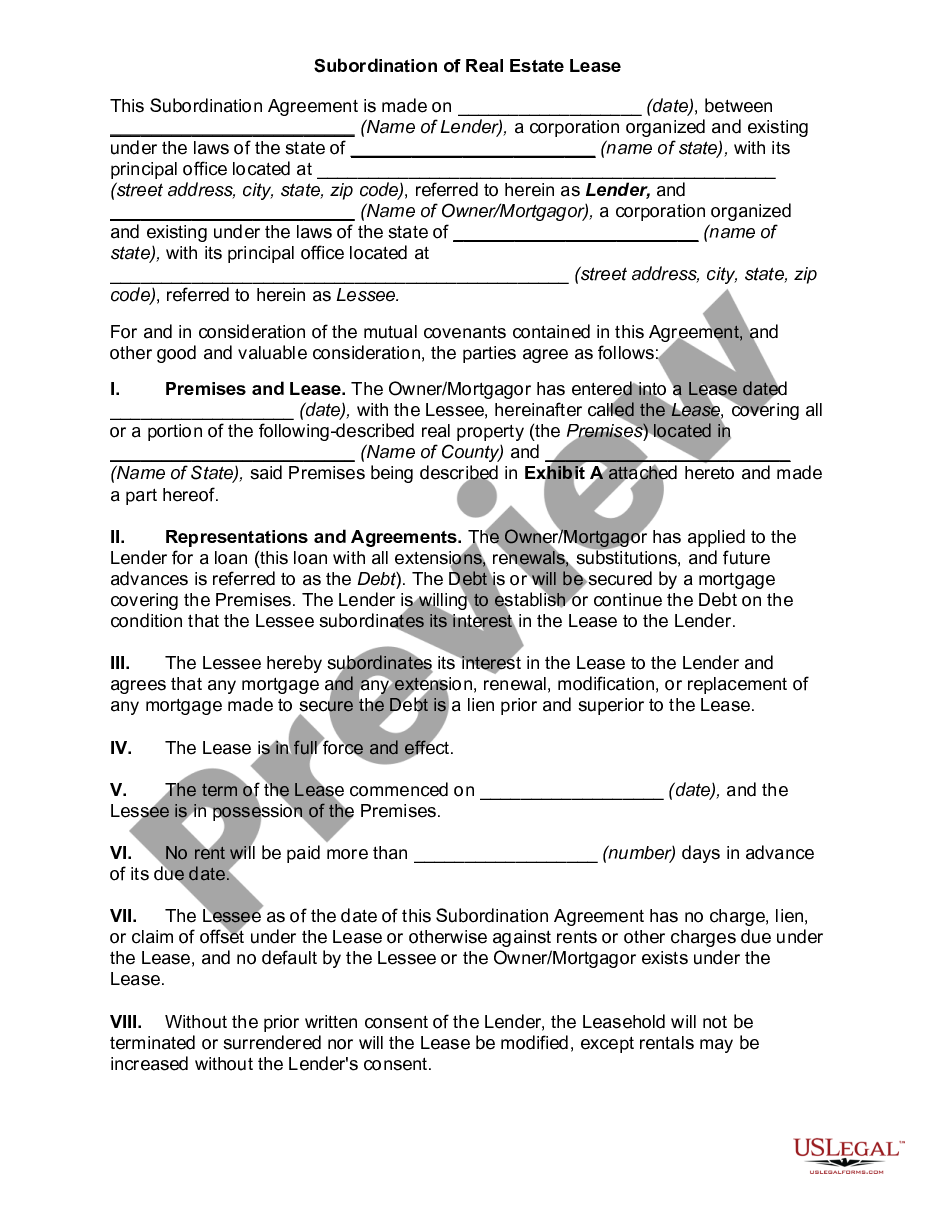

This agreement allows one lien holder to subordinate its deed of trust to the lien of another lien holder. For valuable consideration, a particular deed of trust will at all times be prior and superior to the subordinate lien.

Houston Texas Subordination Agreement of Deed of Trust

Description

How to fill out Subordination Agreement Of Deed Of Trust?

Whether you plan to launch your enterprise, enter into a contract, request your identification renewal, or address family-related legal matters, you need to prepare specific paperwork in accordance with your local laws and regulations.

Finding the appropriate documents can consume considerable time and energy unless you utilize the US Legal Forms library.

The platform offers users access to over 85,000 expertly prepared and verified legal templates for any personal or professional occasion. All documents are organized by state and usage area, so selecting a template like the Houston Subordination Agreement of Deed of Trust is straightforward and efficient.

The forms provided by our library are reusable. By maintaining an active subscription, you can access all your previously acquired documents at any time through the My documents section of your profile. Stop wasting time in an endless search for current formal documentation. Register for the US Legal Forms platform and organize your paperwork with the most comprehensive online form collection!

- Ensure the template meets your specific requirements and complies with state law.

- Review the form description and check the Preview if available on the page.

- Use the search feature to specify your state and find additional templates.

- Click Buy Now to acquire the template once you find the suitable one.

- Choose the subscription plan that best fits your needs to move forward.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Houston Subordination Agreement of Deed of Trust in your preferred file format.

- Print the document or complete it and sign it electronically using an online editor to save time.

Form popularity

FAQ

The deed of subordination serves to clarify the ranking of claims against a property. By employing a Houston Texas Subordination Agreement of Deed of Trust, this deed allows a new lender to establish a superior interest in the property. This is crucial for borrowers who wish to secure further financing while protecting their existing obligations.

Yes, a Houston Texas Subordination Agreement of Deed of Trust generally needs notarization to protect all parties involved. Notarization acts as verification of the identities of those signing the document, ensuring that the agreement is genuine. It's wise to consult with a legal expert to understand the specific notarization requirements in your situation.

The purpose of a Houston Texas Subordination Agreement of Deed of Trust is to modify the priority of existing loans. This agreement allows a second mortgage to take priority over a first mortgage, making it easier for the homeowner to secure additional financing. In turn, this can help homeowners access funds for renovations, debt consolidation, or other financial needs.

To obtain a Houston Texas Subordination Agreement of Deed of Trust, you can start by contacting your lender or the party holding the first mortgage. They may provide you with the necessary forms or outline the required steps. Additionally, working with a legal professional can help streamline the process, ensuring that the agreement complies with local laws.

Establishing a trust in Texas requires a clear declaration of the trust purpose, a designated trustee, and identifiable beneficiaries. It is vital to lay out the terms and conditions governing the trust. When managing financing options like a Houston Texas Subordination Agreement of Deed of Trust, understanding these requirements can help streamline the process and protect your investments.

Some disadvantages of a trust deed include potential complications in foreclosure processes and issues related to the property's title. Additionally, borrowers may face stricter compliance regulations that can lead to lengthier approval processes. It’s essential to understand these factors when considering a Houston Texas Subordination Agreement of Deed of Trust, as they can impact your financial planning.

A deed of priority establishes the order of claims against a property, determining which lenders are repaid first in case of default. In contrast, a deed of subordination allows a second mortgage to take precedence over an existing first mortgage, often used during a Houston Texas Subordination Agreement of Deed of Trust. Understanding these differences helps you make informed financing decisions.

Yes, subordination agreements, including a Houston Texas Subordination Agreement of Deed of Trust, are typically recorded. This recording process is essential as it updates the public land records regarding the priority of lien positions. Recording ensures that all parties, including future lenders, are aware of the current status of the property. Utilizing platforms like USLegalForms can simplify this process for you, making it easy to create and record your necessary documents.

In most cases, a Houston Texas Subordination Agreement of Deed of Trust does need to be recorded. Recording the agreement provides public notice of the changes in priority among lenders. This step helps protect the rights of all parties involved in the agreement. By recording the subordination agreement, you ensure that there is a clear and legal record of the terms for future reference.

Subordinate financing requires that lenders accept a lower priority claim on the property used as collateral. This financing often needs clear conditions regarding payment schedules and risk acknowledgment. In the framework of a Houston Texas Subordination Agreement of Deed of Trust, clear documentation and well-defined terms lay the foundation for a successful transaction.