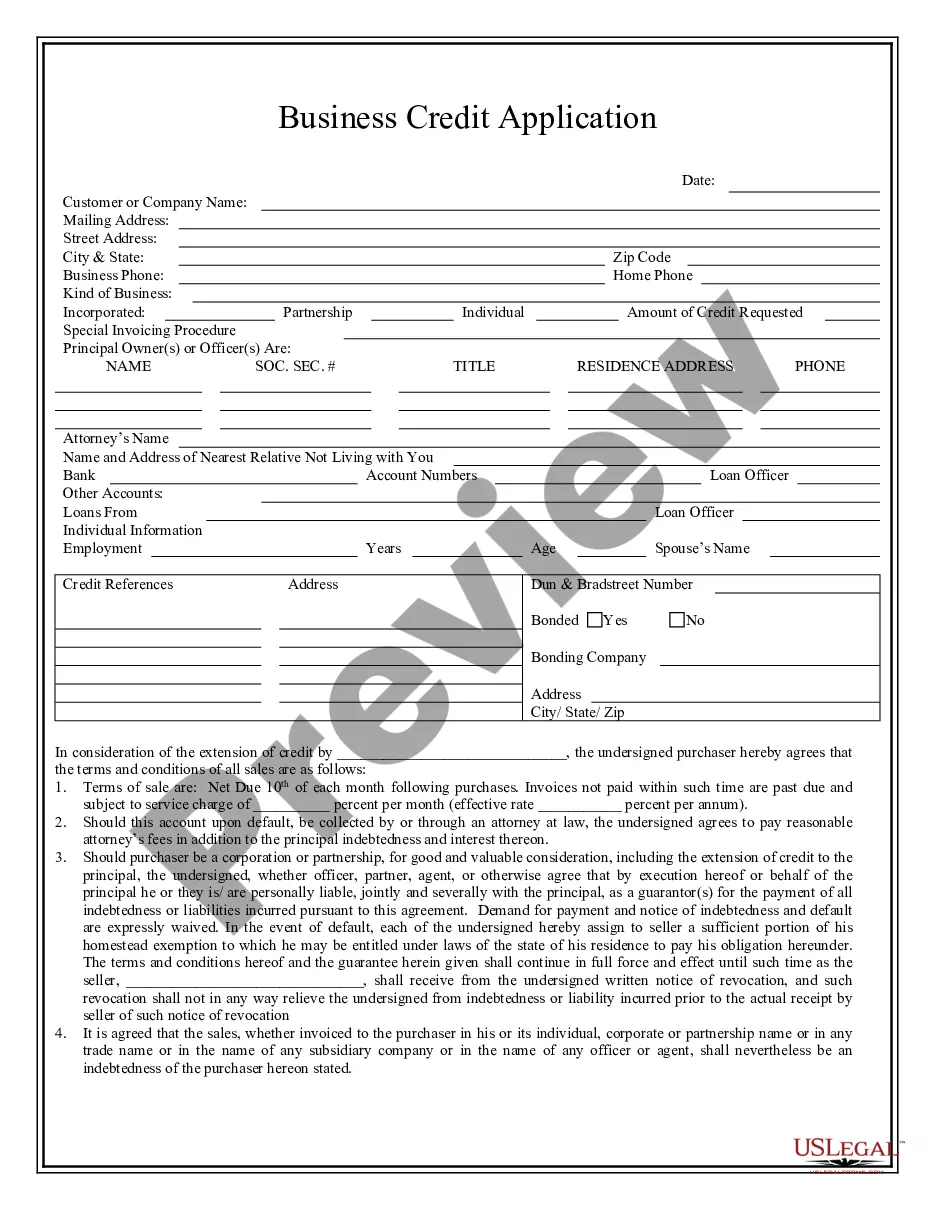

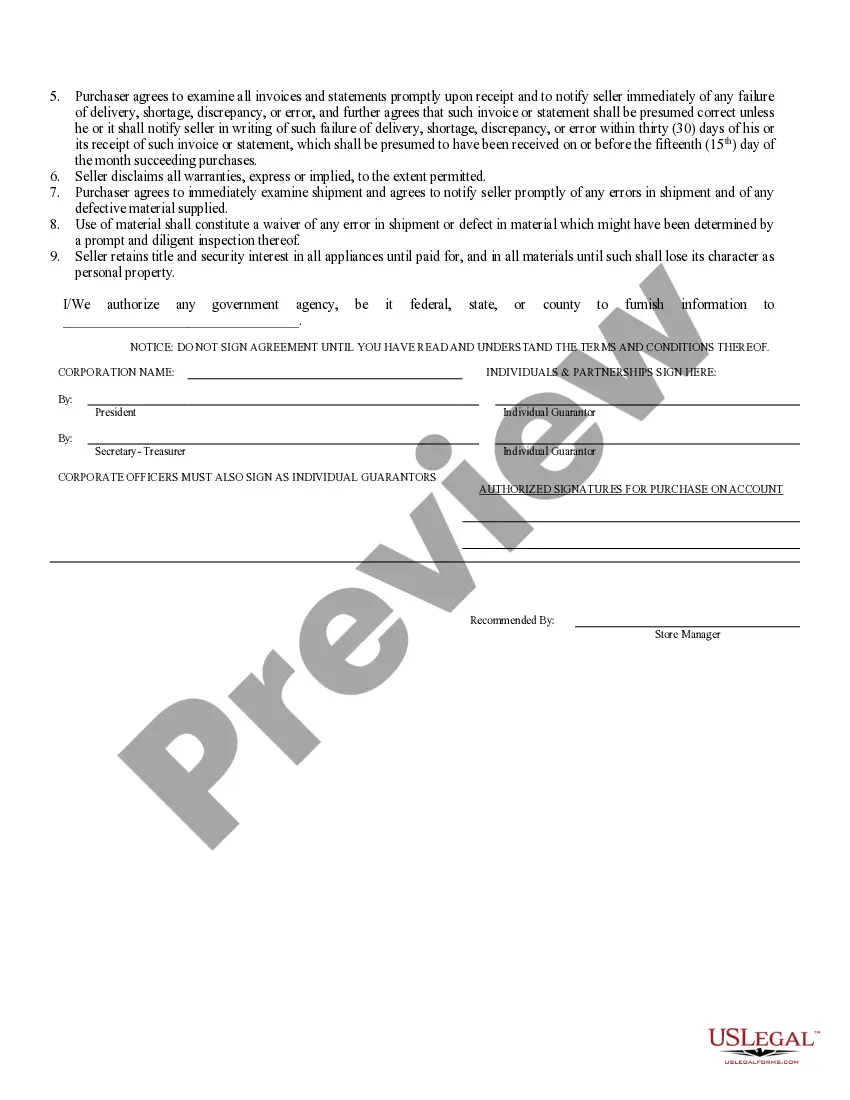

Grand Rapids Michigan Business Credit Application

Description

How to fill out Michigan Business Credit Application?

Regardless of your social or occupational standing, completing legal-related documents is a regrettable requirement in today's work landscape.

Frequently, it becomes nearly impossible for someone without a legal background to create such documents from the ground up, primarily due to the intricate language and legal nuances they entail.

This is where US Legal Forms steps in to help.

Ensure the template you selected is tailored to your area, as regulations from one state or county may not be applicable in another.

Review the document and examine a brief overview (if offered) of the scenarios for which the paper may be relevant.

- Our platform boasts an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal matter.

- US Legal Forms is also an invaluable resource for individuals or legal advisors aiming to enhance their efficiency with our DIY papers.

- Whether you need the Grand Rapids Michigan Business Credit Application or any other document that is valid in your state or county, US Legal Forms puts everything within reach.

- Here's how to swiftly acquire the Grand Rapids Michigan Business Credit Application using our reliable platform.

- If you're already a registered user, you can simply Log In to download the necessary document.

- On the other hand, if you are new to our library, be sure to follow these steps before obtaining the Grand Rapids Michigan Business Credit Application.

Form popularity

FAQ

The minimum credit score for obtaining a business line of credit usually starts at around 600, but higher scores are often preferred by lenders. Each lender has different criteria, so it’s vital to check their specific requirements. Before applying, review your credit score to ensure you meet the minimum for your Grand Rapids Michigan Business Credit Application. US Legal Forms can guide you in assessing your credit and improving your chances.

Requirements for a business credit line typically include a business license, financial documentation, and proof of revenue. Lenders may also request your personal credit history, especially if you are a new business. Understanding the specifics can help you prepare when filling out your Grand Rapids Michigan Business Credit Application. US Legal Forms provides a comprehensive guide to help you navigate these requirements effectively.

The fastest way to get business credit for your LLC is to establish a strong credit profile and maintain a good relationship with your vendors. Applying for a credit line through lenders that specialize in small business financing can expedite the process. Additionally, using a Grand Rapids Michigan Business Credit Application ensures you have all the required documentation in place. At US Legal Forms, we offer templates and support to help you succeed.

To get approved for a business credit line, you need to demonstrate creditworthiness, which includes providing financial statements, business plans, and your credit history. Lenders often evaluate your business income and the strength of your business model. Completing a Grand Rapids Michigan Business Credit Application accurately can also improve your chances. We can assist you with the necessary documentation through US Legal Forms.

Typically, a personal credit score of 680 or higher is preferred for obtaining a business line of credit. However, some lenders may have different criteria or allow for lower scores depending on other factors. It's important to review your credit report before submitting your Grand Rapids Michigan Business Credit Application. This way, you can identify areas for improvement and increase your chances of approval.

Business credit can be challenging to obtain without the right knowledge or resources. Lenders look for established credit histories and solid business plans. You can simplify your application process and improve your chances with the Grand Rapids Michigan Business Credit Application.

Yes, applying for a business credit card may result in a hard inquiry on your credit report, especially for certain accounts. However, understanding your credit position before applying can mitigate any concerns. With the Grand Rapids Michigan Business Credit Application, you can assess which providers might lead to minimal impact on your score.

The process to pull for a business credit card is generally straightforward. Lenders typically perform a soft inquiry, which does not impact your credit score, making it easier to compare options. The Grand Rapids Michigan Business Credit Application can guide you through this process, ensuring you choose the right card for your needs.

Securing business credit can be straightforward if you have a solid credit foundation and a clear business plan. Many lenders are eager to work with startups and small businesses in Grand Rapids, Michigan. Utilizing a Business Credit Application can help you present your financial details effectively to improve your chances.

Typically, a credit score of 680 or higher is recommended for a business credit card. However, some options are available for those with lower scores. It’s beneficial to consult resources like the Grand Rapids Michigan Business Credit Application for specific card requirements aligned with your financial situation.