Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout

Description

Key Concepts & Definitions

Assignment of Overriding Royalty Interest: This is a legal arrangement in the oil and gas industries where the owner of a property leases the oil and gas rights, and assigns a portion of the revenue derived from extracted oil or gas to another party, without transferring the actual ownership of the minerals.

Oil Gas Lease: A contract by which an oil company obtains the rights to explore and drill for oil and gas on a landowner's property.

Mineral Rights Transfer: The process of legally transferring ownership of underground minerals like oil and gas from one party to another.

Step-by-Step Guide to Managing an Assignment of Overriding Royalty Interest

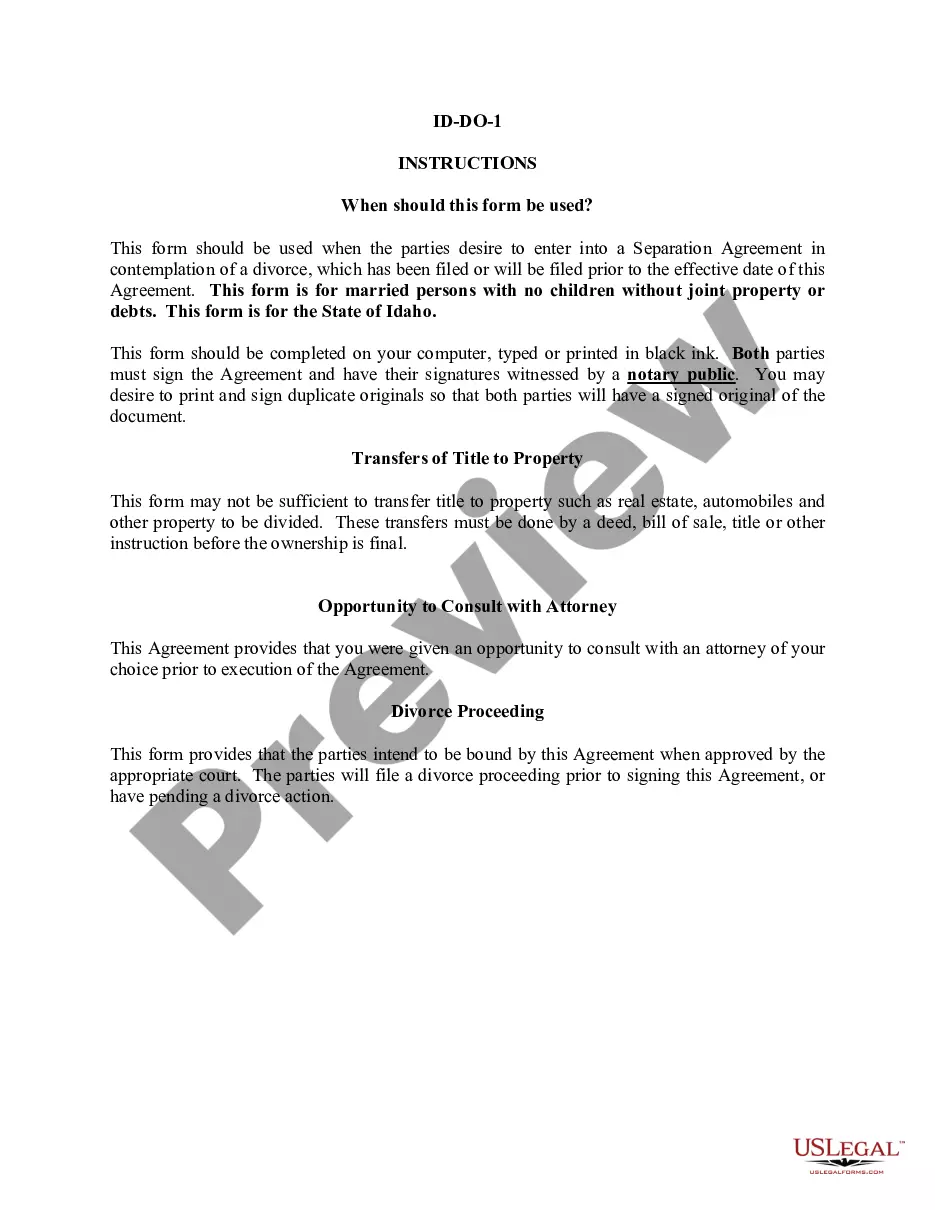

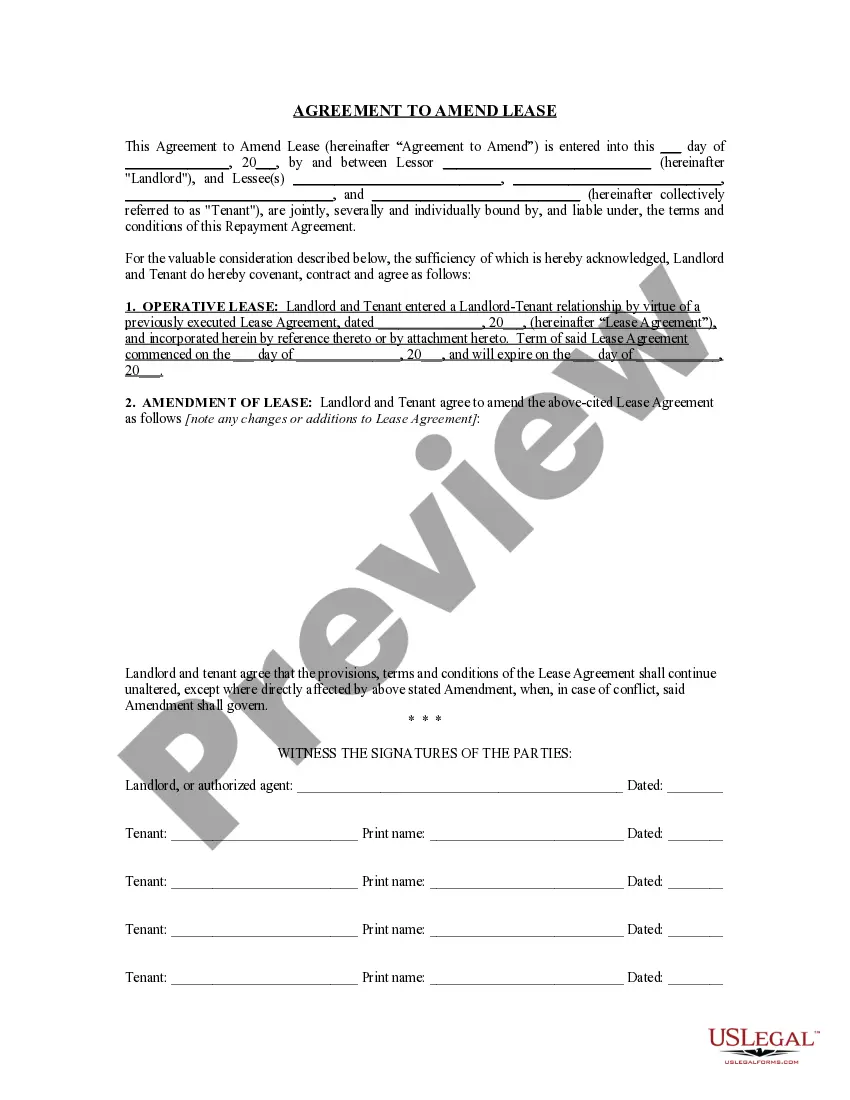

- Understand the Terms of the Lease: Review the oil gas lease documents to comprehend the rights, restrictions, and obligations involved.

- Legal Consultation: Engage with a lawyer specialized in mineral rights to ensure the overriding royalty interest assignment aligns with current laws and regulations.

- Document Preparation: Prepare the overriding royalty interest assignment document, specifying the percentage of revenue and other terms agreed upon.

- Filing the Documents: Properly file the agreement in the relevant county to legally enforce the assignment.

- Monitor the Production: Keep track of the oil or gas production as revenue distribution depends on this metric.

Risk Analysis of Assigning Overriding Royalty Interests

- Price Volatility: Fluctuations in oil and gas prices can affect royalty income significantly.

- Production Uncertainty: Oil well drilling results might not meet the initial estimates, impacting expected revenues.

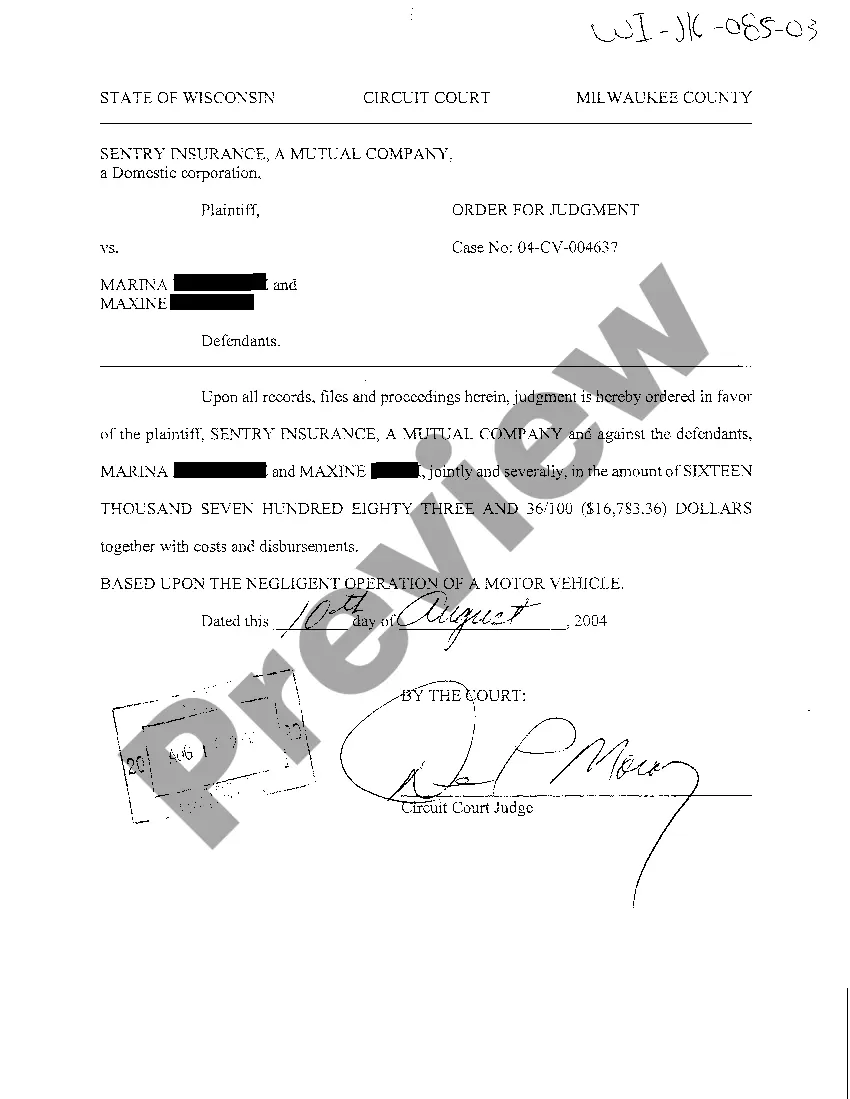

- Legal Disputes: Inaccurate documentation or unclear terms can lead to legal disputes between involved parties.

Best Practices

- Conduct Thorough Research: Investigate oil company revenue trends and geological surveys before committing to any agreements.

- Establish Clear Terms: Clearly define all terms of the royalty interest assignment in the legal documents to avoid future disputes.

- Maintain Open Communication: Regular dialogue with all parties can facilitate smoother operations and agreements.

FAQ

What is an overriding royalty interest? It is a non-possessory interest in the oil and gas production from a lease, which is payable in addition to the basic royalty.

Can an overriding royalty interest be revoked? Typically, overriding royalty interests are binding and cannot be revoked unless agreed upon in the contract terms.

How does one calculate payments from overriding royalty interests? Payments are calculated based on a percentage of the revenue from the oil or gas sold, minus certain permissible deductions as outlined in the lease agreement.

How to fill out Assignment Of Overriding Royalty Interest Partially Convertible To A Working Interest At Payout?

When it comes to drafting a legal form, it’s easier to leave it to the experts. However, that doesn't mean you yourself can not get a template to use. That doesn't mean you yourself can’t get a sample to utilize, nevertheless. Download Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout straight from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. When you are signed up with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout fast:

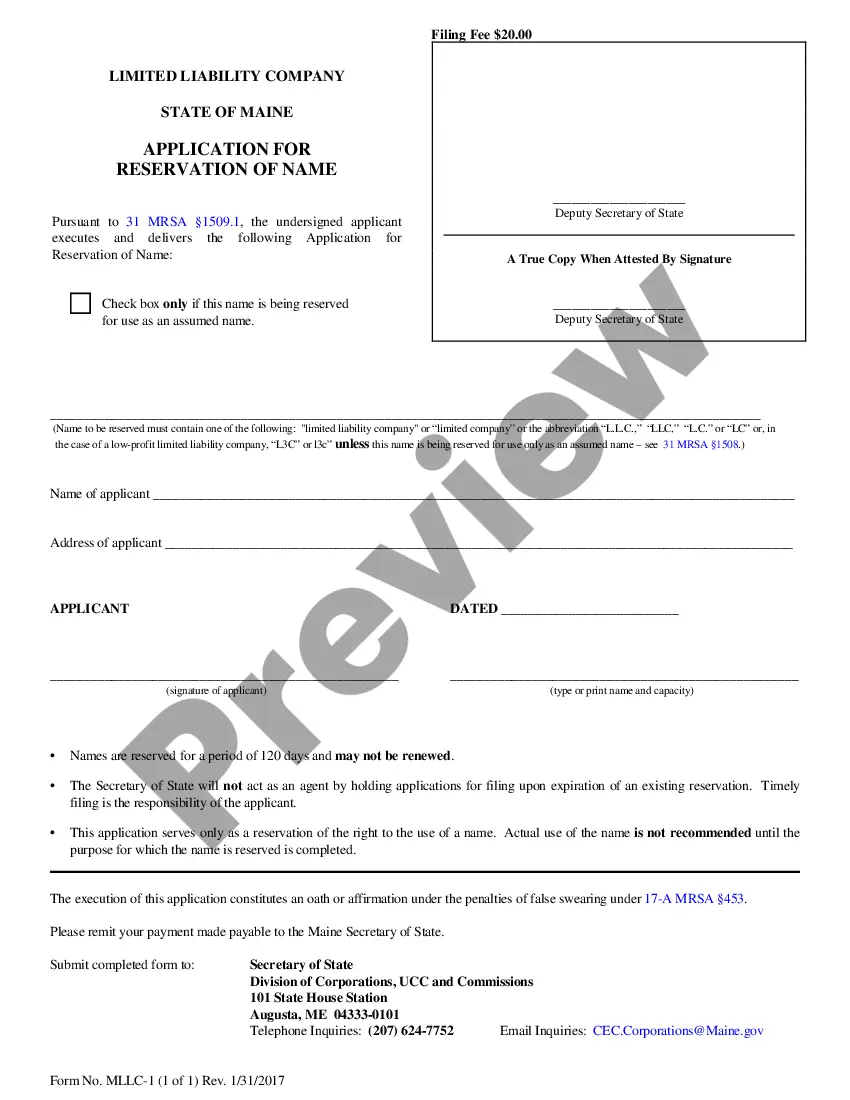

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Select the suitable subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout is downloaded you are able to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

An overriding royalty interest is the right to receive revenue from the production of oil and gas from a well. The overriding royalty is carved out of the lessee's (operator's) working interest and entitles its owner to a fraction of production.

The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

The royalty mineral owner retains ownership of the interest after production stops. Holders of overriding royalty interests have no ownership rights to the minerals under the ground but a non-possessory undivided interest.

An overriding royalty interest generally entitles the owner of the interest to a specified share of the oil and gas produced under the terms of the lease. In Texas and in many other oil-producing states, overriding royalty interests are generally treated as interests in real estate.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.