Syracuse New York Subordination Agreement

Description

How to fill out New York Subordination Agreement?

Locating validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms archive.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the paperwork is systematically categorized by field of application and jurisdiction, making it as straightforward as one, two, three to find the Syracuse New York Subordination Agreement.

Maintaining organized documents that comply with legal standards is critically significant. Leverage the US Legal Forms library to consistently have vital templates for any requirements readily available!

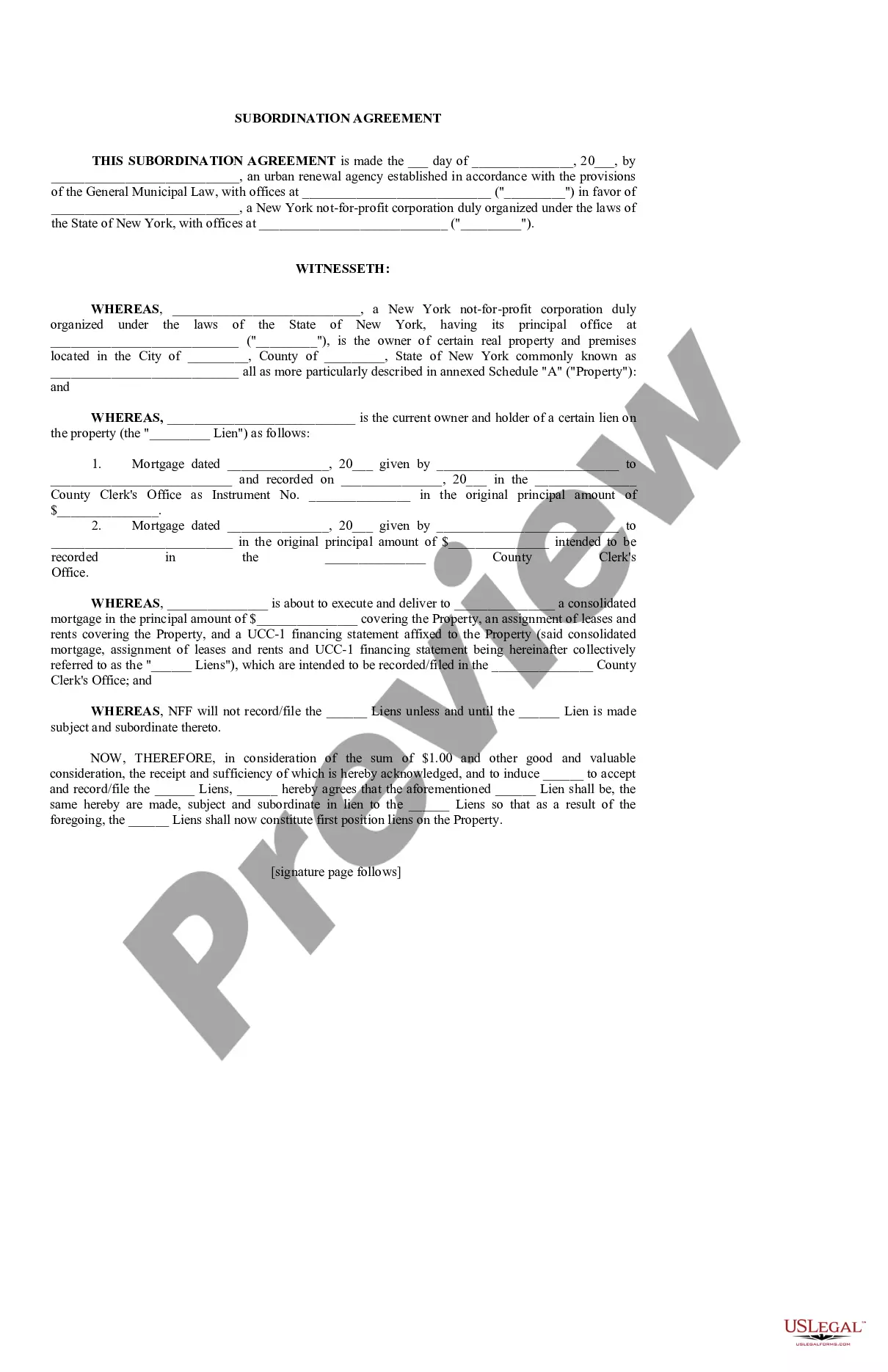

- Examine the Preview mode and document description.

- Ensure you’ve chosen the right one that fulfills your needs and aligns with your local jurisdiction requirements.

- Search for an alternate template if required.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

A subordination agreement in Syracuse New York requires signatures from all parties involved, including existing lenders and new lenders. Typically, the borrower will also need to sign the agreement to acknowledge and consent to the terms. This step is vital for enforcing the document legally. Proper execution ensures that everyone involved understands their rights and obligations.

The preparation of a subordination agreement typically falls to a qualified attorney or a mortgage lender in Syracuse New York. They will draft the agreement to ensure it reflects the interests of all parties. Having a professional handle this task helps prevent legal issues and ensures compliance with state laws. Consider using services like uslegalforms to simplify the preparation process.

A typical example of a subordination agreement in Syracuse New York involves a homeowner who has an existing home equity line of credit (HELOC) and seeks to refinance their primary mortgage. The HELOC lender agrees to subordinate their interest to the refinancing lender, allowing the new mortgage to take priority. This arrangement protects the refinancing lender's position while enabling the homeowner to secure better terms.

Yes, a subordination agreement is generally recorded before a new mortgage is finalized in Syracuse New York. This step ensures that the new mortgage has priority in the event of foreclosure or default. Recording the agreement provides legal protection to the new lender and clarifies the priority of debts tied to the property. Be sure to consult with a legal expert to confirm the correct process.

In Syracuse New York, a subordination agreement is typically prepared by a lawyer or a lender. This document outlines the order of priority between multiple loans on a property. It's essential to ensure that all terms are clear and compliant with local laws. Utilizing platforms like uslegalforms can provide templates and guidance for proper preparation.

Various parties can benefit from a subordination clause, but the most significant advantages go to borrowers and lenders. For borrowers, it can enable better financing terms and additional loans. For lenders, it could mean a safer position in complex financial structures. Utilizing a service like uslegalforms can help you navigate the intricacies of a Syracuse New York Subordination Agreement, ensuring everyone involved understands their roles and benefits.

A subordination clause primarily serves to establish the priority of debts. In the context of a Syracuse New York Subordination Agreement, it allows a borrower to prove that certain loans are subordinate to others. This can facilitate additional borrowing or refinancing options, enhancing flexibility in financial arrangements. It's crucial for anyone involved in real estate transactions to grasp the implications of this clause.

If you need to inquire about IRS lien subordination, you can contact the IRS directly at their general helpline. It's essential to discuss your specific situation with them to understand the steps needed for lien subordination. Remember, clarity on the Syracuse New York Subordination Agreement can assist you in navigating these complexities.

An IRS lien subordination occurs when the IRS allows a taxpayer to subordinate their federal tax lien to another lender. This process is vital for individuals looking to refinance or sell their property while a tax lien is in place. Utilizing a Syracuse New York Subordination Agreement helps clarify terms and ensures that all parties fully understand their obligations in these situations.

An application for lien subordination is a formal request to change the ranking of existing liens on a property. This application outlines why a lender should agree to subordinate their lien. In Syracuse, New York, a Subordination Agreement simplifies this process, ensuring that all terms are clear and legally binding, benefiting all parties involved.