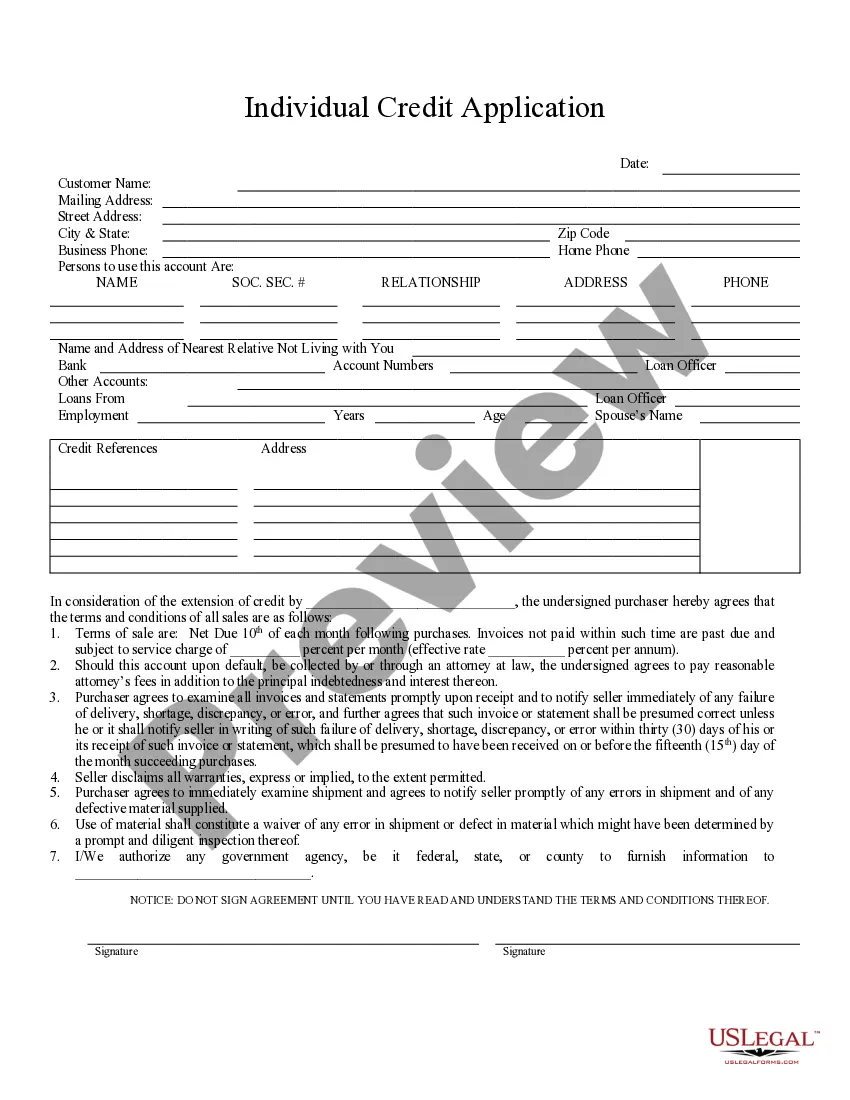

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

Yes, an executor can override a beneficiary's wishes as long as they are following the will or, alternative, any court orders. Executors have a fiduciary duty to the estate beneficiaries requiring them to distribute estate assets as stated in the will.

As an executor, you will have a duty to ensure that you are selling the property for the best possible price, for the benefit of the estate. For example, you must not sell the property at an undervalue to yourself, a member of your family, or indeed to one of the beneficiaries in the will.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county clerk's office before your death. Otherwise, it won't be valid. The beneficiary's rights. The person you name in the TOD deed to inherit the property has no legal right to it until your death.

No probate will be necessary to transfer the property, although of course it will take some paperwork to show that title to the property is held solely by the surviving owner. In Texas, two forms of joint ownership have the right of survivorship: Joint tenancy.

In order to remove the name of the deceased, Form DJP (Deceased Joint Proprietor) must be completed and filed along with a copy of the death certificate. There is no requirement to show the Grant of Representation to the Land Registry, which means updating the title deed can be done soon after death.

In Texas, state and local court rules govern the various time periods that the executor must follow in probating a will. The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate.