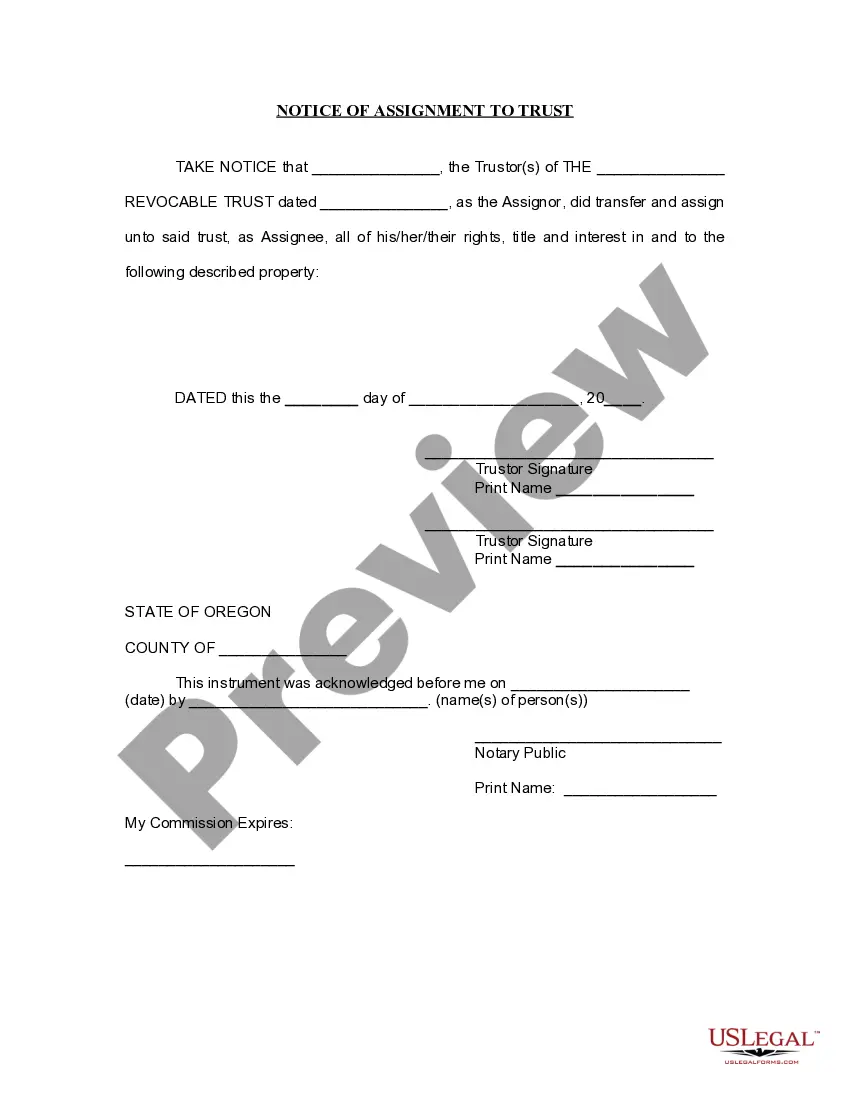

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Gresham Oregon Notice of Assignment to Living Trust is a legal document that signifies the transfer of assets or property to a living trust in Gresham, Oregon. This notice serves as an official notification or declaration of the assignment, ensuring the validity and enforceability of the trust. When creating a Gresham Oregon Notice of Assignment to Living Trust, it is crucial to include specific keywords that accurately describe the document's purpose and its various types. Some relevant keywords include: 1. Living trust: A legal arrangement where property or assets are placed in a trust during the granter's lifetime, managed by a trustee, and distributed to beneficiaries upon the granter's death. 2. Assignment: The act of transferring ownership, rights, or interests of a property or asset to a living trust. 3. Gresham, Oregon: A city located in Multnomah County, Oregon, where the Notice of Assignment to Living Trust is being created and executed. 4. Declarations: Statements made in the notice providing essential information about the assignment and the involved parties, such as the granter, the trustee, and the beneficiaries. 5. Assets: Property, real estate, investments, bank accounts, or any valuable possessions that are being assigned to the living trust. 6. Trustee: The person or entity responsible for managing the living trust and ensuring its distribution according to the granter's wishes. 7. Beneficiary: The individual(s) or organization(s) named in the living trust who will receive the designated assets upon the granter's passing. 8. Validity: The state of being legally binding and enforceable, ensuring that the assignment to the living trust is legally recognized in Gresham, Oregon. Different types of Gresham Oregon Notice of Assignment to Living Trust may include revocable living trust assignments, irrevocable living trust assignments, or amendment notices. Each type may have its specific requirements and procedures, depending on the granter's intentions and the circumstances of the trust. It is essential to consult an estate planning attorney or legal expert in Gresham, Oregon, to ensure accurate completion of the Notice of Assignment to Living Trust, as laws may vary and specific details may be required for different types of assets or trusts.