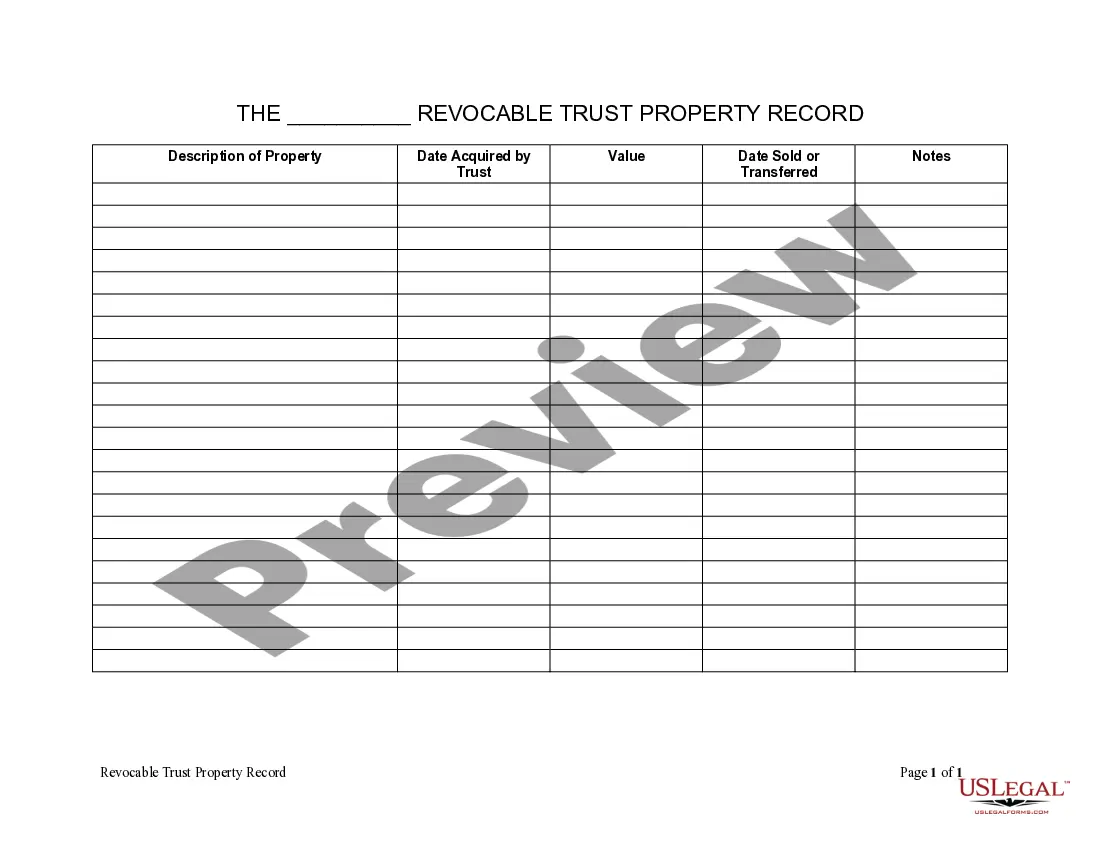

Dayton Ohio Living Trust Property Record

Description

How to fill out Ohio Living Trust Property Record?

Obtaining certified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

All the files are appropriately organized by usage area and jurisdiction, making the search for the Dayton Ohio Living Trust Property Record as straightforward as can be.

Having your paperwork organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to always have essential document templates within reach!

- Review the Preview mode and document description.

- Ensure you’ve chosen the right one that fits your needs and completely aligns with your local jurisdiction criteria.

- Look for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to find the right document. If it meets your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Filing a living trust in Ohio involves creating the trust document and transferring your assets into it. You'll need to ensure that the trust complies with state laws and includes all required elements. Although you typically do not file the trust with any governmental entity, maintaining accurate documentation—such as a Dayton Ohio Living Trust Property Record—is essential. For assistance with drafting and managing your living trust, consider using resources like US Legal Forms.

Generally, a living trust itself does not require recording, but some assets held within the trust may benefit from it. For instance, if your living trust includes real property, recording it can help establish clear title and avoid future challenges. This can assist in creating a reliable Dayton Ohio Living Trust Property Record. To navigate these complexities, consider using platforms like US Legal Forms to ensure your trust is properly managed.

Recording a living trust is not typically necessary, as it usually does not need to be filed with the county. However, you might want to record certain assets, such as real estate, to clarify ownership and prevent disputes. Registering these documents can help in maintaining a clear Dayton Ohio Living Trust Property Record. Consulting a legal professional can help determine the best course of action for your situation.

A living trust can be deemed invalid for several reasons. Common causes include improper execution, such as not having the required number of witnesses, or failing to fund the trust properly. Additionally, if the creator of the trust lacked mental capacity when they made the document, or if they were under undue influence, it may render the trust invalid. Ensuring proper legal guidance is crucial to prevent issues related to your Dayton Ohio Living Trust Property Record.

To place your property in a trust in Ohio, you'll need to first create the trust document. This process involves identifying the trust's terms and designating a trustee. After that, transferring the property title to the trust is necessary. Using resources like uslegalforms can simplify this process, ensuring your Dayton Ohio Living Trust Property Record is set up correctly.

In Ohio, trusts are generally not public record. This means that the details of your trust typically remain private, unlike wills, which go through probate and become part of public records. This privacy feature can be beneficial when dealing with the Dayton Ohio Living Trust Property Record because it safeguards your affairs. Connecting with uslegalforms can help you navigate trust documentation effectively.

Life insurance policies are examples of assets that cannot be immediately placed into a trust. If the trust is named as the beneficiary, ownership transfers happen only after specific conditions are met. This is crucial for maintaining the integrity of the Dayton Ohio Living Trust Property Record. Consider consulting professionals for effective strategies.

Not all assets can be placed in a trust. For instance, retirement accounts, like 401(k)s or IRAs, may not be suitable for funding a trust. Additionally, personal items like vehicles and jewelry typically require special handling outside of the trust. It's essential to explore the Dayton Ohio Living Trust Property Record to understand what fits best.

Yes, Ohio property records are public and can be accessed by anyone interested in learning about property ownership and history. This transparency allows residents to verify details that may concern their own Dayton Ohio Living Trust Property Record and makes the information readily available for those conducting research or due diligence.

The biggest mistake parents often make when setting up a trust fund is failing to properly fund the trust with their assets. It's essential to ensure that all relevant property is included, which can affect how the Dayton Ohio Living Trust Property Record is reflected. Using platforms like USLegalForms can help streamline this process and provide expert guidance.