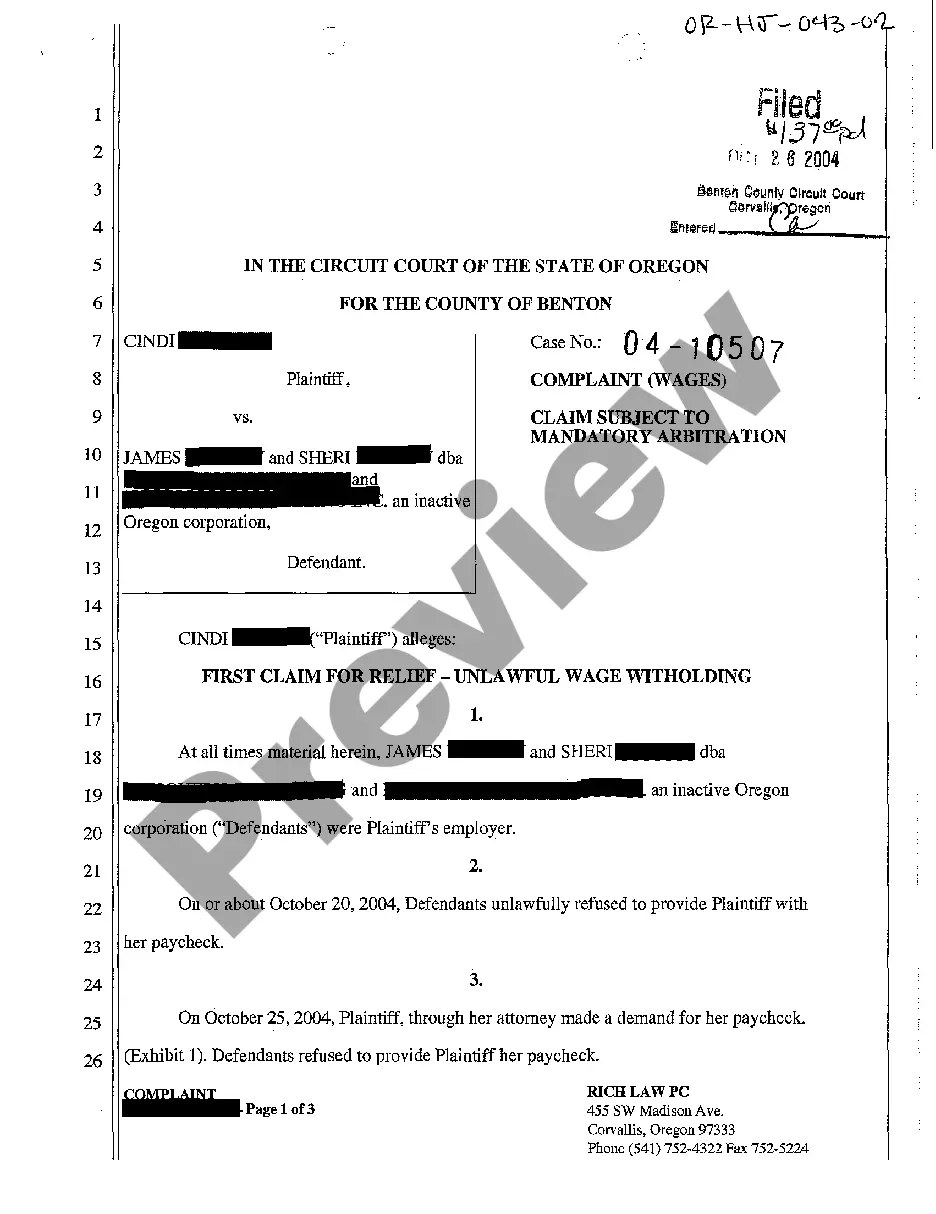

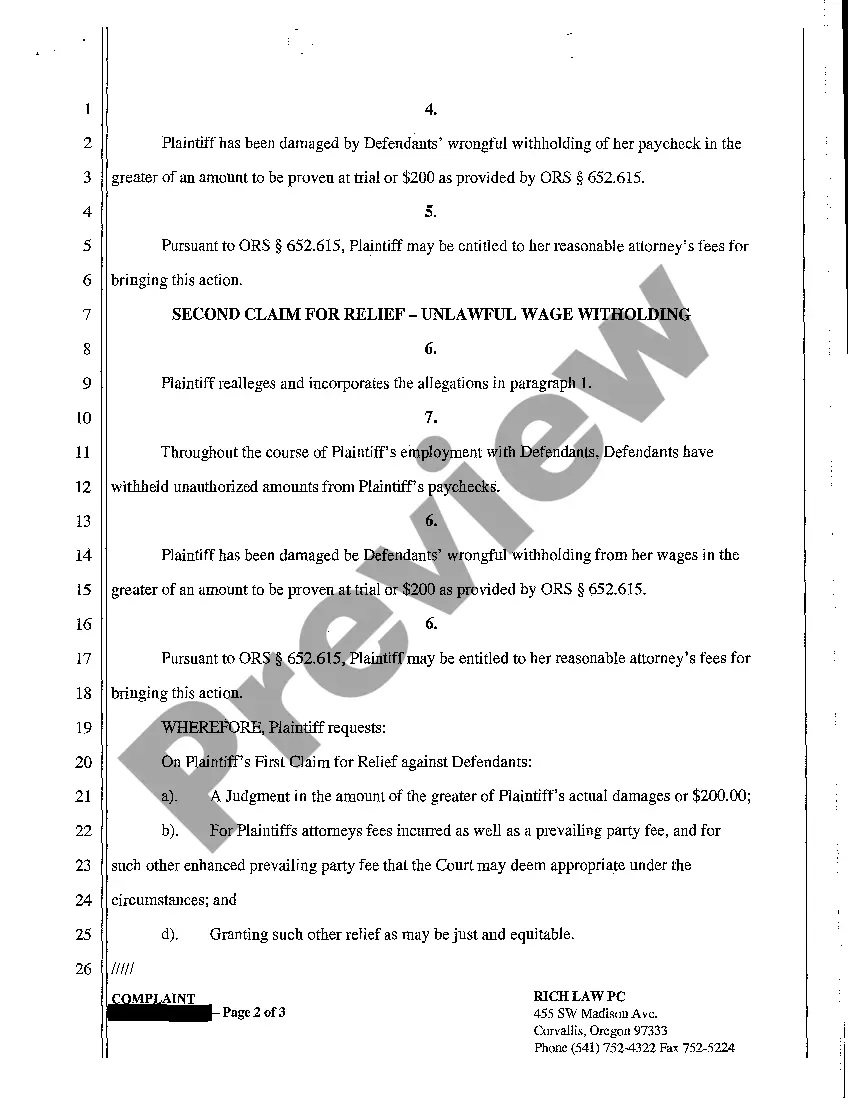

Gresham Oregon Complaint for Unlawful Wage Withholding is a legal situation that arises when an employer withholds an employee's wages in violation of state wage and hour laws. This unlawful act can have serious consequences for employees who rely on their earned wages to meet their financial obligations. One type of Gresham Oregon Complaint for Unlawful Wage Withholding is when an employer fails to pay an employee their rightful wages for the hours worked. This could occur when an employer deliberately chooses not to pay an employee or mistakenly miscalculates the employee's wages. In both cases, it constitutes a violation of the employee's rights and warrants a formal complaint. Another type of complaint is when an employer unlawfully deducts wages from an employee's paycheck without proper authorization or without meeting the legal requirements. Deductions that may be illegal to include those made for benefits the employee did not agree to, damage costs caused by the employee's mistake, or other arbitrary deductions not specified in the employee's agreement. Employees have the right to file a complaint if they believe any such unauthorized deductions have occurred. Furthermore, if an employer fails to pay an employee the statutorily required minimum wage or overtime pay, the affected employees can file a complaint for unlawful wage withholding. Under Oregon law, employers must pay employees at least the state minimum wage (currently $12.75 per hour) and provide overtime pay at a rate of 1.5 times the regular wage for any hours worked over 40 in a workweek. To file a Gresham Oregon Complaint for Unlawful Wage Withholding, employees should gather and document evidence of their wage-related transactions, such as pay stubs, time cards, or any communication with the employer regarding their wages. Additionally, it is advisable for employees to consult with a labor attorney or reach out to the Bureau of Labor and Industries (BOLD) in Oregon to understand the formal complaint process and ensure their rights are protected. Overall, Gresham Oregon Complaints for Unlawful Wage Withholding encompass various scenarios where employers violate state wage and hour laws by withholding or deducting employee wages improperly. Taking prompt action through filing a complaint is crucial for employees to ensure they receive their rightful earnings and to hold employers accountable for their legal obligations.

Gresham Oregon Complaint for Unlawful Wage Withholding

Description

How to fill out Gresham Oregon Complaint For Unlawful Wage Withholding?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Gresham Oregon Complaint for Unlawful Wage Withholding or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Gresham Oregon Complaint for Unlawful Wage Withholding complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Gresham Oregon Complaint for Unlawful Wage Withholding is proper for you, you can choose the subscription plan and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!

Form popularity

FAQ

In an Oregon late pay wage claim lawsuit alleging that the final (last) paycheck was not paid timely, the employee can recover penalty wages in addition to the unpaid wages. ORS 652.150.

Please call 971-673-0761 or email help@boli.state.or.us.

If you quit without notice, the employer must pay all wages due within five days or on the next regular payday, whichever occurs first (not counting weekends or holidays). If your employer fires you, all your earned wages must be paid no later than the end of the first business day after the termination.

Info If you have not been paid wages for hours you worked, overtime wages for hours worked over 40/week, or have had unlawful deductions taken from your paycheck, please submit a claim using this form. If you have questions, please email WHD.SCREENER@boli.oregon.gov or call 971-673-0761.

The employer, or the employee or the employee's beneficiary can file a complaint to MoHRE in case of a breach of the terms or the employment contract or of their rights as per the Labour Law. In all cases, no claim for any rights due will be heard after one year from the date of violation.

Summary. Oregon law prohibits an employer from discriminating and retaliating against employees in a variety of protected classes. Employers must also provide pregnancy accommodations, allow employees to access their personnel files, protect whistleblowers and allow wage discussions.

To pursue your own claim for unpaid wages, you should file a wage claim with the Labor Commissioner's Wage Claim Adjudication Unit, in addition to filing a BOFE report. A notice of your wage claim will be sent to your employer. CALIFORNIA LABOR LAWS PROTECT ALL WORKERS REGARDLESS OF IMMIGRATION STATUS.

What is an unfair labor practice by management? Interference, restraint, or coercion.Employer domination or support of a labor organization.Discrimination on the basis of labor activity.Discrimination in retaliation for going to the NLRB.Refusal to bargain.

Start by approaching the human resource department of your company. It will be in a position to explain where you stand legally and will help resolve the issue. You can also lodge a formal complaint directly with the department and should give it adequate time to evaluate your situation and suggest a solution.

Info If you have not been paid wages for hours you worked, overtime wages for hours worked over 40/week, or have had unlawful deductions taken from your paycheck, please submit a claim using this form. If you have questions, please email WHD.SCREENER@boli.oregon.gov or call 971-673-0761.