Oklahoma City Oklahoma Quitclaim Deed by Two Individuals to LLC

Description

How to fill out Oklahoma Quitclaim Deed By Two Individuals To LLC?

Are you in search of a trustworthy and affordable legal forms service to obtain the Oklahoma City Oklahoma Quitclaim Deed by Two Individuals to LLC? US Legal Forms is your ideal choice.

Whether you require a straightforward agreement to establish terms for living together with your partner or a bundle of forms to facilitate your separation or divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and commercial purposes. All templates that we provide are specifically tailored and structured in compliance with the regulations of individual states and regions.

To acquire the form, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please note that you can access your earlier purchased document templates at any time from the My documents section.

Is this your first visit to our platform? No problem. You can create an account with great ease, but before you do, ensure you complete the following.

Now you can establish your account. Then select the subscription option and proceed to the payment process. Once the payment is finalized, download the Oklahoma City Oklahoma Quitclaim Deed by Two Individuals to LLC in any format available. You can revisit the website whenever you need and redownload the form at no extra cost.

Finding current legal forms has never been more convenient. Try US Legal Forms today, and stop wasting your precious time searching for legal documents online once and for all.

- Verify if the Oklahoma City Oklahoma Quitclaim Deed by Two Individuals to LLC meets the laws of your state and locality.

- Review the form’s specifics (if provided) to understand who and what the form is designed for.

- Reinitiate the search if the form doesn’t suit your particular circumstances.

Form popularity

FAQ

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

Include the property address and its legal description, and identify by name the grantor(s) and the grantee(s). Make copies of the deed and record the deed transfer with the assessor's office in the county where the property is located.

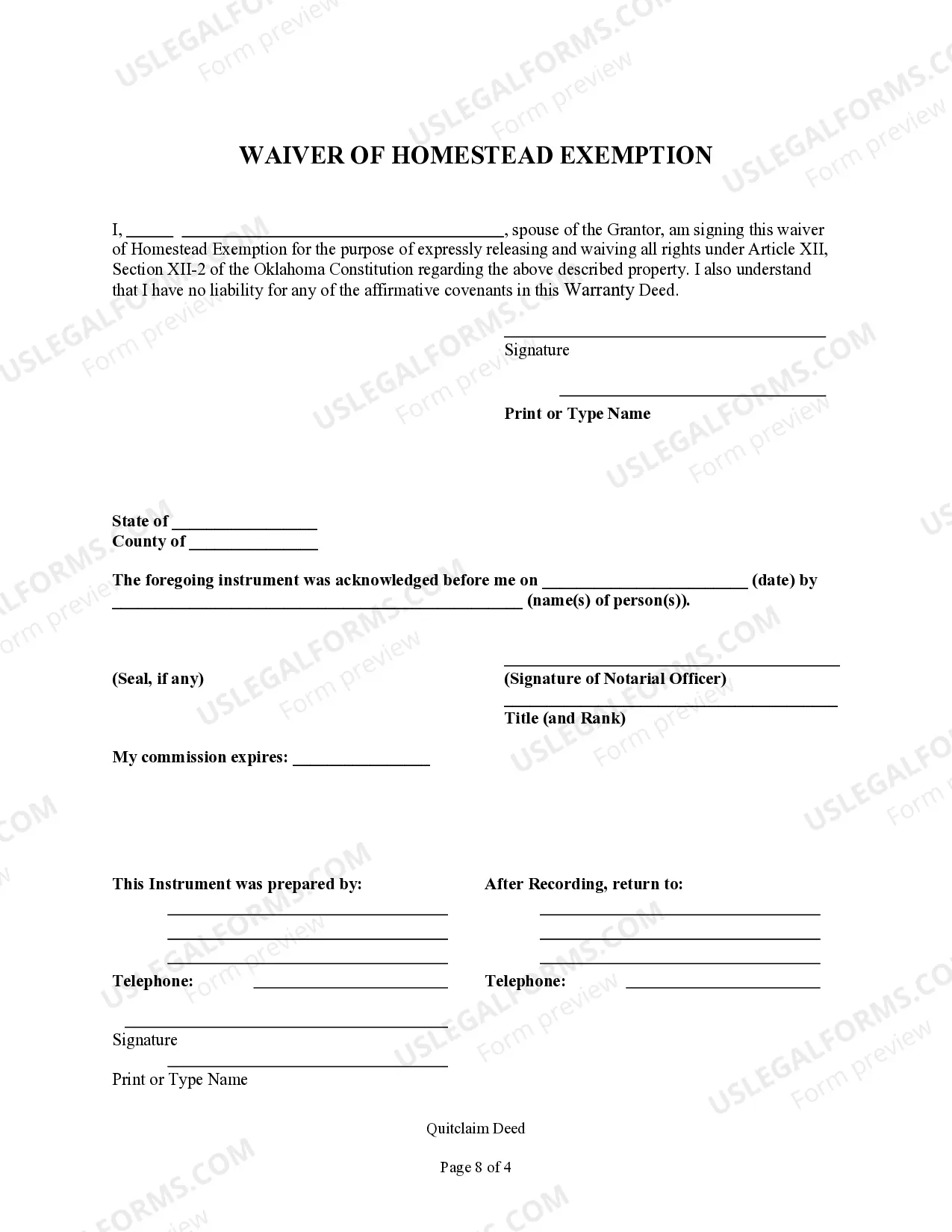

Per state law, an Oklahoma quitclaim deed must be in writing, describe the property, and be signed by the grantor. The grantor's signature must be acknowledged and the deed must be recorded. When recording the deed, you will need to pay a recording fee and a documentary stamp tax, which is a transfer tax.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

How to File a Quitclaim Deed Obtain a quitclaim deed form. Your very first step is obtaining your quitclaim deed.Fill out the quitclaim deed form.Get the quitclaim deed notarized.Take the quitclaim deed to the County Recorder's Office.File the appropriate paperwork.

Signing - According to Oklahoma State Law, the quitclaim deed must be signed by the selling party in the presence of a Notary Public (§ 16-26). Recording - All quitclaim deeds that have been notarized should be filed with the County Clerk's Office within the jurisdiction that the property falls under.

In Oklahoma, interest in real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are statutory in Oklahoma under 16 O.S. Section 41, and they convey all the right, title, and interest of the grantor to and in the property (16 O.S. Section 18).

A quitclaim deed effectively transfers whatever interest the current owner can transfer when signing the deed?including any interest that vests in the future. The new owner, though, cannot sue the current owner for breach of warranty if the transferred interest ends up being invalid or flawed.

Per state law, an Oklahoma quitclaim deed must be in writing, describe the property, and be signed by the grantor. The grantor's signature must be acknowledged and the deed must be recorded. When recording the deed, you will need to pay a recording fee and a documentary stamp tax, which is a transfer tax.

If the quitclaim deed has legal defects, those defects can invalidate the deed. If there's no challenge in the five years after the deed is filed, however, the defects no longer affect the deed's validity.