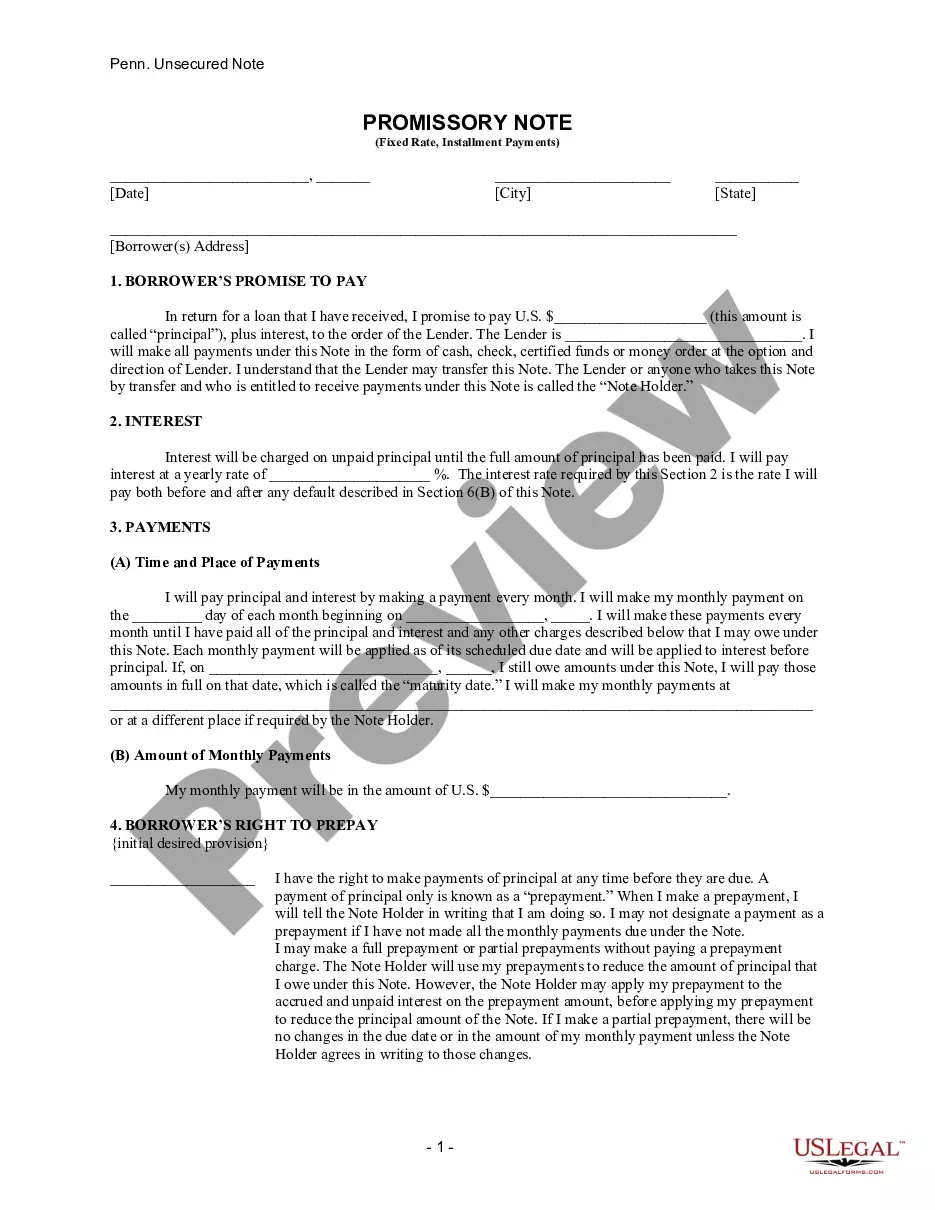

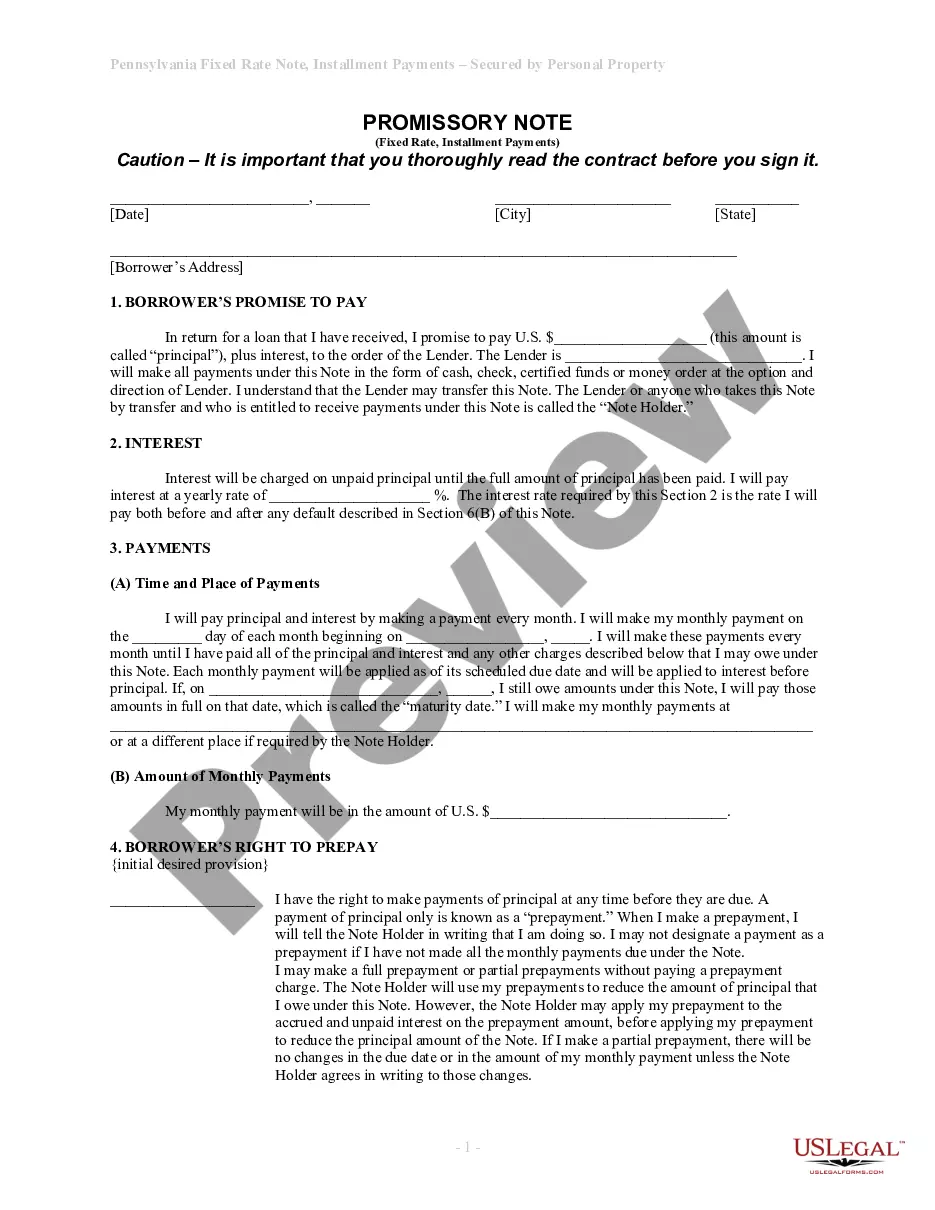

Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Pennsylvania Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Are you seeking a reliable and budget-friendly provider of legal forms to obtain the Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate? US Legal Forms is your top option.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we have you covered. Our platform features over 85,000 current legal document templates for personal and business use. All templates we offer are tailored, not generic, and are designed based on the specifications of specific states and regions.

To download the document, you must Log In to your account, find the necessary form, and press the Download button adjacent to it. Please remember that you can download your previously acquired form templates at any moment in the My documents section.

Is this your first visit to our website? No problem. You can easily create an account, but before doing so, ensure to execute the following.

Now you can set up your account. Then select the subscription plan and proceed to payment. Once the payment is finalized, download the Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in any available format. You can revisit the website anytime and redownload the form at no additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time figuring out legal documentation online once and for all.

- Verify if the Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate aligns with the laws of your state and community.

- Read the form’s description (if available) to understand who and what the form is suitable for.

- Begin the search afresh if the form does not fit your particular circumstances.

Form popularity

FAQ

Yes, promissory notes can indeed be backed by collateral, which adds an extra layer of security to the lending process. In real estate, this collateral often includes the property itself, creating a legal claim for the lender in case of default. This feature is particularly relevant for anyone interested in Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, as it mitigates risk for lenders.

The document that secures a promissory note to real property is known as a deed of trust or a mortgage. This legal instrument establishes the lender's rights over the property, ensuring that if the borrower defaults, the lender can reclaim the property. Understanding this connection is essential when dealing with a Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

To secure a promissory note with real property, you can create a lien against the property. This process involves drafting a security agreement that links the note to your real estate. Once in place, this lien ensures that if the borrower defaults, the lender has a legal claim to the property, providing security for the Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

Yes, you can write your own promissory note in Pennsylvania, as long as it complies with state laws. However, ensure you clearly outline all critical details, such as the repayment terms and any secured collateral. Writing your own note allows for customization but may lead to legal complications if not done correctly. To avoid errors, consider using USLegalForms, which provides clear templates for creating your Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

In Pittsburgh, Pennsylvania, it is typically advisable to notarize a secured promissory note to ensure its validity. Notarization helps to verify the identities of the parties involved and adds an extra layer of security. This process can prevent disputes about the authenticity of the document. For those looking to create a Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, using notarization may streamline potential legal processes.

One disadvantage of a promissory note is that it creates a binding obligation to repay a debt, which can lead to financial stress if the borrower encounters difficulties. Additionally, failing to meet repayment terms can result in legal consequences and loss of collateral. Therefore, when utilizing a Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is essential to ensure the commitment aligns with your financial capabilities.

Promissory notes do not typically require filing in a public office; however, they should be kept in a safe place. If the note is secured by real estate, you may need to file a lien against the property at your local county recorder's office. Using a platform like uslegalforms can help manage the documentation of your Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate efficiently and accurately.

Notarization of a promissory note in Pennsylvania is not legally required, but it is advantageous. A notarized note carries more weight and is often easier to enforce if disputes arise. By choosing to notarize your Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you protect your interests and establish a clear and proven agreement.

Yes, a promissory note can be legally binding even without notarization. However, while it remains valid, lacking a notarized signature may complicate legal enforcement in the event of a dispute. Therefore, it is advisable to consider notarizing your Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, as doing so promotes clarity and confidence.

In Pennsylvania, notarization of a promissory note is not strictly required, but it is highly recommended. A notarized Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Commercial Real Estate enhances its validity and can simplify any future legal proceedings. Moreover, having a notary involved adds an extra layer of security for all parties.