Notice to Debt Collector - Unlawful Messages to 3rd Parties

Description

A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes leaving telephone messages with neighbors or other 3rd parties when the debt collector knows the consumer's name and telephone number and could have contacted the consumer directly.

How to fill out Notice To Debt Collector - Unlawful Messages To 3rd Parties?

When it comes to drafting a legal document, it is better to leave it to the specialists. However, that doesn't mean you yourself can’t get a sample to utilize. That doesn't mean you yourself can’t find a sample to utilize, nevertheless. Download Notice to Debt Collector - Unlawful Messages to 3rd Parties from the US Legal Forms web site. It offers a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. After you are signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Notice to Debt Collector - Unlawful Messages to 3rd Parties promptly:

- Make confident the document meets all the necessary state requirements.

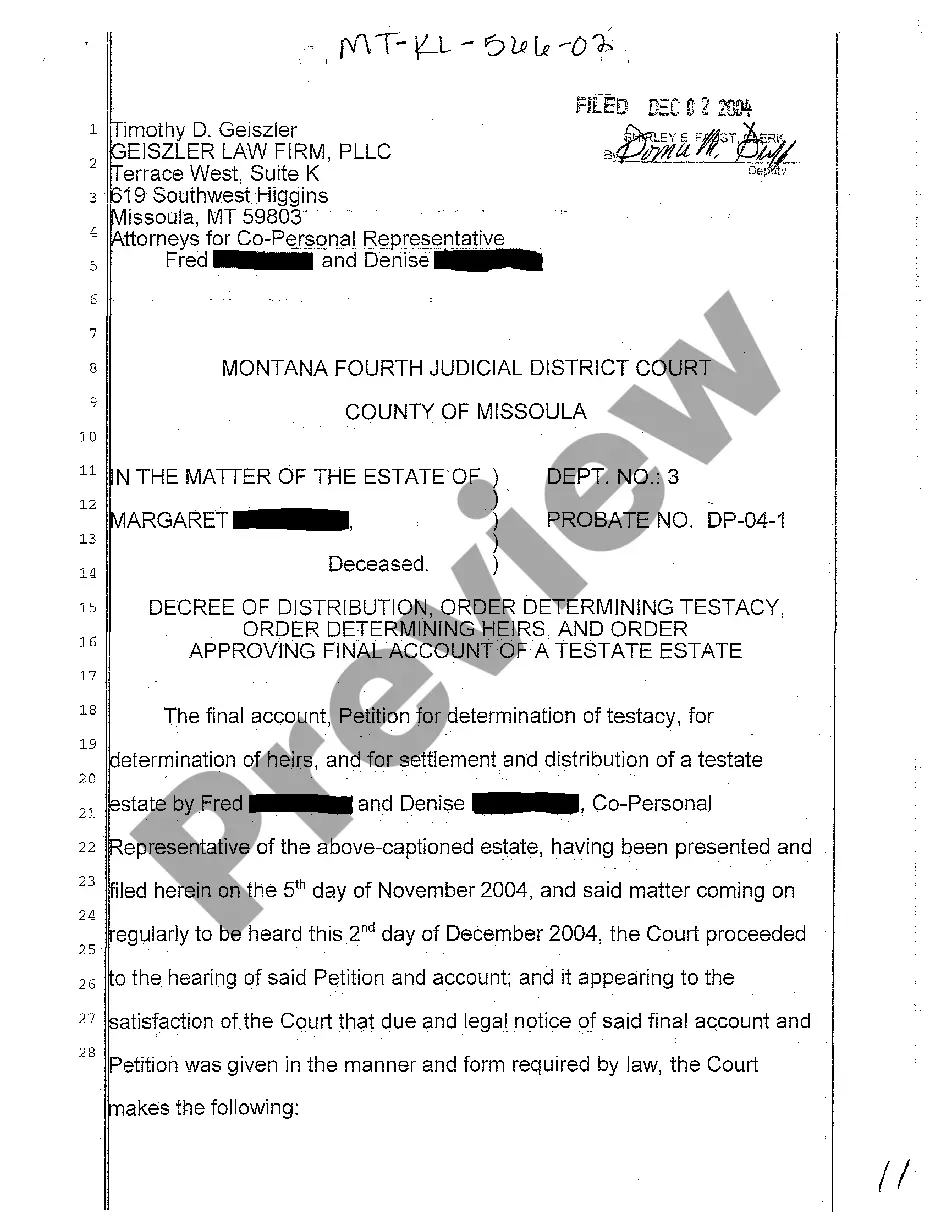

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Select the suitable subscription for your requirements.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Notice to Debt Collector - Unlawful Messages to 3rd Parties is downloaded you are able to complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Create a payment plan. Pay it off in one lump sum. Settle the debt for less than you owe.

Text Messages and Emails A third-party debt collector is permitted to send you electronic messages including texts and emails. Each of these messages must include instructions for a consumer to opt out of receiving those types of messages.

Yes. When a debt is sold to a collection agency, you then owe the money to them instead, meaning you still have to pay what you owe. This is the case whether your debt has been sold to an agency, or the original lender has passed it to one to act on their behalf.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

Text Messages and Emails A third-party debt collector is permitted to send you electronic messages including texts and emails. Each of these messages must include instructions for a consumer to opt out of receiving those types of messages.

Don't ignore them. Debt collectors will continue to contact you until a debt is paid. Find out debt information. Get it in writing. Don't give personal details over the phone. Try settling or negotiating.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

The law: Collectors can call third parties such as family members, neighbors, friends, or co-workers only once to locate the debtor. When they do, they are not allowed to reveal the debt.. They can only make contact again under specific circumstances.

Debt collectors are allowed to contact third parties to obtain or confirm location information, but the FDCPA does not allow debt collectors to leave messages with third parties.The collector cannot ask the third-party to pass on a message, ask for other information, or harass the third-party.