Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate

Description

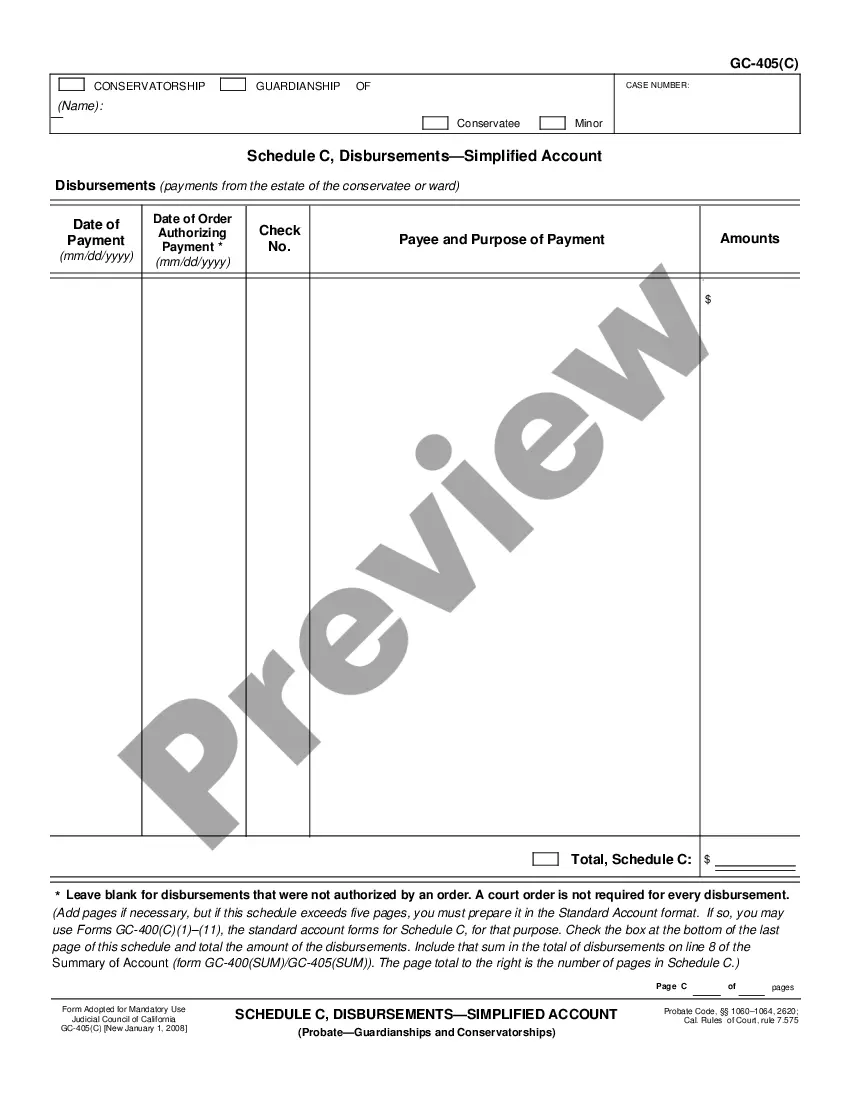

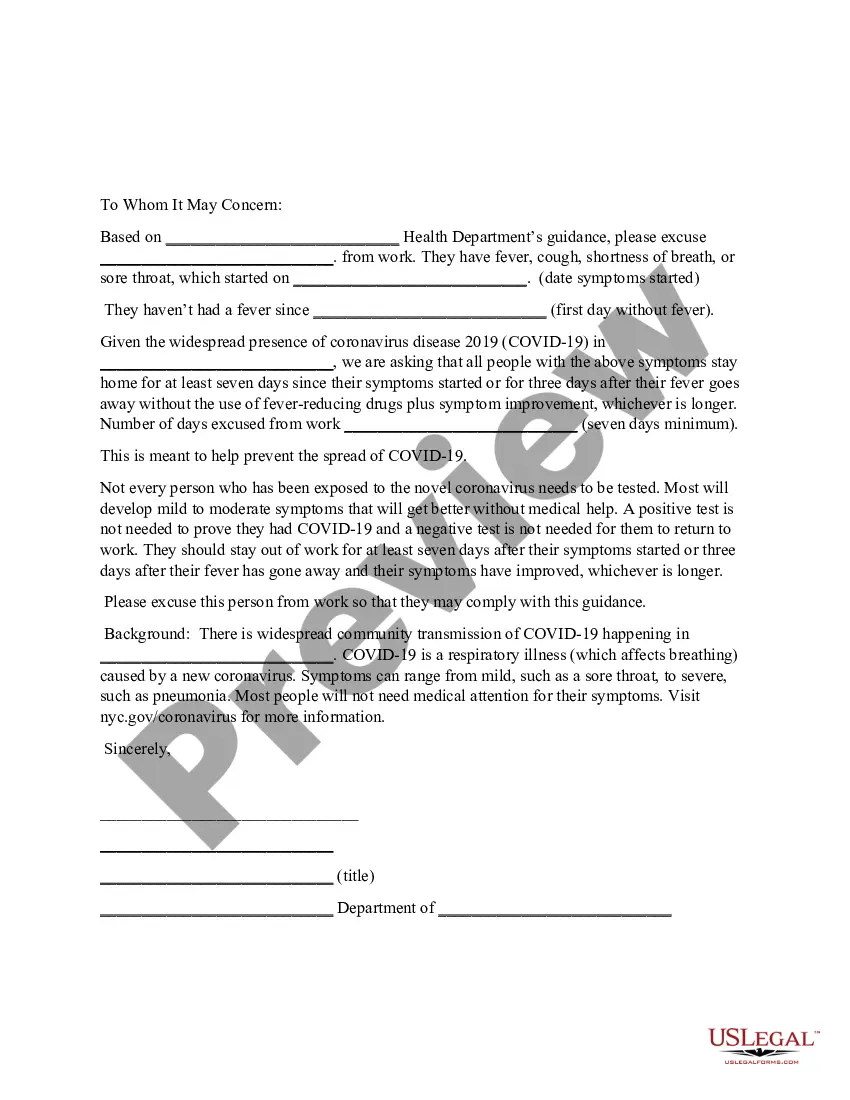

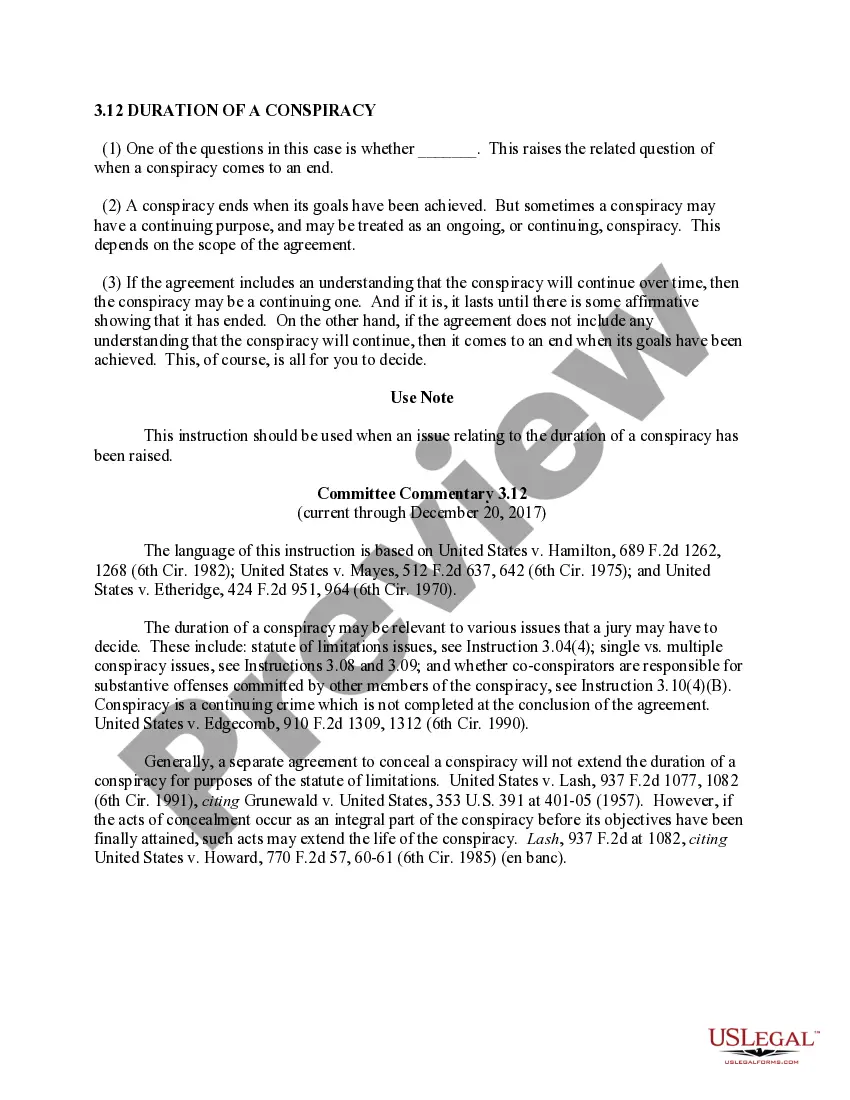

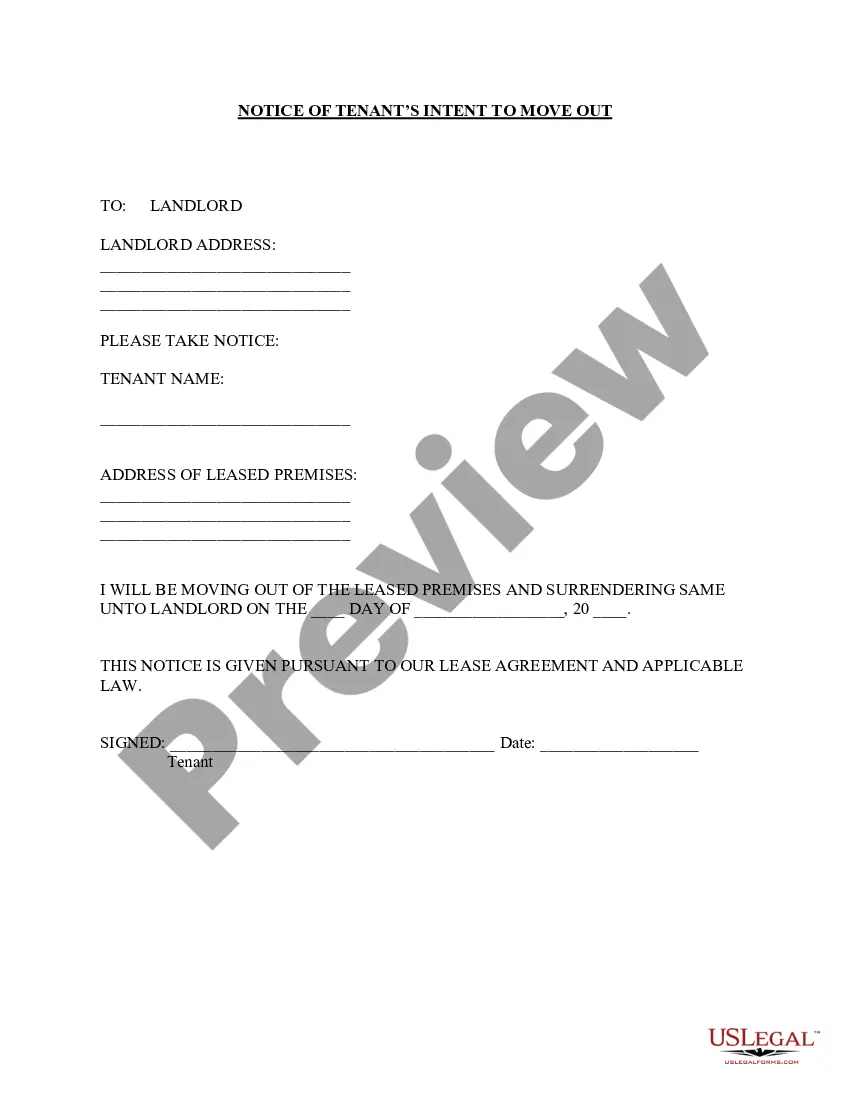

How to fill out Pennsylvania Unsecured Installment Payment Promissory Note For Fixed Rate?

Utilize the US Legal Forms and gain instant access to any document you desire.

Our user-friendly platform, featuring a vast array of documents, streamlines the process of locating and acquiring nearly any document template you require.

You can download, complete, and authenticate the Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate in just a few minutes instead of spending hours online searching for the appropriate template.

Using our database is a superb method to enhance the security of your record-keeping.

Locate the document you need. Ensure that it is the document you were looking for: review its title and description, and utilize the Preview feature when available. Alternatively, use the Search box to find the required document.

Initiate the download process. Click Buy Now and select the pricing option you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- How can you retrieve the Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate.

- If you already possess a subscription, simply Log In to your account. The Download option will show up on all the samples you view. Additionally, you can access all your previously saved documents in the My documents section.

- If you have yet to create an account, follow the instructions outlined below.

Form popularity

FAQ

Writing a promissory note for payment involves stating all necessary terms upfront. Begin with the date and details of the parties involved. Clearly outline the principal amount, interest rate, repayment terms, and consequences of default. Incorporate legal language to make it enforceable, and consider using the Uslegalforms platform for templates and legal guidance to ensure your Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate meets all requirements.

When completing a sample of a Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, read each section carefully. Provide essential information, such as the names of the parties involved, the principal amount, and the terms of repayment. Use the sample as a guideline, but tailor it to fit your specific agreement details. Always review for accuracy before signing.

A reasonable interest rate for a Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate often falls between 5% and 15%. Factors influencing this rate include the borrower's creditworthiness and the prevailing market rates. It is essential to ensure that the interest rate is competitive yet fair for both parties. Consulting with professionals or using resources like uslegalforms can provide additional clarity.

Typically, a promissory note does not need to be formally filed or recorded with a government entity. Instead, it is held by the lender or the person entitled to receive payment. However, for a Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, keeping a copy of the document is critical for your records. Should you later need to enforce the agreement, having it readily available can simplify the process.

A promissory note is often referred to as a 'note payable' or simply 'note.' This financial instrument outlines the borrower's promise to repay a specified amount to the lender, making it essential in various financial transactions. If you're exploring options for a Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, understanding these terms can help you navigate the lending landscape more effectively. In short, regardless of the name, the purpose remains the same.

In Pennsylvania, notarization of a promissory note is not strictly required, but it is highly recommended. Having a notary public witness the signing adds an extra layer of authenticity and can help prevent disputes later on. A Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate would benefit from notarization, as it enhances the document's credibility. Therefore, while it may not be necessary, notarizing your note can protect your interests.

To obtain a Pittsburgh Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, begin by visiting a reputable online platform like USLegalForms. They provide templates that cater to your specific needs. After selecting the appropriate form, simply fill it out with the relevant details, and ensure you review it for accuracy. Finally, you can save and print your completed promissory note for your records.