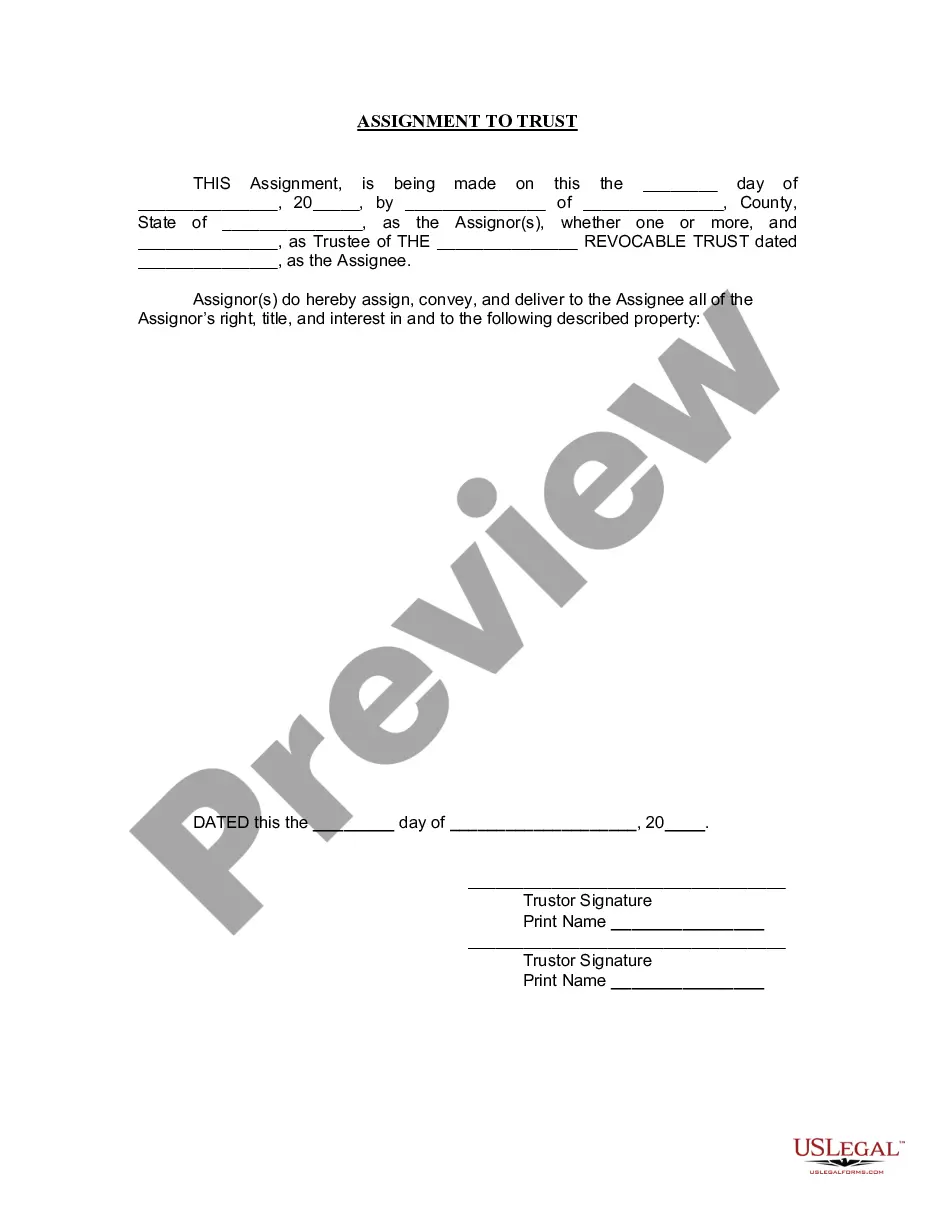

Oklahoma Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Assignment to Living Trust: The process of legally transferring assets into a living trust. Key terminologies include trust assets (assets managed by a trust), personal property (tangible items like furniture and clothing), and personal items (personal effects with emotional or sentimental value). Elder law may intersect with trust administration, especially pertaining to the elderly, addressing issues beyond estate planning like health and capacity.

General Assignment: A document that transfers multiple assets into a trust, often necessary for comprehensive estate planning.

Step-by-Step Guide to Assigning Assets to a Living Trust

- Inventory all assets including personal property and trust assets.

- Prepare a general assignment document to consolidate the transfer process for multiple assets.

- For real estate, prepare a deed transferring the property into the trust.

- If applicable, consider special forms for items needing specific treatment, such as art or jewelry.

- Execute all documents legally with the necessary notarization and witnesses.

- Record or register the transfer as required by state laws.

- Inform all relevant parties including financial institutions of the change in asset ownership.

Risk Analysis

Transferring assets improperly may lead to disputes or loss of control over certain properties. It's crucial to adhere to legal protocols and consult professionals in estate planning and elder law. Another potential risk involves not covering all assets, which might not be protected after the grantor's demise, leading them to pass through probate instead.

Key Takeaways

- Living trusts can simplify the management and transfer of assets upon one's death, bypassing lengthy probate processes.

- It's advisable to continuously update your living trust as you acquire new assets or your intentions change.

- Consider the implications for those with special needs, where a standard living trust might not be suitable without customization.

Best Practices

Always consult with professionals skilled in estate planning when assigning to a living trust to ensure legal and effective asset transfer. Maintain clear records of all transferred items to prevent issues down the line.

Common Mistakes & How to Avoid Them

One common error is neglecting to transfer all relevant assets to the living trust, causing them to undergo probate. Ensure all relevant documents, such as the general assignment and specific deeds for real property, are executed accurately and stored securely.

How to fill out Oklahoma Assignment To Living Trust?

When it comes to completing Oklahoma Assignment to Living Trust, you probably think about an extensive procedure that involves choosing a appropriate form among numerous similar ones after which needing to pay out an attorney to fill it out to suit your needs. In general, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific template in a matter of clicks.

For those who have a subscription, just log in and click Download to get the Oklahoma Assignment to Living Trust sample.

If you don’t have an account yet but need one, keep to the step-by-step guideline below:

- Be sure the document you’re downloading is valid in your state (or the state it’s needed in).

- Do this by reading through the form’s description and by clicking the Preview option (if offered) to see the form’s content.

- Simply click Buy Now.

- Find the suitable plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Skilled legal professionals draw up our templates to ensure after saving, you don't need to worry about enhancing content material outside of your individual information or your business’s info. Sign up for US Legal Forms and get your Oklahoma Assignment to Living Trust example now.

Form popularity

FAQ

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

There is no set price tag on setting up a living trust. It can range from just under $100 to more than $1,000. It all depends on how you create it and how complex your estate is. These days, you can shop around and find plenty of living trust software options.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.