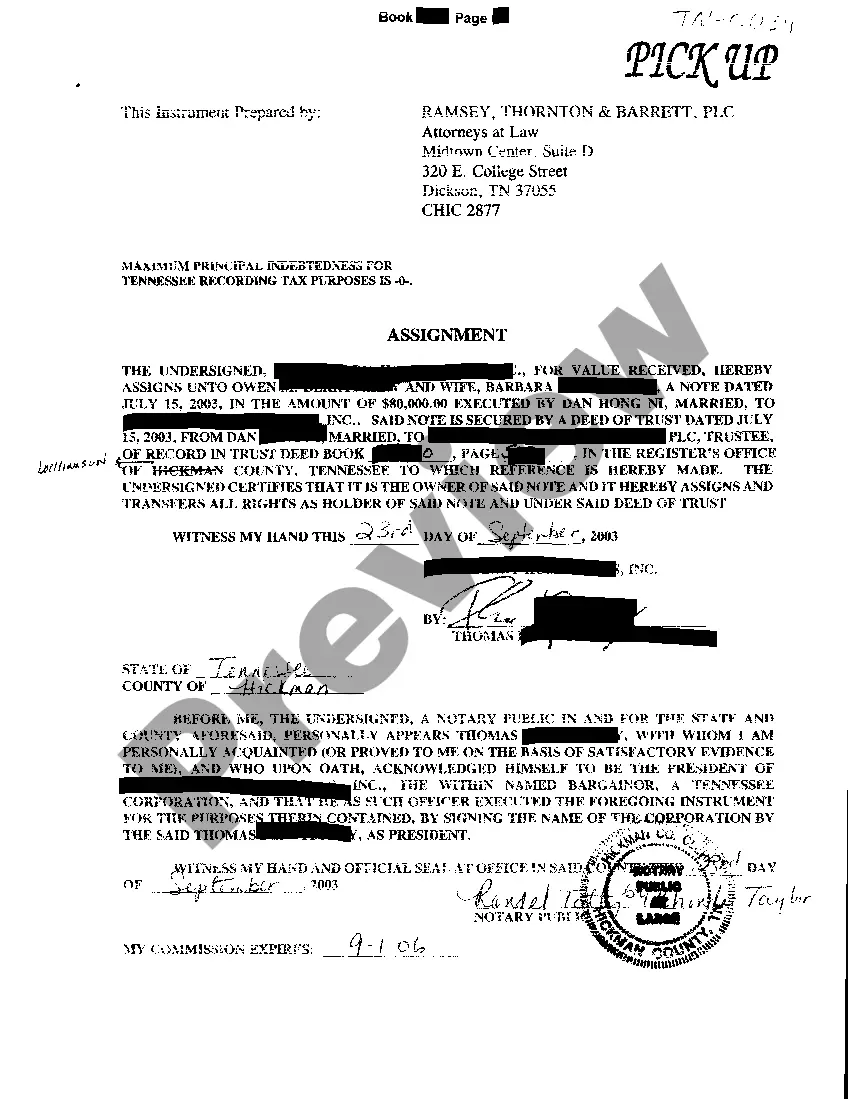

Nashville Tennessee Assignment of Promissory Note

Description

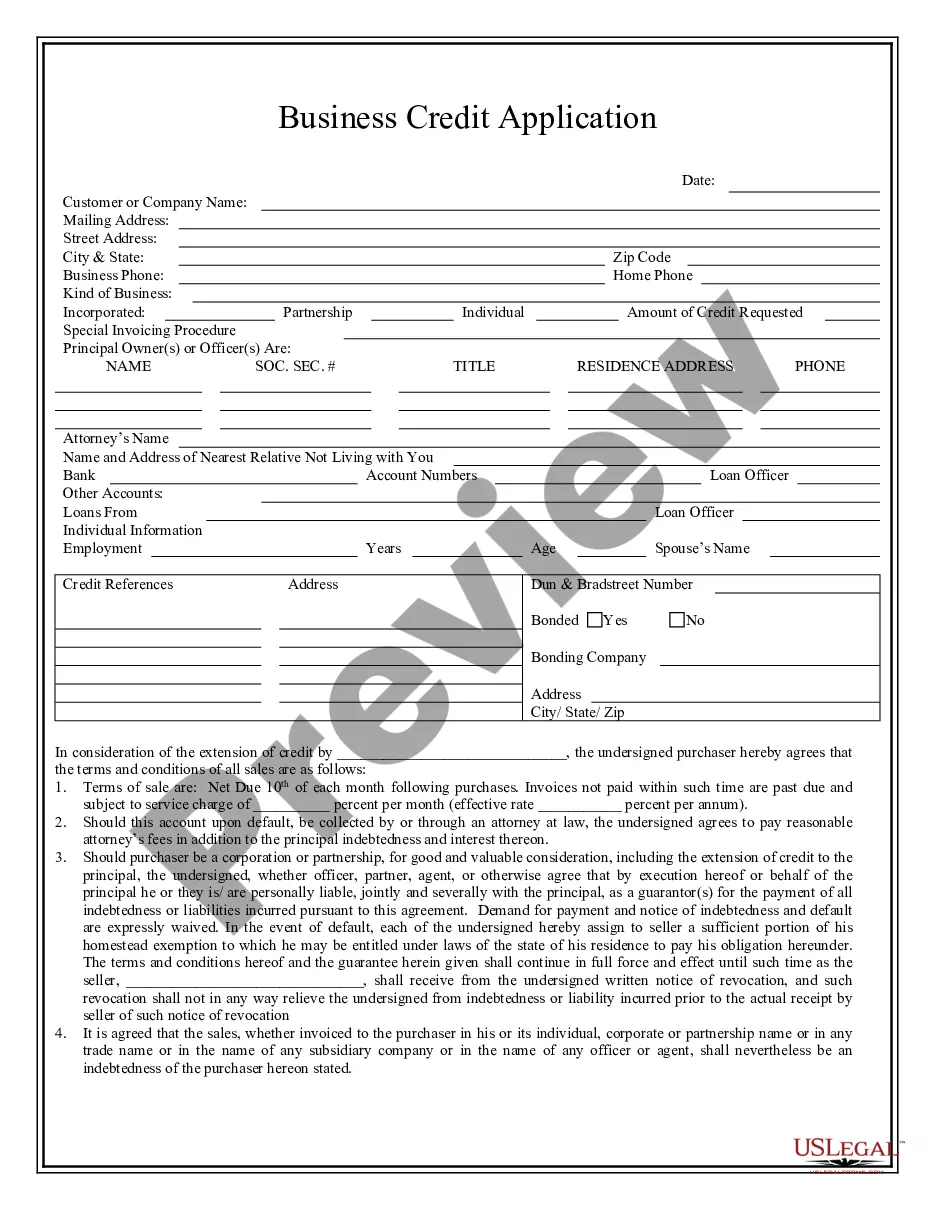

How to fill out Tennessee Assignment Of Promissory Note?

Irrespective of social or professional standing, finalizing legal documents is an unfortunate requirement in today’s business landscape.

Quite frequently, it becomes nearly impossible for an individual lacking any legal background to generate such documents from scratch, primarily due to the intricate language and legal nuances they entail.

This is where US Legal Forms provides assistance.

Ensure the template you select is specific to your area since the regulations of one state or county do not apply to another state or county.

Review the form and read a brief description (if available) of circumstances for which the document can be utilized.

- Our service includes a vast collection of over 85,000 ready-to-use state-specific documents that are applicable for nearly any legal matter.

- US Legal Forms is also an excellent asset for partners or legal advisors who wish to save time by utilizing our DIY documents.

- Whether you need the Nashville Tennessee Assignment of Promissory Note or any other documentation that will be recognized in your state or county, US Legal Forms makes it all easily accessible.

- Here’s how to quickly obtain the Nashville Tennessee Assignment of Promissory Note using our reliable service.

- If you are a returning customer, simply Log In to your account to download the correct form.

- However, if you are new to our platform, be sure to follow these instructions before acquiring the Nashville Tennessee Assignment of Promissory Note.

Form popularity

FAQ

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

When the loan is evidenced by one Promissory Note, the Lender may not at a later date cause any additional notes to be issued. (1) The Lender may assign all or part of the guaranteed portion of the loan to one or more Holders by using the Assignment Guarantee Agreement.

Assignment of Promissory Note is a formal document that is used by the lender to assign the debt to a third party after selling it. In this way, the borrower will make the payment to the third party instead of the original lender.

You can get your loan agreement notarized! A notary public signature acts as a third-party witness to your agreement. You're not required to notarize a promissory note, and your note can still be valid without it.

In Tennessee, there is no legal requirement to have a promissory note notarized. To make the document into a legal document, a Tennessee promissory note must be signed and dated by the borrower.

When the loan is evidenced by one Promissory Note, the Lender may not at a later date cause any additional notes to be issued. (1) The Lender may assign all or part of the guaranteed portion of the loan to one or more Holders by using the Assignment Guarantee Agreement.

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.