Oklahoma City Oklahoma Assignment to Living Trust

Description

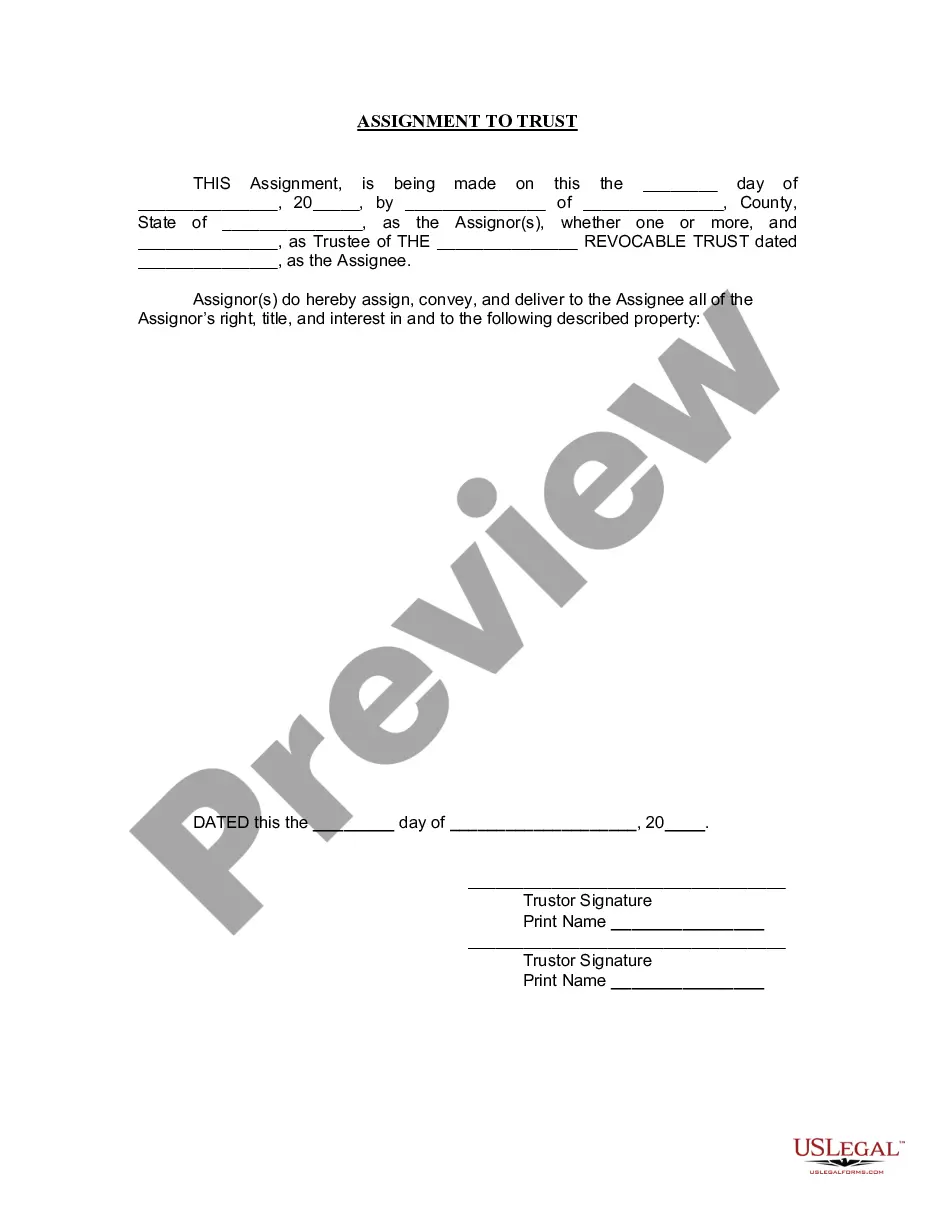

How to fill out Oklahoma Assignment To Living Trust?

If you have previously utilized our service, sign in to your account and retrieve the Oklahoma City Oklahoma Assignment to Living Trust on your device by clicking the Download button. Ensure your subscription is current. If it is not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to secure your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to efficiently locate and save any template for your personal or professional requirements!

- Make sure you have found the correct document. Review the description and utilize the Preview option, if available, to confirm it fulfills your requirements. If it does not fit, use the Search tab above to acquire the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and complete a payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Obtain your Oklahoma City Oklahoma Assignment to Living Trust. Choose the file format for your document and store it on your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

How Much Does It Cost to Create a Living Trust in Oklahoma? There is no set price tag on setting up a living trust. It can range from just under $100 to more than $1,000. It all depends on how you create it and how complex your estate is.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

What Type of Assets Go into a Trust? Bonds and stock certificates. Shareholders stock from closely held corporations. Non-retirement brokerage and mutual fund accounts. Money market accounts, cash, checking and savings accounts. Annuities. Certificates of deposit (CD) Safe deposit boxes.

Trusts can hold many different types of assets, including cash, stocks, bonds, mutual funds, real estate and other property. Once the account is opened, you can transfer assets into the trust.

Using a revocable trust can help you avoid probate Assets that don't pass directly to heirs (such as a bank account, brokerage account, home, etc.) will go through probate before being distributed according to your will (if you had one) or at the court's discretion. Probate is an expensive, time-consuming process.

How Much Does It Cost to Create a Living Trust in Oklahoma? There is no set price tag on setting up a living trust. It can range from just under $100 to more than $1,000. It all depends on how you create it and how complex your estate is.

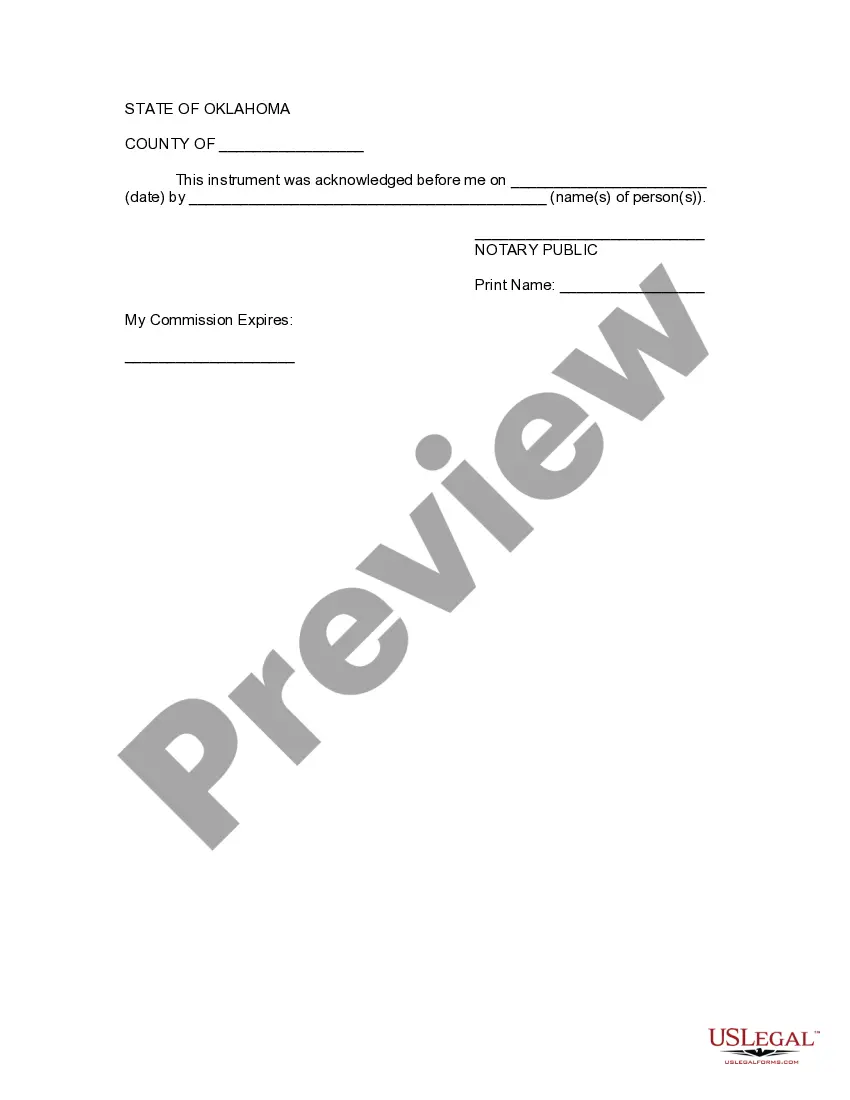

Real Estate ? To transfer real estate into the trust, the Grantor will need to complete an Oklahoma Deed, transfer ownership, have it notarized, and deliver to the appropriate County Clerk's Office.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

A trust is a legal arrangement for managing assets. There are different types of trusts and they are taxed differently. In a trust, assets are held and managed by one person or people (the trustee) to benefit another person or people (the beneficiary). The person providing the assets is called the settlor.

Generally speaking, under Oklahoma law, if a trust instrument does not specifically state that it is irrevocable, the trust will be a revocable trust. ?Every trust shall be revocable by the trustor, unless expressly made irrevocable by the terms of the instrument creating the same.? Okla.