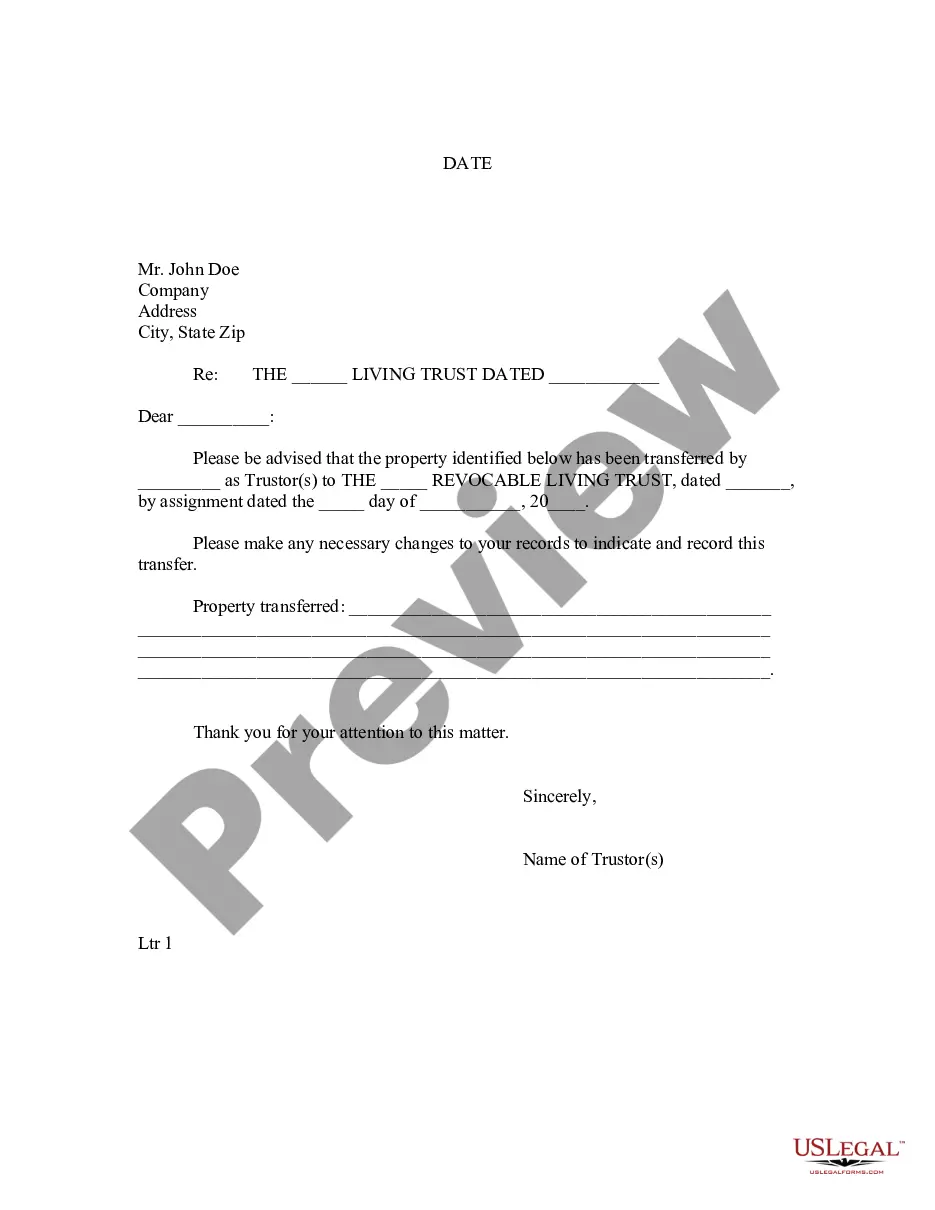

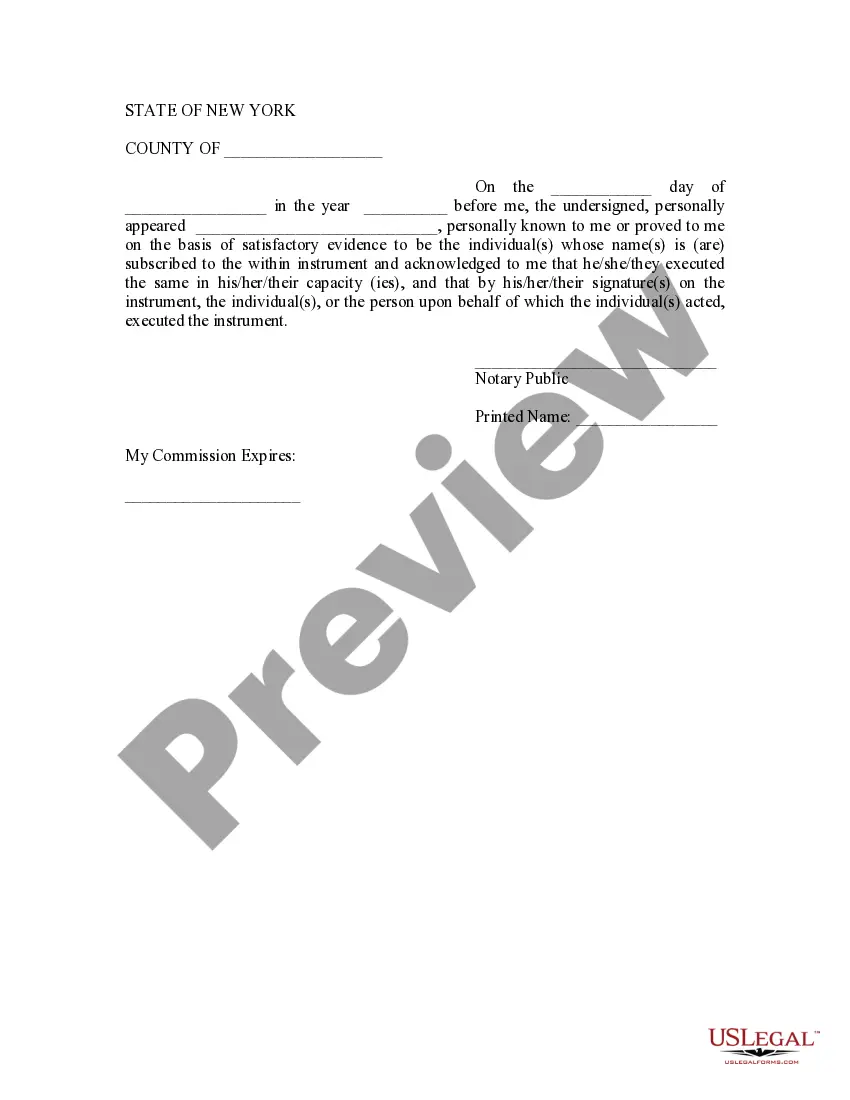

Queens New York Letter to Lienholder to Notify of Trust

Description

How to fill out New York Letter To Lienholder To Notify Of Trust?

We consistently aim to minimize or evade legal complications when engaging with intricate law-related or financial matters.

To achieve this, we seek out attorney services that, as a general rule, are exceptionally expensive. However, not all legal matters are equally complicated. Many can be handled independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform empowers you to manage your affairs autonomously without needing to consult an attorney.

We provide access to legal document templates that are not always freely available. Our templates are specific to states and regions, which significantly eases the search process.

Ensure to verify if the Queens New York Letter to Lienholder to Notify of Trust complies with the laws and regulations of your state and area.

- Take advantage of US Legal Forms whenever you require quickly and securely finding and downloading the Queens New York Letter to Lienholder to Notify of Trust or any other document.

- Simply Log In to your account and click the Get button next to it.

- If you misplace the form, you can always re-download it from the My documents section.

- The procedure is just as simple if you’re new to the website! You can create your account in just a few minutes.

Form popularity

FAQ

Section 13 of the New York lien law outlines specific requirements for enforcing a lien against a property. It provides guidance on notices and deadlines necessary for maintaining the validity of the lien. Understanding this law is crucial, especially when navigating processes related to a Queens New York Letter to Lienholder to Notify of Trust.

To file a lien in New York State, you must complete a lien form, detailing the debt owed and the associated property. You then file this form with the county clerk in the relevant jurisdiction. Utilizing a well-crafted Queens New York Letter to Lienholder to Notify of Trust can also strengthen your position when pursuing a lien.

A notice of pendency in New York remains effective for three years from the date of filing. However, it may be extended upon motion if you have not resolved your legal action during that period. It's vital to monitor your notice's expiration, especially if it pertains to a Queens New York Letter to Lienholder to Notify of Trust.

To file a notice of pendency in New York, you begin by preparing the document, clearly stating your intention. After gathering the necessary information, such as the property description, you must file it in the county clerk's office where the property is located. This process is essential for protecting your interest, especially when using a Queens New York Letter to Lienholder to Notify of Trust.

Filing a lien can limit your financial options, as it may restrict your ability to sell or refinance the property. Additionally, liens can negatively affect your credit score and property value. Understanding these implications is crucial before moving forward with a lien. For guidance, using a Queens New York Letter to Lienholder to Notify of Trust can ensure all legalities are followed correctly.

A notice of intent to lien in New York is a formal notification sent to a property owner before a lien is actually placed on their property. This notice often details the amount owed and the reason for the potential lien. It serves as a warning, allowing the property owner an opportunity to resolve the debt and avoid any legal complications. If you need to send such a notice, consider drafting a Queens New York Letter to Lienholder to Notify of Trust for clarity and legal standing.

In New York, you can obtain a lien release by contacting the lienholder and asking for the official release document. If necessary, send them a Queens New York Letter to Lienholder to Notify of Trust to formally request this document. Once you have the release, ensure it is officially recorded with the county clerk's office to update public records. This step protects your property from future issues related to the lien.

For a lien release in New York, you typically need to provide proof that the lien has been satisfied. This could include the original lien release document, a Queens New York Letter to Lienholder to Notify of Trust, and any relevant payments made to settle the lien. Having all necessary documentation ready helps to expedite the process and ensures that your property records accurately reflect the release of the lien.

To obtain a copy of a lien release in New York, visit the county clerk's office where the lien was filed. You may need to provide details about the lien, such as the original filing date and any associated property information. If you have used a Queens New York Letter to Lienholder to Notify of Trust, it can streamline the process of proving that the lien has been discharged. You may also check online resources or your local government’s website for additional access to these records.

To discharge a lien in New York, you must file a formal request with the appropriate county clerk's office. You'll typically need to provide a Queens New York Letter to Lienholder to Notify of Trust if you are notifying a lienholder about the discharge. This letter serves as a formal communication intended to clarify your intentions concerning the lien. After filing, make sure to obtain a certified copy of the discharge as proof.